|

--- Author: Dr. Chris Wedding If you’re an investor that likes the predictability of debt (check), but loves the upside potential of equity investments (yep), then Revenue Royalty Notes might be worth exploring. Why might investors like Royalty Notes?

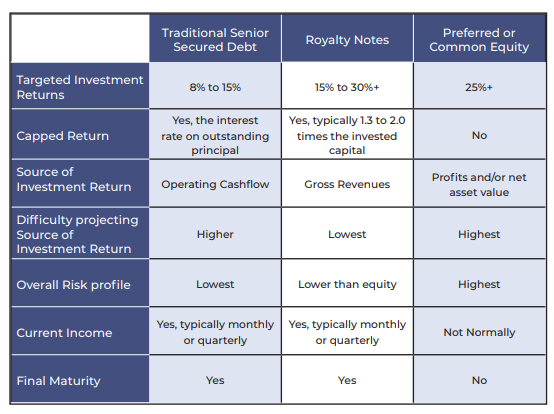

Importantly, future performance cannot be predicted by historical performance, so you’ve gotta feel good about the consistency and duration of a company’s past revenue, plus the sanity they used (or threw out the window) when making forward projections. A Comparison: Royalty Notes vs. Debt or Equity (CaroFin) And since it takes two tango… Why might entrepreneurs like the Royalty Note structure for their growth capital?

One more tiny detail: If there’s no revenue in the business yet, then there’s likely no Royalty Note either. Gotta stick to expensive equity for the time being… Conclusion We may not be able to have our cake and eat it, too. (Although people have been thinking about this since at least the year 1538.) Nor can we defy the Heisenberg Uncertainty Principle and know both the velocity and position of subatomic particles at the same time. [Dang it, my life’s dreams ruined…] (Geek out more here.) But don’t dismay… It is, in fact, possible to invest in companies with instruments having both debt and equity characteristics via the Royalty Note. [Insert a long sigh, and cue inspirational music...] To learn more about Revenue Royalty Notes, check out this article by CaroFin, a private marketplace for alternative investments: --- Photo credit: Pratiksha Mohanty via Unsplash

0 Comments

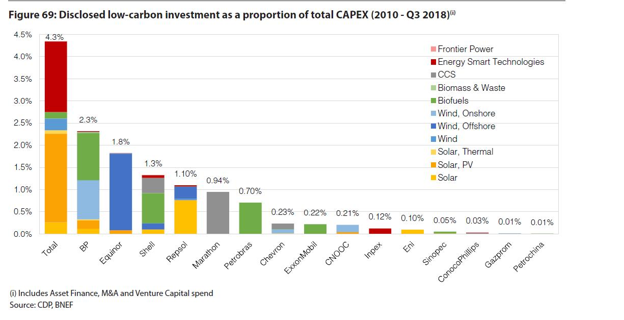

By: Dr. Chris Wedding If you think the “energy transition” is just for Democrats or greenies, then consider this quote from a Goldman Sachs natural resource executive: “I’ve probably spent more time talking with oil company executives about the energy shift and renewables in the last 2 years than the previous 23 put together.” Last year, $6.4B was invested in hydrocarbons versus $5.8B in renewable energy, according to PitchBook. That’s a pretty tight race. And a CDP report notes that 2018 expenditure on clean energy sector by the world’s 24 largest oil and gas companies was roughly 1.3% of total budgets vs. 0.7% last year. On one hand, that’s almost 200% growth year-over-year. Or (slight reframe) its chump change as a fraction of overall investments, with 98.7% of capital still going to conventional energy lines of business. Plus, over 70% of those investments came from EU-based oil and gas majors. Maybe that’s because the science of climate change is magically different across the ocean. (Yep, sarcasm) As further evidence that times are changing, here’s a look at three organizations…

Why are oil and gas major making these investments now? #1. They are already experts in the energy sector. This is partly a situation of a [very powerful] hammer seeking a nail. Decades of experience in conventional energy can translate into efficient capital deployment, project development, and new technology commercialization in the new energy sector, too. Building and operating offshore oil rigs is complicated. The same is true for offshore wind projects, and this is a market expected to reach $60B by 2024. “Have skills, should apply.” Running gas stations is not rocket science, but profitability is also not a given. So, it makes sense for Chevron to add EV charging to its gas stations, as long as they get the rate tariffs right so they do not drown in pricey demand charges. #2. Clean energy investments can be a hedge against softer demand for oil and gas. When Fitch Ratings talks about the growth in electric vehicles potentially creating an “investor death spiral,” it’s worth listening to their reasons. #3. Renewable energy markets are not little runts to ignore anymore. Bloomberg projects that over 70% of all new power capacity investment between now and 2050 is expected to be in solar and wind projects. Their research further shows that clean energy sector investment has exceeded $300B globally for the last five years. Finally, analysis suggests that the advanced energy economy (clean power, alternative transportation, energy-efficient buildings) now exceeds $1.4T, or twice the size of the global airline industry. #4. Corporate sustainability reporting is becoming mainstream. “We are watching you.” At least 85% of Fortune 500 companies now engage in sustainability reporting. Drivers of this trend include stakeholder demands, global trends towards greater transparency, peer pressure, and a realization that sustainability topics can be material to financial risk and return. Samples of third-party sustainability reporting include the following:

What kinds of new energy investments are oil and gas majors making in the last two years? I will only focus on the top four oil and gas majors in terms of their investments in and commitments to lower carbon energy. This includes Total, BP, Equinor, and Shell. (See graph below). I am mostly listing investments by their VC arms, with some other infrastructure investments sprinkled in here and there. Finally, I am not listing companies that are “kind of” related to clean energy, such as ride sharing or financial settlement technologies for the energy sector. Total Energy Ventures

BP Ventures (plus some larger corporate deals)

Equinor Technology Ventures

Shell Ventures (and some bigger Shell New Energies deals)

How will investing in renewable energy be different than their historic energy investments? If recent history is a good predictor (not always true), then low carbon investments are likely to be different than conventional energy investments in the following ways:

How does the increasing involvement of oil and gas majors create winners or losers in the clean energy sector? The (potential) winners include:

The (potential) losers include:

Should you be bearish or bullish? Bearish perspective: Why these trends can be easily ignored

Bullish perspective: Why investors and entrepreneurs should pay more attention

In conclusion, here are some potential action items I will describe these as the 3 “C’’s, with questions for you to ask yourself, answer, and do something about over the next 30 days. (Or just hide under them rug for a while. What could possibly go wrong?) #1 - Canary What do these trends mean in terms of “canaries in the coal mine” for your overall investments in the conventional power, oil, and gas sectors? (Pun intended.) If a Shell executive refers to their “buying spree” in the low carbon sector like this -- “It’s all about survival” — then how or why would your investment allocation to the conventional energy sector be different, and therefore, not face some new risks? If McKinsey and Mining.com report that electric vehicles will likely reach cost parity with conventional vehicles in the early 2020’s, and if Fitch Ratings talks about how this shift in transportation choices could cause an “investor death spiral,” how might you view current or future investments in the oil sector? #2 - Clock Even if you agree that historic changes are coming to energy markets, the key question is this: When? When do you (or sources you trust) think that these shifts in energy investments will actually affect your portfolio? By way of analogy, at some point we may live on Mars, but now is likely not the right time to invest in Martian real estate. (Unless you’re a billionaire who thinks that all hope is lost for long-term survival on this planet.) #3 - Collaboration There may be winners and losers, but it is not a zero sum game. This discussion needs a reframe. Let’s consider a newly created 21st century word: “Coopetition” — collaboration between competitors for mutually beneficial results. For environmentally minded entrepreneurs, how can oil and gas majors be strategic partners, investors, and customers, instead of the enemy, a monolithic group to badmouth for all the world’s problems, the 800-pound gorilla that must be defeated. For VC or private equity investors, how can oil and gas major’s investment decisions serve as an anchors to derisk your capital allocation alongside them? How can you build relationships with them for a future exit opportunities? Finally, thank you... A big shout out to Pitchbook, IPE Real Assets, Greenbiz, Preqin, Bloomberg New Energy Finance, Advanced Energy Economy, Greentech Media, Reuters, CDP, RW Baird, Energy Storage News, Columbia University’s Earth Institute, Oilprice.com, Bloomberg, Mining.com, McKinsey & Company, ThinkProgress, Wind Power Engineering, and Governance & Accountability Institute for their research and reporting on this topic. |

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|