|

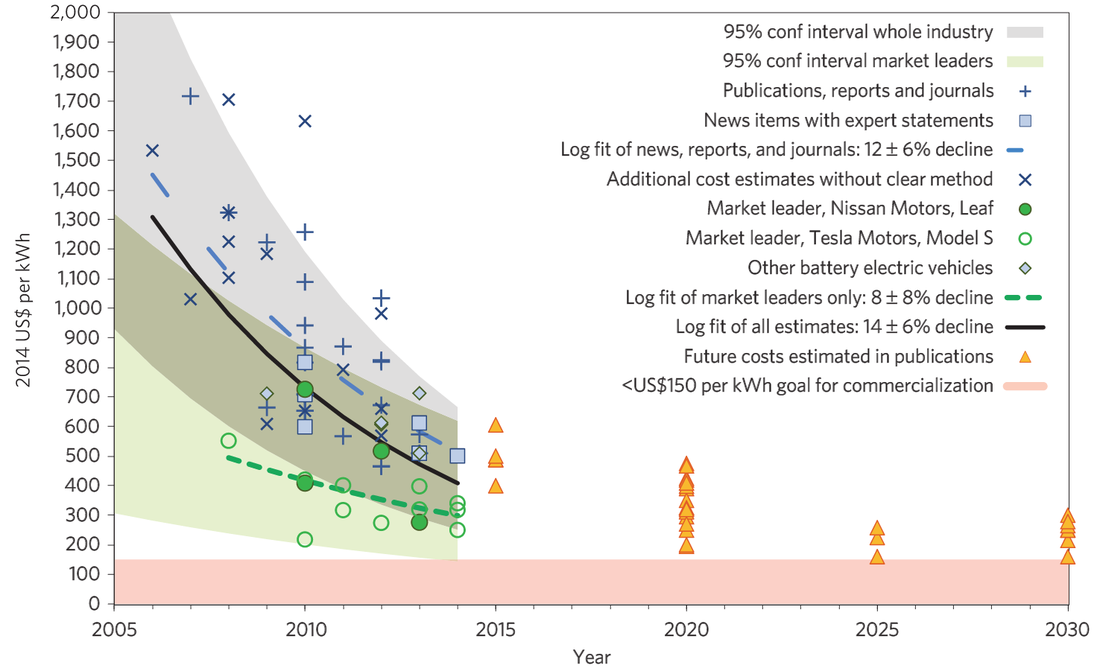

Projections are a fool’s game, but they are also unavoidable if you happen to care about infrastructure finance and policy. Why? Because investors are keen on timing the market, and economists and policy experts want to know when and how to intervene in the market. Understanding the dynamics of technology costs versus willingness to pay is central to both. Even with marked growth in the energy storage sector, the assumption is that the real boom awaits further cost reductions. Everyone is projecting those reductions. Here we dig into "why" and "where" those reductions may come from. Source: Ramez Naam We are all familiar with the proliferation of cost projections out there, much like the one shown above. Lots of reputable establishments produce these projections, with many clever approaches to thinking about technological progress (e.g., stuff getting cheaper and better).

They all tend to take a similar shape, gently downward sloping cost reductions to that special place of widespread commercial adoption. This is the hallowed “no-brainer” zone which solar now enjoys in many locales. There is nothing inherently wrong with this blanket approach to understanding the trajectory of an industry. In fact, I have spent many years of my professional life developing nifty statistical projections and models. After all of that time and effort, it is clear to me that (1) projections are all inherently wrong, though at times useful and (2) projections obscure the more important question of “why.” It is the second point that I want to dig into here. I often encounter the question - “What does the future hold for the energy storage industry?” Often, the response I hear has something to do with projections - X% growth over the next five years, X units of installed capacity, etc. Rarely do I hear any mention of the underlying driver of why this growth is happening. There is just a secular belief in progress, and the only real question is how fast. Here is where things get interesting with energy storage. Unlike solar, energy storage is an remarkably heterogeneous technology with applications that span a wide variety of industries. Yes, solar can be big or small, installed at a residence, commercial building, or as a grid-connected farm. There is some variety, but it all boils down to producing electricity for an off-taker. Technological progress — solar getting cheaper and more efficient — has been driven by ramping up installations across the spectrum of solar applications. “Learning by doing” it is called. The more solar we built, the cheaper it became. Energy storage, on the other hand, has drivers across sectors. There is a boom of interest in residential storage, but not to be outdone by interest in the C&I sector for behind-the-meter storage. Utility-scale storage lurks in the corner, and may ultimately be a larger driver of industry growth when the right market mechanisms are in place. But the 800-pound gorilla in the room are electric vehicles. The explosion of interest in EVs — lead by Tesla, Chevy, Nissan, Volkswagen, and others — is building up pressure for cost reductions in battery technology. If and when battery costs drop below the $200-$300/kWh threshold, it may unleash a flood of consumer adoption. This would be fuel to the flame of that virtuous cycle of adoption driving further cost reductions, which, in turn, would drive even more widespread adoption. My hunch is that growth in EVs will be a more powerful initial key driver in pushing down energy storage costs for building- or grid-level applications. The simple fact of the matter is that EVs can scale faster, thereby spurring much-needed “learning by doing.” So, it may behoove you to keep an eye outside of the normal places to understand the “why” behind the reductions we are witnessing (and hope to witness) in energy storage technology. Comments are closed.

|

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|