|

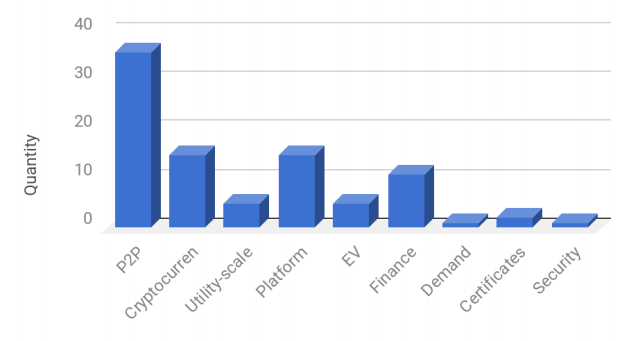

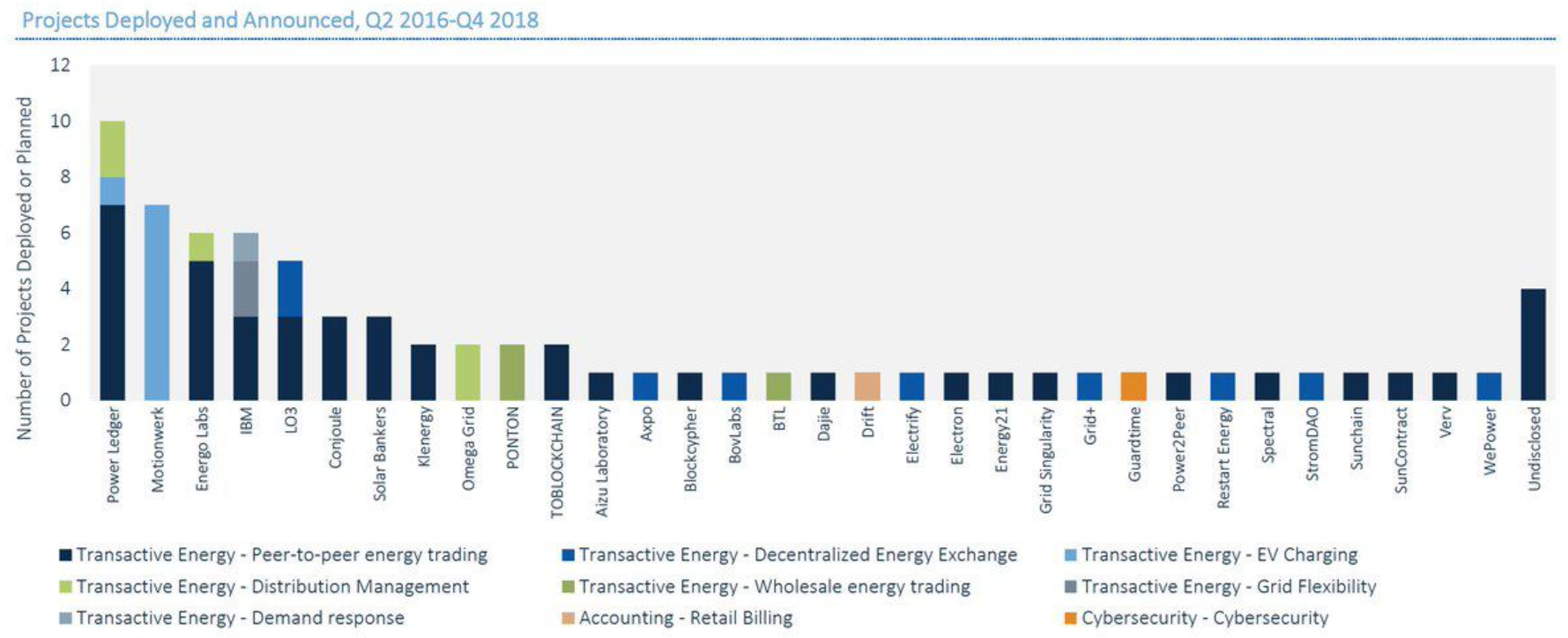

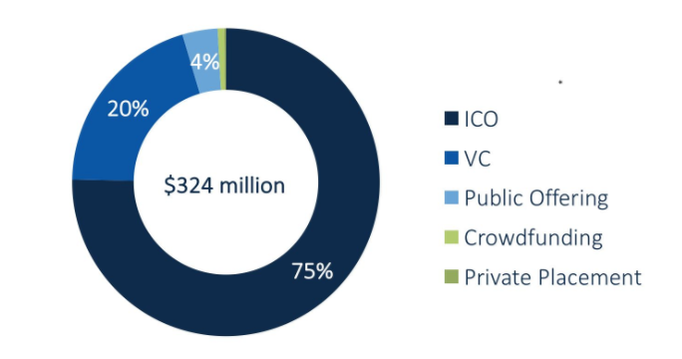

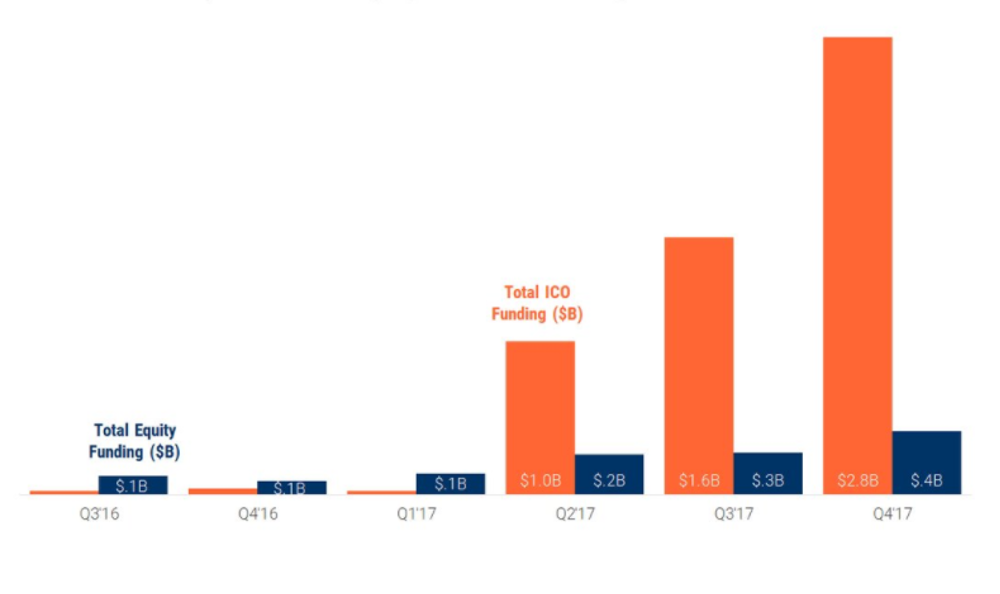

By: Dr. Chris Wedding, Managing Partner In the last quarter, investors poured more than $324M into blockchain for energy companies. Can you believe that? Well, you shouldn’t. But which part is most unbelievable? While $324M seems shocking, it’s all about context. That amount has indeed been raised, but it’s taken 12 months to do so, according to GTM Research. What’s more shocking is that over 75% of this capital has been raised via Initial Coin Offerings, or ICOs. When thinking about this emerging market, it’s kind of like being back in high school: Some investors have FOMO (Fear of Missing Out). But others think they’re too cool to hang out with the kid who just became popular after years of dork-dom. But what should you, oh wise capital providers and ye capital-hungry blockchain entrepreneurs who worship the clean energy gods of purity, know about blockchain-focused energy opportunities? Here are our top 4, out of our longer list of 75. (I exaggerate slightly.) 1. There are 120+ blockchain energy companies. But most are relative newbs. Yep, that’s a term from my kiddos. I can’t wait to finish this blog so I can go tell them I used their word correctly. But do I use the word “newbs” to be mean? Heavens, no. I’m a good Catholic-Buddhist, after all. (Oh, they exist.) What I’m referring to is the age or maturity of most companies in this sector. Research from Solarplaza suggests that most ventures were formed in 2016 or 2017, and investors at the GTM Blockchain Forum note that most founders have little to no operational business expertise. That does not mean that these young ventures lack merit. But it does make the hill to success tougher to climb. (Think steep slopes covered in poison ivy and man-sized Venus flytraps.) As Greentech Media’s Chairman observed [paraphrase]: “We see many white papers for ICOs sponsored by blockchain in energy startups. Some are are interesting. But some are sketchy.” Another panelist at a recent blockchain energy conference noted: "We're currently working with Atari, but we need to be using Playstation 4 to make most [blockchain for energy use cases] work at scale.” An investor panelist put it another way [paraphrase]: “Blockchain is today where the Kardashians were in 2008. When their name is on something, it can print money. But then smart people ask ‘Why? What businesses do they really have? Maybe a clothing line, a home video business (get it?), and a few others?’ But then you realize there is a genius marketing mastermind behind it all. The hype is, in fact, part of the cause for success.” Lastly, all hail innovation. Seriously. This is how it works: First, divergence. Second, convergence. However, we’re very far from the latter. 2. There are a bazillion use cases. And the energy world is 6-trillion-dollars big. Just in case you thought that 120 companies in the same emerging sector was a lot, think again. The Energy Web Foundation, co-led by our friends at the Rocky Mountain Institute, see over 200 potential uses cases for blockchain in energy. Even if only half of those scenarios prove to be real, that is still many, many niche markets ripe for multiple companies to do well in many geographies. Moreover, the energy industry is not a tiny pearl hiding in a small oyster. It’s more like an ocean full of 100-foot long blue whales, as plentiful as squirrels on a college campus. But seriously...no wine glass in hand...The energy market is one of the biggest industries on the planet, and it’s full of intermediaries that control the flow of electricity and money. This creates a huge playground for diverse and interoperable blockchains, distributed and trusted ecosystems of counterparties, and automated and smart contracting abilities. 3. ICOs are crushing equity investors. But that can (should?) not continue. In the broader universe of early-stage blockchain companies, ICOs are killing venture capital. I mean, like the Incredible Hulk vs. me in a boxing ring, or some such awful mismatch. However, the U.S. Securities and Exchange Commission is taking a pretty hard look at ICOs — in the past, present, and future. And let’s just say that their eyebrows are raised, you know, where one is raised higher than the other. While many ICOs have tried to avoid SEC oversight, when it walks like a duck and quacks like a duck, then...It’s a security. (If you don’t know what I mean, take a look at their guidance here.) All is not lost for conventional equity investors. Venture capital and corporate strategic investors bring value that can be far greater than capital alone. (The latter is the extent of the contribution from ICOs.) The other benefits of working with institutional equity investors include rich networks that can lead to partners and customers, insights on corporate governance based on lessons learned from dozens of past ventures, and deep sector expertise to allow for threat and opportunity recognition beyond what the core team might focus on while their heads are down building a company. Capital Raised for Blockchain Companies: Q3 2016 to Q4 1017 Equity (blue) vs. ICOs (orange) Source: CBInsights, Tokendata 4. Blockchain is not just for nerds. It’s for the C-suite.

Some famous venture capitalists have said that they look for the next big investment opportunities by watching what scientists, engineers, and other smart folks are doing outside of work, perhaps late at night or on the weekends. Blockchain may have started out that way. But today, it’s a topic that rises up to, or comes down from, the highest level in organizations — the C-suite or the Board of Directors. Why is that? One guess is that they see blockchain as a disruptive innovation focused on challenging core competencies and going outside of the box to amplify corporate synergies, finding opportunities in AI, and gobbling up low-hanging fruit. Just kidding. I was trying to use as many meaningless buzzwords as possible in one sentence. But the reality is not too far off: The top level of management is charged with finding and responding to risks and opportunities that lurk further out, beyond the blocking and tackling of tactical business execution, metaphorically crouching behind a dumpster to surprise the marathon runner in mile 20. Wrap up, Part 1: What are some things that investors love about blockchain? Blockchain-based energy companies can be attractive because...

Wrap up, Part 2: What are some attributes that investors hate...ur...worry about blockchain-based energy ventures? Investments in blockchain-based energy companies can be challenged because...

Conclusion: Is there one? OK, so like many emerging sectors for investment, there is plenty of risk and reward. But as they say, “Sitting on the sidelines is no way to win a game.” (Can you tell that it’s almost March Madness. I grew up in Kentucky and am a professor at Duke and UNC, so go blue!) As IBM put it in a recent Tweet, “We do not know where #blockchain will go, but there is a need to jump on board!”

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|