|

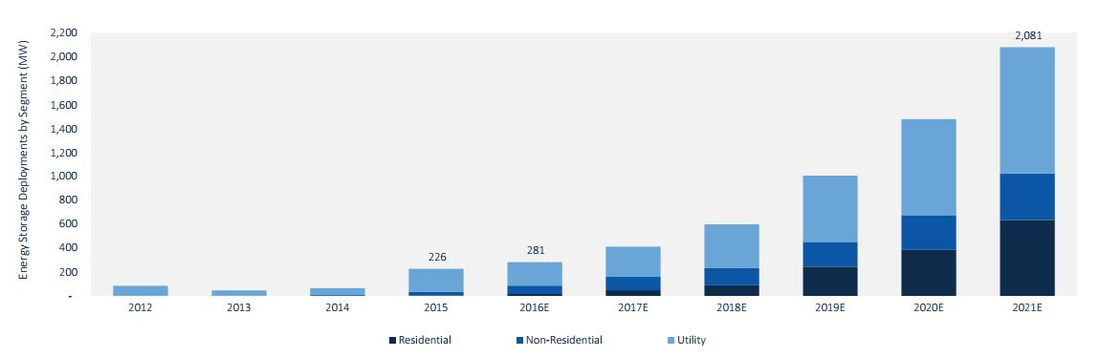

9/26/2016 U.S. Energy Storage Market to Grow 8x by 2020: What If It Had Its Own Special Tax Credit?Read Now Source: GreenTech Media Can the energy storage industry withstand the scrutiny of having their own ITC? It cannot be understated how transformative an energy storage ITC would be for the industry. At IronOak Energy, we have written previously on the impact of such an ITC, and even presented a positive take on its potential rollout. Here, I want to pose the question of whether the industry is really ready for such a game-changing policy. The graph above shows projections for the growth of energy storage development under the current policy regime. Not too shabby. But is the energy storage industry prepared to put that delicious tax equity to good use on stand-alone energy storage projects (in practice, solar + storage applications currently qualify for the solar ITC)? Of course, the answer is always: it depends. Depends on what? Some would argue that the critical issue holding back a tidal wave of energy storage projects is the technology. One could easily view the vast array of energy storage technologies vying for prominence with some trepidation. Some are commercially viable, while many are not. It takes some brainpower to suss out the contenders from the pretenders. Even the smarties at MIT have a tough time doing it. Do we want the government to incentivize the deployment of technologies that may not be ready to contend for the main stage? Conversely, is that precisely the role we want the government to take? The double-edged sword of government subsidy This is a classic double-edged sword phenomenon. On one edge, there are green grassy fields of opportunity in rolling out new storage technologies in commercial applications. Accelerating storage deployment will drive down costs and help evolve viable business models. Beautiful. Lurking on that other edge is the distinct possibility that many storage technologies in earlier stages of development will simply fail. And failure is bad press, even if it is the Darwinian process of technological progress. It puts the government in the untenable position of having subsidized a “reckless” experiment with taxpayer dollars. “Picking winners and losers” they will say, even though an ITC is designed to avoid precisely this potential conflict. And, let’s just say that there is a history of nasty repercussions for such interference with the so-called free market for energy (ahem - myth). Solyndra - need I say more. Some will say that Solyndra was blown out of proportion (it was) AND it was 5 years ago (a lifetime ago in the clean energy industry). To top it off, Solyndra was backed with loan guarantees, not really what the ITC is about. Details, details... But now, the vengeful energy gods have gifted us SunEdison. It was an altogether explicable collapse, but one that, nonetheless, provides ammunition against government support for the clean energy industry. Who knows what would have happened with the extension of the solar ITC if SunEdison has filed for bankruptcy in 2015 rather than 2016. So, be careful for when you wish upon your industry the scrutiny of being a target of government support. Technological risk is a red herring -- it is really all about how to finance storage Sure, risk exists with many energy storage technologies. Even the most established battery technologies lack the operational history to assuage the concerns of investors looking at decadal time horizons. If you are absolutely intolerant of risk, go invest in government treasuries (just kidding - terrible idea). Just running down the ladder to the cheapest storage technology fails to capture the complexity of the underlying value proposition. Cost is king, but there are many other factors competing for a role on the king’s court. Energy storage technologies cannot be reduced to a simple efficiency or production metric, as with solar or wind (even that is an oversimplification, but at least a reasonable one). There are more than a dozen potential services that could be generated by a given storage technology, many of which have few established market mechanisms to generate reliable revenue. So, here’s the central takeaway. The biggest challenge in the energy storage market is not how to choose the right technology. It is how to design the right market structures to support financial innovation. Making energy storage bankable is close to being a precondition for the successful utilization of an ITC. Recall that the success of the solar PPA model hinged on stable, contracted cash flows. Making solar bankable unlocked a vast market potential that we are still in the early stages of witnessing. There is no equivalent financial structure with energy storage, yet there remains a distinct need to create consistently financeable project cash flows. But wait, SolarCity and Tesla (perhaps soon to be joined in holy matrimony) pioneered a solar + storage PPA earlier this year. The energy storage industry needs a financial product the equivalent of a PPA, and perhaps we are not too far off. Thus far, it has taken a savvy, not mention risk tolerant, investor to back energy storage projects. There is only so much runway with this sort of approach. Easing the path for new investment in storage will hinge on making this inherently complex technology and market application simpler. There are already frontrunning markets generating experiences that will guide future market design and development - thanks, California. In tandem with this type of market development, energy storage needs a greater degree of standardization of financial strategies and structures to help make projects pencil. And not just for the smartest guys in the room, but for a broad swath of interested investors. The question remains as to whether an energy storage ITC will aid or inhibit such progress. Related Reading:

Related data points:

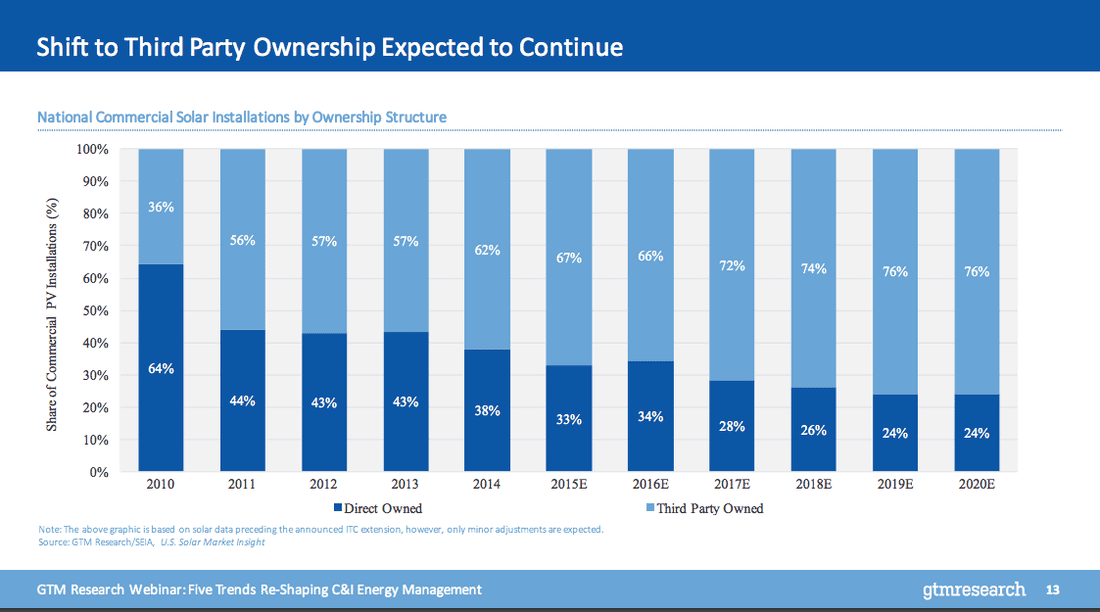

Amid the buzz of Solar Power International 2016 last week, there was a persistent cry of the financing gap in C&I solar. Yes, big money is flooding in searching for good projects to finance. The low-hanging fruit has always been utility-scale solar. Scale, credit-rated offtaker, stable cash flows - check. But margins are being squeezed as the race to bottom out PPA prices builds momentum. Enter C&I solar - a tantalizing large potential market of smaller-scale projects, trending towards 3rd party ownership (translation = welcome investors!), with low hanging fruit ripe for the picking. Commercial and industrial offtakers seem more willing than ever to sign up for solar, and at PPA rates often substantially higher than what can be gotten from our utility friends. But, is C&I solar the greenfield opportunity that many hope it to be? (Source: GreenTech Media) C&I solar is not blessed with the same attributes as a utility-scale project - smaller scale, offakers with no credit ratings, and, most importantly, extreme heterogeneity. Diversity is every infrastructure financier’s nightmare, as it stymies standardization, which is the key ingredient to scaling investment from more risk-averse, low cost of capital investors. And the C&I solar market has bedeviled many attempts to solve the standardization challenge. By way of example, I am going to pick on beEdison and their flagship risk analytics product, truSolar. TruSolar, a project cofounded by Distributed Sun, Dupont, RMI, and Underwriters Laboratories, was an attempt to create a uniform method for assessing project risk in C&I solar. The truSolar Risk Screen Criteria and Methodology (RSCM) identified over 800 unique risk elements and thousands of scoring dependencies. Impressive? Or overkill? Hard to say. On top of this great risk analytics tool, they created a marketplace platform, used a ton of project data to train their risk algorithms, created nifty flow charts like the one below, and hoped that buyers and sellers would seek holy matrimony at their table. By all accounts, truSolar is the real deal, and who doesn’t like marketplaces, but are buyers and sellers coming? They built it, so did they come? beEdison claims to have 200 members and 1,000+ projects totally over 4 GW and $10B of dealflow. But, I have to admit - I am skeptical. Around 2 GW of solar was developed in Q2 2016, and less than 20% of that was in C&I market (SEIA). So, it appears as though the 4 GW number is just maybe a bit of an overstatement. (Source: beEdison)

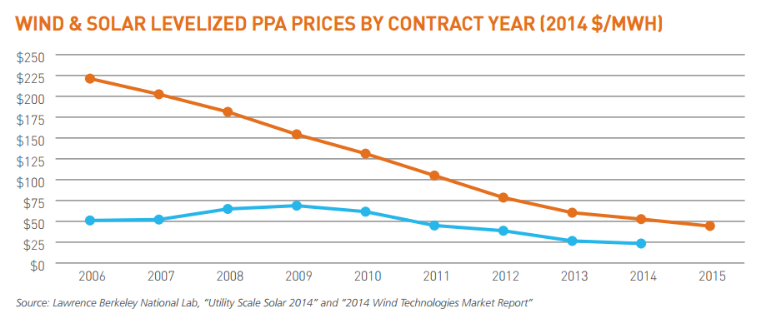

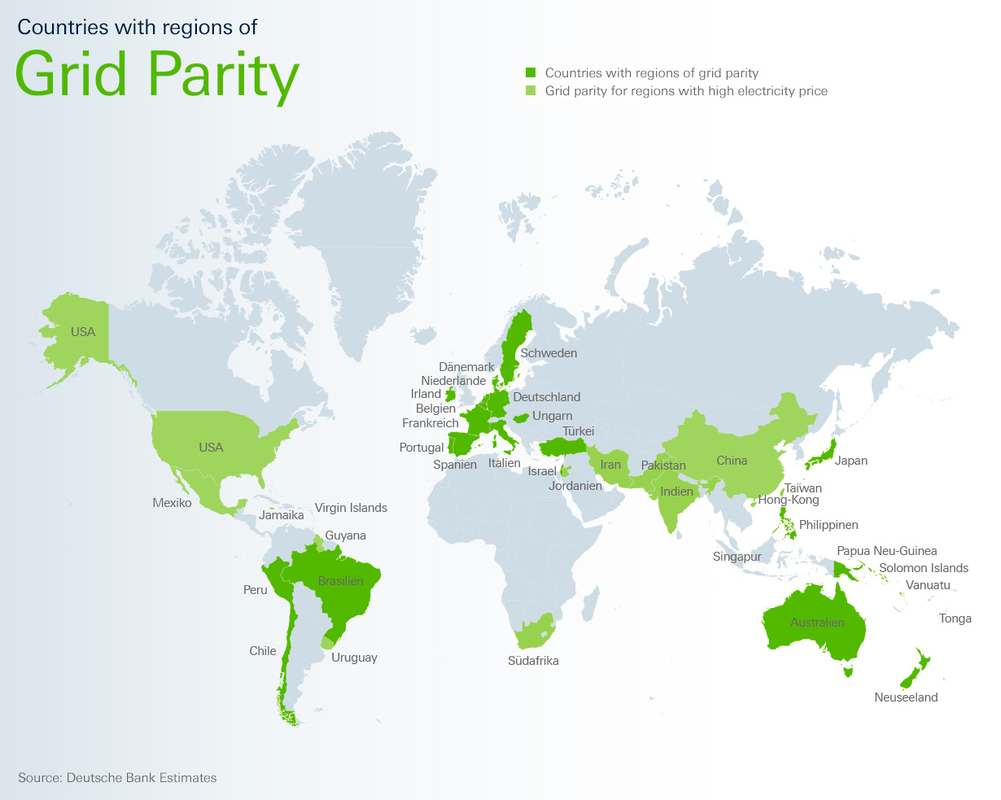

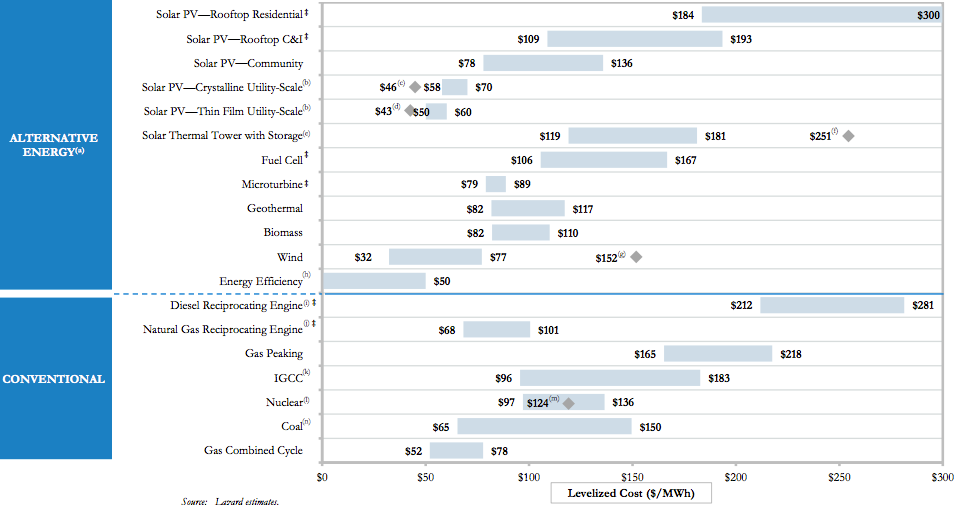

To be sure, I am fan of beEdison’s approach. It is ambitious, and it solves a real challenge in the solar C&I market using - everyone’s favorite buzzword - BIG DATA! So, why is it not sweeping through the marketplace with wild abandon? Perhaps, they made the risk analytics process too opaque and complex. Perhaps, sellers do not trust the idea of using a platform to meet sellers, or vice versa. Or, perhaps the real issue is that solar C&I projects are not penciling like investors would hope. The real challenge in the solar C&I market is not just standardization and credit analysis. It is that these projects do not turn out to be nearly as rich as investors had hoped. It is a classic case of failing to achieve economies of scale. Development and construction cost efficiencies in the utility solar market allow projects to pencil even with really low PPA rates. It is really difficult to translate those cost efficiencies into the C&I solar market due to the aforementioned issue of extreme heterogeneity. Said another way, solar C&I projects just cost more. And only in niche markets can those high project costs be supported by the prevailing PPA rates that a C&I customer will accept. Many geographies are blessed with low retail electricity rates, especially for large electricity users. These offtakers are not likely to accept a PPA which locks them into a higher electricity cost today, even if the long-term impact will likely be in their favor. When high development and construction costs run up against this ceiling of acceptable PPA rates, you start to see margins squeezed. But the difference is that these margins are on small projects with funky risk profiles. So for the time being, solar C&I remains a “diamond in the rough” market. Investors are seeking the gems out there, while many (I mean, many) projects out there just fail to meet their hurdle rates, risky or not. But be on the watch - there are many other companies exploring ways to serve this sector efficiently, and at scale. The real gamechanger may not be nifty platforms, but rather the tried and true method of securitization. Solar securitizations are happening, pioneered by SolarCity and SunRun, but can the question remains as to whether they can open the floodgates of institutional capital given the fragmented and idiosyncratic nature of solar C&I projects. Nobody likes paying more than they should. And my dad is a CPA, so this is definitely true for me, too. But this barrier is not unique to renewable electricity. The same expectation is true for most non-luxury goods and services. Yet I still hear the objections everywhere -- from sophisticated investors to family friends -- that solar and wind are too expensive. Is that still true? Yes, but increasingly no. OK, to be clear, most of the data says no, but as you know, perception is reality. This lingering misperception is also being observed by other energy leaders, including the Director of Sustainability and Cleantech at Schneider Electric in recent a Greentech Media article about Scheider’s New Energy Opportunities (NEO) Network. Consider the graph below from Clean Edge, which is based on data from the US Lawrence Berkeley National Laboratory. The levelized costs for solar electricity (LCOE) has fallen from 22.5 c/kwh to less than 5 c/kwh. That’s a roughly 78% drop in price over the last 10 years. But unless an investor or corporate executive has regularly re-evaluated the business case for alternative energy, they might have missed these market changes. It’s important to note that this refers to utility-scale solar, not rooftop solar. The latter has a higher LCOE (c/kwh), but it also competes with higher retail electricity rates. Additionally, Deutsche Bank estimates that unsubsidized rooftop solar is 30% cheaper than retail power prices in many countries. See their map below showing countries with substantial areas of grid parity. Finally, here’s another data-driven perspective from investment advisory firm, Lazard. The resolution is not great, so let me help you out. Here are some of the lowest LCOE values from highest to lowest:

Here’s a link to the full Lazard report, version 9.0.

If you like data and charts, you’re going to really enjoy this. Grab a big coffee and settle in for some quant goodness. And next time someone says that solar is too expensive, you can admit they are partially right. But then give them a little dose of 2016 data. The Chief Technology Officer of Tesla, J.B. Straubel, stated recently that it doesn’t make sense for electric vehicles to send electricity back to the grid. In the same remarks, he also noted the following:

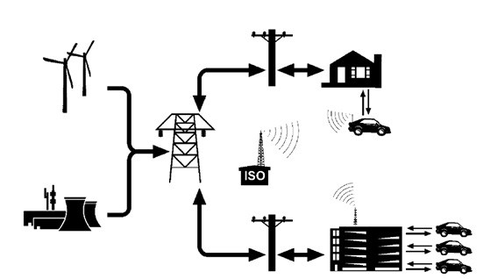

What the CTO is criticizing — vehicle-to-grid or V2G -- is essentially distributed energy storage on wheels. The function It takes advantage of unused EV battery storage capacity to allow for power sales back to the grid, either by draining some power when the vehicles are not in use or reducing the vehicle charging rates. At a basic level, V2G has three requirements:

Vehicle-to-Grid Schematic Source: Jim Motavalli, The Azimuth Project The EV technology and services company AC Propulsion, a V2G proponent, outlines the potential benefits of V2G as related to grid services: peak power sales, spinning reserves, base load power, peak power (either as a form of direct load control or to reduce demand charges), and reactive power.

In turn, the EV owners get paid for the energy services provided. But aren’t all of these benefits just the same as those for storage, but in EV form? The figure above seems very similar to one that would be drawn for fixed batteries. The challenges of V2GSeveral hurdles would have to be crossed in the current market and policy environment for V2G to be commercially viable. Among the not-so-attractive characteristics of V2G:

V2G Lite -- Commercial Fleet Applications The first of those challenges above could potentially be met with a market-derived refund incentive, though it is unclear how many EV owners would be willing to own a car with a shorter lifespan in exchange. Alternatively, EV battery manufacturers could design future batteries for more frequent power cycling, but that would require a major and disruptive shift from the current design parameters that do not take V2G into account. The second challenge would seem to be one of public policy, and conceivably overcome if stakeholders from the EV space were united in pushing for V2G (which they’re not). The third challenge might be addressed with commercial EV fleets. In this “V2G Lite” scenario, a fleet owner -- who with the help of data analytics has a good sense of the driving patterns of the fleet -- would be able to sign a power supply contract with a utility that guarantees a certain amount of EV battery capacity at different times during the day. Fleet contracts could be bundled, so risk is spread and utilities only have to deal with a few intermediaries when relying on this stored power source. Even if a fleet was designed to spend most of the day on the road and most of the night charging, there could still be some battery capacity free at certain times, available to be used by (and sold to) the grid. Along these lines, Nissan is notably optimistic about V2G’s horizons, and has been so since last spring when it announced cooperation on V2G efforts with Endesa, a subsidiary of the Italian energy multinational Enel. Now the automaker is working with Enel and the Californian V2G services provider Nuvve to install a commercial V2G hub in Copenhagen, Denmark. The 100 kW project is admittedly small, with 10 Enel 10 kW V2G charging units paired with 10 Nissan EV vans and a Nuvve platform to coordinate when idle vehicles can send energy back to the national grid on demand. V2G Strong -- V2G for Everyone? Or, what might be good for the public isn’t necessarily good for Tesla A group of EV researchers at the University of Delaware is at the leading edge of EV research and those advocating for full V2G penetration. In one study the numbers and justification for a full V2G push are impressive: if we put 20 million light duty V2G EVs on the road (just 10% of the current total U.S. fleet), and conservatively assume a peak power rating of 50 Kw for the cars, we could have a combined power capacity equivalent to the entire U.S. Electric grid. Paired with renewables, the V2G EV fleet would bring game-changing results for CO2 emissions and other transportation sector pollution. The EV future is being built now, with new cars, new charging stations, and new rules and practices. As this new EV built environment grows and develops, integrating V2G capabilities may just add an additional layer of complexity to the overall project, without a certain return. But if we were to make a major push for V2G capabilities to be integrated at the ground level, the benefits for society and the planet could be large. |

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|