|

--- Author: Dr. Chris Wedding If you’re an investor that likes the predictability of debt (check), but loves the upside potential of equity investments (yep), then Revenue Royalty Notes might be worth exploring. Why might investors like Royalty Notes?

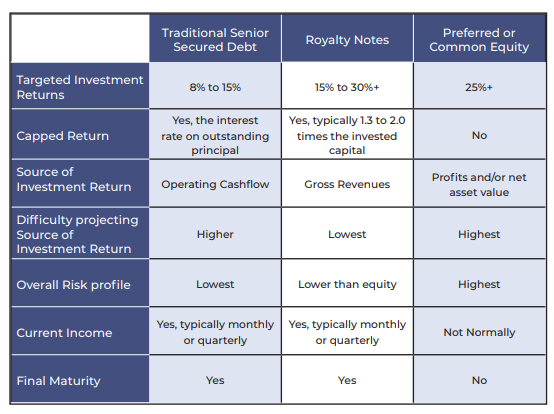

Importantly, future performance cannot be predicted by historical performance, so you’ve gotta feel good about the consistency and duration of a company’s past revenue, plus the sanity they used (or threw out the window) when making forward projections. A Comparison: Royalty Notes vs. Debt or Equity (CaroFin) And since it takes two tango… Why might entrepreneurs like the Royalty Note structure for their growth capital?

One more tiny detail: If there’s no revenue in the business yet, then there’s likely no Royalty Note either. Gotta stick to expensive equity for the time being… Conclusion We may not be able to have our cake and eat it, too. (Although people have been thinking about this since at least the year 1538.) Nor can we defy the Heisenberg Uncertainty Principle and know both the velocity and position of subatomic particles at the same time. [Dang it, my life’s dreams ruined…] (Geek out more here.) But don’t dismay… It is, in fact, possible to invest in companies with instruments having both debt and equity characteristics via the Royalty Note. [Insert a long sigh, and cue inspirational music...] To learn more about Revenue Royalty Notes, check out this article by CaroFin, a private marketplace for alternative investments: --- Photo credit: Pratiksha Mohanty via Unsplash

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|