|

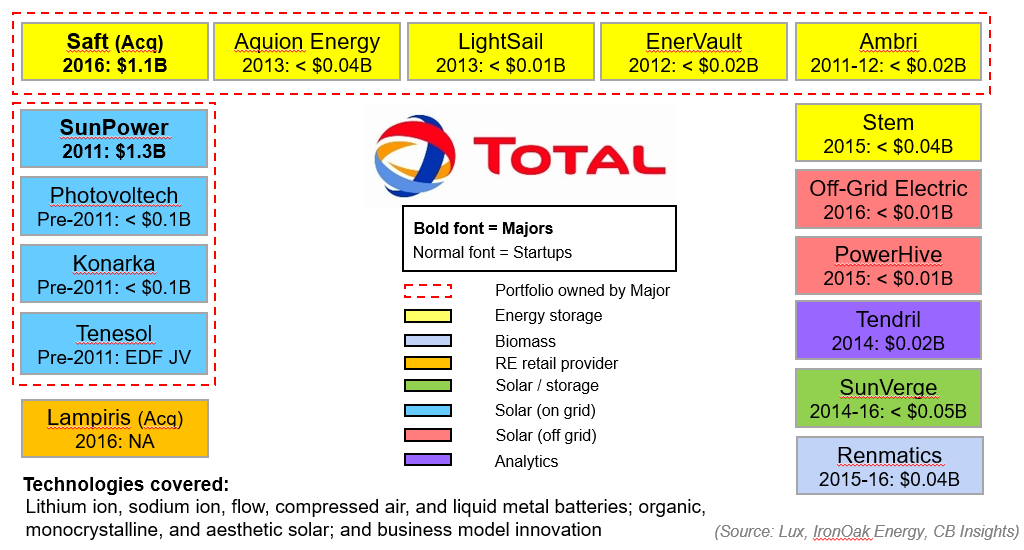

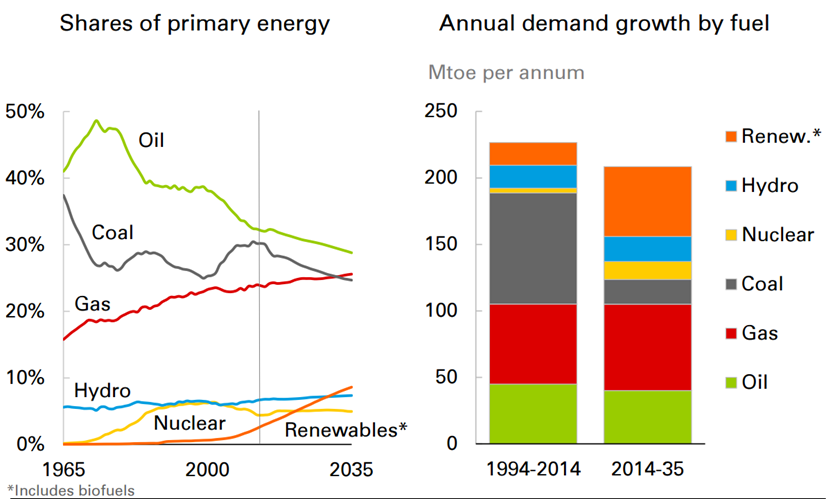

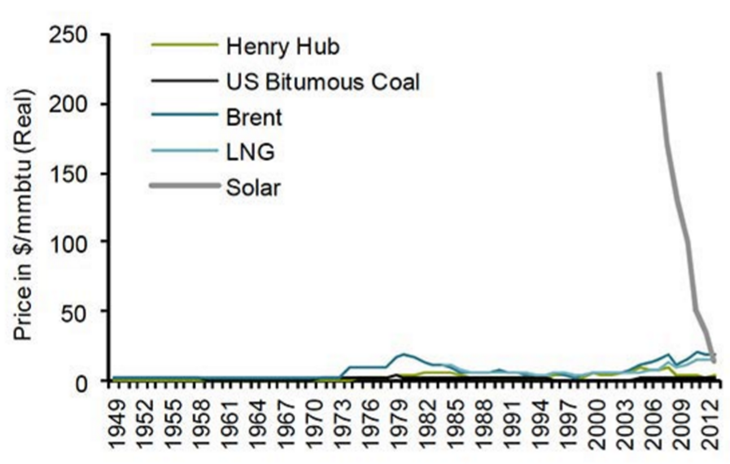

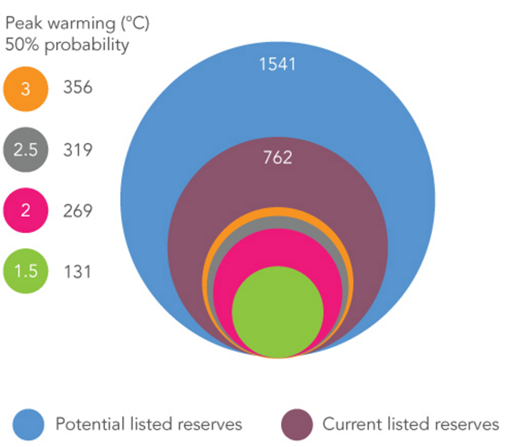

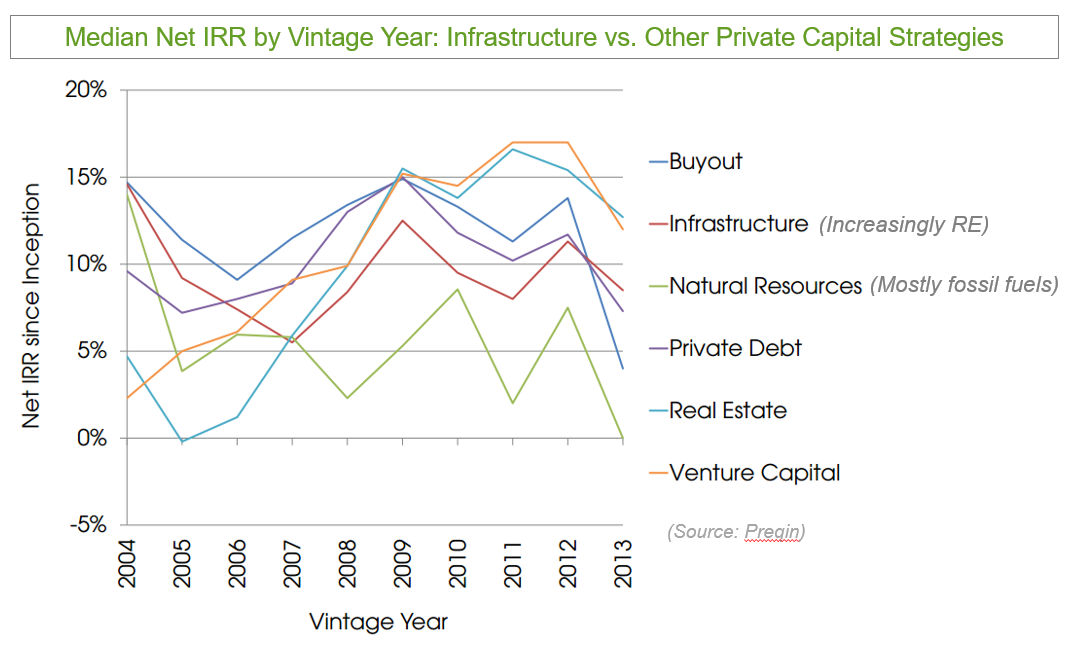

8/30/2016 Major Oil and Gas Companies’ Growing Interest in Renewable Energy Investments: Passing Fad or Major Trend?Read Now You may remember BP’s attempt to rebrand as “Beyond Petroleum” years ago. Perhaps sincere, or maybe a public relations game, it did not last long. One thing for sure: It bred some real clean energy innovators, some of whom we at IronOak Energy work with today in their new ventures. The question is this: Are today’s headlines about fossil fuel majors investing in renewable energy any different? As I prepared to deliver a webcast to 75 global energy investors on this topic, many of our investment colleagues were doubtful. But I do think that things have changed. I’ll try to illustrate why I think this is the case (and hopefully I won’t look back in five years with my tail between my legs). Consider the leading conventional energy company in this new paradigm: Total, the French energy giant. Below is a figure which illustrates most of Total’s alternative energy investments, whether direct or indirect. Source: Lux, CB Insights, IronOak Energy But their clean energy play doesn’t stop there. Consider these additional facts from 2015: They committed to investing $500M in renewable energy per year going forward. They invested $225M to convert an unprofitable oil refinery into a biofuel plant. Why are oil and gas giants moving to more clean energy? 1. Granola-eating, Birkenstock-wearing They have become a bunch of long-haired hippies. Nope, not true. I'm just seeing if you’re paying attention. 2. FOMO? If you’re not a Millennial, let me clarify. This is not a curse word. Instead, it stands for Fear of Missing Out. The global energy mix is projected to change, and they don’t want to miss out on high-growth opportunities. See the graphs below. Source: BP 3. Costs Solar and wind costs are much more competitive today. Consider the two large solar farm contracts at 2.9 c/kWh in Chile and the Middle East. See graph below. Source: BNEF Source: Bernstein Research, CIA, EIA, World Bank 4. Global policy The Paris Accord showed 197 countries agreeing to significant greenhouse gas reduction goals. If their forecasts by the International Energy Agency are correct, $16.5T of low-carbon finance is needed to achieve the goals laid out in Paris. 5. Stranded assets Experts at the London School of Economics, Citi, and Carbon Tracker suggest that 60-80% of assets held by publicly listed conventional energy companies may be “unburnable” if the world is to stay below the 2 degrees Celsius target. Citi’s estimate is that $100T of oil, gas, and coal reserves may fall into this category. Yikes. (See graph below. Compare the smaller pink circle to the larger purple or blue circles. Units are GtCO2.) Source: Carbon Tracker, Grantham Research Institute, LSE 6. Growing interest in infrastructure The World Economic Forum estimates a $1T/year gap between global infrastructure needs and what limited government budgets can afford. This spells a big need for private capital to fill this gap. This combined with the current low-yield environment has led to growing investor interest in the global infrastructure market with an aggregate $3.7T/year need. Investors are seeing the attractive risk-reward fundamentals of infrastructure investment, in which renewable energy represented 55% of all deals in 2015. See the graph below highlighting the relative attractiveness of infrastructure investments. And by the way, I’m just getting started. We haven’t even talked about clean energy investments by other oil majors.

With between $5B and $30B in cash on hand, how will they diversify going forward? Surely not all to renewable energy, but probably a greater allocation than in years past. Comments are closed.

|

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|