|

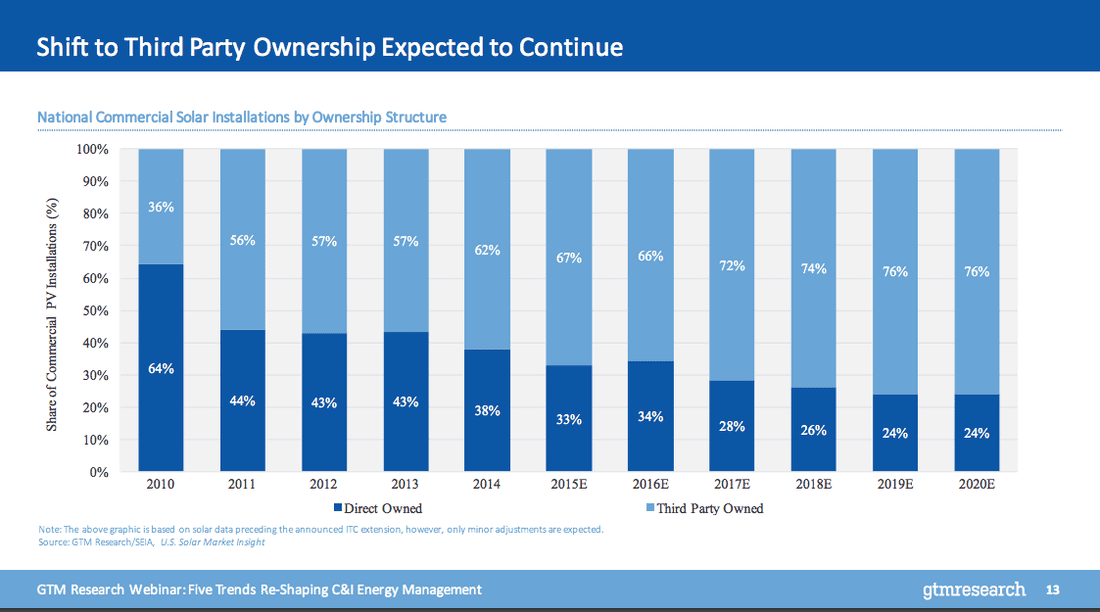

Amid the buzz of Solar Power International 2016 last week, there was a persistent cry of the financing gap in C&I solar. Yes, big money is flooding in searching for good projects to finance. The low-hanging fruit has always been utility-scale solar. Scale, credit-rated offtaker, stable cash flows - check. But margins are being squeezed as the race to bottom out PPA prices builds momentum. Enter C&I solar - a tantalizing large potential market of smaller-scale projects, trending towards 3rd party ownership (translation = welcome investors!), with low hanging fruit ripe for the picking. Commercial and industrial offtakers seem more willing than ever to sign up for solar, and at PPA rates often substantially higher than what can be gotten from our utility friends. But, is C&I solar the greenfield opportunity that many hope it to be? (Source: GreenTech Media) C&I solar is not blessed with the same attributes as a utility-scale project - smaller scale, offakers with no credit ratings, and, most importantly, extreme heterogeneity. Diversity is every infrastructure financier’s nightmare, as it stymies standardization, which is the key ingredient to scaling investment from more risk-averse, low cost of capital investors. And the C&I solar market has bedeviled many attempts to solve the standardization challenge. By way of example, I am going to pick on beEdison and their flagship risk analytics product, truSolar. TruSolar, a project cofounded by Distributed Sun, Dupont, RMI, and Underwriters Laboratories, was an attempt to create a uniform method for assessing project risk in C&I solar. The truSolar Risk Screen Criteria and Methodology (RSCM) identified over 800 unique risk elements and thousands of scoring dependencies. Impressive? Or overkill? Hard to say. On top of this great risk analytics tool, they created a marketplace platform, used a ton of project data to train their risk algorithms, created nifty flow charts like the one below, and hoped that buyers and sellers would seek holy matrimony at their table. By all accounts, truSolar is the real deal, and who doesn’t like marketplaces, but are buyers and sellers coming? They built it, so did they come? beEdison claims to have 200 members and 1,000+ projects totally over 4 GW and $10B of dealflow. But, I have to admit - I am skeptical. Around 2 GW of solar was developed in Q2 2016, and less than 20% of that was in C&I market (SEIA). So, it appears as though the 4 GW number is just maybe a bit of an overstatement. (Source: beEdison)

To be sure, I am fan of beEdison’s approach. It is ambitious, and it solves a real challenge in the solar C&I market using - everyone’s favorite buzzword - BIG DATA! So, why is it not sweeping through the marketplace with wild abandon? Perhaps, they made the risk analytics process too opaque and complex. Perhaps, sellers do not trust the idea of using a platform to meet sellers, or vice versa. Or, perhaps the real issue is that solar C&I projects are not penciling like investors would hope. The real challenge in the solar C&I market is not just standardization and credit analysis. It is that these projects do not turn out to be nearly as rich as investors had hoped. It is a classic case of failing to achieve economies of scale. Development and construction cost efficiencies in the utility solar market allow projects to pencil even with really low PPA rates. It is really difficult to translate those cost efficiencies into the C&I solar market due to the aforementioned issue of extreme heterogeneity. Said another way, solar C&I projects just cost more. And only in niche markets can those high project costs be supported by the prevailing PPA rates that a C&I customer will accept. Many geographies are blessed with low retail electricity rates, especially for large electricity users. These offtakers are not likely to accept a PPA which locks them into a higher electricity cost today, even if the long-term impact will likely be in their favor. When high development and construction costs run up against this ceiling of acceptable PPA rates, you start to see margins squeezed. But the difference is that these margins are on small projects with funky risk profiles. So for the time being, solar C&I remains a “diamond in the rough” market. Investors are seeking the gems out there, while many (I mean, many) projects out there just fail to meet their hurdle rates, risky or not. But be on the watch - there are many other companies exploring ways to serve this sector efficiently, and at scale. The real gamechanger may not be nifty platforms, but rather the tried and true method of securitization. Solar securitizations are happening, pioneered by SolarCity and SunRun, but can the question remains as to whether they can open the floodgates of institutional capital given the fragmented and idiosyncratic nature of solar C&I projects. Comments are closed.

|

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|