|

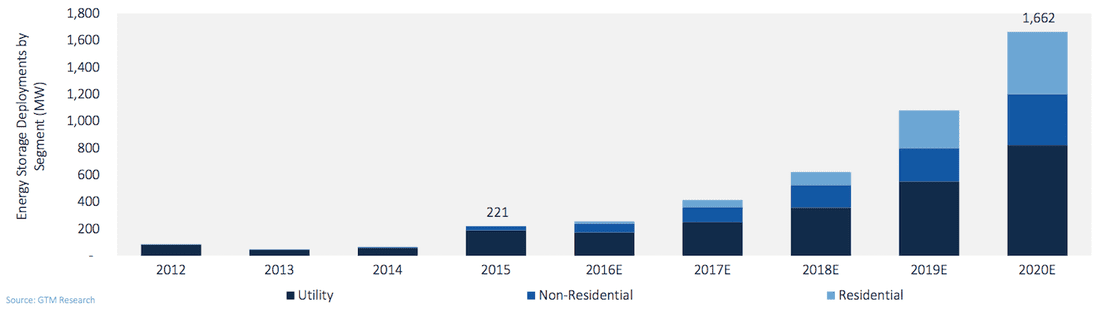

Annual U.S. Energy Storage Deployments, 2012-2020E Can somebody throw the energy storage industry a bone? It is a little known fact that the investment tax credit (ITC) was a key catalyst for the emergence of solar as an essential component of the future electric grid. Well, not really. That statement borders on platitudinous. It should be no surprise, then, that the energy storage industry is angling for similar treatment by the almighty tax deities at the IRS. Energy storage, after all, is touted as being a key enabler of high levels of renewable energy penetration. Handcuffing energy storage will only undermine the grid integration of solar and wind down the line. So, can the energy storage industry get a bone here? Yes, it is a relatively nascent industry (at least in battery technology) undergoing a rapid period of technological learning and experimentation. But out of the frey, we are starting to see some dominant technologies and applications emerge within functional markets. While lithium ion batteries are the current industry darling, there are many other viable storage technologies including stored hydropower, which still dominates the energy storage field overall. In the periphery, there are a host of other storage technologies incubating in R&D facilities, start-up companies, and corporate technology giants. Perhaps in response to the eventuality of energy storage becoming a key component of the electric grid, the IRS threw the energy storage industry a bone, but it came with some strings attached. Energy storage already qualifies for the ITC, right? Yes and no. Yes, energy storage already qualifies for the ITC, but no, it is does not qualify under all circumstances. Energy storage that is powered by solar or wind qualifies for the ITC, though with some caveats related to the extent to which grid electricity is also used to charge the energy storage system. This is where things get a little tricky. Assume that you have an off-the-grid solar + storage facility (a grid defector!). Simple - the ITC applies, and you can get on with your homesteading. But for all grid-connected systems, there is an upper limit to how much charging your storage system can receive from the grid and still qualify for the ITC. That magic number happens to be 25%, meaning that a whopping 75% of energy storage charging needs to come from solar. That is just the minimum standard for qualifying for the ITC. The full ITC benefit is reduced in proportion to the amount of energy input coming from the grid, so anything less than an energy storage system charged by 100% solar will receive less than the full ITC benefit. Add to string the fact that solar + storage projects are benchmarked to the first year’s solar power output for the subsequent four years of the tax benefit, which means that any reduction in solar output will be penalized with a lower ITC benefit. And all of this was articulated in a private letter, which does technically establish a precedent, but is a somewhat opaque way to communicate what could be a substantial benefit to the energy storage industry. See here for a clever dive into the details of solar + storage. Stand-alone energy storage ready for an ITC vaccination It is clear that coupling solar (or wind) with energy storage is a good idea, and will be done with increasing frequency over time. It is also clear that energy storage will not and should not be relegated to the sidelines of the ITC prom waiting for some attention from the solar and wind dancers on the floor. In fact, it is imperative that energy storage be granted a clear and clean invitation to the ITC prom independent of their relationship to solar and wind, when and where appropriate. If the aim is to reduce barriers to more energy storage development providing flexibility and ancillary services to the grid, then there is a pretty obvious argument to be made about the need for a little ITC vaccine for stand-alone energy storage. Why a vaccination? Well, energy storage, like many emerging clean energy and smart grid technologies, could benefit from an inoculation against investor skepticism. There is no shortage of bullish projections about the future of energy storage, yet many project developers find themselves searching for capital. Even when they land upon a willing investor, their investment often comes with a heavy cost of capital penalty due to the perceived risks and uncertainties associated with energy storage projects. Not unjustified on the part of the savvy investor in search of those ever elusive risk-adjusted returns. But also not the formula for ramping up energy storage deployment, which, after all, is the key to sussing out technologies, business models, and financing structures. Learning, in other words, which is exactly what the ITC has been doing solar all of these years. Roping in stand-alone energy storage projects into the ITC framework could be just what can get investors over the hump of really going gangbusters on energy storage. Comments are closed.

|

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|