|

Related data points:

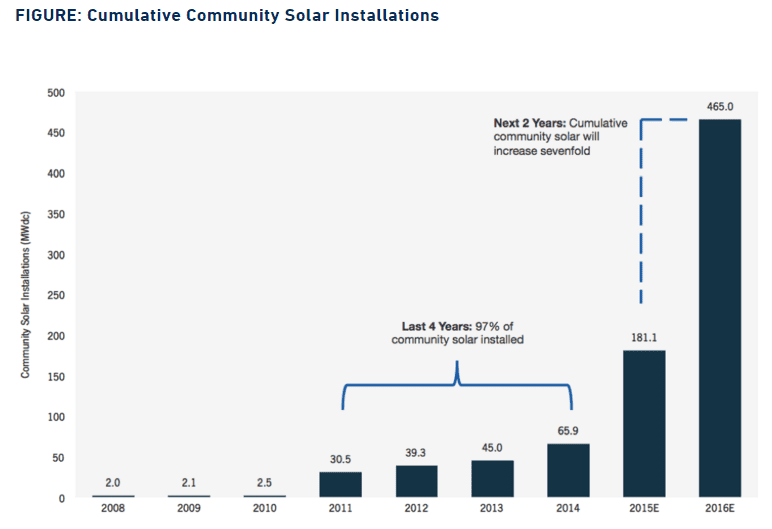

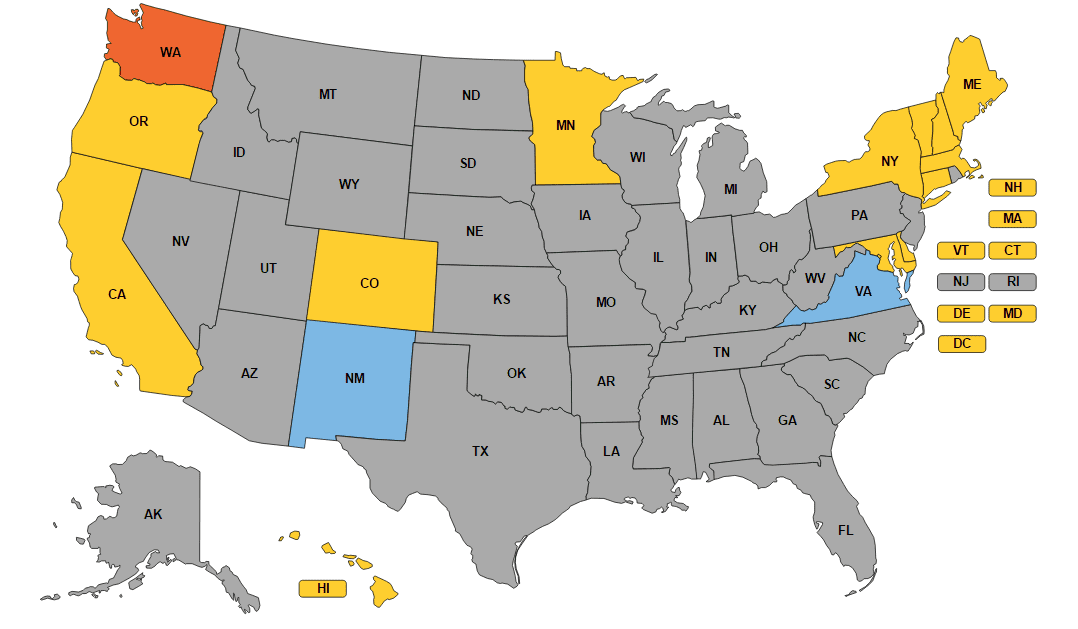

In June 2015, six months before Congress extended the solar ITC beyond 2017, GTM Research predicted that by 2020 community solar will be a half-gigawatt annual market. With the new ITC extension, the recent IRS private letter ruling on community solar, and EPA’s Clean Power Plan gradual march forward, more and more actors in the solar industry are starting to realize the prospects created by community solar programs across the country. Indeed, community solar could well mark the second revolution in the solar market. For those who have missed the rooftop solar revolution, community solar could be the second chance to get on the solar train. (Source: GTM Research) Why community solar and why now? A relatively new concept in renewable energy, community solar allows customers who might find solar panels to expensive or impractical to install on their property to enjoy the benefits that come with owning solar panels without the need to install a solar facility on their property. The primary purpose of community solar initiatives is to reduce member costs and risks through a joint investments scheme in a community solar facility to be located in a suitable location in proximity to the contracting community. By aggregating customer-generators, project participants could benefit from the electricity generated by the community solar farm, which costs less than the price they would ordinarily pay to their utility. With somewhere between half to 85% of electric consumers in the U.S. unable to install solar panels because they don't own their home, don't get enough sun, or don't have the required financial resources, community solar represents a huge, mostly untapped market waiting to be grabbed. Unfortunately, as with every new market, uncertainties are abound. It is therefore not a coincidence that the states with the most community solar projects are generally the states that have addressed investor concerns through strong enabling legislation. These states include Colorado, Minnesota, Massachusetts, and Vermont. Other states are rapidly catching up, and currently 15 states and the District of Columbia are contemplating or have already introduced community solar programs through legislation. Unfortunately, state programs differ widely, and some programs do not offer the same level of investor certainty as others. (Source: Shared renewables (in blue: pending legislation))

Addressing investors’ concerns In comparison to traditional distributed energy projects, community solar initiatives pose a heightened credit risk. Multiple members with varying degrees of creditworthiness make investors uneasy, to say the least. Moreover, restrictions on exit make community solar unattractive to potential members who have only a small stake in the project and are therefore wary of signing contracts that impose penalties on members who leave the community; while the potential for high member turnover scares investors away. Add to this the usual concern that multiple parties to a transaction mean higher transaction costs, and the reason why investments in community solar are hard to come by becomes clear. However, an in-depth assessment of community solar schemes across the U.S. reveals that several states have done a remarkable job addressing these concerns, making investments in community solar in their jurisdiction not only relatively safe but also quite attractive. To ease operations and reduce transaction costs, Public Utility Commissions in New York, Maryland, Minnesota, and Colorado have introduced an intermediary special purpose entity (SPE) responsible for aggregating membership interests and managing the relationship with the local utility. Thus, instead of contracting directly with the residents in the community, the utility enters into an agreement with the SPE which serves as the project’s manager. The SPE aggregates members and collects payments; provides the utility with member information; and distributes excess credits to members (or instructs the utility how to distribute excess credits). To allow flexibility and innovation, the states left it to sponsors and potential members to determine the terms of their contractual relationships, including conditions for removal and replacement of members. The SPE structure makes member replacement fairly easy. Since utilities are engaged with the SPEs and not individual members, they are agnostic to member exits and replacements. When it comes to removing, replacing, or adding members, the SPE’s sole responsibility is to notify the utility of the change in a timely manner. While not as flexible, other states took a fairly close approach to reducing risk associated with multiple members. New Hampshire, Massachusetts, and Delaware require that the community designates a “host” member with an ownership interest in the solar facility to contract with the utility, administer group relationships, instruct the utility on credits allocation, and control membership structure. Vermont’s community solar scheme is not run by a utility or third-party SPE. Instead, members are free to organize themselves, stipulating their own process for allocating the generation credits among their accounts. The program’s flexibility is hailed as attracting investments in community solar, but projects are only attractive when the terms of subscriber contracts allow for immediate termination of defaulting members. In other states, programs are either overly restrictive (Maine, Washington), are still in the works, or undergoing revisions (Connecticut, Virginia, Oregon, DC, Hawaii, California). What’s next? Through our work with interested investors and qualifying developers, we have come to appreciate the market potential for community solar in the seven “leading” states (New York, Maryland, Minnesota, Colorado, New Hampshire , Massachusetts, Delaware, and Vermont). However, strong opportunities do not mean zero risks. Although the regulatory environment in these states makes it easier for community solar administrators to mitigate risks associated with multiple members, in practice finding and contracting with an alternative member is contingent on the characteristics and contractual terms of the specific project. A profitable project with a simple member replacement mechanism should not experience difficulties in recruiting new members to replace those who defaulted. To ensure that a project is investment-worthy, developers and administrators are therefore advised to include terms in solar community agreements that allow for the immediate termination of defaulting members’ subscription even if such language might mean an initially harder-to-market project. In addition, developers should restrict member subscription, reserving a pool of unsubscribed interested and potential members in the community for future member replacements. From an investor perspective, investors should carefully examine developers’ subscription and management contracts, verifying that administrators and hosts have adequate measures for addressing the risks associated with multiple members. Comments are closed.

|

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|