|

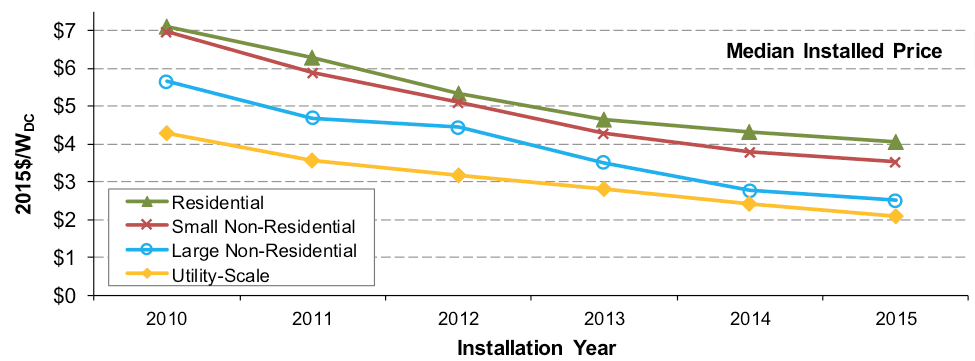

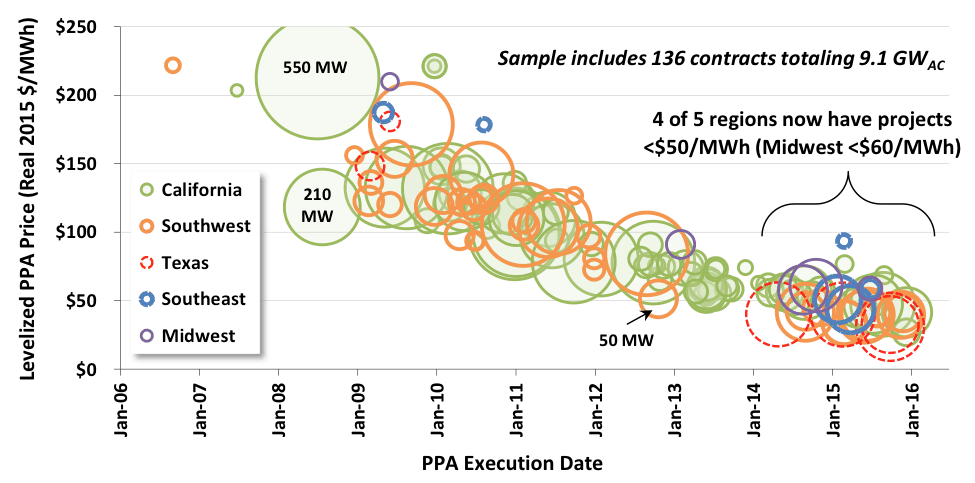

Does every solar project have to be big? Many solar investors’ intuition rests easy when they see the graph below. It fits into the elegant framework of “economies of scale.” The bigger the project, the lower unit cost of installation. The smaller the project, more cost-inefficient. Going big is part and parcel with cost efficiency, or so the saying goes. (Source: Lawrence Berkeley National Laboratory) But be careful, this is precisely the rationale used to advocate that utility-scale solar is the only form of solar in which we, as a society, should be investing. Heck, Warren Buffett believes so, and that guy never makes a bad bet (at least publicly). Why produce electricity from projects that can be built at $4/MW on top of a house, when you can generate those same electrons from a larger project that can be built for half the cost? It is a compelling argument, I must admit. But it suffers from the same “big infrastructure” fallacy that is currently hamstringing our legacy centralized energy system. Build BIG projects for cheap on a per MW basis. Big is cheap and efficient. But, as any good economist knows, external costs can cause headaches (and asthma, skin cancer… you get my drift). Utility-scale projects have gotten a free ride See, BIG projects are cheap, in part, because they burden society with costs not borne by the projects themselves. What costs you might say -- only the never-ending litany of transmission and distribution expenditures. Billions of dollars of deferred T&D expenditures hang like a dark cloud over electric sector. And who is paying for those? Not the project owner, that is for sure. Yes, there are interconnection costs, but let’s be real, they hardly cover it. That is not to say that there is not, in fact, a significant need for big projects. But only to a certain extent. Why only build projects that necessitate that we continue to invest so heavily and T&D infrastructure? Small can be beautiful (and efficient), too. Yes, we should invest in more high voltage DC transmission. But, why not minimize the need for such costly investments by building smaller C&I and residential projects? They may be more costly on paper, but at the scale of the whole grid, they may actually be introduce some much needed cost-cutting. Thus, it is the prospect of avoided T&D costs that gives any credence to the claim that smaller-scale projects can be both both prudent and cost-efficient. Avoided costs is a common concept in utility-scale generation, but, for some reason, this logic is not applied to smaller-scale projects. It is not because they don’t make sense, it is because utilities are uncomfortable with power producers that they do not control. Investors start to take notice of smaller-scale solar Now, from the perspective of an investor looking to be a long-term project owner, things get interesting. The graph below show the slow march down the path of PPA price decline. (Source: Lawrence Berkeley National Laboratory)

On the one hand, great - solar power is getting cheaper, and fast! On the other, there is a palpable sense that there is large-scale suppression of investors returns taking place. Fair enough. Once a market matures, actual or perceived technological risk reduces, and returns should decrease. But that does not stop investors from feeling the squeeze. And that squeeze is happening particularly in the utility-scale market. In part because utilities have a lot of negotiating power in many markets, PPA prices are plummeting, some creeping below the $0.04/kWh threshold. There is still value to be had, but the pressure to find good deals has encouraged (ahem… forced) investors to look back into the C&I market for the returns they seek. This is great from the standpoint of increasing access to capital for a market segment which historically has been more difficult to finance. Less standardized and smaller projects, diverse off-takers, many without credit ratings, and less financially robust developers have all hampered the expansion of C&I solar. But, now the suppression of utility-scale solar returns has led investors to start poking around the sleeping giant of C&I solar. Many C&I off-takers have the ability and willingness to pay much higher PPA rates than utilities. Translation = sweet returns. And, there are a LOT of them. If you are lucky enough to find them in places like Nevada where many large-scale C&I customers have been summarily pissed off by the antagonistic treatment by the utilities commission, then you could make some big waves. And, as C&I developers have become more sophisticated, projects are trending towards more consistency, bankability, and less risk. So, keep a lookout as the C&I solar market starts to find that sweet spot in the classic risk vs. return story. Small can be beautiful in the solar market. Comments are closed.

|

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|