|

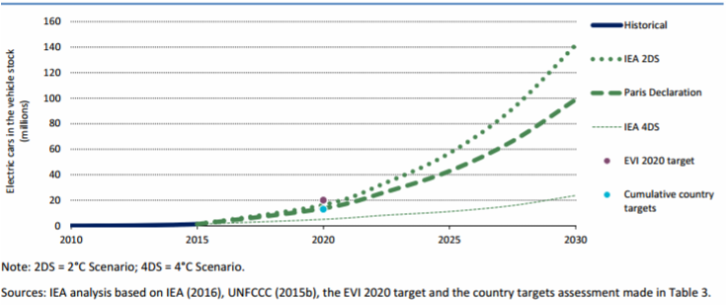

It is easy to relegate a discussion about electric vehicles to Tesla toys for the affluent. But that would not be the whole truth. As an illustration, I recently served on the Advisory Board for Vulcan in its Smart City Challenge partnership with the U.S. Department of Transportation, which jointly awarded US$50M to a single U.S. city to support transportation innovation, including electrification. In all, 78 cities competed. The enthusiastic response, impressive potential for scale, and wide-ranging innovation were a pleasant surprise. Although there are only about two million electric vehicles on the road globally today, that estimate is expected to grow to roughly 100x if the Paris Climate Accord has its targeted impact (International Energy Agency, 2016). Electric Vehicle Projections, 2010-2030 (Source: International Energy Agency, 2016) Although these vehicles are often deemed to be “too expensive,” many electric vehicles actually offer a lower total cost of ownership than conventional vehicles when assess over their entire lifecycle.

Moreover, by 2022, the average first cost of electric vehicles is projected to be the same as the average first cost for conventional cars. With cost concerns removed, plus the other benefits of less noise, no gasoline smell, fewer moving parts, and the “cool factor,” this market is expected to grow quickly from this point forward (BNEF, 2016). In fact, the growth of electric vehicles is expected to be so meaningful that Fitch Ratings recently stated that the sector’s rise presents potential for “investor death spiral” negatively impacting the oil sector (Financial Times, 2016). And at the Oil & Money Conference last month, Statoil’s CEO noted that electric vehicles could catalyze oil’s peak sales within five years, with a steady decline thereafter (Climate Home, 2016). Considerations for infrastructure investors:

Comments are closed.

|

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|