|

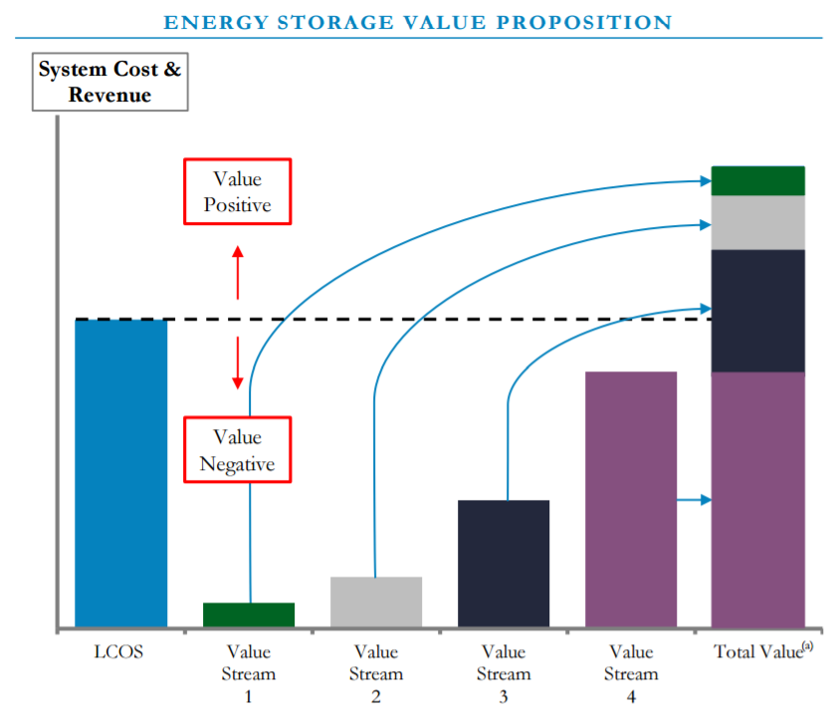

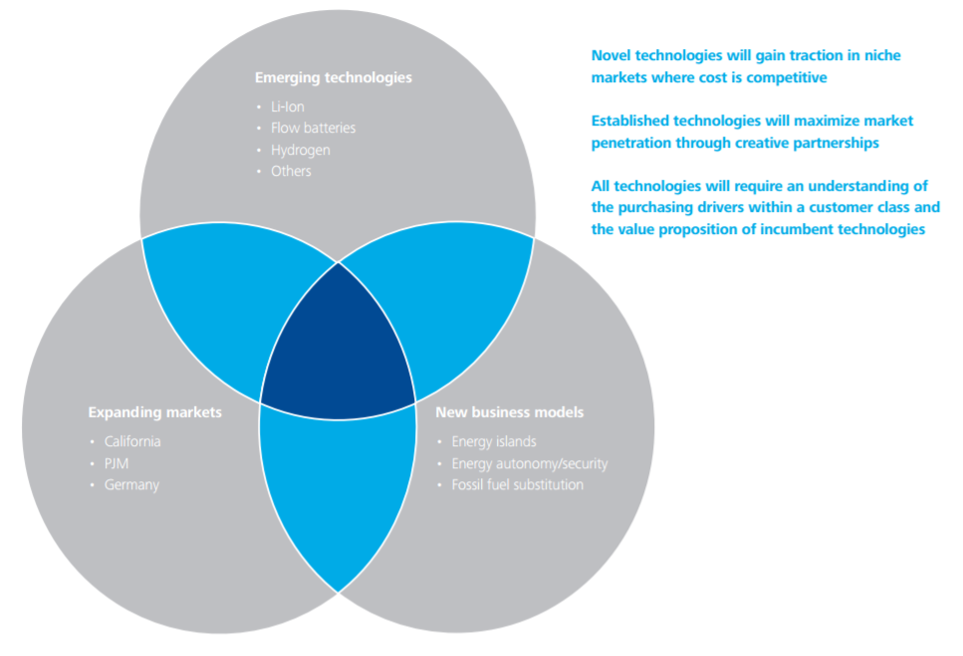

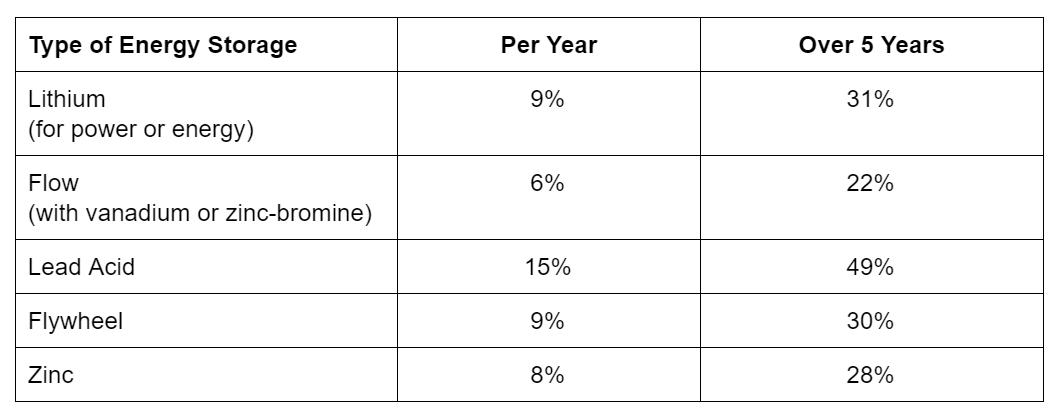

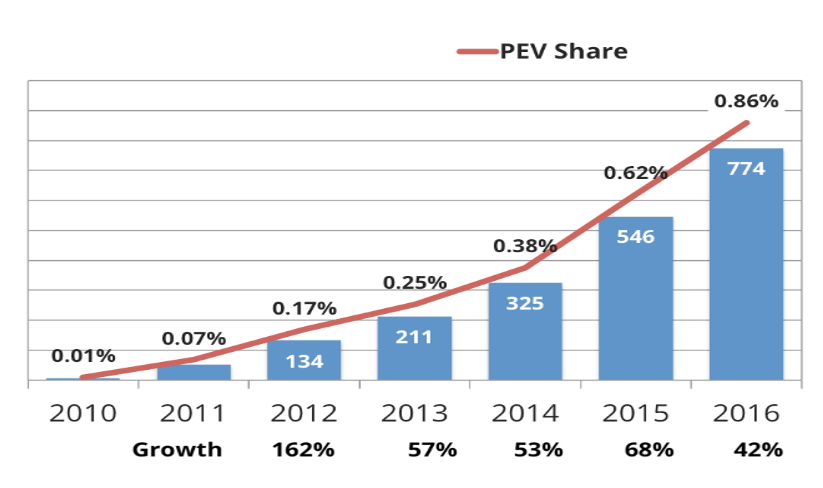

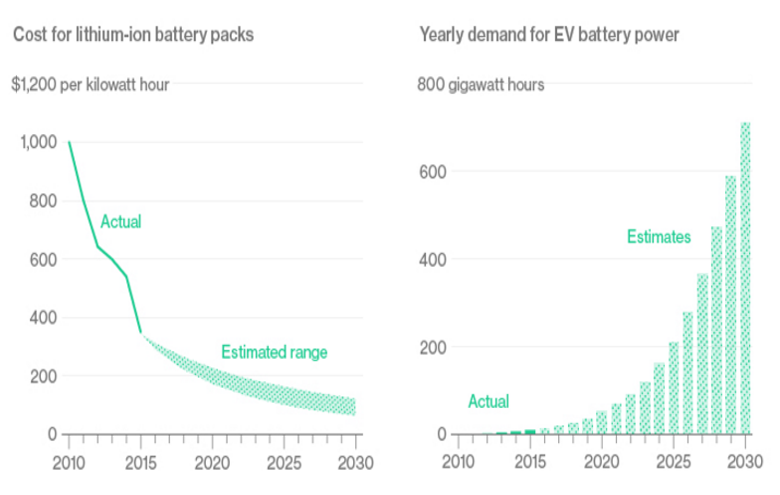

By: Dr. Chris Wedding, Managing Partner The storage market is projected to grow over 100x from 2013 to 2022. That’s great. Let’s go celebrate. Or maybe the famous William Gibson quote is worth highlighting: “The future is here — it’s not very evenly distributed.” When it comes to battery storage, that “future” today is defined as Hawaii, California, and the Mid-Atlantic (i.e., PJM power territory), with some random outliers such as Kentucky and Michigan as well. However, the financial feasibility of energy storage will grow quickly. Analysts project that commercial storage pencils today in 7 states. But that number is projected to rise to 19 U.S. states by 2021. (Minor footnote: The assumption for that math is that investors accept a 5% IRR. I hope that will be true. But today our investor network suggests a higher return threshold, perhaps in the mid-teens.) Battery costs are, of course, a key driver. So let’s consider four trends for investors to keep in mind. 1. Energy cost is not the most important driver in assessing financial returns “Wait, what? But you just said that costs were critical.” Let me explain. Capital costs get most of the attention in discussions about energy storage investment opportunities. And there’s good news: Prices are falling quickly. (Statistics below) However, capital costs are not the only consideration in achieving an attractive IRR. Instead, here is the key question. (Be prepared for some rocket science.) Is value greater than cost? As the Lazard figure below illustrates, when “stacking benefits” from energy storage projects, more and more project opportunities will begin to make financial sense. These benefits, or potential revenue streams, can include grid benefits (e.g., regulating frequency, deferring major capital cost upgrades) as well as host-user benefits (e.g., lowering demand charges on power bills). Unfortunately, policy and technology are still barriers to the realization of multiple sources of revenue for the same storage system. Both are slower to adapt to market possibilities than entrepreneurs and investors would like. Energy Value Proposition: Value vs. Cost (Source: Lazard) Furthermore, if you’re coming from the wind or solar industry, it’s helpful to remember that energy storage is not an industry where one size fits all. There is not one energy storage market. There are many. Finding battery investment opportunities that make sense require the right match among technology, geography, utility territory, customer, and business model. (See the figure below.) Energy Storage Feasibility: The Nexus of Technology, Market, and Business Model (Source: Deloitte) 2. The costs for batteries has fallen about 50% since 2010 According to a 2015 Moody’s report, energy storage costs have fallen by half in the last six years. They predict “significant market impacts” for power producers. But even greater costs reductions have been seen in recent months. For example, over the 18 months prior to June 2016, energy storage provider Stem saw a 70% reduction in their costs for batteries. The falling prices can be attributed to a number of factors, such as the overall scale of production among all manufacturers, the volume of production on an individual company basis, and the balance of supply versus demand. 3. Storage costs are projected to fall another 25-50% by 2020 First, be aware that storage cost projections vary depending on the technology (e.g., lithium, flow, flywheel, sodium, zinc, compressed air) and the use case (e.g., commercial, residential, microgrid, island grid, transmission-level, peaker replacement, frequency regulation). Below is a snapshot of expected storage price drops on an annual and five-year basis. The outlier, not included in this chart, comes from Telsa. (Are you surprised?) Its Nevada-based Gigafactory is expected to drive down the costs of its lithium-ion batteries by at least 50% by 2020. Average Projected Energy Storage Cost Reduction: 2016-2020 (Source: Lazard) 4. Battery cost dynamics are closely linked to electric vehicles in two ways First, let’s be clear: We’re just talking about lithium-ion batteries. (Apologies if you’re now shaking your head saying, “Duh, of course.”) First, lithium batteries will fall, in part, because EV sales have increased dramatically in the last five years — a nearly 600% increase in annual sales between 2012 and 2016. Furthermore, EV sales are poised to grow more significantly in the years ahead. BP predicts 100 million EVs by 2030, for a 6% market penetration, while other analysts project 15% to 35% market penetration, where EV sales account for 8 out of 10 new car purchases. See the two graphs below. And be sure to compare the EV sales for 2016 on both graphs. Wow, indeed. Get your motors running… Just like we see in so many sectors, with greater scale comes lower costs for all lithium batteries, not just those for EVs. (Again, common sense comes in very handy.) Annual EV Sales: 2010-2016 Source: EV Volumes PEV = Plug-in EV Correlation: Projected Cost for EV Batteries vs. Growing Demand for EV Source: BNEF The second reason that battery costs and EV sales are connected is this: Like U.S. Marine drill sergeants, EVs demand a lot from their batteries. Once the battery capacity gets below about 75%, the EV needs a replacement. But the battery still has lots of useful life in less intensive applications, such as stationary uses serving the grid, industry, or homes. Car companies like BMW and Nissan are already working on second-life uses for their EV car batteries for the home storage market. It seems like an obviously great idea — preserve that supply-constrained lithium, don’t throw away a perfectly good technology, and most importantly, get cheaper batteries for the masses. But, it’s not that easy. (Is it ever?) How do you combine used batteries from different manufacturers? Or those from the same manufacturer but made in different years with different technology? How do you assess useful remaining battery life in a non-invasive manner that doesn’t destroy part of the battery in the process? How do you ensure safety? And get relevant warranties and insurance needed for selling thousands of second-hand systems? Conclusion Energy storage costs have fallen about 50% since 2010, and are projected to fall another 25-50% by 2020. That said, costs are not the sole determinant of investor interest. The value of storage systems is severely constrained today because policy and technology has not yet enabled the potential multiple revenue streams from the same under-utilized storage systems. But that is changing. So, will you dip your toe into the energy storage market today? Or will you wait for it to make progress on its 100x market growth trajectory between 2013 and 2022? Said differently… How do you feel about the risks today versus the risks tomorrow, when there are far less technology and policy challenges, but far greater competition to invest in the best projects?

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|