|

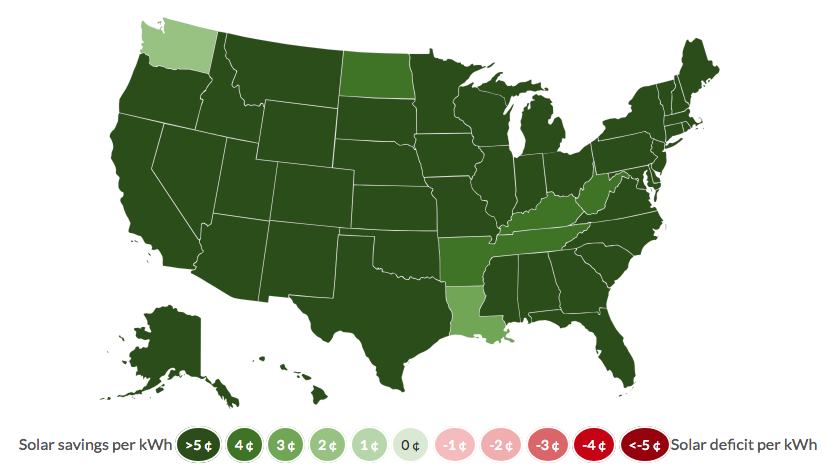

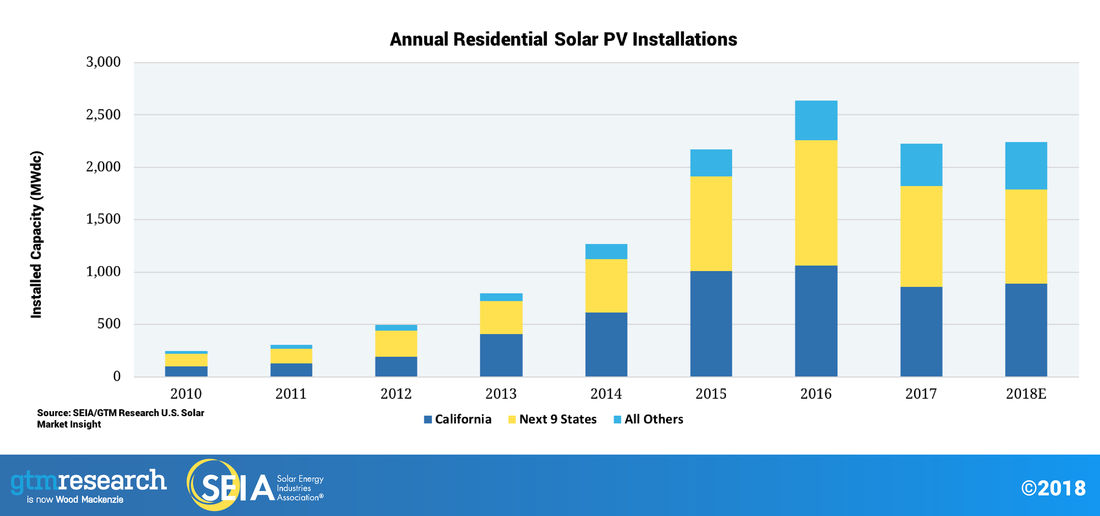

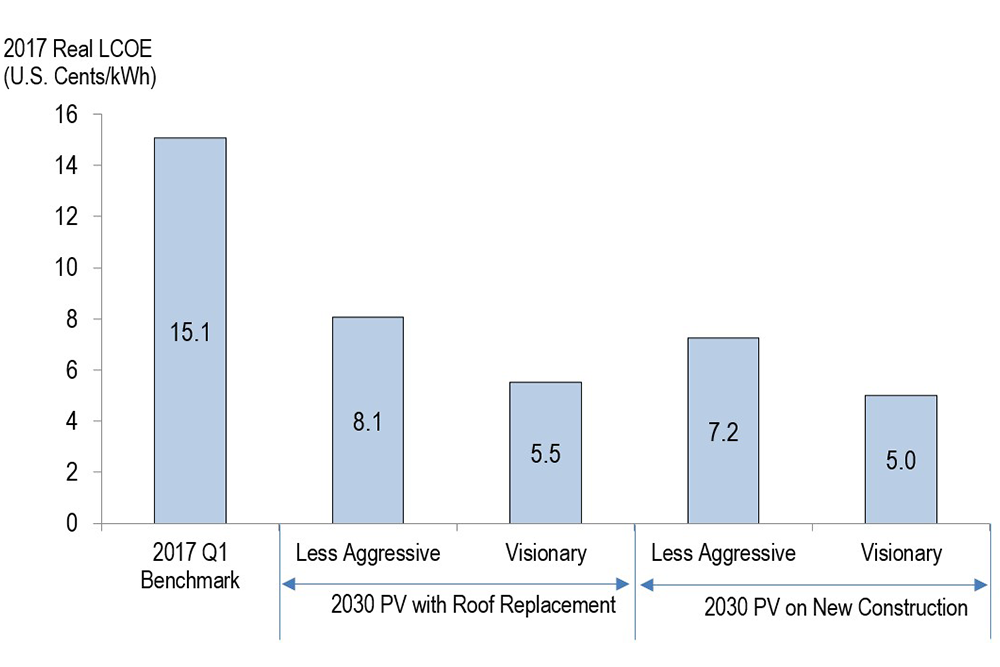

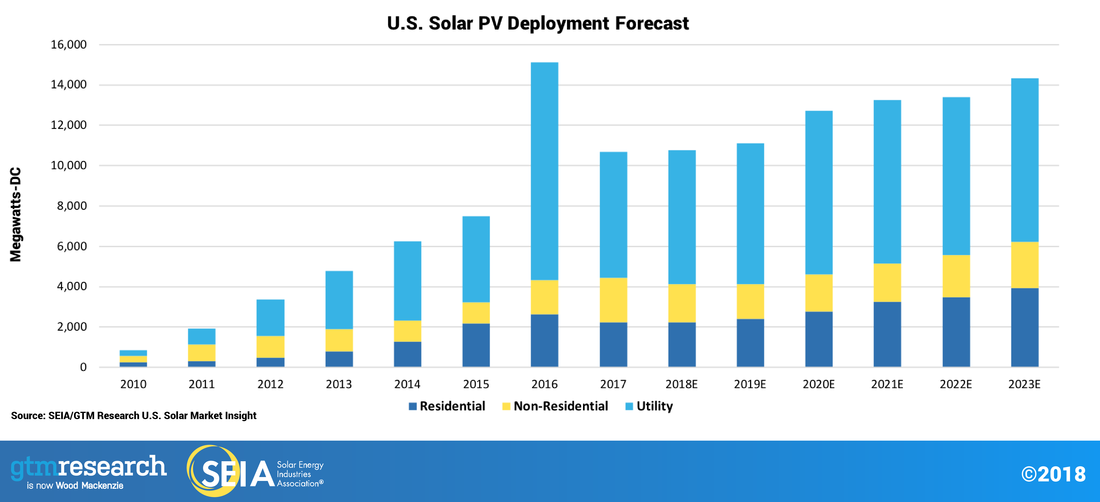

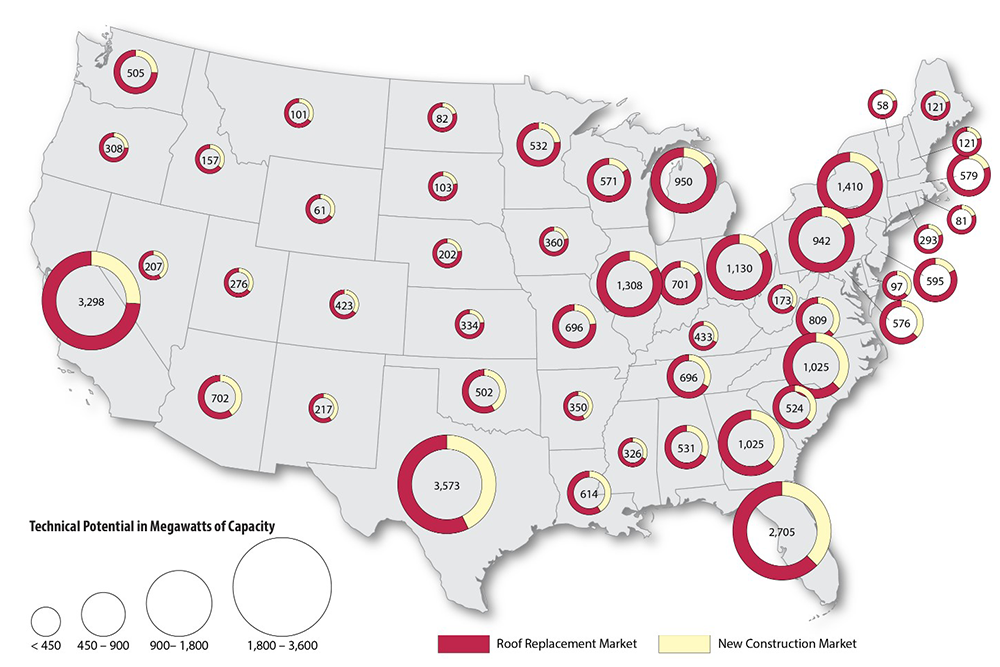

Recent solar industry headlines (see the latest from Forbes) would suggest that international trade negotiations (or perhaps more precisely, disputes or wars) are among the most important things to know about solar. Opinions vary on the efficacy of such international policy, but suffice it to say that this escalating trade kerfuffle is masking the growing strength of the solar industry. Let’s not get caught up in the headlines. Be smart and take a deeper dive. Part of the beauty of solar is that it comes in many shapes and forms, ranging from utility-scale solar farms to smaller-scale applications on homes and businesses. Here, I want to focus on bread-and-butter solar applications for homes, leaving the bigger, headline-grabbing projects aside. Residential solar is no longer just a “California and a bunch of others” story Far from being a luxury for the rich, residential solar has grown to being a legitimate complement to grid electricity (alternative if paired with energy storage) across the US. Generally speaking, the reason is simple -- cost. On average, residential solar is now cheaper in essentially every state in the US according to SUNMetrix, which produces a state-by-state solar cost comparison analysis. Even if the solar federal tax credit were completely eliminated, only two states would no longer offer cost savings to solar adopters. Figure 1: US Solar Cost Comparison with Grid Electricity Source: SUNMetrix, 2018 Figure 2: Annual Residential Solar Installations Source: GTM Research & SEIA, 2018 Precipitous reduction in solar costs, and still going Let’s put some numbers to this story. According to the National Renewable Energy Laboratory (NREL), residential solar costs have decreased from a levelized cost of energy (LCOE) of $0.52/kWh in 2010 to $0.151/kWh in 2017, with projections to reach $0.09/kWh or below by 2030 depending on technological innovations. That is over a 70% reduction in solar electricity costs the last 7+ years, with another 40% reduction projected over the next decade or so at a minimum. Translation: The already significant financial benefit of solar will only grow over time. #WhySolar Figure 3: Comparison of Modeled Solar Cost Pathways Source: NREL, 2018 The clever skeptic may retort -- this is apples-to-oranges when you compare the average cost of electricity on your utility bill with the initial installation cost of solar. Good point, oh revered skeptic. Initial capital costs to install solar have always been a limiting factor for potential consumers. Fortunately, this is also precisely the problem that was solved in order to unlock the potential of this market. Early on, the solution was for solar companies to offer long-term power purchase agreements (PPAs) to customers. The solar company would install the system at no cost, retain ownership of the system over the long-term, and sell the homeowner power from the solar panels at a specified rate over, say, 20 years. While PPAs still exist, they are giving way to solar loans, which allow the homeowner to retain ownership of the system and pay it down over time as with any other loan. Point being -- there are many options to offset those initial capital costs over a long period of time so that the solar adopter is, in effect, making an apples-to-apples monthly payment. These dramatic cost reductions paired with a wider array of consumer financing options have driven massive growth in market adoption, which is generally what we see in market growth, as shown in the GTM Research graph below. It is not the quintessential hockey stick graph due some policy uncertainty at various times in the past, but the growth trends are apparent, and not projected to abate even after the federal tax credit for solar is eliminated in 2022. Figure 4: US Solar Installation Forecast, 2010-2023E Source: GTM Research & SEIA, 2018 Still miles to go in market potential Even with this rapid market growth, there is still a large untapped, addressable market throughout the US. According to the NREL, there is a 30 GW annual technical market potential for residential solar nationwide across both new construction and roof replacements. “Technical” being the operative word here. There are many factors beyond just technical feasibility that drive market adoption, especially when it comes to a big expenditure for a person’s home. Notwithstanding, the point is clear. The addressable market dwarfs the current market penetration numbers, which were at just above 2 GW in 2017 according to GTM Research. Figure 5: Average estimated annual residential rooftop PV market capacity potential from 2017 – 2030 Source: NREL, 2018 Parsing the signal out out the noise among the morass of residential solar companies

At its core, the residential solar business is relatively simple -- sales, equipment, installation. As such, there are fewer barriers to entry compared to many industries, which has paved the way for hordes of supremely adequate solar installation companies. It is the quintessential “two guys (or gals) and a truck” phenomenon. It is not too hard to make reasonable money installing solar systems (at least for a little while), so a bunch of relatively unsophisticated companies are doing it. Yes, you have the publicly traded stars out there -- SunRun, Vivnt, prior to its Tesla acquisition SolarCity, etc. However, these national brands appear to be ceding their market position in many geographies to more locally grown and known companies that are buffeted by the holy grail of marketing, happy customers and word-of-mouth advertising. There is a smorgasbord of these smaller, local and regional companies. Some have really refined operations, well-oiled machines so to speak. Others have slick advertising, but spotty execution. In all cases, it is really difficult to cut through the noise to discern which are positioned to capitalize on the growing market opportunity in residential solar. Here are five hallmarks of a “cream of the crop” residential solar company:

Buyer beware, there is no magic formula to identifying the best performers among residential solar providers. It requires diligence, research, and some perceptive sleuthing to find those diamonds in the rough. The market conditions are ripe, however, for a number of successes to emerge out of this exciting sector. |

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|