|

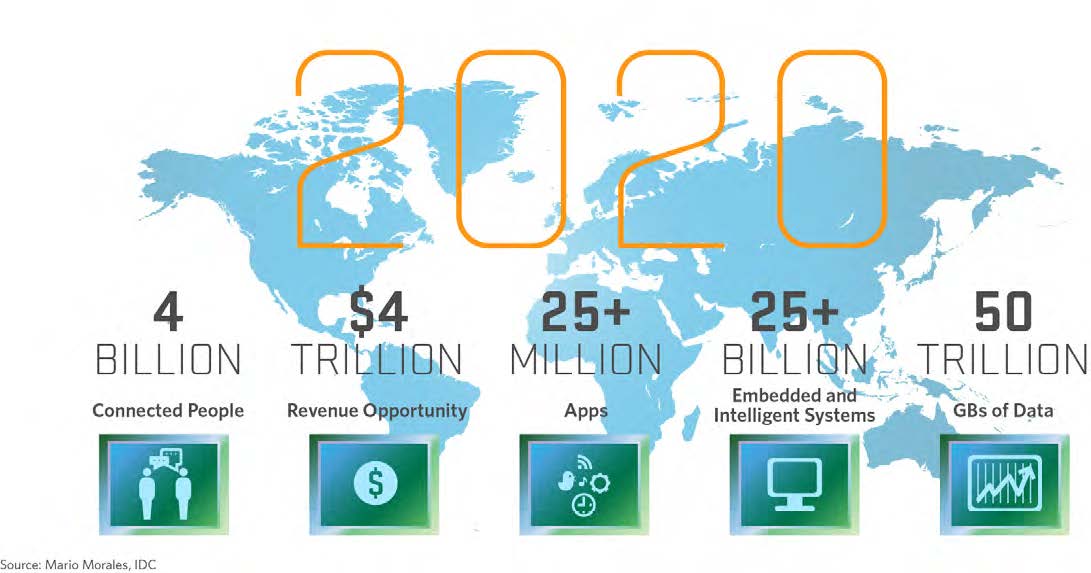

You may have heard of phrases such as “The Internet of Things” (IoT) or the “Smart Grid.” Both terms are defined differently by many people. According to IBM, the IoT refers to the “digitization of the physical world.” According to the U.S. Department of Energy, the smart grid can be defined as “a [new] class of technology to bring utility electricity delivery systems into the 21st century, using computer-based remote control and automation.” The investment opportunities in improving the intelligence of our electricity generation, transmission, and generation system can be summed up by a joke reserved only for energy geeks (like me). It goes like this: “If Thomas Edison were alive today, and you showed him a smart phone, he would be blown away by the innovation. In contrast, if you showed him how we produce and distribute electricity, he would say, ‘Oh yeah, I recognize that.’” As an example of the scale we are talking about, estimates suggest that the U.S. alone needs to invest US$2.1T by 2035 to upgrade its electrical grid and integrate the massive surge in renewable energy and the need for greater resilience. (International Energy Agency, 2016) As an example of what is coming, consider analyst predictions that the number of internet-connected devices globally will grow from approximately 13 billion in 2015 to almost 39 billion in 2020. (Juniper Research, 2015) Or consider the scale of the opportunity in the infographic below. Source: Mario Marales, IDC Considerations for infrastructure investors:

Comments are closed.

|

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|