|

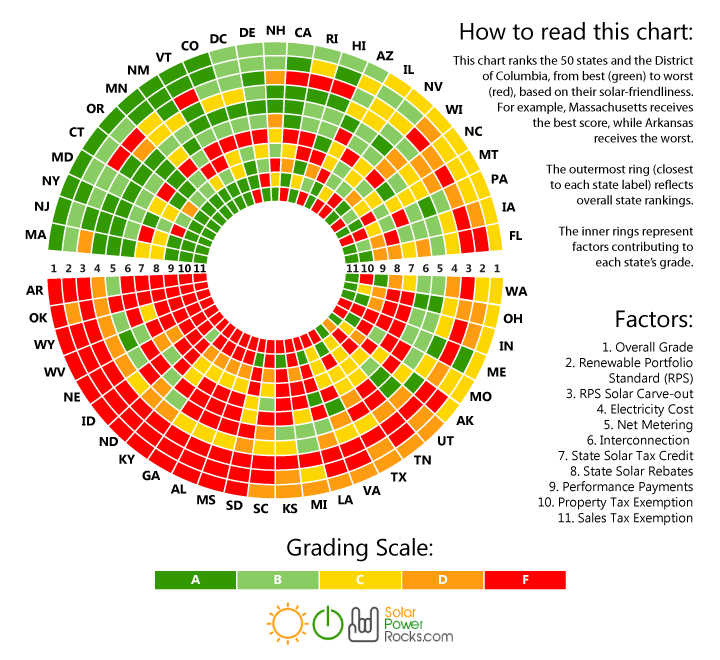

1. Have no delusions about policy risk -- it exists, but it is not unique to the solar market It is not an uncommon stance for private equity investors to claim that they will not enter markets with “policy risk.” Being someone trained in economics, this statement comes across as somewhat strange, bordering on naive. Markets are policy constructs. There remains some secular ideal of a free market without government or policy intervention. While this may exist out in the far reaches of less formal economies, it is wholly inapplicable to electricity markers. The policy landscape defines the contours of where and what kind of solar development can take place and where capital can be deployed with the reasonable expectation that it can meet investor hurdle rates. Ignore policy at your own peril. The most enterprising investors are constantly searching for ways to anticipate markets movements largely through the lens of policy. That said, if there is anything that will put a damper on sustained investment activity, it is policy uncertainty. And that pertains to everything from state-level mandates to utility-level interconnection practices to local land use planning. While it is relatively easy to have a clear view of the state-level policy, it requires much more on-the-ground knowledge of utilities, permitting agencies, and landowners to really discern where the most productive spaces to invest are. 2. The states rights debate emerges in the electricity market It is easy to assume that the biggest energy-related issue at stake at the federal level is the Clean Power Plan. Of course, whether the CPP makes it through the Trump administration’s grinder is a matter of no small importance, but let’s just say the odds are not in its favor. It’s a shame, as the CPP was never really given a chance to shine (pun intended). There is a larger structural issue at stake concerning federal vs. state jurisdiction. States used to control most of the electricity market regulation, but has started to cede authority to FERC as the electric grid has become more regionalized, interstate electricity markets have formed, and and transmission development issues have cropped up. Yet again, the age-old story of federal vs. state rights comes to bear its head. States have lead the charge with RPS mandates, various compensation schemes for distributed resources such as RECs, implementation of PURPA, and a host of competitive policy issues. And, as any clever investor or developer knows, this has created a remarkably vibrant but fragmented investment landscape for solar in the U.S. FERC is left to argue over who is responsible for creating a coherent picture of this vast mosaic of policy approaches. Left to their own devices, states will forge ahead with their own plans and policies. But that will not necessarily suffice when trying to address regional and national resource adequacy, generation mix, and transmission concerns. Keep an eye out for more rulings on how the energy transition will be governed and regulated at the federal and state level. Especially for states that are behind the curve, so to speak, it will be really impactful on how utilities are regulated and where new emerging markets for solar development and investment emerge. (Source: SolarPowerRocks.com) 3. Grid modernization is essential (and cool sounding), but it’s still going to be a bumpy road The New York REV program gets a lot of love, but don’t forget about California, Massachusetts, and Maryland, among others. Each is whipping up a unique secret sauce to address a docket of issues surrounding utility structures and incentives and the integration of distributed energy resources (DERs). At a high level, efforts such as these will ease the path to higher penetrations of renewables, a long-standing (and perhaps specious) contention of renewable opponents and skeptics. More importantly, these policy initiatives aim to create a more cooperative and predictable environment for developers to build projects and investors to deploy capital in the solar sector. Developers are always interested in more (low cost and patient) capital and high quality pipeline. But, increasing their Christmas wish lists include more certainty and predictability in navigating the increasingly gnarly regulatory landscape. If there is any simple heuristic for forecasting new solar markets, it is where grid modernization processes are underway. If it only were so simple. Where modernization makes developers and investors a little uneasy is how new DER compensation schemes are going to change the value of their development assets and operational projects. From a technical standpoint, it makes all the sense in the world to treat DER according to the value it contributes to the grid. By no means is this easy or straightforward, but there is some logic to doing it. But it is an entirely different matter to get investors comfortable with underwriting projects with significantly different revenue streams. Underwriting solar projects is something that the industry has become quite adept at, and there will be some reluctance in adapting to entirely new structures. If this comes to pass, and we are no longer in a solar world dominated by simple PPAs, then the most enterprising investors will need to lead the charge on how to finance these projects. (Source: Clean Edge) 4. PURPA has been a cornerstone in the solar market, but watch out for potential attacks. The Federal Public Utility Regulatory Act, otherwise known by the attractive sounding acronym PURPA, far preceded the solar industry as we know it today. Dating back to 1978, this policy lay relatively dormant for many years before becoming a key driver of growth in small utility-scale markets in many states. North Carolina can attribute its high ranking in terms of operating solar capacity - #3 as of 2015 - in great part due to PURPA projects, also known as qualified facilities (QFs). For years, this had been perhaps the best example of a market with low policy risk because the law mandates that utilities purchase electricity from small-scale generators at (or close to) their avoided costs. Developers could count on relatively predictable PPA rates and terms for their projects, which smoothed the way for scaling development and investment quickly. Many very successful developers got their start in these markets, and many investors could deploy large amounts of capital into portfolios of essentially identical projects, thereby reducing transaction and financing costs. But recently, many utilities in many states -- here’s to you North Carolina, Montana, Utah, and Oregon, among others -- have made efforts to slow activity in the PURPA market. Before you get your hackles up, let’s pause for second to consider how woefully unprepared many utilities were for the onslaught of QF development activity once solar costs dropped low enough to have projects pencil for investors. It is not altogether unreasonable that the PURPA market be reconsidered, as it might not be serving the purpose for which it was originally intended. That said, the disruptive tactics being used by utilities to cool the PURPA market have created a contentious environment. The risk and uncertainty surrounding the future of this market has undermined years of effort and investment on the part of developers and investors. (Source: GreenTech Media) 5. Is solar ready to wean its from the ITC? The time might be sooner than you think. Lest you thought that I was going to skip over perhaps the most important incentive in the solar industry, here are my two cents on the ITC. First of all, weren’t we just here? I recall at the end of 2015 all the consternation over whether the ITC would be extended beyond 2016. We poured over what-if scenarios like the one from BNEF below. We were all in store for a blitz to the ITC finish line at the end of 2016, and, lo and behold, Congress passed an extension just before holidays. That led to some interesting dynamics in 2016, as some solar development that was slated for 2016 ended up being pushed into the future. But, all in all, the solar industry thrived in 2016, and business-as-usual was the expectation through the early 2020s. Given the proliferation of fossil fuel industry proponents and climate skeptics entering the new administration touting the “all of the above” energy strategy as their cornerstone approach, it does call to question whether the ITC is as safe as we thought it was just a short time ago. On the one hand, the solar industry has, with notable success, achieved bipartisan support from the bluest to the reddest states. Solar job creation is an unadulteratedly positive story that few can dispute. On the other hand, there are many Republicans that would love to cut government subsidies of all kinds, regardless of the public good that they might provide. Moreover, there is some momentum behind the idea of a large tax reform, which might lead to a reconsideration of the ITC, among many other tax-related subsidies. Is the solar industry strong enough to survive without the ITC? Clearly, yes. But not everyone, and not all markets. There are many investors who would not lament the elimination of tax equity from the capital stack. But make no mistake, it would be a rude awakening to abruptly end the ITC. I would not put my money on that happening. The cost is modest and there is a sunset clause already in the policy to limit long-term government liabilities. But I cannot, in good faith, make any strong predictions, so be prepared for anything. (Source: BNEF)

Comments are closed.

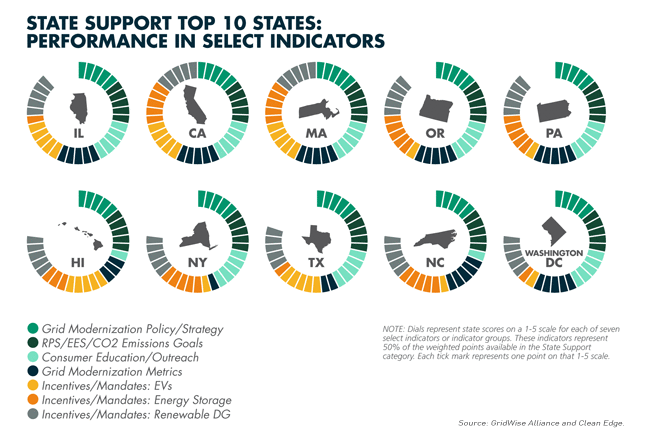

|

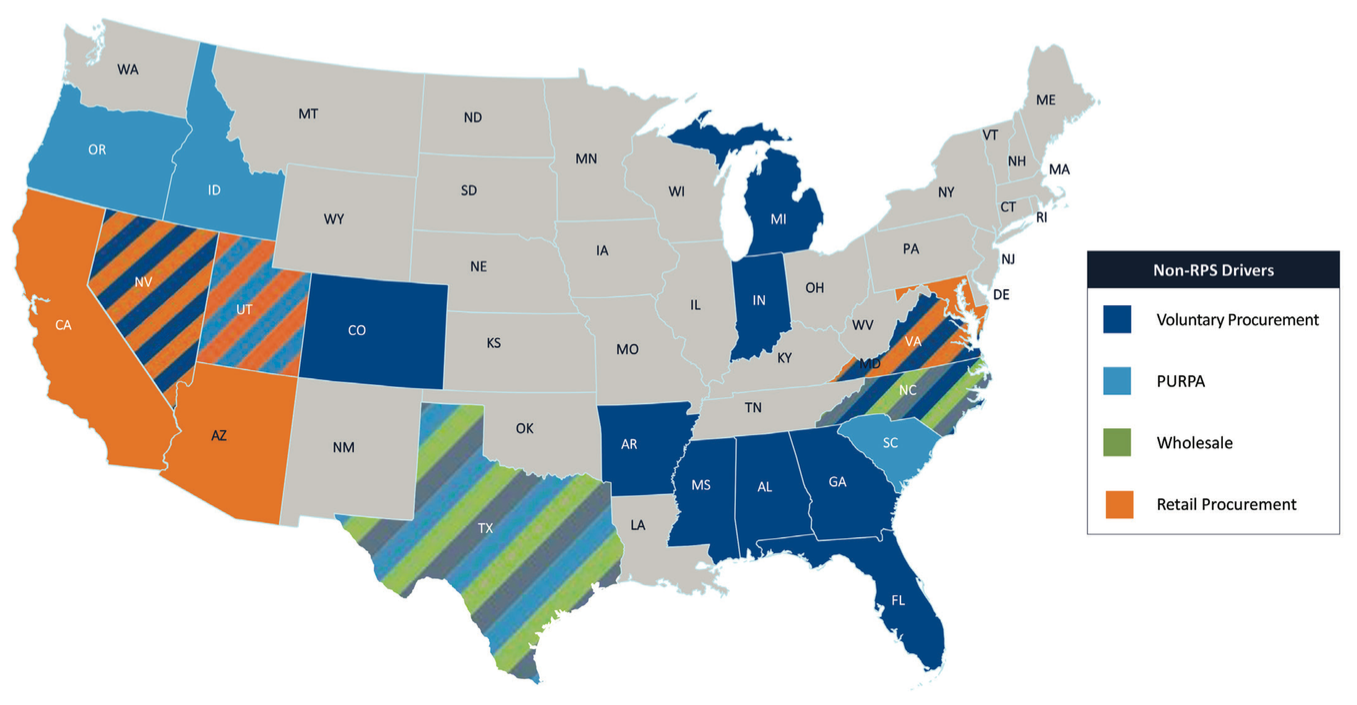

Details

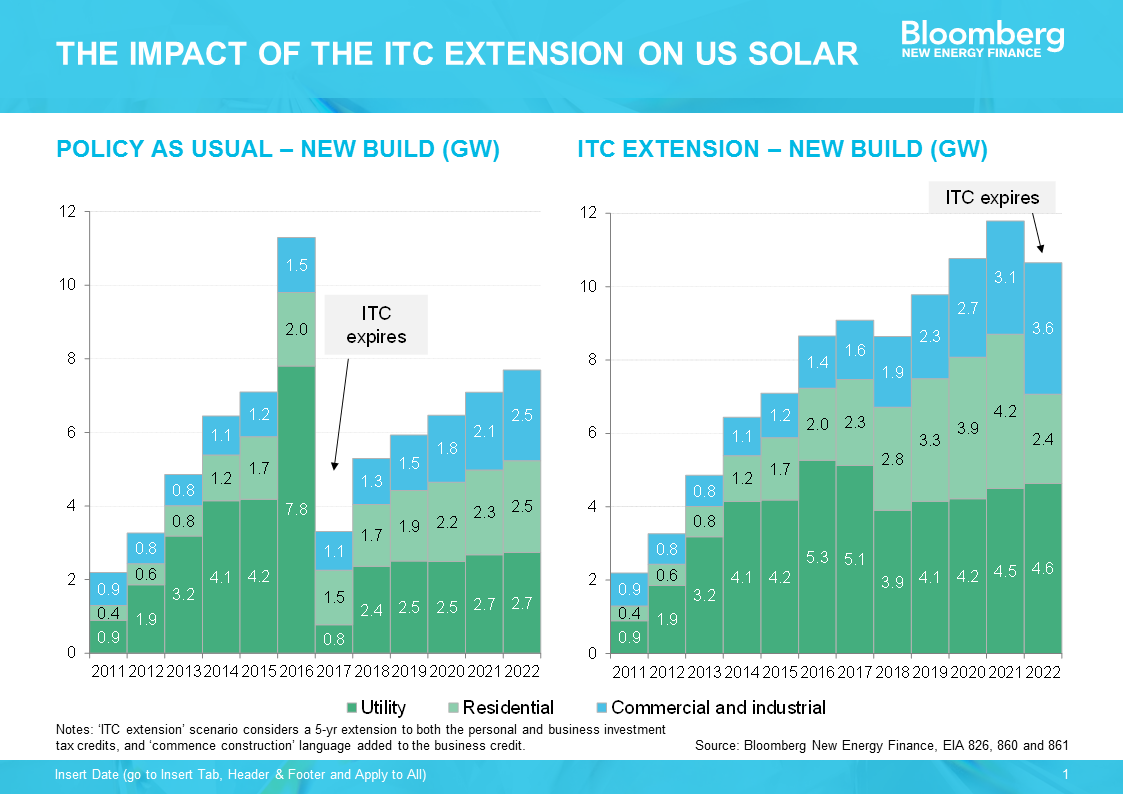

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|