|

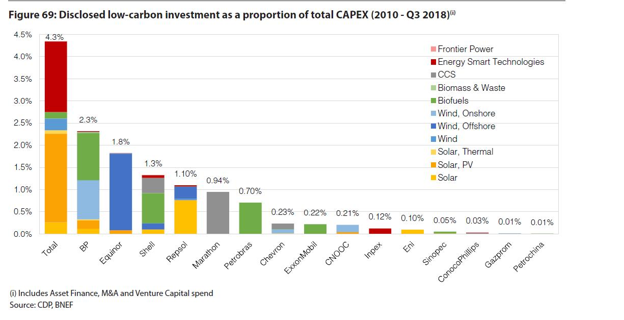

By: Dr. Chris Wedding If you think the “energy transition” is just for Democrats or greenies, then consider this quote from a Goldman Sachs natural resource executive: “I’ve probably spent more time talking with oil company executives about the energy shift and renewables in the last 2 years than the previous 23 put together.” Last year, $6.4B was invested in hydrocarbons versus $5.8B in renewable energy, according to PitchBook. That’s a pretty tight race. And a CDP report notes that 2018 expenditure on clean energy sector by the world’s 24 largest oil and gas companies was roughly 1.3% of total budgets vs. 0.7% last year. On one hand, that’s almost 200% growth year-over-year. Or (slight reframe) its chump change as a fraction of overall investments, with 98.7% of capital still going to conventional energy lines of business. Plus, over 70% of those investments came from EU-based oil and gas majors. Maybe that’s because the science of climate change is magically different across the ocean. (Yep, sarcasm) As further evidence that times are changing, here’s a look at three organizations…

Why are oil and gas major making these investments now? #1. They are already experts in the energy sector. This is partly a situation of a [very powerful] hammer seeking a nail. Decades of experience in conventional energy can translate into efficient capital deployment, project development, and new technology commercialization in the new energy sector, too. Building and operating offshore oil rigs is complicated. The same is true for offshore wind projects, and this is a market expected to reach $60B by 2024. “Have skills, should apply.” Running gas stations is not rocket science, but profitability is also not a given. So, it makes sense for Chevron to add EV charging to its gas stations, as long as they get the rate tariffs right so they do not drown in pricey demand charges. #2. Clean energy investments can be a hedge against softer demand for oil and gas. When Fitch Ratings talks about the growth in electric vehicles potentially creating an “investor death spiral,” it’s worth listening to their reasons. #3. Renewable energy markets are not little runts to ignore anymore. Bloomberg projects that over 70% of all new power capacity investment between now and 2050 is expected to be in solar and wind projects. Their research further shows that clean energy sector investment has exceeded $300B globally for the last five years. Finally, analysis suggests that the advanced energy economy (clean power, alternative transportation, energy-efficient buildings) now exceeds $1.4T, or twice the size of the global airline industry. #4. Corporate sustainability reporting is becoming mainstream. “We are watching you.” At least 85% of Fortune 500 companies now engage in sustainability reporting. Drivers of this trend include stakeholder demands, global trends towards greater transparency, peer pressure, and a realization that sustainability topics can be material to financial risk and return. Samples of third-party sustainability reporting include the following:

What kinds of new energy investments are oil and gas majors making in the last two years? I will only focus on the top four oil and gas majors in terms of their investments in and commitments to lower carbon energy. This includes Total, BP, Equinor, and Shell. (See graph below). I am mostly listing investments by their VC arms, with some other infrastructure investments sprinkled in here and there. Finally, I am not listing companies that are “kind of” related to clean energy, such as ride sharing or financial settlement technologies for the energy sector. Total Energy Ventures

BP Ventures (plus some larger corporate deals)

Equinor Technology Ventures

Shell Ventures (and some bigger Shell New Energies deals)

How will investing in renewable energy be different than their historic energy investments? If recent history is a good predictor (not always true), then low carbon investments are likely to be different than conventional energy investments in the following ways:

How does the increasing involvement of oil and gas majors create winners or losers in the clean energy sector? The (potential) winners include:

The (potential) losers include:

Should you be bearish or bullish? Bearish perspective: Why these trends can be easily ignored

Bullish perspective: Why investors and entrepreneurs should pay more attention

In conclusion, here are some potential action items I will describe these as the 3 “C’’s, with questions for you to ask yourself, answer, and do something about over the next 30 days. (Or just hide under them rug for a while. What could possibly go wrong?) #1 - Canary What do these trends mean in terms of “canaries in the coal mine” for your overall investments in the conventional power, oil, and gas sectors? (Pun intended.) If a Shell executive refers to their “buying spree” in the low carbon sector like this -- “It’s all about survival” — then how or why would your investment allocation to the conventional energy sector be different, and therefore, not face some new risks? If McKinsey and Mining.com report that electric vehicles will likely reach cost parity with conventional vehicles in the early 2020’s, and if Fitch Ratings talks about how this shift in transportation choices could cause an “investor death spiral,” how might you view current or future investments in the oil sector? #2 - Clock Even if you agree that historic changes are coming to energy markets, the key question is this: When? When do you (or sources you trust) think that these shifts in energy investments will actually affect your portfolio? By way of analogy, at some point we may live on Mars, but now is likely not the right time to invest in Martian real estate. (Unless you’re a billionaire who thinks that all hope is lost for long-term survival on this planet.) #3 - Collaboration There may be winners and losers, but it is not a zero sum game. This discussion needs a reframe. Let’s consider a newly created 21st century word: “Coopetition” — collaboration between competitors for mutually beneficial results. For environmentally minded entrepreneurs, how can oil and gas majors be strategic partners, investors, and customers, instead of the enemy, a monolithic group to badmouth for all the world’s problems, the 800-pound gorilla that must be defeated. For VC or private equity investors, how can oil and gas major’s investment decisions serve as an anchors to derisk your capital allocation alongside them? How can you build relationships with them for a future exit opportunities? Finally, thank you... A big shout out to Pitchbook, IPE Real Assets, Greenbiz, Preqin, Bloomberg New Energy Finance, Advanced Energy Economy, Greentech Media, Reuters, CDP, RW Baird, Energy Storage News, Columbia University’s Earth Institute, Oilprice.com, Bloomberg, Mining.com, McKinsey & Company, ThinkProgress, Wind Power Engineering, and Governance & Accountability Institute for their research and reporting on this topic.

0 Comments

By: Dr. Chris Wedding, Managing Partner I recently spoke about investing in energy storage at the SuperReturn Energy investor conference in Boston. In this blog, I hope to pass along 4 of my top 100 takeaways. (OK, slight exaggeration, but productive indeed.) Unfortunately, I am unable to also magically transmit the decadent Legal Seafoods’ lobster tails and sushi rolls from the sponsored dinner (#WeLoveLawFirms) or the conference bling (#MyKidsLoveGiftsFromWorkTravel). 1. Natural gas is misunderstood. First, low commodity prices will not always mean low power prices. The costs of distribution of gas to the power plant, plus the transmission and distribution of the electricity it produces take place on an ancient grid. (That’s a technical term. But Edison would recognize today’s grid if he magically reappeared in his Florida laboratory.) Recent research suggests that the average age for power lines is 28 years, while the U.S. DOE quotes studies by the Brattle Group (for the Edison Electric Institute) estimating about $2T in investment needs for the grid from 2010 to 2030 just to maintain the service reliability. Second, natural gas is not a perfect “bridge” to a low carbon future. On one hand, its emissions factor (pounds of CO2 per BTU emitted when burned) is roughly 43% lower than burning coal (whose butt it is kicking). On the other hand, the operational emissions factor for natural gas is infinitely higher than solar or wind (#DivideByZero). Also, methane leaks during exploration and distribution likely counteract its lower greenhouse gas emissions (compared to coal, that is) when combusted at power plants. As you know, methane’s greenhouse gas impact is at least 30x more potent than CO2. Third, there are two giants in the natural gas ecosystem that see some writing on the wall, and I think they see lots of four-letter words there. GE has laid off 12,000 workers in its power generation business, and now Siemens is considering selling off its natural gas turbine business, whose Q2 revenue was down to $114M from $438M in Q2 2017. And with Bloomberg estimating 157 GW of renewables added vs. just 70 GW of conventional power in 2017, we can understand why they might be making those moves. Having said all of that, I don’t pretend to live in a world of rainbows and unicorns. Conventional energy will likely be part of the global mix for many decades to come. Even in a world where solar and wind power dominate, this analysis shows that natural gas will have a large, though diminishing role over time. 2. $1T of clean energy investment presents challenges for entrepreneurs and investors. Most climate change scientists, policymakers, and private sector leaders project a need for $1T of low-carbon investment needed per year in companies and projects in order to keep global temperature increases below 2o C. However, last year Bloomberg suggests that global clean energy investment stood at just $333B. By my math, that’s 67% lower than the amount of capital we will need. To get there, we need at least two things:

As for investor interest, it is growing. When I first began speaking at the SuperReturn investor conference series three years ago in Boston, London, and Berlin, I was often part of the 1%. (No, not that 1%. I am a pauper compared to my colleagues in attendance who manage billions in capital.) What I mean is that I was often the only guy talking about the future opportunities and threats presented by the mainstreaming of energy storage and electric vehicles, or the continuation of investment opportunities in solar, despite the challenges of (and false conflation with) the cleantech VC missteps of the late 2000’s. Today, many more investment professionals -- with decades on Wall Street instead of roots in the jungles of the Central American rainforest -- are making big investment commitments to renewables, exploring new deals in energy storage, or analyzing the threats that EVs pose to mid- and long-term oil prices. [You can read more here about the mainstreaming of renewable energy investing in my feature piece for Preqin, a global leading for market intelligence for private capital markets.] In contrast to this growing interest, investors worry about yield compression. With lots of capital chasing a disproportionately smaller number of good deals at scale, and with risks being hammered out of renewable energy infrastructure, IRRs have gone down. [Note: Although IRRs are a helpful underwriting metric, many investors prefer to look at the “multiple of invested capital,” or total cash out vs. total cash invested.] When I first began investing in solar power projects, we underwrote to private equity returns north of 20%. Today investors in operating projects might get 6-9%, while those investing in development plus operation and/or platform plays (investing in the development company, too) are targeting “mid-teens” returns. To clarify, these are leveraged returns. And when most oil and gas investors hear this, they laugh a little on the inside when comparing these numbers to their target returns from 20-30%. But this is apples-to-orange, due to risk. Renewable energy infrastructure returns are based on [15-25]-year contracted cash flows, while oil and gas investments often depend on far riskier exploration and development, plus volatile global commodity markets. As for deal flow, scale and quality are the two constraints. Regarding the scale of these markets, things are getting better. For example, annual U.S. solar project installations are up roughly 50% versus just two years ago, and by 2023 total installed U.S. solar capacity is expected to increase by more than 2x. But we still need more entrepreneurs to build more projects and companies worthy of investors’ capital. (A tantalizing call to action, for sure.) Regarding quality, over the years, we’ve vetted 100s of MWs of solar projects. But very few have passed review and made it to investment committees. Again, things are getting better. Developers and entrepreneurs are learning from past mistakes (e.g., using venture capital, the most expensive capital on earth, to built factories to make s*#t). For more about what it takes to increase a company’s chances of raising capital, we’ve written a few primers, structured in numbered lists, with attempts at humor included.

3. We overestimate the impact of new tech in the short-term, and underestimate its impacts in long-term. This quote from Bill Gates highlights a comment from an investor panelist: In the current energy transition, trillions of dollars will be created and destroyed. Another investor put is this way: If you have no strategy on the growing role of clean energy, then you’re leaving value on the table. For my panel on energy storage investments, the topic on most investors’ minds was this: “Is energy storage a real market today?” Opinions varied. But here is the right one: Heck ya, it’s real today. But it’s not real everywhere...yet. Hence the confusion. There are hundreds of millions of investment already committed to or invested in batteries each year at the utility, commercial and industrial, and residential level, including projects involving our clients. Consider these stats from Greentech Media:

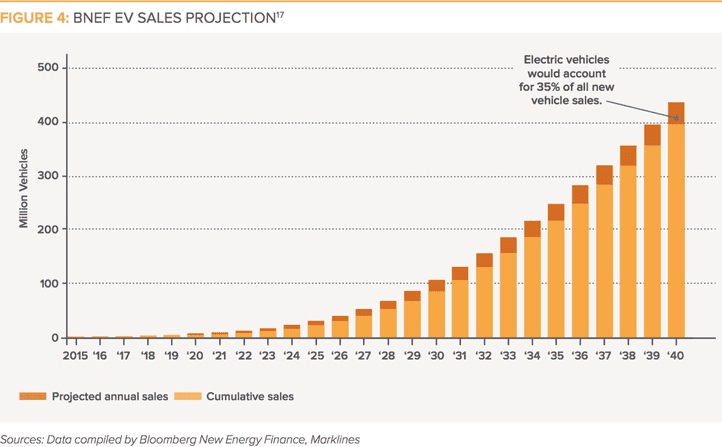

To be sure, the bulk of energy storage investments have yet to come. Bloomberg estimates $100B invested by 2030. For a great graph of billions of dollars projected to be invested, check out the black bar graph here. But even today, giants like NextEra estimate that no new gas peaker plants will be built post-2020 due to the falling price and increasing performance of large-scale battery storage. [For more about energy storage investing, you can read our research here -- Financing Energy Storage: A Cheat Sheet.] Despite early indications of massive growth for new clean energy solutions like storage or EVs, most people see them as a long-term thing. Not a material consideration for today’s portfolio. However, this graph from NYT / HBR shows that often new technologies are being adopted on increasingly quick timelines, following S-curves with step change growth, not incremental linear progress. Of course, when comparing EV adoption to smartphone adoption, investors at the conference pointed out that there is a massive difference in the CapEx among these items; hence much slower adoption is possible. But if any fraction of Tony Seba’s projections in his ReThinkX report on the future of transportation are correct (the question may be “when, not if”), then we could be talking about switching from a CapEx discussion to an OpEx discussion, thereby making the mass transition from ICE (internal combustion engine) vehicles to EVs much quicker. According to one investor panelist, this research estimates that most Americans spend about $10,000 per year on their cars, while ReThinkX projects that autonomous shared EVs could reduce personal travel costs by 90% while also delivering convenience, too. (Ah...to relax and work while going to the airport in a Lyft, instead of navigating traffic and crowded parking garages in my own vehicle.) Building on that theme, while at the event, I received an update from Bloomberg on their EV projections for 2040: 55% of new sales and 33% of global fleet. (#ThatAintNoNiche) [Quick aside: Some panelists laughed at the idea that EVs meant clean energy. True, it depends on the grid mix of high vs. low carbon energy sources. But this calculator from U.S. DOE shows that EV CO2 emissions are roughly 50% less than gasoline-powered cars based on average in the U.S. The calculator lets you see differences by state location, too.] Panelists also noted that major adoption of EVs in the U.S. could lead to 2x growth in utility power output, even describing this monumental revenue-generating opportunity as a “w*t dream” for utilities. (And, yes, the room was mostly full of men. I apologize. Just the messenger...) In a time when Moody’s just gave the utility sector a negative outlook for the first time in history, maybe Elon Musk is right: The electrification of transportation could be a much needed savior for the challenged power sector. Considering that the average capacity factor for U.S power plants is roughly 40%, the utility sector has lots of excess capacity in sunk costs to harness with 100+ EV models coming online by 2020. [Background: Most grids tend to overbuild capacity in order to manage peak loads, thereby underutilizing power plants and perhaps wasting CapEx for perhaps 90%+ of the hours in a year.] On a related note, solar plus storage has until recently been an enticing topic for discussions at conferences, or fun projects for my graduate students. But this, too, is changing quickly. Today almost all renewable energy RFPs from utilities in deregulated markets require the inclusion of energy storage capacity. And suprisingly, the bids are coming in at very low prices. As an example, Xcel Energy’s recent process resulted in 10+GW of bids for solar plus storage at 3.6 c/kWh and wind plus storage at 1.8 c/kWh, which are both new record low prices. Finally, investors often feel limited in their consideration of long-term trends and multi-decade infrastructure assets due to the [8-10]-year life of most private equity funds. In response, panelists came out in two camps:

4. Definitions of ESG and sustainable energy vary widely. Despite the concern that ESG (Environment, Social, Governance) or sustainable investing is for hippies who love to earn below market financial returns, many investment giants would disagree. Below are samples of their thinking:

Yet still there is confusion about what the terms mean. Some panelists said their investments in oil and gas have been doing ESG for many years. Now they just needed to add social sustainability goals. However, they were equating ESG with HSE -- Health Safety, and Environment. While there is overlap, and both are important, there is at least one key difference:

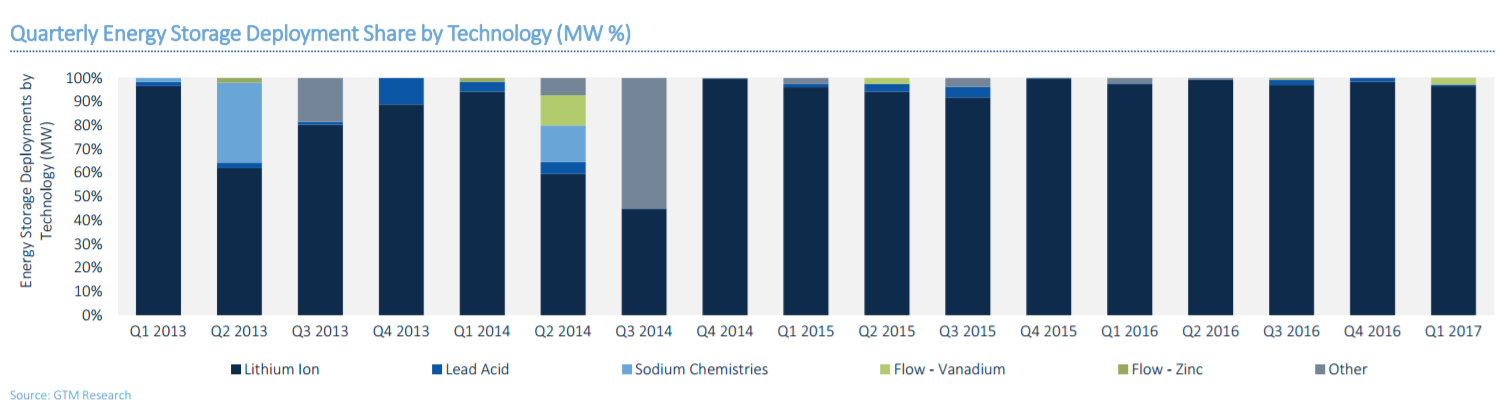

Furthermore, some conventional energy asset managers, intending to do better in ESG, described their greenhouse gas footprinting efforts, and believe that that their conventional energy holdings are low carbon. Some said the CO2 impacts of oil and gas investments were very low impact because exploring, drilling, and transporting via pipelines constituted a very small amount of the sector’s air pollution. This is true relative to the combustion of those resources. However, companies are increasingly being expected to consider and account for broader life cycle impacts of their investments, inside and outside of their direct corporate control. In this new world order, a new analogy may apply: Making guns, but not accepting some accountability for gun deaths, could be a dead argument. (Yep, pun and controversy intended.) --- For more short (and sweet?) commentary on clean energy finance, along with tips on productivity, life hacks, and trivia for your next dinner party, check out our (mostly) weekly newsletter -- 2 Bullet Tuesdays. It’s a quick 4-minute read, with bullets and short paragraphs, plus links for you to learn more if you somehow have more than 24 hours in a day. --- Photo by Jesse Collins on Unsplash By: Dr. Chris Wedding, Managing Partner It’s easy to assume that the energy storage market is plagued with technology risks. With over 70 battery chemistries being tested or deployed, it is no surprise that many financiers worry about backing the wrong horse and earning a “goose egg.” However, as the Transformers comic series so wisely noted years ago, this is another situation where there is “more than meets the eye.” (Get your nerd on, and read more at the Transformers Wiki. Yep, it’s a real thing.) In this post, I will call out 7 factors that are projected to make lithium-ion batteries the top energy storage technology through at least 2025. 1. Lithium — Not One, But Many This dominant type of battery is a leader in part because it is not defined by just one type of chemistry. So, the math is not quite fair. Many of these versions of lithium-ion batteries actually compete amongst themselves. Lithium-ion batteries include varieties with cobalt oxide, manganese oxide, iron phosphate, nickel manganese cobalt oxide, nickel cobalt aluminum oxide, and titanate (titanium oxide). Use cases for this smorgasbord of lithium-ion options cover areas of great interest to us at IronOak Energy Capital — such as grid services, demand charge reduction, and EV uses — as well as non-power sector applications such as medical devices and power tools. For more, here’s a good summary from Investing News. 2. Experience with the Technology Lithium-ion is about as innovative as a middle-aged person. (That was meant to terrify all Millennial readers.) But seriously… With roots in the 1970’s, lithium has gone from science labs and discussions of the distant future to billions of dollars of investment and global dominance. In terms of actual energy storage installations, lithium-ion batteries increased their market share considerably: 29% (2012), 40% (2013), 46% (2014), 71% (2015), and 93% (2016) of all batteries installed globally. (Source: IHS and Navigant) The numbers are even higher today. In the U.S., lithium-ion batteries led all energy storage installations for the tenth straight quarter, including a roughly 97% market share in Q1 this year. (Source: GTM) The next biggest player was vanadium flow batteries with 3% market share. Source: GTM Research

With each additional quarter of lithium’s leadership, the whole host of market players becomes more comfortable with the technology, from regulators and developers to investors and suppliers. Furthermore, costs for lithium batteries have fallen 50-70% since 2010 and are expected to fall another 25-50% by 2020. (Sources: Lazard, Moody’s, Tesla) In addition, each year their performance continues to increase. As such, competitors to lithium face a moving target, one where the bar is constantly rising. 3. Scale of Invested Capital: Divided and Conquered With dozens of lithium-ion competitors trying to win over technology investors, they each receive less capital than they need to scale quickly. Lux Research notes that “beyond lithium” battery companies raise an average of $40M over 8 years. Compare this to the $5B invested in Tesla’s Nevada Gigafactory. Or the three additional gigafactories they announced in February of this year. In addition, this trend is happening outside of Tesla’s magnetic media coverage. Experts suggest Tesla’s factory is only 1 of 12 such factories around the world. In Asia, Amperex Technology, Panasonic, LG Chem, and Boston Power are all planning new lithium factories in China. And Samsung and BYD plan to expand their existing plants. And in Europe, Daimler announced in May this year its own big ole’ lithium-ion battery plant. But it will only cost about $500M. (Yep, sarcasm.) 4. Size of Balance Sheets Startups are known for innovation, being nimble, and disrupting 800-pound gorillas. While exciting, those are also correlated with company-level risk and balance sheets that leave something to be desired. So, if you are the developer and investor in a large stationary battery installation serving the power grid, or the global manufacturer of thousands of electric vehicles, do you choose an innovative startup or an 800-pound gorilla to supply your batteries? Yep, you guessed it. Big and boring wins the day when it comes to scale. As an imperfect proxy, think of large market capitalizations — Samsung ($254B), Panasonic ($26B), LG Chem ($18B), or Tesla ($57B). As they say, “You won’t get fired for hiring McKinsey.” It reminds me of another grim expression: “I want just one throat to choke.” If something goes wrong with those batteries years down the line, you want to be able to … well, you get the idea. 5. Expert Analyst Projections With its considerable inertia, the lithium-ion battery market is expected to continue leading the battery market through at least the next decade. Projections vary, but here are a few to digest:

It’s worth noting that some lithium competitors may have stronger Compound Annual Growth Rates than these projections imply. However, they are starting from a much smaller base so percentages can be deceiving. 6. U.S. Government Projections When countries don’t have what they need, they look for alternatives. (Or go to war. But let’s stay positive.) In terms of known global lithium reserves, the U.S. has roughly 0.3%. That’s not so great when projections suggest $1.4T of U.S. infrastructure could be underutilized over the next 15 years without feasible energy storage solutions. It can also be a limiting factor when electric vehicles hold the keys (yep, bad pun) to managing grid stability as renewable energy penetration grows. As an example, consider that California, the sixth largest economy in the world, is eyeing a new 100% renewables target by 2045. Accordingly, U.S. national laboratories are on the hunt for lithium alternatives. The most notable initiative is Joint Center for Energy Storage Research (JCESR), an innovation hub based at Argonne National Laboratory. So, what is their latest conclusion after considering dozens of next generation battery technologies? Well, one of the two is still based on lithium — that is, lithium-sulfur batteries, which are lighter and have greater energy density than today’s lithium-ion versions. 7. Will Lithium Popularity be Its Demise? You have undoubtedly seen articles suggesting that lithium is a rare metal whose availability will be entirely consumed by Tesla’s Gigafactory. OK, now forget all of that. Let’s talk about the difference between lithium reserves vs. resources.

Quiz time: Fill in the blank.

So, which is reserves and which is resources? Duh, right? Resources refers to the lower, much higher number. Reserves applies to the upper, lower number. Moreover, the volume of resources should continue to climb higher as projected future demand for lithium entices companies to invest more in exploration. Now consider some wild numbers from Mr. Musk: The world could be powered 100% by clean energy if we had the storage capacity output form 100 gigafactories. If true, and if you assume that the full volume of resources is static, then experts suggest we would still have enough for 50 years of lithium supply. In Conclusion All in all, no one can predict the future. But it’s nice when many prognosticators are saying similar things: Lithium batteries make up 97% of new installs in the U.S. (and similar dominance globally). In addition, the seven factors above suggest that its market appeal is likely to continue into the foreseeable future. That said, lithium-ion batteries are not perfect. For example, their maximum duration is four hours of storage. Yet experts suggest that in the years ahead power markets will demand longer duration batteries that allow for over four hours of capacity. Some even call for seasonal storage — think multi-month capacity. And lithium batteries are also not perfectly scalable. So, a 5x increase in size may not mean a 5x increase in power, as would be the case for a flow battery. But keep in mind that the perfect is the enemy of the good when it comes to controlling market share. Ah, to have a crystal ball and see this future play out.

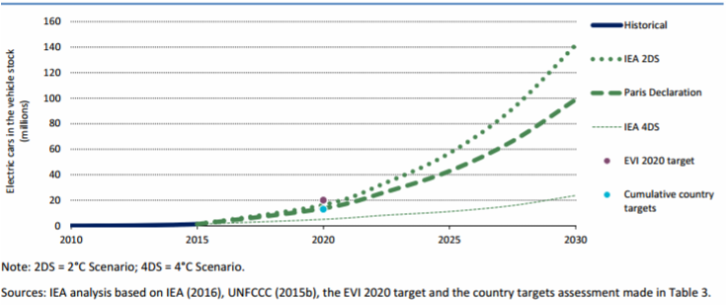

Or better yet, to be a character in the movie Back to the Future. Also about futuristic cars, I might add. (If you don’t know what I’m talking about, go ask a super “old person,” like a 41-year-old. Oh how my kiddos define “old.”) Maybe you care about future growth estimates for electric vehicles (EVs) because you stand to win… For example, EV manufacturers, utilities that can better monetize sunk costs in power generation assets during off-peak hours, battery makers, NGOs working to protect human health, or lithium and other precious metal supply chains. Or maybe you care because you’re industry stands to lose, at least initially… For example, major car manufacturers, government leaders concerned about falling revenues linked to gasoline taxes, utilities unable to manage peak power challenges, or...um...the oil industry. Whatever the motivation, one thing is for sure… There is no agreement on how, when, or if EVs will come to dominate the transportation sector. And importantly, the same metric used for these EV projections is often not the same. It could be “percentage of new sales” or “percentage of total vehicles on the road.” Even trickier is the fact that calculations from various sources do not use the same year for the end state. Some use 2030, others 2040, and...well...you get the idea. It’s almost intentionally confusing so as to prevent an apples-to-apples comparisons among different EV projections. So, here are five things to keep in mind regarding the “all over the map” nature of future EV growth. 1. Calculations for EV expansion continue to be revised upward (more favorably) No one is perfect, and all estimates of future EV growth are wrong. As such, credible sources for these data frequently offer updated projections. Consider the US Energy Information Administration (EIA). Almost everyone considers this to be an authoritative source on energy trends, though many agree they have been conservative when envisioning (or being blind to) renewable energy’s rapid recent growth. (See explanation from David Roberts at Vox.) The US EIA’s vision for EV sales three months ago is 2x higher than one year ago, and 10x higher than its estimates from ten years ago. 2. Estimates for EV penetration by 2020 vary by 11x, depending on the source Consider the range of EV adoption from these trusted sources:

It’s also worth stating the obvious: The disruptive nature of EVs is significant enough that non-transportation management consultancies and big banks like PwC, Deutsche Bank, Deloitte, and BCG are spending time making forecasts to win new business in the sector. #NotaTinyNiche (Yep, Millennial readers, I’m so hip that I just dropped a hashtag.) 3. Non-proponents of EV (Fitch Ratings, big oil executives) are taking notice of its potentially significant impacts It’s not uncommon to hear the term “death spiral” in reference to utilities who face increasingly tough competition when electricity from solar plus storage becomes cheaper than grid power. But those statements, sometimes deemed hyperbolic, tend to come from renewable energy proponents. Biased, one might say. This time, it is instead coming from Fitch Ratings, one of the big three credit ratings agencies. Bloomberg summarizes below the takeaway from Fitch’s October 2016 report, Disruptive Technology: Batteries: “Batteries have the potential to ‘tip the oil market from growth to contraction earlier than anticipated,’ according to Fitch. ‘The narrative of oil’s decline is well rehearsed -- and if it starts to play out there is a risk that capital will act long before” and in the worst case result in an ‘investor death spiral.’” (link) And despite very conservative EV projections from BP and OPEC (see below), many oil executives are aware of EV’s impacts on the sector, and are, in part, noting a decline in oil demand starting in the late 2020s or early 2030s. But note: Though there are still critics who believe the coming EV tidal wave is totally overblown. Here is a good counterpoint from the Financial Times. For a deeper dive into how oil and gas majors are increasing their investment in renewable energy, check out our other article: “Oil and gas companies’ and renewable energy: Passing fad or major trend?” Also, check out this graph that represents the 120 EV car models coming to market by 2020. All of these car manufacturers bets on EV can’t be wrong, right? (Tongue twister, I know.) 4. EV market share by 2040 varies by 13x, depending on the source As you can guess, the potential for errors increases as the length of time in the projection increases. So, how do projections for EV penetrations vary for 20 years in the future?

And how about projections for EVs as a percentage of all new car sales?

Are you confused yet? Yep, me, too. But that can be the sign of a sector that presents opportunities for above-market returns. 5. Adoption of new technologies has historically happened quicker than common sense would suggest Consider the microwave, dishwasher, cell phones, refrigerator, internet, VCRs, or computers. They are not perfect comparables to a vehicle, but suspend disbelief for just a second. These technologies often went from zero to 80%+ market penetration within about 25 years after their initial 1% market adoption (i.e., roughly where EVs are today). This graph shows these trends well. Here are some assumptions you could use to create your own simple spreadsheet:

Potential results:

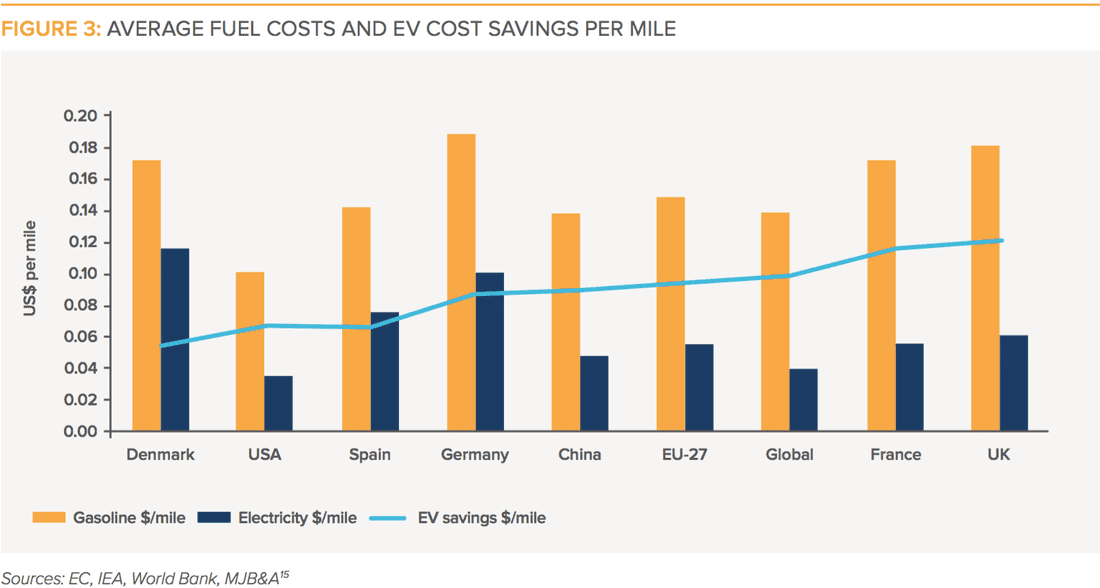

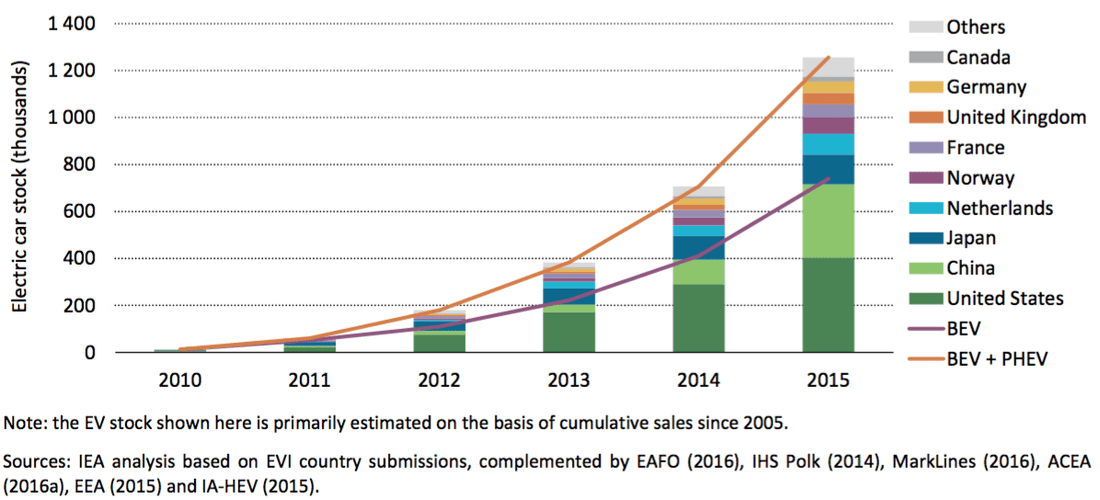

-- In conclusion When it comes to predicting the future role of EVs in the transportation or energy sector, no one is right. However, it’s a little bit like deer hunting with a bazooka. (Bear with me...I’m born and raised in the South.) It doesn’t require the precision of a bow and arrow, so odds are you’re going to be putting some free range meat in your freezer after that trip to the great outdoors. Translation: Abundant opportunities exist for entrepreneurs, large corporates, and investors in the EV market in the short and long term. As the Chairman of Bloomberg New Energy Finance noted recently, with 100+ EV models on the road within three years, EVs will make internal combustion vehicles look old fashioned. It is easy to relegate a discussion about electric vehicles to Tesla toys for the affluent. But that would not be the whole truth. As an illustration, I recently served on the Advisory Board for Vulcan in its Smart City Challenge partnership with the U.S. Department of Transportation, which jointly awarded US$50M to a single U.S. city to support transportation innovation, including electrification. In all, 78 cities competed. The enthusiastic response, impressive potential for scale, and wide-ranging innovation were a pleasant surprise. Although there are only about two million electric vehicles on the road globally today, that estimate is expected to grow to roughly 100x if the Paris Climate Accord has its targeted impact (International Energy Agency, 2016). Electric Vehicle Projections, 2010-2030 (Source: International Energy Agency, 2016) Although these vehicles are often deemed to be “too expensive,” many electric vehicles actually offer a lower total cost of ownership than conventional vehicles when assess over their entire lifecycle.

Moreover, by 2022, the average first cost of electric vehicles is projected to be the same as the average first cost for conventional cars. With cost concerns removed, plus the other benefits of less noise, no gasoline smell, fewer moving parts, and the “cool factor,” this market is expected to grow quickly from this point forward (BNEF, 2016). In fact, the growth of electric vehicles is expected to be so meaningful that Fitch Ratings recently stated that the sector’s rise presents potential for “investor death spiral” negatively impacting the oil sector (Financial Times, 2016). And at the Oil & Money Conference last month, Statoil’s CEO noted that electric vehicles could catalyze oil’s peak sales within five years, with a steady decline thereafter (Climate Home, 2016). Considerations for infrastructure investors:

The Chief Technology Officer of Tesla, J.B. Straubel, stated recently that it doesn’t make sense for electric vehicles to send electricity back to the grid. In the same remarks, he also noted the following:

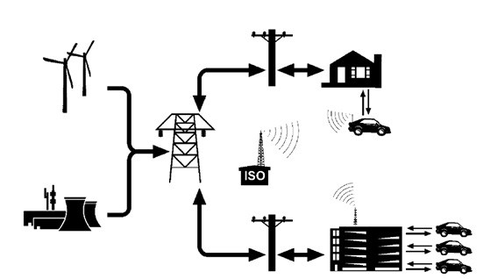

What the CTO is criticizing — vehicle-to-grid or V2G -- is essentially distributed energy storage on wheels. The function It takes advantage of unused EV battery storage capacity to allow for power sales back to the grid, either by draining some power when the vehicles are not in use or reducing the vehicle charging rates. At a basic level, V2G has three requirements:

Vehicle-to-Grid Schematic Source: Jim Motavalli, The Azimuth Project The EV technology and services company AC Propulsion, a V2G proponent, outlines the potential benefits of V2G as related to grid services: peak power sales, spinning reserves, base load power, peak power (either as a form of direct load control or to reduce demand charges), and reactive power.

In turn, the EV owners get paid for the energy services provided. But aren’t all of these benefits just the same as those for storage, but in EV form? The figure above seems very similar to one that would be drawn for fixed batteries. The challenges of V2GSeveral hurdles would have to be crossed in the current market and policy environment for V2G to be commercially viable. Among the not-so-attractive characteristics of V2G:

V2G Lite -- Commercial Fleet Applications The first of those challenges above could potentially be met with a market-derived refund incentive, though it is unclear how many EV owners would be willing to own a car with a shorter lifespan in exchange. Alternatively, EV battery manufacturers could design future batteries for more frequent power cycling, but that would require a major and disruptive shift from the current design parameters that do not take V2G into account. The second challenge would seem to be one of public policy, and conceivably overcome if stakeholders from the EV space were united in pushing for V2G (which they’re not). The third challenge might be addressed with commercial EV fleets. In this “V2G Lite” scenario, a fleet owner -- who with the help of data analytics has a good sense of the driving patterns of the fleet -- would be able to sign a power supply contract with a utility that guarantees a certain amount of EV battery capacity at different times during the day. Fleet contracts could be bundled, so risk is spread and utilities only have to deal with a few intermediaries when relying on this stored power source. Even if a fleet was designed to spend most of the day on the road and most of the night charging, there could still be some battery capacity free at certain times, available to be used by (and sold to) the grid. Along these lines, Nissan is notably optimistic about V2G’s horizons, and has been so since last spring when it announced cooperation on V2G efforts with Endesa, a subsidiary of the Italian energy multinational Enel. Now the automaker is working with Enel and the Californian V2G services provider Nuvve to install a commercial V2G hub in Copenhagen, Denmark. The 100 kW project is admittedly small, with 10 Enel 10 kW V2G charging units paired with 10 Nissan EV vans and a Nuvve platform to coordinate when idle vehicles can send energy back to the national grid on demand. V2G Strong -- V2G for Everyone? Or, what might be good for the public isn’t necessarily good for Tesla A group of EV researchers at the University of Delaware is at the leading edge of EV research and those advocating for full V2G penetration. In one study the numbers and justification for a full V2G push are impressive: if we put 20 million light duty V2G EVs on the road (just 10% of the current total U.S. fleet), and conservatively assume a peak power rating of 50 Kw for the cars, we could have a combined power capacity equivalent to the entire U.S. Electric grid. Paired with renewables, the V2G EV fleet would bring game-changing results for CO2 emissions and other transportation sector pollution. The EV future is being built now, with new cars, new charging stations, and new rules and practices. As this new EV built environment grows and develops, integrating V2G capabilities may just add an additional layer of complexity to the overall project, without a certain return. But if we were to make a major push for V2G capabilities to be integrated at the ground level, the benefits for society and the planet could be large. (Source: RMI Electric Vehicles as Distributed Energy Resources)

Where are you, rational car buyers? The myth of the rational economic man lurks around the issue of electric vehicles (EVs). See, rationality is something to which many learned folks aspire, but it turns out to be a mirage. Yes, we stumble towards it in a thirsty stupor, dreaming of drinking up its cool, clean sensibility. But, we never get there. It always remains a misty illusion just out of reach. The rationality dilemma with EVs is pretty simple. Let’s make it clear -- EV purchasers are no more rational than EV skeptics. EV purchasers will look at the graph above, and say -- ha! -- I am saving money on a per mile basis compared to all of your fools with internal combustion engine (ICE) cars. They are not wrong, but neither are they entirely right. EV skeptics will look at the graph above and say -- ha! -- you are being duped into assuming this is an apples-to-apples comparison. Again, they are right, but that is not the whole picture, either. Why you are going to lose the “EVs are cheaper over the long haul” debateIt boils down to this. Yes, electricity is a great source of energy, and it is cheaper on a per mile basis than gasoline (even the highly subsidized gasoline that we enjoy, and abuse, in the US). But electricity is electrons, difficult to contain, eager to be used immediately. Gas is a portable, energy dense liquid fuel that affords the owner of this magical worker unsurpassed flexibility in how and when to use it. Ironically, in certain places electricity and gas are made of the same stuff -- oil. I am looking at you, Curacao and Gibraltar, where 100% of electricity is generated from oil! So the real calculation about EVs is more complex because the services that you gain from gas and electricity are not interchangeable. What value do you place on your American right to cruise the highways to your heart’s delight? If the answer is high, then the comparatively lower cost of an EV-mile is meaningless. Your peace of mind in hitting the road without a worry in the world as to how your next mile will be fueled is, in economic terms, infinite. It trumps all other concerns. The term of art for this is “range anxiety.” What value do you place on cheap, clean transportation within a relatively small driving radius? If the answer is high, then the EV vs. ICE cost comparison is how your explain to your beloved significant other why you just purchased a car that cannot comfortably drive the family to visit your in-laws. Oh, and by the way, the sticker price was a little steeper than that conventional car you had agreed to purchase. But really, the EV question is even more complicated than that And that is just the tip of the iceberg. There are many other factors -- your comfort with rapidly improving battery technology, your assumption that EV charger networks will continue to expand, your belief that manufacturers will not bail on EVs in the future, etc. -- that ultimately weigh heavily on any rational calculation justifying or dismissing the idea of purchasing an EV. Dilemmas breed a “let’s wait and see” attitude, how boring Which brings me to the last point. I grant you permission to purchase (or lease) an EV (or PHEV if just want to dip your toes). Don’t feel like you have to explain yourself to your neighbors (though this tactic will not work with your significant other). After all, why did they buy that Honda Odyssey? Was it on a purely rational, benefit-cost maximizing basis? No, they wanted something comfortable and reliable for the family, period. They just wanted it, just like you just want an EV. And let’s be real, you want it because it is cool, wave-of-the-future technology. Because it allows you to avoid ever patronizing another neerdowell, franchised Exxonmobil (or BP, or Shell, or fill-in-the-blank) gas station. Or maybe you just like getting all the best EV charger parking spots. It doesn’t matter - embrace the irrationality. Be an early(ish) adopter. Get onboard, because EVs are where we are headed, like it or not. Queue EV hockey stick graph. Most investors we talk to are not investing in electric vehicles for a few reasons:

In this and our future market insight pieces, we’ll address these concerns. Yep, the EV market is tiny, but it will be mainstream in just a few years. The time to get smart on EVs and take action is now. The data below is from the good folks at Deutsche Bank. Note a 3x growth by 2020 and 5x growth by 2025. Who’s winning the EV race?

1. Duh, it’s Tesla. 2. What? Tesla is not the only EV in the world? 3. The competition is global. Many investors have never heard of some leading EV car lines. Again, great stuff from the environmental NGO....uh...I mean, global investment giant Deutsche Bank. Kudos. (Source: IEA) The International Energy Agency must love the Stanley Cup Playoffs because their recently published Global EV Outlook was full of hockey sticks! The hockey stick graph, you may recall, was popularized as a key piece of evidence supporting the existence of climate change. Rest assured, there will be no debate of climate change here. I am a deep believer in the appropriate use of sports metaphors to describe complex phenomena. The greenhouse gas emissions hockey stick graph tells about as simple a story as can be told about climate change. The hockey stick is a pithy way of showing how a creeping linear trend jumps into an exponential growth (or decay) phase. Our minds are wary of things that change exponentially. They are just not normal. That is because from one time period to the next, your worldview, let’s call it your umwelt, is dramatically different. Yet, as history shows, this Law of Accelerating Returns holds to key to understanding technological progress over the course of history. We see hockey sticks everywhere now. Some, we should get excited about like renewable energy deployment. Others, we might be wary of like the growth of the economy. Some indicate a phase shift, as in the case of the transition to renewable energy. Others might indicate a boom-and-bust cycle, with exponential growth followed by precipitous declines. The trick is understanding the underlying drivers of change. So, about EVs. Not long ago, EVs were very rare, too expensive, and only the most ostentatious environmentalist among your friends was even considering buying one. Skip ahead five years, and all of sudden, your umwelt has changed. The Law of Accelerating Returns has been hard at work. Now, you are starting to see EVs everywhere you look, EV charging stations are taking up the best parking spots, and your neighbor down the street likes to park their EV in the driveway to show it off while it charges. And this is just the beginning. (Source: IEA)

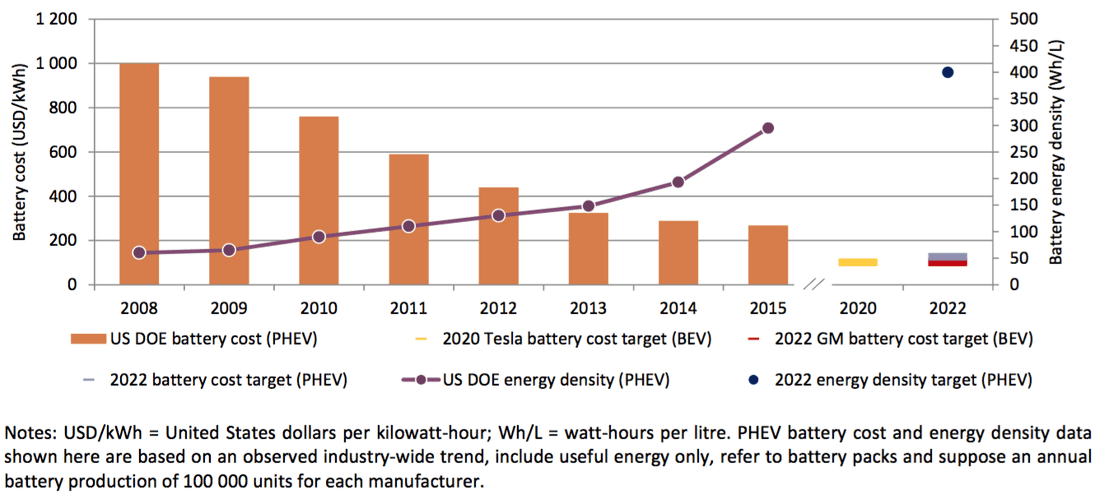

What changed? Well, largely it was a story of rapid technological innovation leading to dramatic cost reductions. The most important of these is with the battery, of course. As batteries make up around ⅓ of the cost of an EV, the increases in energy density coupled with the reduction in battery cost have started to bring EV costs down from the stratosphere. And not to dismiss, also helped alleviate the all-important “range anxiety.” We Americans do have a pastime of hitting the open (or congested) road without a worry until the next gas station. If battery technology continues its march of progress, look out for the Law of Accelerating Returns to come into full force in the EV sector. |

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|