|

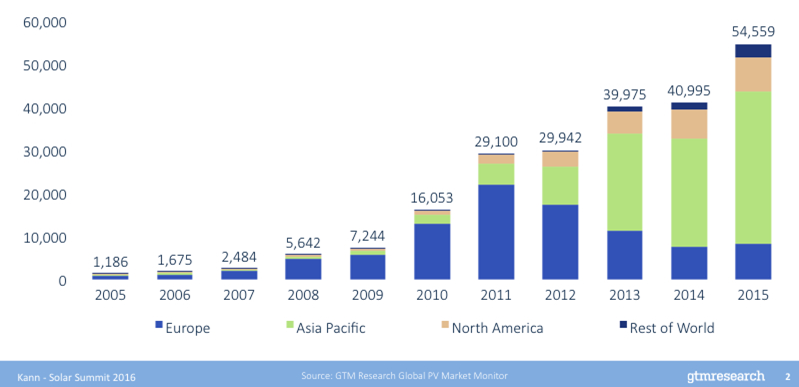

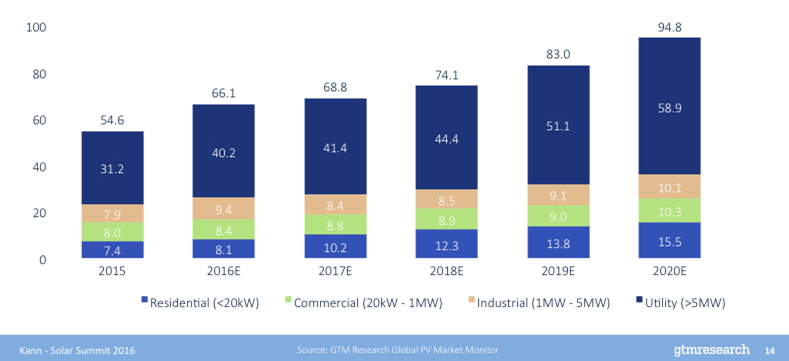

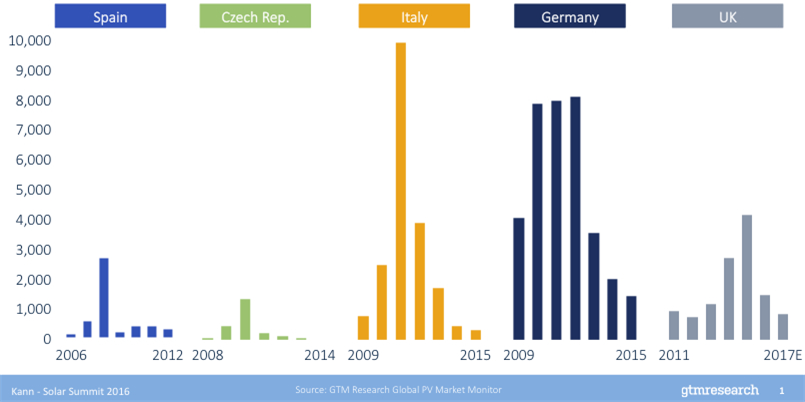

Everybody loves solar. Well, except for those who think solar panels cause cancer and prevent plant photosynthesis. (Seriously. Summary here.) But we digress… Solar projects makes for great headlines, company brochures, and dinner party conversation. But are these good infrastructure investments? (Let’s keep investments in companies separate for now. Venture capital and public equities are very, very different beasts.) If you ask Warren Buffett, he has already answered, with more than $15B invested in solar (and wind) projects. I hear that he’s a pretty good investor, so that says something. And if you look at the two graphs below, then you should agree that the market is trending up. Predictable markets, especially at the utility scale, with 5-year projected growth of 1.9x versus 2015. Residential solar also looks strong at 2.1x growth over the same period. However, commercial and industrial markets may only increase about 1.3x, with one-off credit risks that challenge scaling. So, go long on U.S. solar, right? Broadly, yes, but the devil is in the details. Picking the right market, site, developer, offtaker, and finance model will, of course, make or break the deal. And these are just U.S.-specific projections. The world is a big place. Now let’s look at other countries’ experience. Summary: It’s not predictable year-over-year growth for many years. The graph below tells a different story: Solar project investments are better defined as taking a ride screaming with joy and pain on the “solar coaster.” So, short solar markets in certain countries? Well, maybe, though not technically easy to do since this is mostly private, not public, equity. In summary, should you go long or short on solar infrastructure? Um...yes, let’s grab a beer and talk in more detail. Comments are closed.

|

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|