|

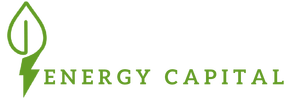

The latest U.S. Solar Market Insight Report from GTM Research and the Solar Energy Industries Association reveals that the U.S. installed a record 7.3 GW of PV capacity in 2015, with solar installations surpassing natural gas capacity additions. Overall, solar accounted for 29.5% of all new energy capacity additions in the U.S. in 2015. U.S. Solar PV Installations, 2000-2015 (Source: GTM Research / SEIA U.S. Solar Market Insight Report) Among the different solar sectors in the U.S., residential PV has been the fastest-growing market segment, expanding by at least 50% over the past three years and 66% in 2015. By Q1 2016, the number of U.S. homeowners with rooftop solar is expected to cross the 1 million mark. Indeed, the falling costs of installation paired with rising retail electricity rates make residential solar economics increasingly attractive in a growing number of states. A GTM study released in February found that 20 U.S. states have reached grid parity for residential solar. However, the increase in rooftop solar installations and the accompanying rise of net energy metering policies have revealed several issues underlying high penetrations of solar, among them:

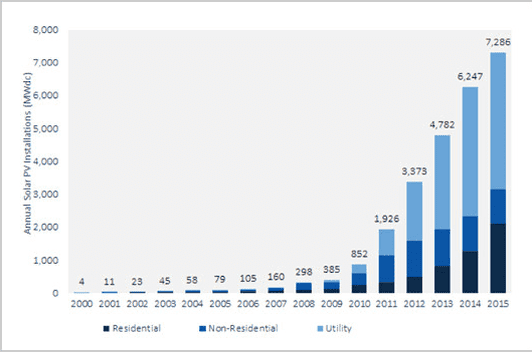

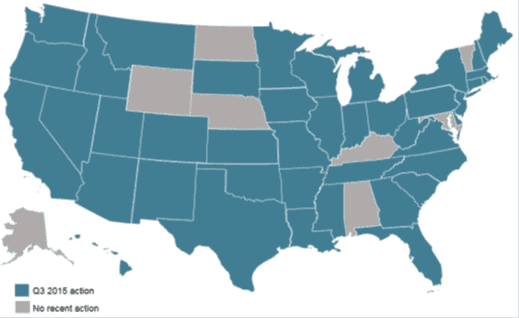

In response to these concerns, and especially the concern among utilities that a decline in sales will generate insufficient revenue to cover the fixed costs of maintaining the grid, some utilities have suggested imposing higher fixed charges on their customers as a method to recoup costs. In 2015 alone, 61 utilities in 30 states requested public utility commissions to increase fixed charges, making it the most frequent policy proposal impacting distributed solar in the last year. 21 utilities in 13 states proposed adding new or increasing existing charges specific to residential solar customers, with the median requested increase at $5 per month. While seemingly a “quick fix” for utilities’ declining revenue concerns, fixed charges do not vary with usage and cannot be avoided with energy net metering credits. Thus, higher fixed charges significantly reduce the financial value of installing solar PV systems. Moreover, fixed charges harm low income and low usage customers and they fail to provide accurate price signals to customers, thereby reducing customer incentives to save on energy use. Research institutes, think tanks, and regulatory agencies have suggested other approaches to address concerns associated with net energy metering in high solar penetration states, among them: time-of-use pricing, smart metering, locational marginal pricing, minimum bills, and revenue decoupling. These suggestions are currently being weighed by legislators and public utility commissions in at least 27 states. Unfortunately, rate review processes are lengthy, and in the meantime the solar industry is paying the price for policy uncertainty. After the Nevada Public Utility Commission’s controversial December 2015 decision to slash net energy metering, many residential solar installation companies halted operations in Nevada, with giants like SolarCity and Sunrun exiting the state. This month, Massachusetts reached its net metering and REC caps, halting operations of solar developers and installers in a state that has more solar jobs than any other state except California. Recent Action on Net Metering, Rate Design, and Solar Ownership Policies (Source: N.C. Clean Energy Technology Center, 50 States of Solar: A Quarterly Look at America’s Fast-Evolving Distributed Solar Policy Conversation.) One state that has remained below the solar radar is suggesting a new approach for addressing solar rate design concerns. Maine’s new proposal for replacing net energy metering with a market aggregator is making ripples in the solar policy world for its innovative ratepayer-focused approach. The proposal contemplates the creation of a market aggregator that would purchase energy, RECs, capacity value, and ancillary services potential from distributed energy generators at a fixed per-kWh rate guaranteed under a 20-year contract. Centralizing procurement is supposed to reduce transaction costs and create new opportunities for the aggregator to sell the different attributes solar energy provides in applicable markets. Based on a Maine Public Utility Commission March 2015 study that estimated the value of distributed solar at $0.337/kWh, the proposal suggests a starting purchase price from distributed energy generators of $0.20/kWh, higher than the current net energy metering rate ($0.13/kWh) but lower than the $0.337/kWh Maine value of solar estimate. The Public Utility Commission can set a different rate (higher/ lower) based on market conditions and other criteria (there is a lower rate for small commercial projects of 1 to 5 MW). For the wholesale distributed generation market, the aggregator will conduct a quarterly reverse auction for specified levels of installed capacity, with the lowest offer winning a purchase contract from the aggregator who then sells the energy and attributes in the applicable markets. The program is hailed by solar advocates, utilities, and regulators as meeting the needs of all stakeholders involved. Solar customers enjoy rate certainty for a period of twenty years, which is the common term for solar equipment financing. At the same time, all ratepayers are set to enjoy the revenues from the sale of the aggregated energy and attributes in wholesale markets, which are to be allocated equally across the entire rate base. Overview of Market Transactions (Source: Strategen, A Ratepayer Focused Strategy for Distributed Solar in Maine.)

The bill incorporating the new solar program was endorsed by a bipartisan group of lawmakers, environmental organizations, utilities, solar installers, and consumer advocates. According to the bill’s sponsors, the new program will not only boost Maine’s solar industry but also save $100 million for ratepayers. For those who thought that community solar marks the second revolution in the solar market, Maine’s promising new solar purchase program serves as another example of how aggregation of solar generation and attributes could increase returns for all parties involved. The emerging lesson from these two examples is that with solar energy, economies of scale could be achieved without unnecessary investments in large and expensive infrastructure. Innovative market models and creative policy approaches will determine the next leaders of the solar world. Comments are closed.

|

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|