|

By: Dr. Chris Wedding, Managing Partner 1. Investor interest in energy storage is high — perhaps irrationally high Enthusiasm around the energy storage sector is more feverish than ever. This is simultaneously encouraging and concerning. Important questions remain. Here are a few:

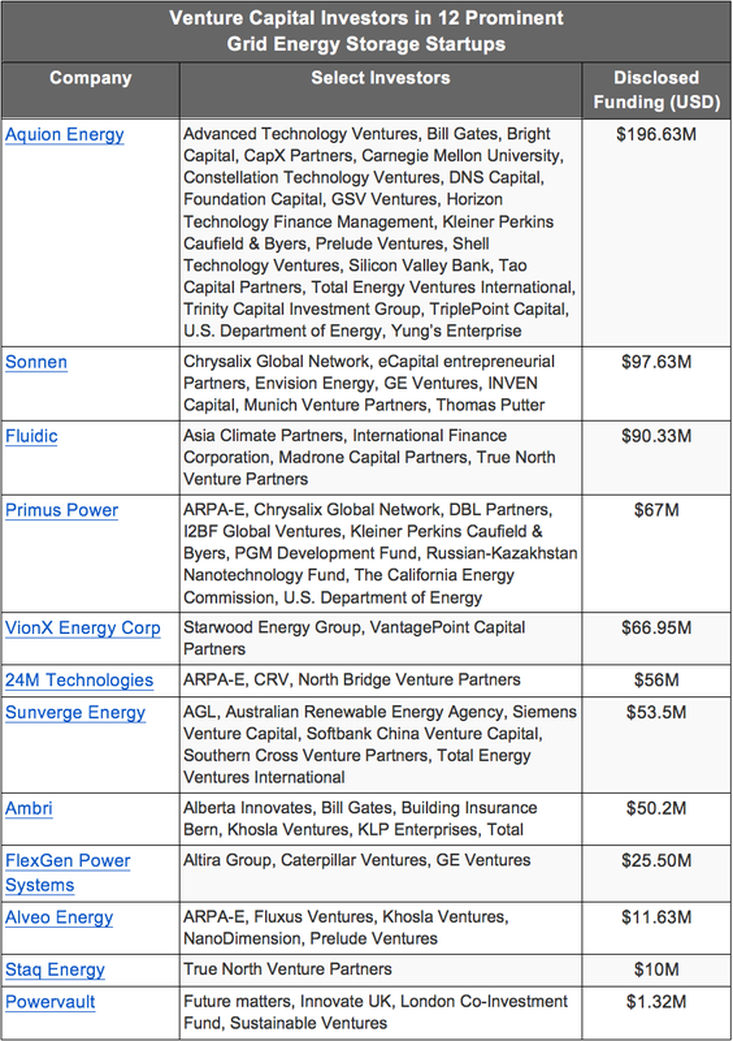

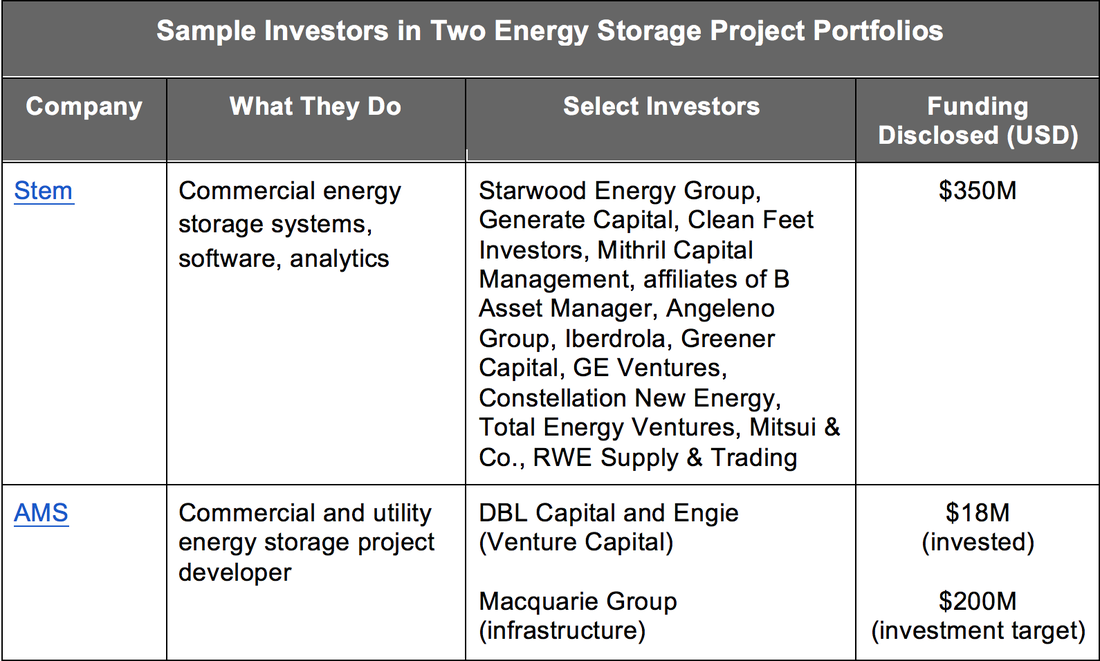

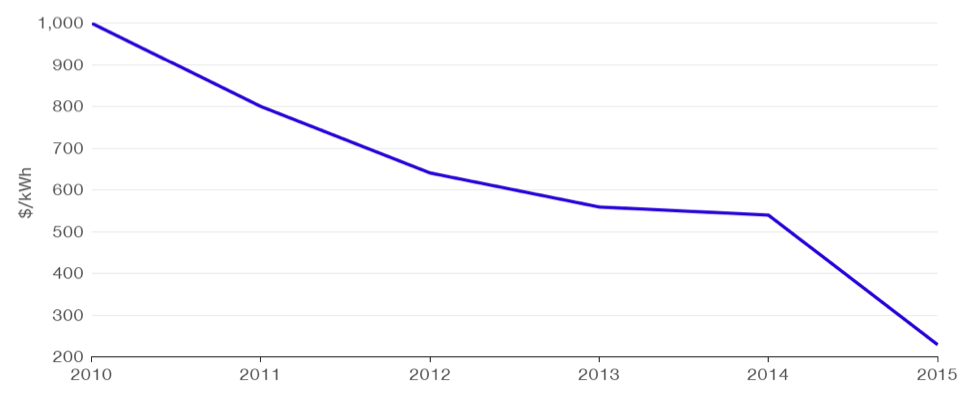

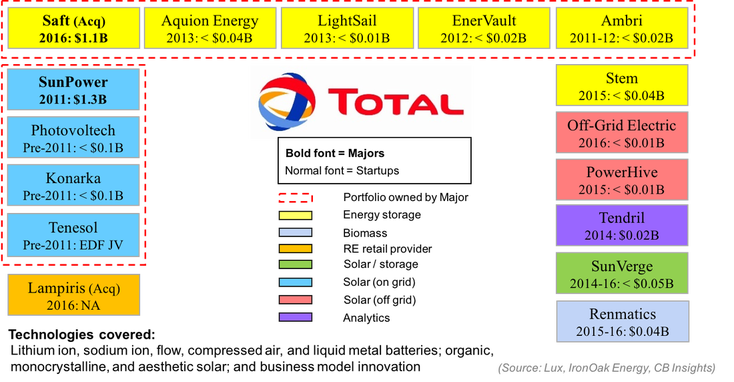

Despite such rationale thinking, many investors want in on the action. Consider the statistics below from the website AngelList, a trusted resource for angel and venture capital investors. 2. Most battery investors are angel and venture capital investors — for now Technology — both software and hardware — are today’s investment focus. As such, angel and venture capital investors drive this discussion. The table below from the witty and savvy data scientists at CB Insights offers a great summary of who’s investing in energy storage technology. (Source: CB Insights) 3. Project financing for batteries is coming — albeit slowly Given the industry’s youth, examples of infrastructure investment in this sector are hard to find. However, energy storage projects, not technology, will receive the vast majority of capital in the years to come. Let’s look at two examples of investors deploying capital for battery project finance. The table below is compiled using data from the good folks at GreenTech Media and Crunchbase. (Sources: GreenTech Media, CrunchBase) As the costs of batteries continue to fall roughly 10% per year, and as technology performance and warranties improve, more debt and infrastructure investors will get into the game. Bloomberg’s graph below illustrates how fast prices have fallen for batteries used in vehicles. Cost Decline for Electric Vehicle Battery Packs: 2010-2015 4. Oil and gas majors want a piece of the energy storage opportunity As an article at OilPrice.com put it, “Who cares why the [global] temperature is rising?” Said differently, regardless of where an individual, investor, or company stands on the issue of climate change (**), the opportunity to profit from the shifting global energy mix is very attractive, if not historic. Consider McKinsey research which projects that the global energy storage market could be worth $90B to $635B by 2025, depending in part on adoption of electric vehicles. Or take a look at the figure below illustrating how Total, one of the world’s seven supermajor oil and gas conglomerates, is investing in energy storage, amongst its broader renewable energy investments (e.g., 66% ownership in solar powerhouse SunPower). Total’s Investments in Energy Storage and Other Renewable Energy Other oil and gas giants are also making bets on energy storage, such as:

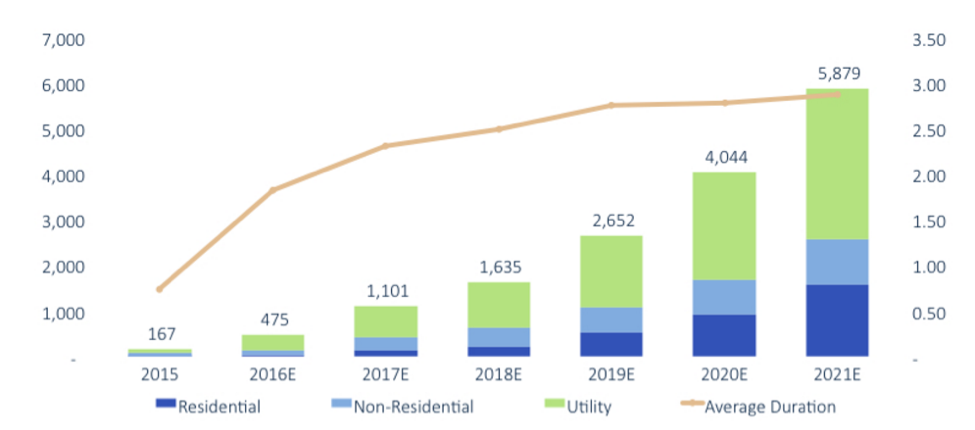

** We are not climate change scientists, but we defer to those who are: According to the US federal government (NASA), over 97% of actively publishing climate scientists agree that climate change over the past century is extremely likely due to human activity. Moreover, at least 18 of the world’s leading scientific organizations (e.g., US National Academy of Sciences) have issued public statements endorsing this position. 5. Lithium batteries are not the (only) opportunity When I speak to investors about the energy storage market, many are worried about technology risk. While the Energy Storage Association tells me there are over 70 battery chemistries being tested or deployed, research shows that there is just one dominant family of battery chemistries. Lithium-ion batteries made up 96% of all batteries installed in the US in 2015. More importantly, as the market demands batteries with longer duration, installations may shift away from lithium-ion, which are typically discharged in increments of seconds and minutes or perhaps two hours, to longer duration batteries, such as flow batteries. GreenTech Media’s projections below illustrate how investors may want to think about growth segments and technology as the market shifts from largely utility-scale installations to almost half of storage deployments taking place behind the meter. US Energy Storage Installations (MWh, left) & Battery Duration (hours, right): 2015-2021E (Source: GreenTech Media)

Conclusion If industry soothsayers are correct, and the energy storage market today is where the solar market was in 2005, then we could see substantial investment opportunities in this sector. But do not jump in with both feet. Warranties, balance sheets, developer assumptions on revenue and cost, track record, and policy enablers all require an extra set of eyes. (And, yes, we would be happy to help on that front.) Comments are closed.

|

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|