|

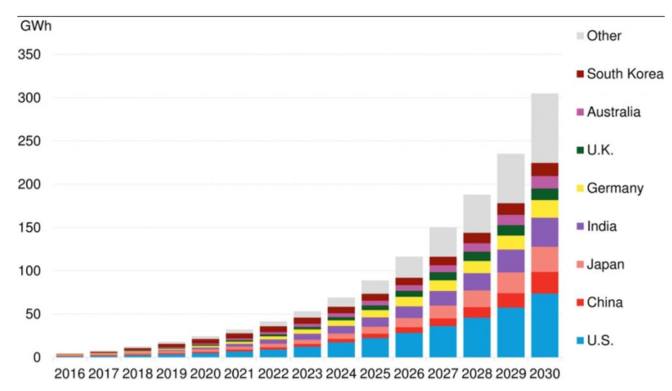

The energy storage market is kind of like the Loch Ness Monster — It’s rarely seen. It’s said to be huge. And many think it’s not real. If you’re like us, you have dozens of articles and reports on energy storage (and other topics) starred for reading later. But “later” never seems to arrive with the free time you needed to read about this high potential market. As such, we’re providing this “Cheat Sheet for Energy Storage Finance” based on our work as buy-side and sell-side investment bankers experienced in both energy storage venture capital and project finance. I’m also including some perspectives from my panel last week at the UNC Cleantech Summit entitled “Financing Energy Storage.” Thanks to Greentech Media, GTM Research, Utility Dive, Bloomberg New Energy Finance, Bloomberg, McKinsey & Company, i3 (Cleantech.com), Lazard, Energy Storage Association, PV Magazine, Rocky Mountain Institute, Renewable Energy World, and Energy Storage News for their great work that helped us compile this research. The Market Opportunity Big picture: The rise of energy storage is expected to mirror the giant leap that the solar sector took between 2000 and 2015 (link). For those of you who rode the solar roller coaster like we did, you might want to get that amusement park seatbelt and whiskey ready. You may need them. Global Market U.S. Market

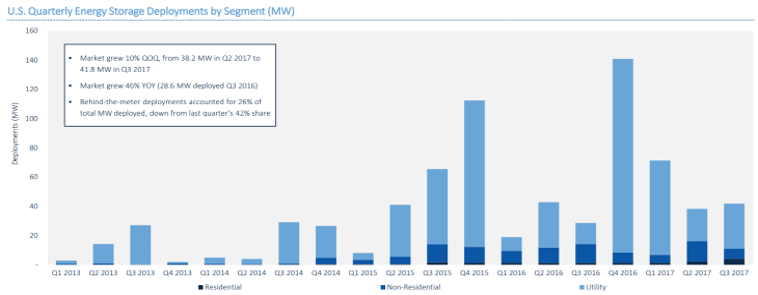

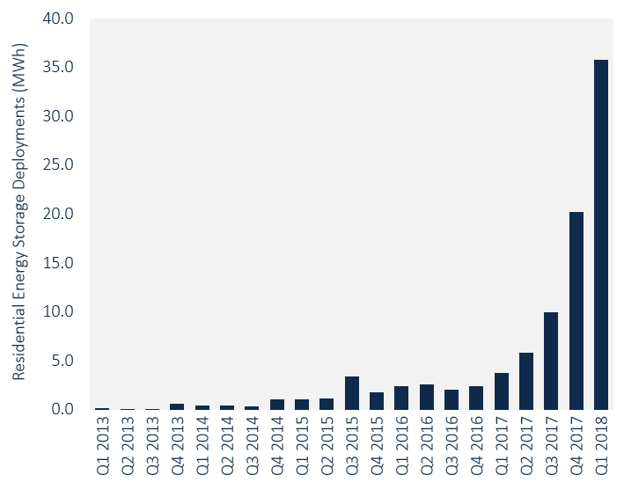

This September 2018 headline from Bloomberg sums it up well on the residential front: “Residential Energy Storage Surging, No Longer Just a ‘Cool Toy’” (link) Their impetus was two-fold:

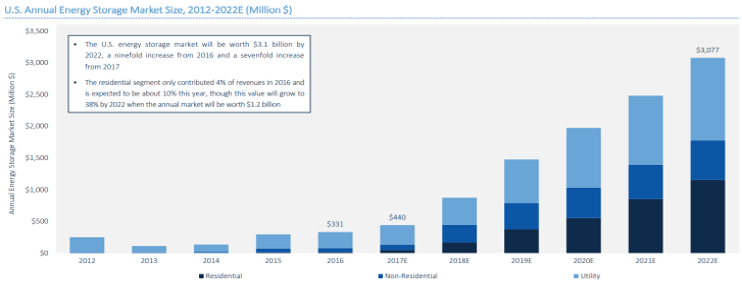

U.S. Annual Energy Storage Deployment Forecast: 2012-2022E (millions of dollars) Source: Greentech Media Technology

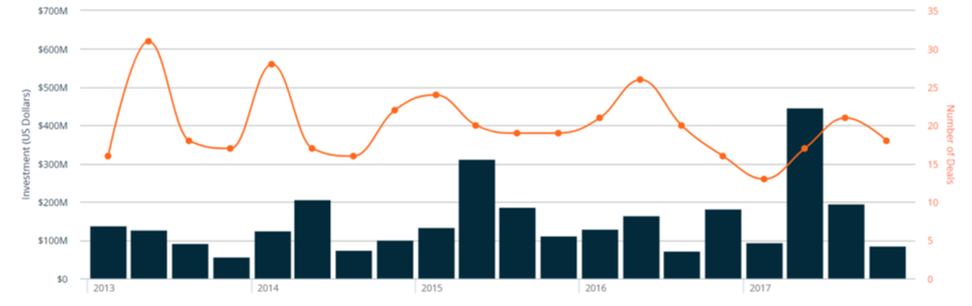

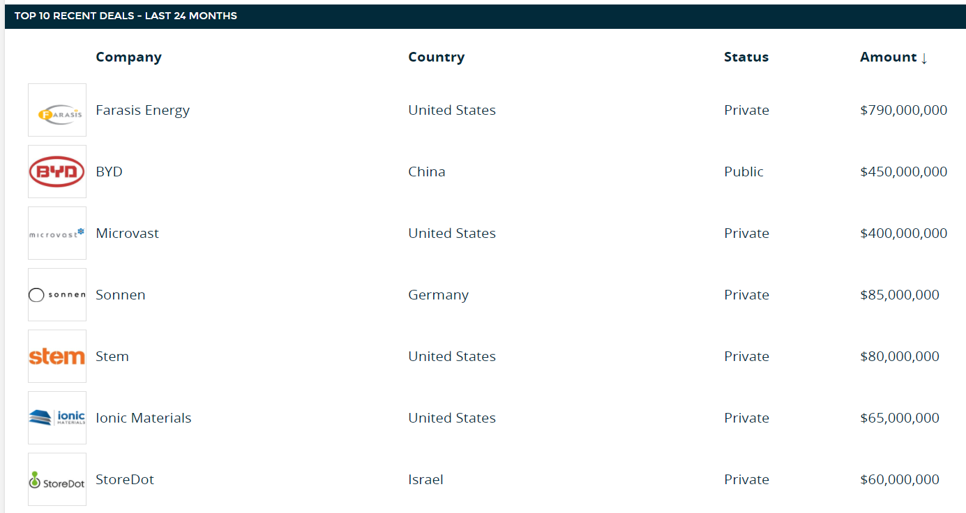

Angel & Venture Capital Finance We’re just in the first inning of this game. And for a guy who prefers basketball (born in Kentucky and living in North Carolina), that’s saying a lot. There’s little doubt that Stem has been the big winner, with almost $300M invested to date. With its focus on artificial intelligence, aggregation of distributed batteries, and managing demand charges for commercial customers, it makes sense. We’ve also seen a host of energy storage companies get gobbled up by bigger giants eager to get a headstart in the battery game. Enel bought Demand Energy. Wartsila snatched up Greensmith. And Aggreko consumed Younicos. See a longer list here. No one knows what other innovations will make it to market, but we can guess that they will make storage easy and beautiful, take advantage of multiple revenue streams, serve more than one customer, and be loved by utility giants for the grid problems they’ll help solve. Here some other statistics for your next dinner party:

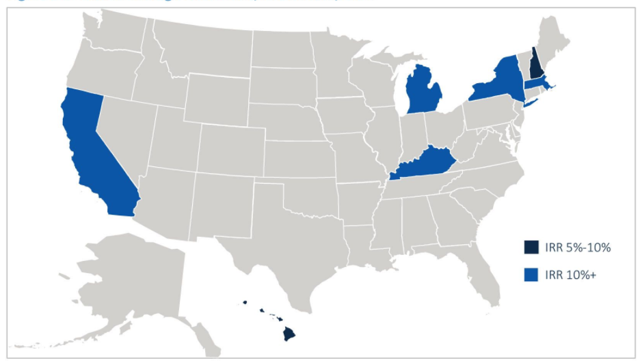

Project Finance The scale of investments in energy storage project finance will continue to dwarf venture capital investments in the sector. It’s also worth noting that non-recourse financing -- i.e., no corporate or personal guarantees necessary — is on the way. Three big project developers have won this unique benefit of the project finance model: Powin | RES | Green Charge. However, limitations to quicker market expansion for battery project finance revolve around these investor considerations:

Here some other fun facts for your quiz later: Conclusion If you’re looking for a Blue Ocean Strategy play in clean energy, something with few competitors and new customers, then the time is nearing when you might be late to the party. But don’t run away crying and defeated just yet. With $100B of expected investment in the sector over the next 12 years, “the cup runneth over” with opportunities, whether your cup of tea be VC-stage innovation with hundreds of possible winners to choose from, or perhaps project finance targets for lower risk and much bigger capital deployment. -- Shout out to Thomas Kelley for the cool Volts photo.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|