|

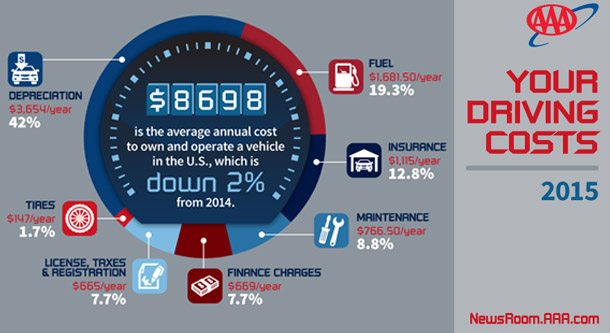

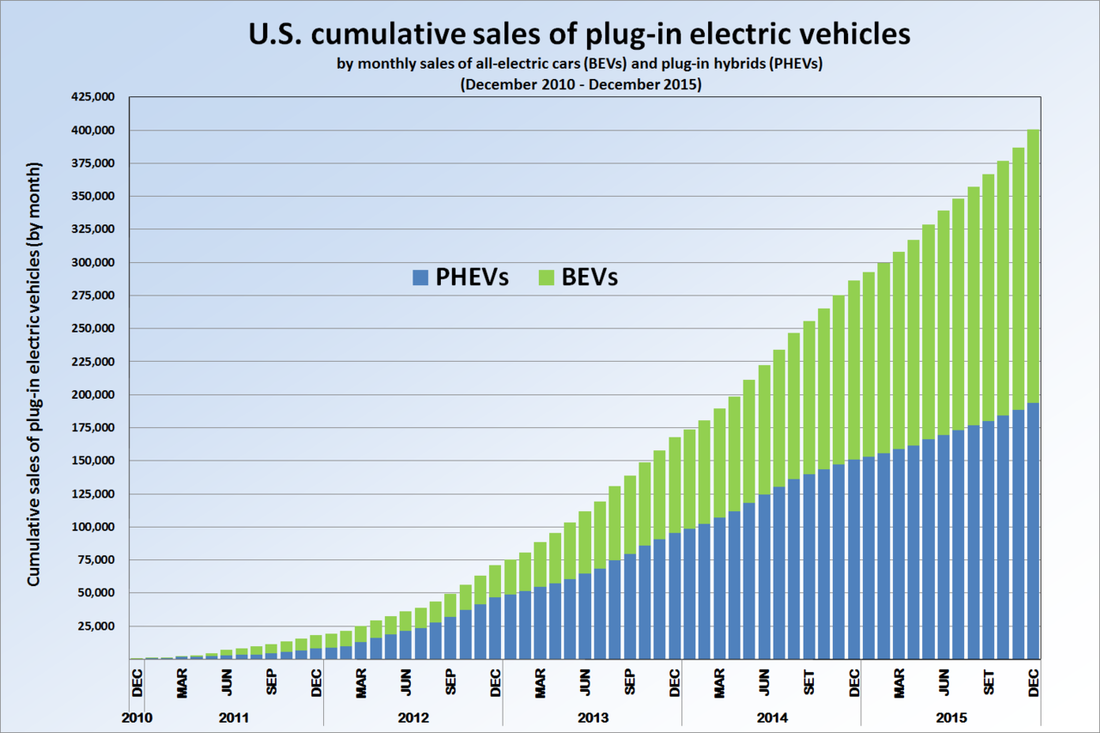

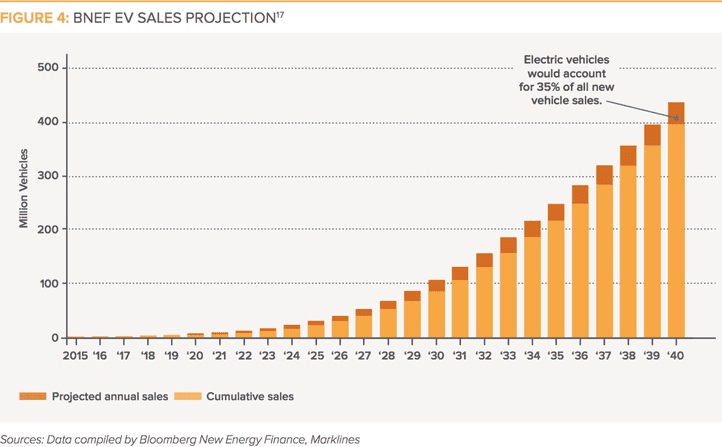

You’ve heard the buzz. Tesla (est. value $32.6B) seeks to acquire SolarCity (est. value $2.8B). Could a holy trifecta of clean energy come to pass? Solar + electric vehicles (EV) + energy storage all under one excited electron-pumping roof? A clean energy corporate union more valuable than Apple one day? Ah, to dream. Or, perhaps not a dream, and instead an achievable goal -- that is, a dream with the master plan of today’s Edison? We have concerns about the potential merger, and investors do, too. However, the benefits for U.S. consumers are tantalizing. And we’re big Musk fans. So consider us cautious enthusiasts. Let’s look at some numbers from a recent article by soothsayer and king of candor Jigar Shah’s recent piece “The Bullish Case for the Tesla / Solar City Merger.” (If you don’t know who he is, check out Greentech Media’s Energy Gang podcast. His honesty will shock and delight. A good dude, too.) 1. Cars are expensive to own and maintain. AAA says we pay about $800/month. See the breakdown below. (To clarify, if this calculation is based on a new-ish car that is financed. Cheaper vehicles purchased with car would see lower implied monthly costs than $800/mo.) 2. Going all solar and driving a Tesla can actually save many consumers money each month. For rough math, Jigar assumes $200/mo in energy bills. So, car plus energy equals $1,000/mo. If the solar system ($20k) and EV ($35k), plus some efficiency ($10k), were financed at, say, 8% for 20 years, and treated partly like a service, consumers could see payments of less than $600/mo. In that hypothetical, they save $400/mo, or 40% vs. status quo. But now they can also brag to their friends about how “green” they are. I’m just making up numbers, but you get the idea. The point: It’s not a scenario of selling your kidney to go carbon-free. Plus, the idea of EVs as a monthly cost vs. a one-time purchase is in line with current EV adoption: 75% of EV users lease vs. about 30% of conventional vehicle owners. 3. This EV + solar thing is a global opportunity, so think about big, big potential revenue. Deutsche Bank projects that solar power will be at grid parity -- that is, the same or lower cost than retail rates from conventional power -- in 80% of the world by 2017. Just to clarify, that is next year, not 20 years from now. Moreover, we’ve got about 1.2 billion cars on the road now. But in 2035 that number is projected to reach 2.0 billion. Ugh. Why not start those new car owners off on the right foot -- Tesla-finance EVs that cost less than conventional vehicles on a monthly basis, and offer fun features like air purification (cough, cough, Beijing)? Finally, consider that EVs are expected to be cost neutral vs. gas-powered cars from a first-cost point of view by 2022. As wiser men have said before, the future is [already] here; it’s just not evenly distributed. How fast can that future be more evenly distributed? So far, we’re liking the slope of that graph. But don’t get too excited yet. We’re still just at the starting line of an exciting marathon ahead of us. Start drinking that Gatorade. Source: Hybridcars.com, Baum & Associates, EDTA

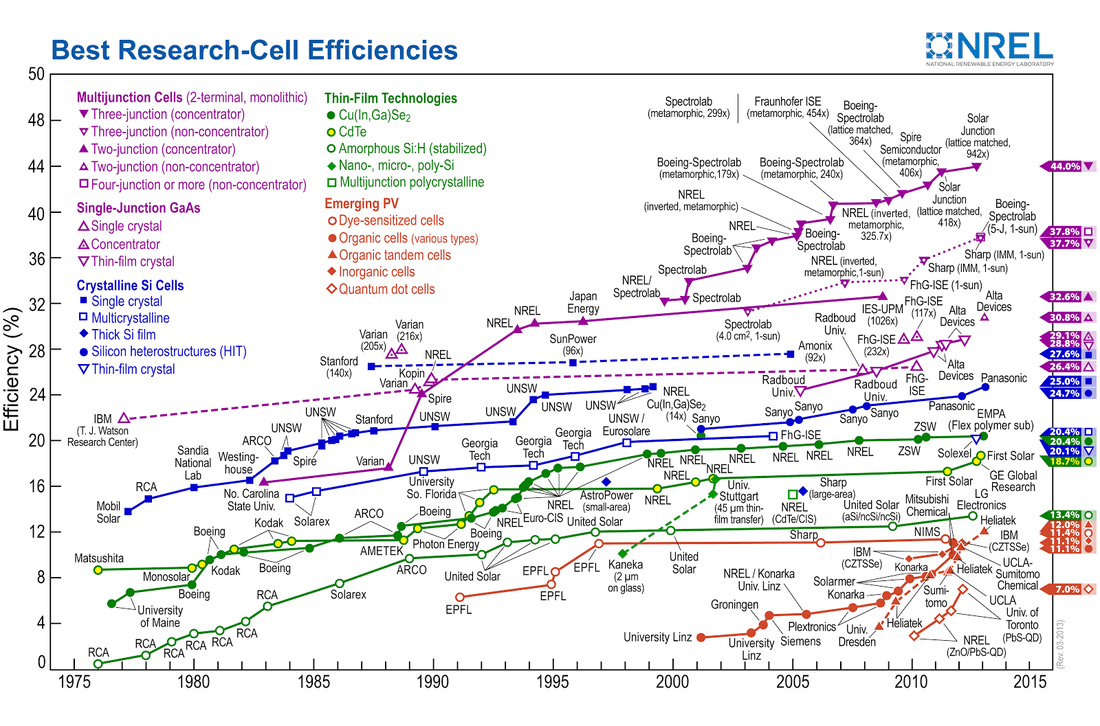

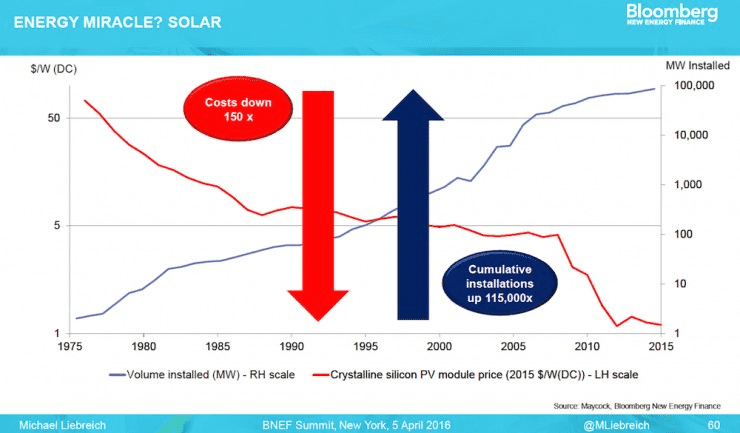

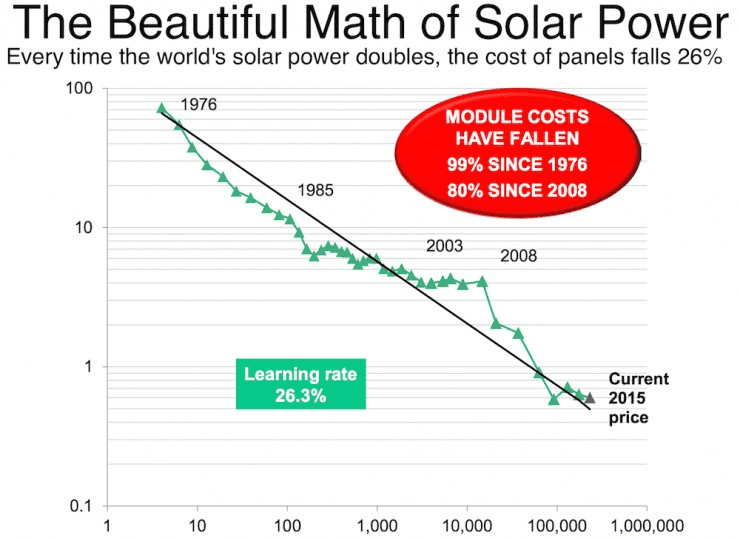

You’ve seen many headlines touting “record new solar panel efficiency.” We get excited seeing those, too. But they don’t matter. Alright, that was shock value. Let me explain. First, take a gander at the mind-numbing chart from the US National Renewable Energy Lab (NREL) below. This is one of my favorite figures in the whole world. Now, please memorize it -- there will be a quiz later. (Or so I tell my corporate and military executive students. They laugh at my false threats.) What does this figure say to you? Three potential takeaways: 1. There are way more types of solar panels than you thought, right? 2. Solar panel efficiencies have improved considerably between 1975 and 2015. Duh. 3. The guys doing the stuff in red font should get new jobs given their low efficiency. (Not really. Those are super cheap organic polymer-based solar cells. Their future will come one day.) OK. Now forget that graph. Look at these two more important charts from Bloomberg. Do you see any relationship between these the red and blue lines? (I hope you do.) Cost falls. Solar installations go up. And now for the next chart. Yes, you are reading that right. A 99% drop in solar panel prices since 1976.

I know, I know. I hear the devil’s advocate: But doesn’t greater volume of solar installations drive down costs? Yep, but the opposite is more true. Cost drives volume. China got in the manufacturing game just as the recession of 2008 hit and EU solar demand fell off. Solar panel prices fell faster and haven’t really stopped, resulting in an 80% drop prices in the last 8 years. For more data and graphs about solar's falling costs and coming world domination (insert dramatic music), see energy rockstar Joe Romm's piece "You’ll Never Believe How Cheap New Solar Power Is." In case you fear that my ponytail is getting in the way of my PhD and love of private equity (insert humor), and that I'm being too kind to solar, consider this projection from Bloomberg: By 2040, global investment in solar will total $3.4 trillion, while fossil fuels and new nuclear will only receive $2.1 trillion and $1.1 trillion, respectively. One word: Yikes. So what? The next time you hear a sales pitch about panel efficiency, praise them for their ingenuity. They are real wizards. But just keep asking: What is the resulting $/kwh and Internal Rate of Return of the solar project? Efficiency is the finger point at the moon. Please go after the moon. (Source: RMI Electric Vehicles as Distributed Energy Resources)

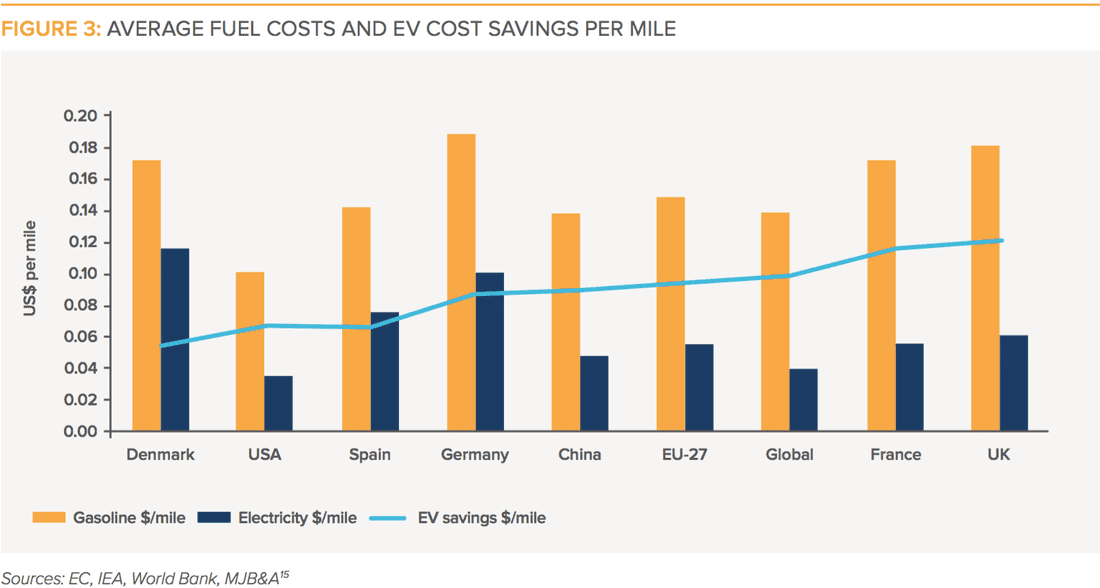

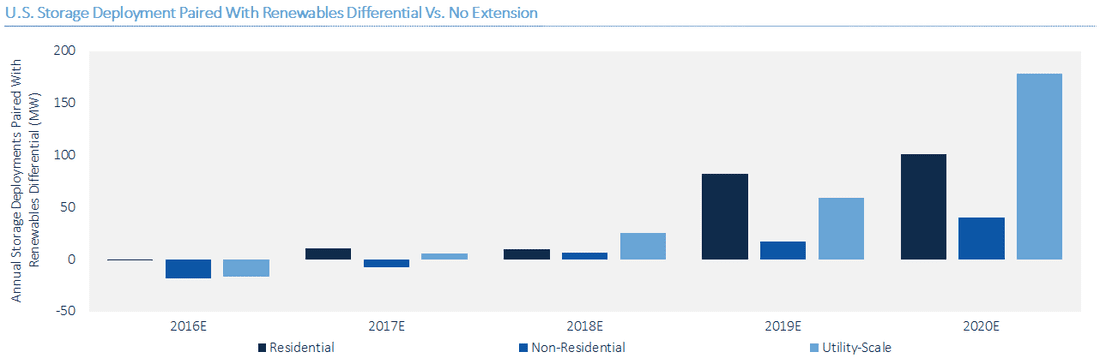

Where are you, rational car buyers? The myth of the rational economic man lurks around the issue of electric vehicles (EVs). See, rationality is something to which many learned folks aspire, but it turns out to be a mirage. Yes, we stumble towards it in a thirsty stupor, dreaming of drinking up its cool, clean sensibility. But, we never get there. It always remains a misty illusion just out of reach. The rationality dilemma with EVs is pretty simple. Let’s make it clear -- EV purchasers are no more rational than EV skeptics. EV purchasers will look at the graph above, and say -- ha! -- I am saving money on a per mile basis compared to all of your fools with internal combustion engine (ICE) cars. They are not wrong, but neither are they entirely right. EV skeptics will look at the graph above and say -- ha! -- you are being duped into assuming this is an apples-to-apples comparison. Again, they are right, but that is not the whole picture, either. Why you are going to lose the “EVs are cheaper over the long haul” debateIt boils down to this. Yes, electricity is a great source of energy, and it is cheaper on a per mile basis than gasoline (even the highly subsidized gasoline that we enjoy, and abuse, in the US). But electricity is electrons, difficult to contain, eager to be used immediately. Gas is a portable, energy dense liquid fuel that affords the owner of this magical worker unsurpassed flexibility in how and when to use it. Ironically, in certain places electricity and gas are made of the same stuff -- oil. I am looking at you, Curacao and Gibraltar, where 100% of electricity is generated from oil! So the real calculation about EVs is more complex because the services that you gain from gas and electricity are not interchangeable. What value do you place on your American right to cruise the highways to your heart’s delight? If the answer is high, then the comparatively lower cost of an EV-mile is meaningless. Your peace of mind in hitting the road without a worry in the world as to how your next mile will be fueled is, in economic terms, infinite. It trumps all other concerns. The term of art for this is “range anxiety.” What value do you place on cheap, clean transportation within a relatively small driving radius? If the answer is high, then the EV vs. ICE cost comparison is how your explain to your beloved significant other why you just purchased a car that cannot comfortably drive the family to visit your in-laws. Oh, and by the way, the sticker price was a little steeper than that conventional car you had agreed to purchase. But really, the EV question is even more complicated than that And that is just the tip of the iceberg. There are many other factors -- your comfort with rapidly improving battery technology, your assumption that EV charger networks will continue to expand, your belief that manufacturers will not bail on EVs in the future, etc. -- that ultimately weigh heavily on any rational calculation justifying or dismissing the idea of purchasing an EV. Dilemmas breed a “let’s wait and see” attitude, how boring Which brings me to the last point. I grant you permission to purchase (or lease) an EV (or PHEV if just want to dip your toes). Don’t feel like you have to explain yourself to your neighbors (though this tactic will not work with your significant other). After all, why did they buy that Honda Odyssey? Was it on a purely rational, benefit-cost maximizing basis? No, they wanted something comfortable and reliable for the family, period. They just wanted it, just like you just want an EV. And let’s be real, you want it because it is cool, wave-of-the-future technology. Because it allows you to avoid ever patronizing another neerdowell, franchised Exxonmobil (or BP, or Shell, or fill-in-the-blank) gas station. Or maybe you just like getting all the best EV charger parking spots. It doesn’t matter - embrace the irrationality. Be an early(ish) adopter. Get onboard, because EVs are where we are headed, like it or not. Queue EV hockey stick graph. Congress is again considering an energy storage investment tax credit The proposed H.R.5350, known in short form as the “Energy Storage Act of 2016,” seeks “To amend the Internal Revenue Code of 1986 to provide for an energy investment credit for energy storage property connected to the grid, and for other purposes.” Sponsored by Silicon Valley’s Congressman Mike Honda (D-CA), the bill has bipartisan co-sponsorship from Reps. Tom Reed (R-NY), Chris Gibson (R-NY), and Mark Takano (D-CA). As reported, it also has the full support of the Energy Storage Association: “The bipartisan Energy Storage Act of 2016 would unlock competitive access to investment in a more resilient and efficient modern electrical grid by expanding the investment tax credit (ITC) to include all types of advanced energy storage,” according to ESA Executive Director Matt Roberts. We’ve seen public support for energy storage tried before at the national level, such as with last year’s push to pass a national storage mandate. The current initiative builds on earlier efforts for a storage ITC. For example, in 2013 Sen. Ron Wyden (D-OR) proposed a bill that would have granted a 20% tax credit for systems above 1 MW/1 MWh and a 30% credit for smaller 1 kW/5 kWh systems. A potential $2 billion for energy storage The details are as follows. A 30% investment tax credit is allowed for any “qualified energy storage property” (see below). Two billion dollars would be set aside in total credits for the life of the proposed program, with any single storage project capped at $40 million. As a side note, under these constraints it makes sense to assume that energy storage project developers would be incentivized to keep total project size under a $133 million price tag. What qualifies? At a first reading there does not appear to be a capacity size requirement for any large project, as long as it is used for one of the following purposes: 1) peak demand management; 2) deferral or substitution of investments in generation, transmission, or distribution; 3) backup for variable generation; 4) transmission or distribution grid reliability; 5) end-user energy consumption management; or 6) disconnection of load from the main grid. All energy storage technologies are also covered, including mechanical, electrical, thermal, and electrostatic. Small residential storage would qualify as well, if installed at primary residences and used for peak energy reduction for primarily onsite consumption. These systems must have a 5 kWh capacity and the ability to deliver 1 kW of electricity over 4 hours. What doesn’t qualify? In general, non-residential energy storage that is designed primarily for on-site consumption does not qualify, unless it exceeds a 5KWh energy capacity and the ability to discharge 1 KW for 5 hours. Special exceptions are given to both pumped hydro and compressed air storage -- these projects must begin construction and operation within set timeframes or risk losing the credit. Supporting storage? Two points to consider The first point to consider is that -- to the extent to which energy storage is paired with renewables -- it may be under-supplied in the current market and deserving of public support. A study that was released in-press last week in Applied Energy from researchers at the University of East Anglia is garnering a lot of attention. In the article, “The value of arbitrage for energy storage: Evidence from European electricity markets,” researchers simulate the arbitrage value of price-taker pumped hydro and compressed air energy storage under different market characteristics and across a portfolio of energy trading strategies. Not surprisingly, decisions can be made to maximize these values across different conditions. More significant was a summary conclusion: “Government subsidies should be used to encourage investment in energy storage systems if renewable power is to be fully integrated into the sector…” The second point is that a separate energy storage ITC is not the only pathway to support energy storage. Some storage is in fact already eligible for the solar ITC as long as it follows strict rules about explicit pairing with and charging from solar power generation sources. As seen below, we already know that energy storage is expected to receive a huge boost from the extended ITC for solar, whether or not it takes advantage of this limited opportunity under the solar ITC. U.S. Storage Deployment Paired with Renewables Differential vs. No Extension (Source: Greentech Media)

The current IRS rules on storage eligibility under the solar ITC have been described as “ambiguous.” In February, the IRS issued a request for comments on this issue, with observers hoping for further clarification in future letters. Regarding the eligibility of storage, the required pairing with renewables was seen as necessary in order to avoid subsidizing storage that was existing merely to arbitrage with the grid, rather than serving as a support for renewables. Conceivably the IRS could decide to expand storage eligibility under the existing solar ITC, but this seems like a case of trying to fit a new effort (storage) under a policy for which it was not designed (solar power promotion). The good news is that the new proposed energy storage ITC excludes subsidizing projects that exist merely for arbitrage. Allocation of the credits across projects would be determined by the DOE, to choose those that maximize the following metrics: reliability or economic benefit, integration of renewable resources on the grid, or efficiency of grid operations. H.R. 5350 is just beginning its path from bill to law, but the possibility is there for an energy storage ITC to complement the existing solar ITC. (Source: GreenTech Media)

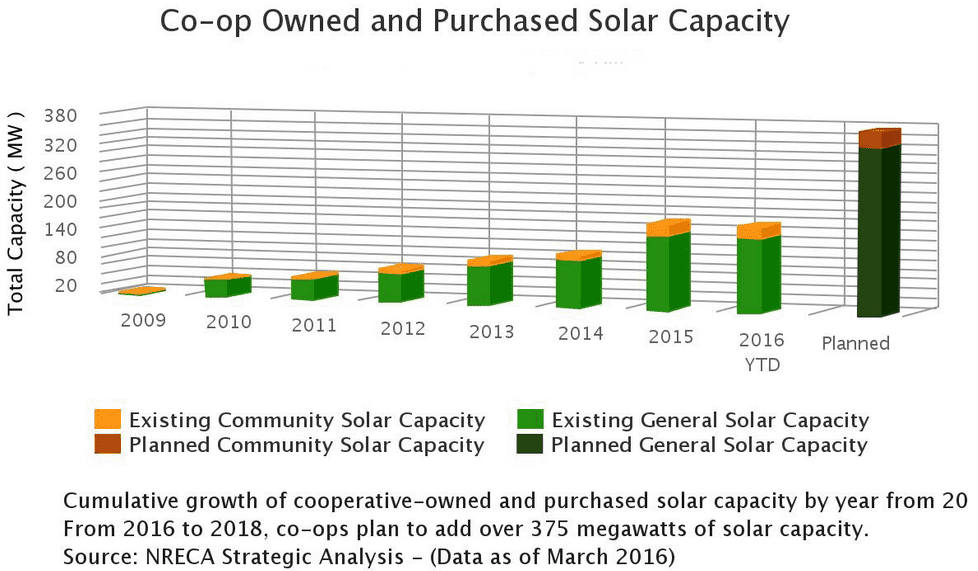

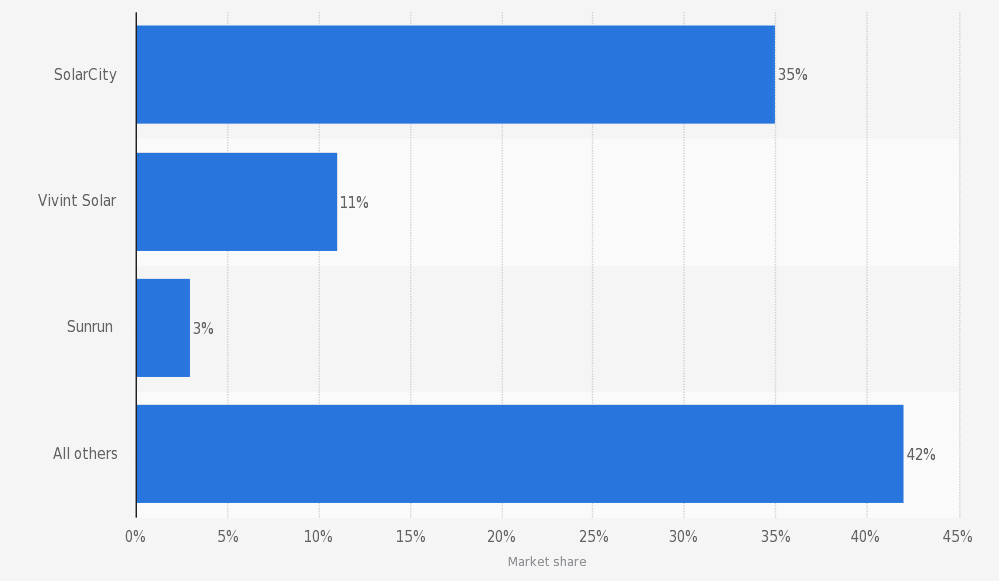

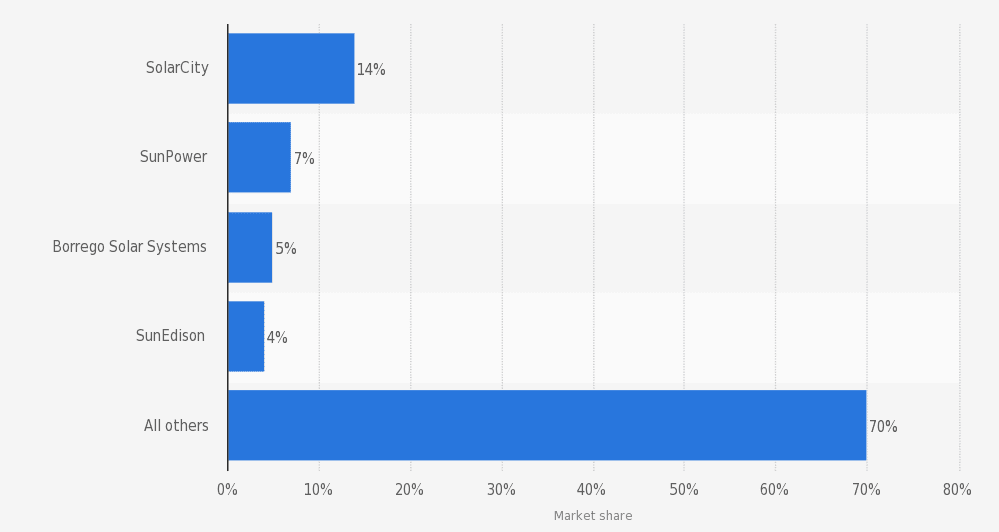

Co-ops and munis finally get a spot at the clean energy table In the energy industry, utilities have long run the show. The transition to clean energy is undercutting utilities’ historical dominance of how electricity generation, transmission, and distribution occurs. Distribution cooperatives and small municipal utilities have long ridden on the shoulders of these giants, working through contracts that typically stipulate that they must purchase nearly all of their electricity from generation and transmission (G&T) providers. In most contracts, a whopping 5% has been the limit placed on their self-generation, rendering these smaller players [almost] powerless in determining their own energy future. There is some poetic justice in having the small folks granted a spot at the distributed clean energy table. As electric cooperatives and municipal utilities were severely handicapped in their ability to procure their own electricity, they have only dabbled in contracts with independent power producers (IPPs) and other clean energy generators. This came to a head with probably the most unsuspecting sounding cooperative you could think of, the Delta-Montrose Electric Authority (DMEA). As a member-owned, rural electric cooperative based out of southwest Colorado, it is not hard to imagine that the time would come when they would want to be afforded the right to procure their electricity from whoever they please. In an act of magnanimity that perhaps surprised many, the Federal Energy Regulatory Commission (FERC) ruled in favor of DMEA in their case against Tri-State, another cooperative that provides generation and transmission services to 44 distribution co-ops across five states. In short, the ruling lifted the limit on DMEA’s ability to procure electricity from renewable qualified facilities (QFs). The loophole, of sorts, lies in the fact that the Public Utility Regulatory Policies Act of 1978 mandates that utilities must purchase electricity from QF projects. The de facto interpretation of PURPA, for oh the last 38 years, has been that larger-scale utilities and G&T providers would be sole purchaser of electricity from QF projects. DMEA, in a moment of true inspiration, said “to hell with that,” and managed to supersede their contract with Tri-State by asserting that they are themselves a utility, and should be afforded the same rights. This move did not ingratiate DMEA to Tri-State, to say the least, and Tri-State attempted to impose an exit fee on DMEA, which FERC summarily rejected. Message received. Renewables on the grid will no longer be a unilateral decision. Co-ops & Community Solar = Match Made in Heaven It is not hyperbole to claim that this is a game-changer for the nation’s 905 electric co-ops and 835 municipal utilities who woke up following this FERC ruling to a new world of opportunity. How fitting. Co-ops and munis were probably on the leading edge of support for renewables, and now they have license to act on their values, rather than be subjected to energy procurement decisions out of their influence. And that is a very good thing. In fact, it is 987 TWh/yr of a good thing, which if you do the math, implies that the potential market for co-op/muni renewables approaches 400 GW. Many co-ops and other smaller utilities are structured in ways that are much more conducive to serving the public good. Often they are publicly or member-owned, or at the very least not publicly traded, which makes them more intimately connected to their customers and ratepayers than the larger utilities and G&T providers that dominate much of the electric power procurement space. Moreover, they are more likely the engage in novel project types like community solar. There is some cosmic symmetry in enabling co-ops/munis to sponsor community solar projects. It makes so much sense. It seems ludicrous that this was ever challenging to execute at a meaningful scale for many co-ops. According to RMI, the market for community-scale solar projects ranging between 500 kW and 5 MW of capacity each could exceed 10 GW by 2020. Wake-up Call for the Generation and Transmission Providers An ancillary benefit of this new arrangement is that community solar projects may now be easily integrated into the local distribution system, therein avoiding many costly infrastructure upgrades. Translation: electric distribution co-ops/munis may be able to purchase power directly from QF projects at a lower cost than what they are currently charged by their G&T providers. Memo to G&T providers. This also means that they will be reducing their reliance on your services and undercutting your revenues, unless you can evolve together into helping to co-create a clean energy future. Now, there are limits to be sure. Electric distribution co-ops/munis have only been afforded the right to negotiate PPAs (and not just based on avoided costs, as in the past) with QF projects in their territory. Not a bad deal, but it does not make them an autonomous entity. Co-ops/munis still have to balance their energy supply, which can only be done through grid management in the transmission and generation system. So, there may be some building tension in the marriage between electric distribution co-ops and their larger G&T brethren. No one wants to see the G&T providers go extinct. In fact, they are still a critical species in the electric grid ecosystem. But, the challenge will be in better collaborating and coordinating with their member co-op/muni friends. This is not a reach. And there is no better time than now. Look for inspiration? Well, look no further than RMI’s Shine Initiative, an innovative program aimed at helping accelerate solar procurement in the community-scale market. Fragmented Commercial and Industrial Marketplace The recent barrage of articles detailing the bankruptcy of a renewable energy giant (SunEdison) and the pending sale of Elon Musk’s third favorite company (SolarCity) has been nothing short of suffocating. IronOak Insights contributed our own sobering account to the stockpile of SolarCity acquisition articles last week as we didn’t want our readers to think that we were living under a rock. But outside of those two headline grabbing companies lies a diverse ecosystem of large scale developers working to expand the commercial and industrial solar landscape. Per the graphs below, while only 42% of the U.S. residential solar market in 2015 was serviced by regional installers, 70% of the C&I solar market in 2015 was serviced by companies whose names were not SolarCity, SunEdison, Sunpower, or Borrego Solar. Let’s dive into some of the activity within the fragmented C&I solar marketplace. Leading Residential Solar Installers in the U.S. in 2015 (market share by MW installed) (Source: Statista) Leading Non-Residential Solar Installers in the U.S. in 2015 (market share by MW installed) California’s Cash Crop

As the perpetual leader in the U.S. solar race, California dominates every other state with its relentless pipeline of large-scale solar PV projects. The state’s consistent appeal exists because above-average electricity rates are coupled with some of the best insolation in country, along with a small state program called the California Solar Initiative. In addition to solar electricity generation, all of that sunshine has long supported California’s agriculture industry, and now California-based solar developers, like CalCom Solar, are targeting Ag companies as perfect companions for mid-scale PV facilities. CalCom recently completed a 2.2 MW solar farm for a fruits and vegetable grower, and the single-axis tracker installation now stands as the largest customer-owned, net metered system in Monterey County. CalCom is one of many developers across the country that are leveraging USDA REAP (Rural Energy for America Program) grants along with the federal ITC to provide attractive PPA rates for applicable off-takers. PFMG Solar (Partners For Many Generations), a top 15 U.S. solar developer, also takes a targeted approach in California by focusing on mid-scale solar solutions for suitable school districts. PFMG recently completed a 1.5 MW installation for a California school district and they’re a likely candidate to pick up some of SunEdison’s solar assets related to education centric off-takers. Full Steam Ahead in Colorado and North Carolina Just this week, Xcel Energy received the Colorado Utility Commission’s approval to move forward with the utility’s plan to develop 29.5 MW of PV from community solar projects. This is welcomed news for Denver-based community solar developer SunShare who commissioned a1.5 MW community solar garden in Arvada, CO on June 21st. SunShare joins Community Energy and Clean Energy Collective as the three juggernauts supercharging the community solar space in Colorado. Community Energy made headlines recently when they offloaded six North Carolina-based projects to Duke Energy with a total capacity of 30 MW. North Carolina’s solar market has remained strong despite the repeal of the state’s lucrative 35% solar tax credit. San Francisco-based Ecoplexus also recently completed six projects in NC, totaling 54 MW and requiring $79M in total investment. Ecoplexus has 36 MW under construction and claims more than 1 GW in their development pipeline that spans across 12 US states and dispersed international development. The West Texas Solar Patch Have you ever imagined an oil field man camp with LED lighting, tankless hot water heaters, and bike racks? Me neither, but maybe that concept becomes a selling point for solar field workers relocating to West Texas for the impending solar boom. ERCOT, the grid operator that services 90% of the Texas electric grid, is anticipating more than 560 MW of PV to be installed in Texas during 2016. That’s more than double the 212 MW installed during the previous year. Texas already ranks 9th in the U.S. in terms of installed solar capacity, and many analysts are expecting that ranking to climb up in the coming years. Texas, specifically West Texas, has some of the highest insolation in the U.S., large tracts of suitable land, low regulatory costs, and above average electricity rates. Although solar produced electricity will only account for 3% of the state’s generation capacity in 2017, ERCOT is projecting solar to supply more than 17% of the state’s electricity by 2030. While a large percentage of the anticipated development will come from utility-scale developers including First Solar and Recurrent Energy, regional developers will still have the opportunity to fill a void in the marketplace. I recently spoke with a developer that was already complaining of long interconnection study delays, so make sure to get your paperwork started sooner rather than later. |

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|