|

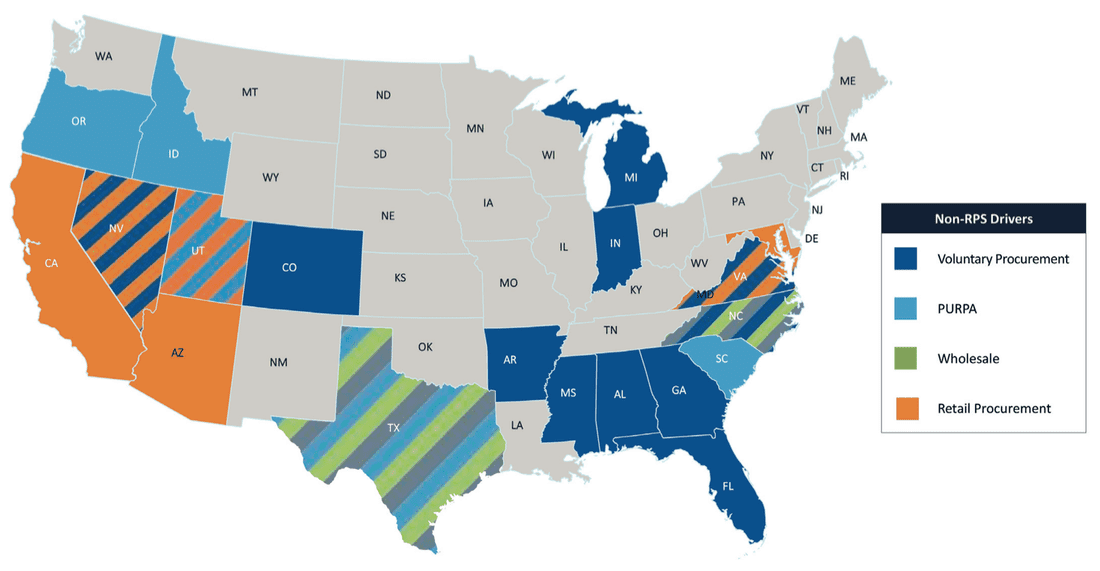

States with > 50 MW Non-RPS Utility PV in Development (Source: GreenTech Media)

Related data points:

Conventional wisdom says that the solar market is policy-driven, but this is changing in a big way The most vibrant and active solar markets are driven by Renewable Portfolio Standard (RPS) programs with supporting net metering and feed-in-tariff (FIT) programs, or so goes the conventional wisdom. California and Massachusetts exemplify this supposition, as their RPS programs undergird two of the largest utility-scale solar markets in the U.S. But evidence is mounting that the solar market will no longer be driven exclusively by RPS mechanisms. In 2015, 39% of utility-scale solar was procured using non-RPS mechanisms, and this is projected to increase to 52% in 2016. This begs the question - what is driving this marked shift? Falling costs are making solar more competitive with conventional generation The fact that solar has been undergoing rapid cost reductions is a borderline platitude at this point (see here for a good summary of key facts). Estimates for the average installed cost of utility-scale solar in the U.S. was $1.45/watt in 2015, with more reductions projected in the coming years. However, the real interesting question is how these cost reductions are changing the dynamics of competition across energy sources for utilities. Grid parity is considered the holy grail for utility-scale solar, and grid parity (or better) with prevailing natural gas prices has become a reality in many U.S. states (see here for some more detail on grid parity). This change in the market is making it real easy for utilities to make the simple economic argument that signing 20-year PPAs at below $60/MWh is not only the most prudent course of action from a bottom-line perspective, but also the best hedging strategy, which is discussed further below. This has also given rise to a new wave of avoided-cost contracts in states where solar is cheaper than conventional alternatives. This was enabled by PURPA (Public Utility Regulatory Policy Act), a landmark energy law from the 1970s that mandates that utilities purchase electricity from independent power producers (IPPs) if their cost is below the marginal cost of increasing the utility’s generation capacity through conventional means. This type of arrangement greatly reduces the risk of developing solar projects of a certain size, and has fueled the markets in states such as North Carolina. There is another big story behind the rise of non-RPS utility-scale solar related to the role of corporate PPAs, which you can dig into in a previous blog. The hedge against variable (and volatile) natural gas and coal fuel costs is attractive Many utilities are starting to see the writing on the wall in terms of their exposure to variable and volatile fossil fuel prices. Do not believe the hyperbole that oil and gas prices have reached a “new normal” with prices hitting lows not seen for many years (see a good discussion of peak oil here). We are likely amid an anomalous period of low petroleum prices brought on by a confluence of factors - namely, historically high oil prices prior to the 2008 recession which escalated investment in exploration, and cheap financing made available through low interest rates. The current oil and gas low prices are undercutting the ability of firms to invest in exploration, which will eventually erode the current surplus and lead to future deficits and much higher prices than we see today. As discussed in a previous blog, even the most conservative projections of future natural gas prices has them increasing, with many projections substantially above current prices. The future of coal is a more complicated matter, but suffice it to say that any utility which maintains coal as a primary long-term energy procurement strategy will be taking on a great deal of policy and financial risk. When seen from this perspective, any rational observer of the U.S. utility sector would naturally conclude that they need to invest heavily in hedge strategies to protect against the inevitability of volatile and unpredictable fossil fuel prices. As many utilities have gained exposure to and comfort with solar PPAs as a compliance mechanism to meet RPS targets, it started to dawn on them that there could be substantial benefits to using PPAs as a hedging strategy. As a consequence, we are now witnessing a boom of procurement taking place outside of the RPS-driven solar markets, at least partially driven by the desire to increase their portfolio of low-risk electricity generation from solar PPAs with predictable rates for 10-25 years. It seems somehow fitting that utilities are increasingly more willing to exchange their variable-priced fossil fuel capacity for variable-generation solar capacity. Further reading:

Comments are closed.

|

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|