|

Until recently, it has seemed that “cleantech VC” was a four-letter word.

Or perhaps a term reserved for hushed whisphers of digust and distrust thanks to the financial woes in the sector about ten years ago. But, it appears that the tide may be turning. Here are three headlines that might give cleantech entrepreneurs some hope. #1: Renewal Funds just raised $145M to invest in cleantech (what?) Here are some highlights (link):

#2: ArcTern Ventures just raised $165M to invest in cleantech (oh my!) Here are some highlights (link):

#3: Clean Energy Ventures just raised $110M to invest in cleantech (gasp!) Here are some highlights (link):

But wait… Before all of us entrepreneurs get too excited about sending an email to these groups and receiving $10M in growth capital the next day, let’s remember this... Venture capital firms reject at least 95%+ of all the deals they review

Far less than 1% of startups raise capital from VC firms. The estimates vary:

In contrast, the last study above showed that “57% of startups are funded by personal loans and credit, while 38% eceive funding from family and friends.” These VC firms like low company valuations.

Fundraising takes a ton of time, and will distract you from running your business.

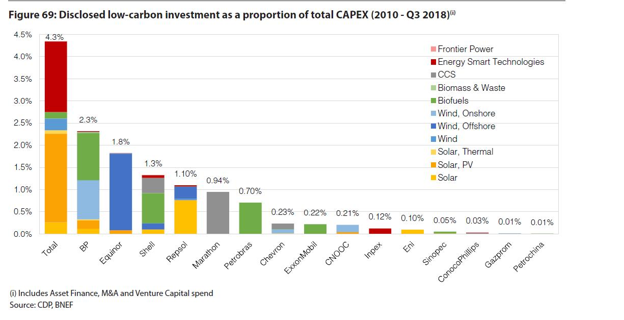

By: Dr. Chris Wedding If you think the “energy transition” is just for Democrats or greenies, then consider this quote from a Goldman Sachs natural resource executive: “I’ve probably spent more time talking with oil company executives about the energy shift and renewables in the last 2 years than the previous 23 put together.” Last year, $6.4B was invested in hydrocarbons versus $5.8B in renewable energy, according to PitchBook. That’s a pretty tight race. And a CDP report notes that 2018 expenditure on clean energy sector by the world’s 24 largest oil and gas companies was roughly 1.3% of total budgets vs. 0.7% last year. On one hand, that’s almost 200% growth year-over-year. Or (slight reframe) its chump change as a fraction of overall investments, with 98.7% of capital still going to conventional energy lines of business. Plus, over 70% of those investments came from EU-based oil and gas majors. Maybe that’s because the science of climate change is magically different across the ocean. (Yep, sarcasm) As further evidence that times are changing, here’s a look at three organizations…

Why are oil and gas major making these investments now? #1. They are already experts in the energy sector. This is partly a situation of a [very powerful] hammer seeking a nail. Decades of experience in conventional energy can translate into efficient capital deployment, project development, and new technology commercialization in the new energy sector, too. Building and operating offshore oil rigs is complicated. The same is true for offshore wind projects, and this is a market expected to reach $60B by 2024. “Have skills, should apply.” Running gas stations is not rocket science, but profitability is also not a given. So, it makes sense for Chevron to add EV charging to its gas stations, as long as they get the rate tariffs right so they do not drown in pricey demand charges. #2. Clean energy investments can be a hedge against softer demand for oil and gas. When Fitch Ratings talks about the growth in electric vehicles potentially creating an “investor death spiral,” it’s worth listening to their reasons. #3. Renewable energy markets are not little runts to ignore anymore. Bloomberg projects that over 70% of all new power capacity investment between now and 2050 is expected to be in solar and wind projects. Their research further shows that clean energy sector investment has exceeded $300B globally for the last five years. Finally, analysis suggests that the advanced energy economy (clean power, alternative transportation, energy-efficient buildings) now exceeds $1.4T, or twice the size of the global airline industry. #4. Corporate sustainability reporting is becoming mainstream. “We are watching you.” At least 85% of Fortune 500 companies now engage in sustainability reporting. Drivers of this trend include stakeholder demands, global trends towards greater transparency, peer pressure, and a realization that sustainability topics can be material to financial risk and return. Samples of third-party sustainability reporting include the following:

What kinds of new energy investments are oil and gas majors making in the last two years? I will only focus on the top four oil and gas majors in terms of their investments in and commitments to lower carbon energy. This includes Total, BP, Equinor, and Shell. (See graph below). I am mostly listing investments by their VC arms, with some other infrastructure investments sprinkled in here and there. Finally, I am not listing companies that are “kind of” related to clean energy, such as ride sharing or financial settlement technologies for the energy sector. Total Energy Ventures

BP Ventures (plus some larger corporate deals)

Equinor Technology Ventures

Shell Ventures (and some bigger Shell New Energies deals)

How will investing in renewable energy be different than their historic energy investments? If recent history is a good predictor (not always true), then low carbon investments are likely to be different than conventional energy investments in the following ways:

How does the increasing involvement of oil and gas majors create winners or losers in the clean energy sector? The (potential) winners include:

The (potential) losers include:

Should you be bearish or bullish? Bearish perspective: Why these trends can be easily ignored

Bullish perspective: Why investors and entrepreneurs should pay more attention

In conclusion, here are some potential action items I will describe these as the 3 “C’’s, with questions for you to ask yourself, answer, and do something about over the next 30 days. (Or just hide under them rug for a while. What could possibly go wrong?) #1 - Canary What do these trends mean in terms of “canaries in the coal mine” for your overall investments in the conventional power, oil, and gas sectors? (Pun intended.) If a Shell executive refers to their “buying spree” in the low carbon sector like this -- “It’s all about survival” — then how or why would your investment allocation to the conventional energy sector be different, and therefore, not face some new risks? If McKinsey and Mining.com report that electric vehicles will likely reach cost parity with conventional vehicles in the early 2020’s, and if Fitch Ratings talks about how this shift in transportation choices could cause an “investor death spiral,” how might you view current or future investments in the oil sector? #2 - Clock Even if you agree that historic changes are coming to energy markets, the key question is this: When? When do you (or sources you trust) think that these shifts in energy investments will actually affect your portfolio? By way of analogy, at some point we may live on Mars, but now is likely not the right time to invest in Martian real estate. (Unless you’re a billionaire who thinks that all hope is lost for long-term survival on this planet.) #3 - Collaboration There may be winners and losers, but it is not a zero sum game. This discussion needs a reframe. Let’s consider a newly created 21st century word: “Coopetition” — collaboration between competitors for mutually beneficial results. For environmentally minded entrepreneurs, how can oil and gas majors be strategic partners, investors, and customers, instead of the enemy, a monolithic group to badmouth for all the world’s problems, the 800-pound gorilla that must be defeated. For VC or private equity investors, how can oil and gas major’s investment decisions serve as an anchors to derisk your capital allocation alongside them? How can you build relationships with them for a future exit opportunities? Finally, thank you... A big shout out to Pitchbook, IPE Real Assets, Greenbiz, Preqin, Bloomberg New Energy Finance, Advanced Energy Economy, Greentech Media, Reuters, CDP, RW Baird, Energy Storage News, Columbia University’s Earth Institute, Oilprice.com, Bloomberg, Mining.com, McKinsey & Company, ThinkProgress, Wind Power Engineering, and Governance & Accountability Institute for their research and reporting on this topic. By: Dr. Chris Wedding I recently spoke on a panel about impact investing at the UNC Cleantech Summit, where 1,000 good souls joined to talk about opportunities and challenges in smart and connected communities, energy storage, grid modernization, sustainable farming, coastal resiliency, and energy innovation for economic development. Fellow panelists included these smart folks:

To begin our panel, we talked about the definition of impact investing. If you can’t describe something, it’s hard to assess where it’s been, where it’s going, who’s involved, what the challenges are, what opportunities are most exciting, and… [drum roll, please] ...whether impact investing delivers financial returns that are less than, equal to, or greater than other comparable investments in the market. Starting from the broadest definitions and moving to the narrowest, here we go… ------------------ #1: Impact investing = “Total portfolio approach” This framing moves away from the magnetism of venture capital and instead points to the obvious: Every investment has some impact. Accordingly, all bonds, stock, checking accounts, and savings accounts need at least a cursory review for positive and negative impacts, as well as other alternative investment classes such as hedge funds, real estate, infrastructure, and private equity. In ImpactAlpha, William McCalpin, managing partner of Athena Capital Advisors, with $5.5B under management, put it this way: “Carving out $10M to do a few impact deals is no longer enough for many investors. Institutions want to drive this through their whole portfolio.” To that end, the impact investment non-profit TONIIC has created its 100% Network, a “global network of high net worth, family office and foundation asset owners who have committed to deploying 100% of their investments in at least one portfolio in pursuit of deeper positive net impact. These investments are made across all asset classes, in alignment with each investor’s social and environmental priorities.” This initiative provides tools, lessons learned, and a community to share best practices. Total market size:

------------------ #2: Impact investing = “SRI (Socially Responsible Investing)” Many of us associate SRI with negative screens — that is, public equity investments that screen against (and don’t invest in) “sin industries,” such as firearms, tobacco, gambling, and alcohol. (Though the latter, in moderation, is hopefully not a big sin, lest I need to repenteth.) This approach to investing goes way back, like hundreds of years, like ancient history, like Biblical times, man. (Insert surfer voice.) Investopedia will take you back in time to illustrate that SRI is not some newfangled innovation from know-nothing “hippie capitalists” (a term coined by my MBA friends years ago). Centuries-old SRI includes Jewish law, from about 3,000 years ago in the Pentateuch (first five books of the Bible); Shariah law, from about 1,400 years ago in the Quran; and Methodists’ and Quakers’ beliefs and practices, from about 200 and 100 years ago, respectively, in the U.S. Despite, or perhaps because of, this rich history, SRI has become an umbrella for many related themes of investor interest, including ““community investing,” “ethical investing,” “green investing,” “impact investing,” “mission-related investing,” “responsible investing,” “socially responsible investing,” “sustainable investing,” and “values-based investing,” per US SIF: The Forum for Sustainable and Responsible Investment. Total market size:

------------------ #3 : Impact investing = “ESG (Environment, Social, Governance), aka Responsible Investing” SRI was version 1.0 of investing for financial and social or environmental motivations, while ESG is supposed to be version 2.0. However, these two terms are still used somewhat interchangeably in many circles. For me, ESG is about an active approach and a positive screening process to not just do less bad (e.g., sin industries) in a passive style as in SRI. This includes seeking out companies that excel in the management of social, environmental, or governance issues. The goal is to reduce risk (beta) and increase profit vs. benchmarks (alpha). The United Nations Principles for Responsible Investment (PRI) may be the most popular group for defining ESG. (So, if you want to be one of the cool kids, you better, like, join now. I mean, totally.) UN PRI counts 1,900+ signatories from the finance sector, representing over $89T in AUM. Before you get excited thinking that about 50% of the world’s assets are invested according to ESG principles, hold those horses. These signatories apply ESG practices selectively, not across their entire portfolio. However, according to the principles to which they publicly commit (see below), the plan is for an evolution to a more all-encompassing approach to Responsible Investing. UN PRI -- Signatories’ Commitment “As institutional investors, we have a duty to act in the best long-term interests of our beneficiaries. In this fiduciary role, we believe that environmental, social, and corporate governance (ESG) issues can affect the performance of investment portfolios (to varying degrees across companies, sectors, regions, asset classes and through time). We also recognise that applying these Principles may better align investors with broader objectives of society. Therefore, where consistent with our fiduciary responsibilities, we commit to the following:

The Principles for Responsible Investment were developed by an international group of institutional investors reflecting the increasing relevance of environmental, social and corporate governance issues to investment practices. The process was convened by the United Nations Secretary-General. In signing the Principles, we as investors publicly commit to adopt and implement them, where consistent with our fiduciary responsibilities. We also commit to evaluate the effectiveness and improve the content of the Principles over time. We believe this will improve our ability to meet commitments to beneficiaries as well as better align our investment activities with the broader interests of society. We encourage other investors to adopt the Principles.” To learn more about the segments within ESG and SRI, you can view some great graphics and summary PDFs by by US SIF. Total market size:

------------------ #4: Impact investing = “Measurable social or environmental impact alongside financial returns” For this definition, I’ll reference a leading impact investing sector non-profit association, the Global Impact Investor Network, GIIN. [And if you’re remembering my prior reference to another impact investing industry association, TONIIC, and asking yourself whether investors in this sector actually do love “sin” industries like alcohol (gin + tonic), the answer is...I don’t know. But the more interesting question is this: Does the impact community have a stronger sense of humor relative to other financial sectors?] In their annual survey of impact investors (n = 229), they report a 13% increase year-over-year in impact investments globally, with total assets under management at about $228B. Here is a summary of the most popular sectors as determined by the percentage of impact investors investing in each:

GIIN stresses that impact investments should have intentionality (i.e., positive outcomes cannot be accidental) and should require impact measurement (e.g., show me your KPIs). Now, I love metrics as much as the next guy or gal steeped in finance and science. However, as I experienced when I was co-leading sustainability at a $2B private equity fund, measuring social or environmental impacts is tricky. To that end, Andrew Beebe, Managing Director of Obvious Ventures — a VC firm “on a mission to help fuel startups that combine profit and purpose,” aka, #worldpositive companies — had this to say about metrics. [Note: This may be the longest quotation I’ve every used in an article, but bear with me. It’s worth it.] “We don't require hard metrics in sustainability or impact from our portfolio company for specific reasons. First, it's super hard. When you ask a vegan cheese company, "Please tell us your positive impact each month," how do you figure that out? Is it how many cows didn't have to get milked? Is it how much methane from each cow that didn't get produced? But then, of course, you'd have to offset that with the emissions from your delivery trucks. It's just too hard. That's the practical reason, but there's also a strategic reason: Companies will pivot. And when they change, you have to rejigger all of those impact measures. What we do is simply ask the question, is this company likely — regardless of pivot and because of the value of its leadership — going to continue to have a positive impact on the future of humanity? On the human potential? After that point, our decisions are economically driven.” (Source: Greenbiz) As for whether impact investors are seeing real impacts from their allocations, 97% of the GIIN respondents report that they are meeting or exceeding their impact goals. As further validation of this type of measurable impact investing, TPG, one of the world’s largest private equity firms with over $100B in AUM, launched its Rise Fund in 2016 with $2B in AUM. That’s serious amount of capital from a very serious investor, who has no interest in below-market returns. Combining their deep investment experience with partners champions like U2’s Bono, impact investment experts like Elevar Equity, and nonprofit strategy advisor Bridgewater Group, fundraising has been fairly easy. In fact, they are now raising a second fund targeting $3.5B. The Rise Fund website provides more detail on the opportunity, the societal need, and their rigorous approach to impact measurement: “It will take more than $2.5 trillion per year to meet the United Nation’s Sustainable Development Goals...We have defined 30 key outcome areas, aligned with the United Nations Sustainable Development Goals, in which impact is both achievable and measurable through evidenced-based, quantifiable assessment. For each potential investment, we calculate an Impact Multiple of Money (IMM)™, part of our proprietary assessment methodology that allows us to estimate a company’s potential for positive impact.” Total market size:

------------------ #5: Impact investing = “Filling a gap” Finally, some industry professionals restrict the impact sector to investment opportunities that are thought to be unfinanceable — that is, ones that mainstream investors will not, or supposedly, cannot touch due to fiduciary duty, the responsibility to put financial returns above all else. The problem with this definition is that the boundaries of what investors consider attractive, or not, is always changing. Consider off-grid funding for small solar energy solutions. The size of the need (only recently deemed a “market opportunity”) is immense: According to the International Energy Agency, roughly 1 billion people globally lack access to electricity. I’ve been on the ground in Ethiopia and India doing work d.light and Greenlight Planet, two global leaders in this field, and I’ve seen how life-changing these microsolar products can be. Five years ago, most investors would have viewed this field as being all about charity, led by foundations and government aid organizations. However, today we see investments commitments such as these:

The other problem is that this definition severely restricts the size of the market. So, as a proponent of the sector, I don’t like it. But if I put my cheerleading pom poms down for a second, constraining the market size also means that mainstream investors might miss out on emerging sectors, demographic, and geographies that represent new ways to place capital and generate attractive financial, environmental, and social returns in parallel. Luckily, this is the least common definition of impact investing. Total market size:

------------------ Financial Returns: Below or Above Market? Ah, the most critical question and the most misunderstood: “Does impact investing require concessionary returns, a financial sacrifice in order to do the right thing?” One of the most authoritative studies on the topic was conducted by Deutsche Asset Management and the University of Hamburg in 2016. They reviewed 2,200 reports to assess the linkage between ESG excellence and the financial performance of companies. The results?

For another perspective, we can look at the responses from impact investors in the 2018 GIIN report. Here were their conclusions:

Going one step further than the mainstream might be ready for, as he does so well, Al Gore is championing a new initiative called the Fiduciary Duty in the 21st Century Progamme. Led by the UN Environment Program Finance Initiative (UNEP FI), UN PRI, and Generation Investment Foundation, it flips this discussion on its head. Instead of seeing impact returns as being at odds with an investor’s fiduciary duty, it notes that “there are positive [fiduciary] duties to integrate environmental, social and governance factors in investment processes.” That is, to ignore ESG consideration may be akin to slacking on one’s duty to achieve the best risk-adjusted returns for investors. To put some of this into practice, they have created roadmaps for institutional investors that “address fiduciary training, corporate reporting, asset owner interaction with service providers, legal guidance, the development of investment strategies, ESG disclosure and governance structures.” For more on this topic, you can check out more research aggregated here by US SIF. ------------------ Why is this market not growing faster? Because people too often act like ostriches burying their heads buried in the sand to avoid new impending realities? Nope. (And, by the way, ostriches don’t really do this. You can trust my source: National Geographic Kids. “Ostriches don't bury their heads in the sand—they wouldn't be able to breathe! But they do dig holes in the dirt to use as nests for their eggs. Several times a day, a bird puts her head in the hole and turns the eggs.” OK, Fun Fact Time is now over.) Below are a few barriers based on the reports referenced above and my own experiences in the sector:

------------------ So what? Impact investing is not going away. Instead, it will become mainstream. I think it’s going to be like other niche fields that I’ve entered five years ahead of the masses — green real estate, solar power, energy storage — before the billions of dollars began flowing into sectors thought to be purely about mission, solely the purview of “hippie capitalists.” If you don’t agree, then consider one more trend: An estimated $30T of wealth is expected to be transferred from Baby Boomers to Millennials over the coming decades. And research shows that this younger generation cares more about using their capital to make an impact, not just a profit. Luckily, both are increasingly possible. |

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|