|

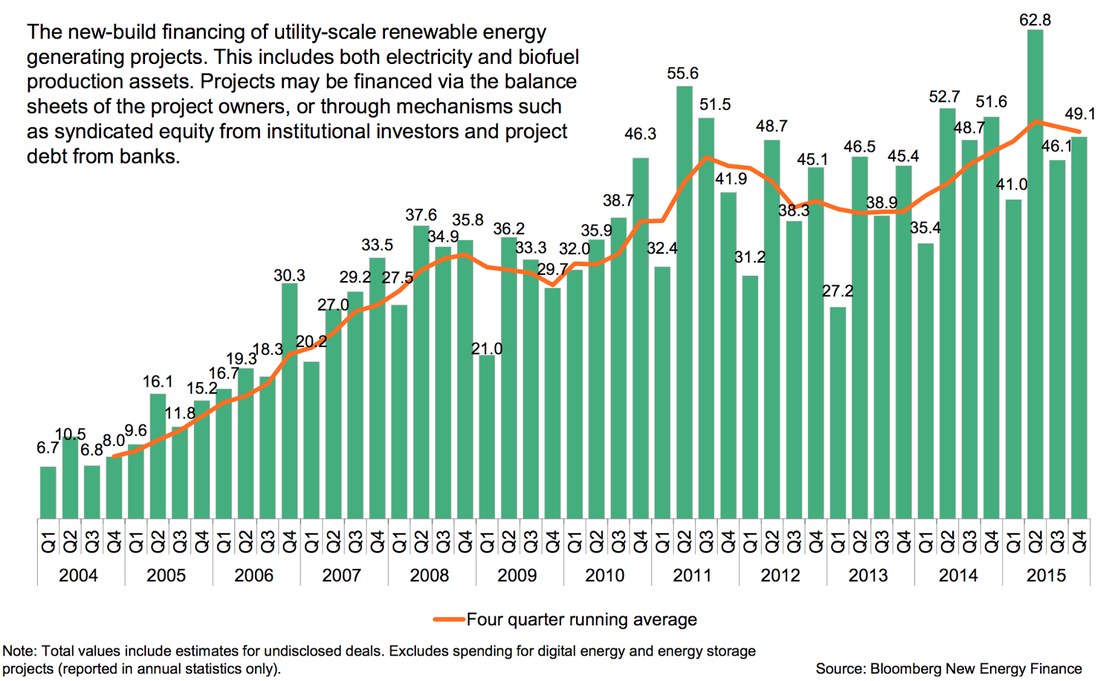

Institutional investors have been reluctant to invest in solar, until now Perceived risks have long dissuaded institutional investors from venturing too deep into solar investments. Fortunately, perceptions can change. Whereas once the solar industry was hampered by the perception that technology was risky, markets were untested, and policy uncertain, now the solar industry is increasingly seen as a low-risk infrastructure investment that is increasingly enticing for the less risk tolerant institutional investors out there. Asset Financing for New-Build Renewable Energy Assets ($B) To be sure, the solar investment space is pulling in interest from institutional investors, but it is also being pushed out of many fixed income and treasury investments due to the extended period of low interest rates.

Now that those “risk-free” assets are now also return-free, investors are anxious to explore investments with stable and predictable yields, ideally that generate free cash flows. As solar performs more like an infrastructure investment, with contracted cash flows, predictable technology, and a very long runway of future demand, interest from institutional investors is piquing. The question is - can solar meet the scale and risk-return profiles that institutional investors require? Can clean energy projects match the capital and risk profiles to entice investment? There are many ways that institutional investors may want to increase their allocation in clean energy - green bonds, low-carbon investment funds, etc. — but here I am going to focus on direct investments in projects. Over the last decade, the solar industry has expanded into a highly diffused ecosystem comprised of a large range of developers, EPCs, OEMs (though many fewer of these), and financiers. On the financing side, the availability of debt and tax equity has been a key driver of where and what type of projects could be built, and sponsor equity providers have come in as the final layer of the capital stack. Many solar projects with stable cash flows for 15-20 years and limited construction risk can yield returns of 10% or more, which easily beats the returns that can be achieved in the bond market. To really catch the eye of an institutional investor, portfolio sizes need to be in the $100s of millions, ideally yielding unlevered returns of 8% or more. Though large scale projects and bigger portfolios of projects have started to come through the pipeline, it is still difficult for a single developer to create an investment opportunity of the scale and risk profile that serves the needs of institutional investors. Even when these investment opportunities exist, institutional investors are wary of direct investments that expose them to illiquidity or diversification risk. Because of this, much of institutional investment to date has been in providing debt restructuring or acquiring an equity stake in operating assets, as most investors do not want to take on development risk. This is changing, but this mismatch remains an obstacle for moving beyond opportunistic engagement with institutional investors. As a result, some funds specializing in clean energy and low carbon infrastructure investment have emerged to act as stewards of institutional dollars. But will this be enough to really jumpstart institutional investment into solar projects? Asset-backed securities hold the key to bringing institutional investors on board In reality, institutional funds are not going to become big players until a market emerges that can bundle clean energy projects into securities and match institutional investor appetite. And given the predictable cash flows generated by solar projects with long-term PPAs interconnected in stable markets, these projects may actually lend themselves well to forming relatively low-risk, transparent, cash-generating securities. The key here boils down to risk mitigation. When a portfolio of solar project cash flows are pooled into one fund, that fund serves to protect the investor from the developer/sponsor’s corporate risk, which allows for standardized securities to be issued against the capital in that pool. Then, investors have a tradable security through which to commit capital to solar infrastructure investment. If these securities are well received in the market, they can create a virtuous cycle of demand-pull for the underlying asset, in this case solar. Beware: this virtuous cycle also occurred for the housing industry in response to mortgage-backed securities, so this positive feedback can have distortionary impacts on the market as well. At least presently, the solar industry does not seem to invite the same overzealous market speculation that threw the housing industry into a downward spiral. So, are we seeing the emergence of clean energy-backed securities to help leverage institutional investor capital? To some degree, the answer is yes. We can see this primarily in the rise of the green bond market. Bonds as a debt instrument, generate a contracted cash flow, which can back a security. The global green bond market grew to over $40B in 2015, a portion of which was asset-backed securities used to finance aggregate portfolios of smaller debt facilities into institutional investor-sized offerings. But there is a lot of work to do on expanding clean energy finance beyond the bond market. So, keep a lookout for innovations in solar securitization, as it holds the key to attracting institutional investors. Related data points:

Further reading:

Comments are closed.

|

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|