|

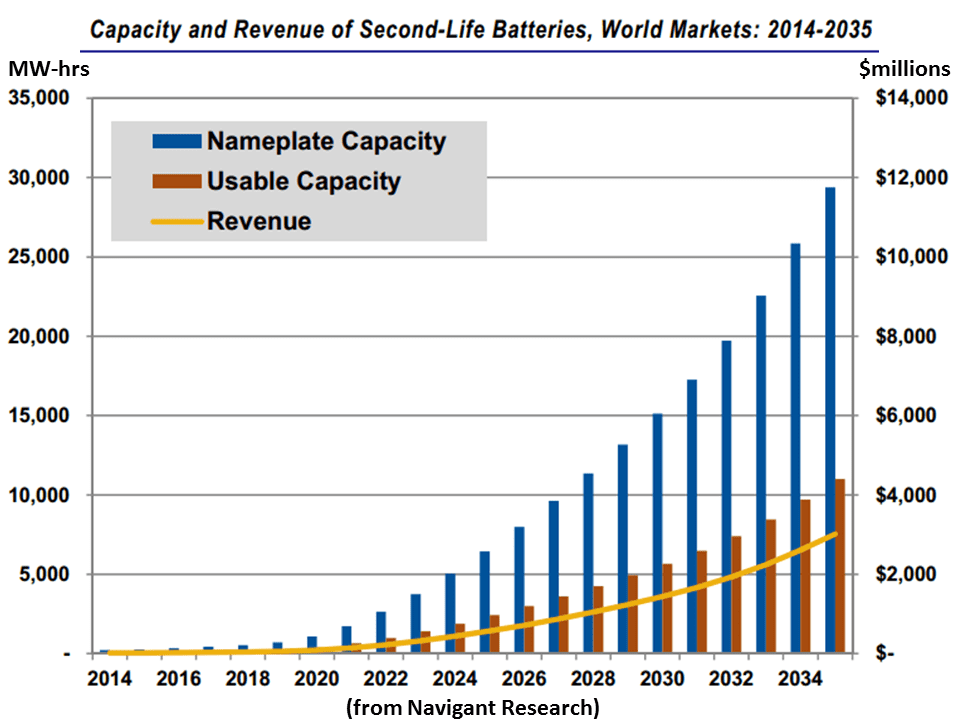

For most EV businesses, the details of solar project development and operations are a related but distant world. Similarly, to solar developers and investors, the EV market is interesting, and most of them want to own a Tesla (including me), but integrating the two industries is a bit of a leap. However, some of us are wearing both hats. At IronOak, we simultaneously supply solar project investors and developers, as well as EV market makers, with research and transaction advisory services. In fact, at this moment, we are working on hundreds of MWs of solar projects and fleet roll outs totalling thousands of EVs in major U.S. cities. As one example, I serve as an Advisory Board member for Paul Allen’s Vulcan, Inc. in its innovative partnership with the U.S. Department of Transportation Smart City Challenge, which will award $50M to a single city to help electrify its transportation network. A report this month by the German Renewable Energy Federation highlights the massive potential link between the EV and solar markets. Estimates suggest that second-hand batteries from the world’s nearly 90 million EVs sold by 2030 could provide 1,000 GWhs of power in stationary uses such as integrating renewable power into grid, homes, and businesses. Apparently, when EV batteries get below about 80% of their original capacity, which occurs roughly 6-10 years after they’re first used, it’s time to replace them. Yet they might still have 10 years of life left. If true, this is important for two reasons:

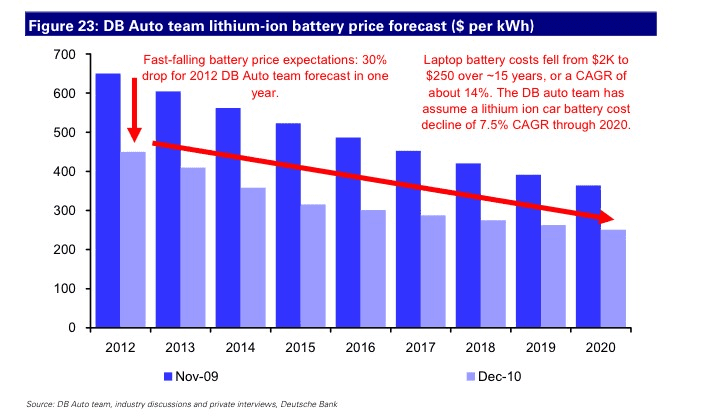

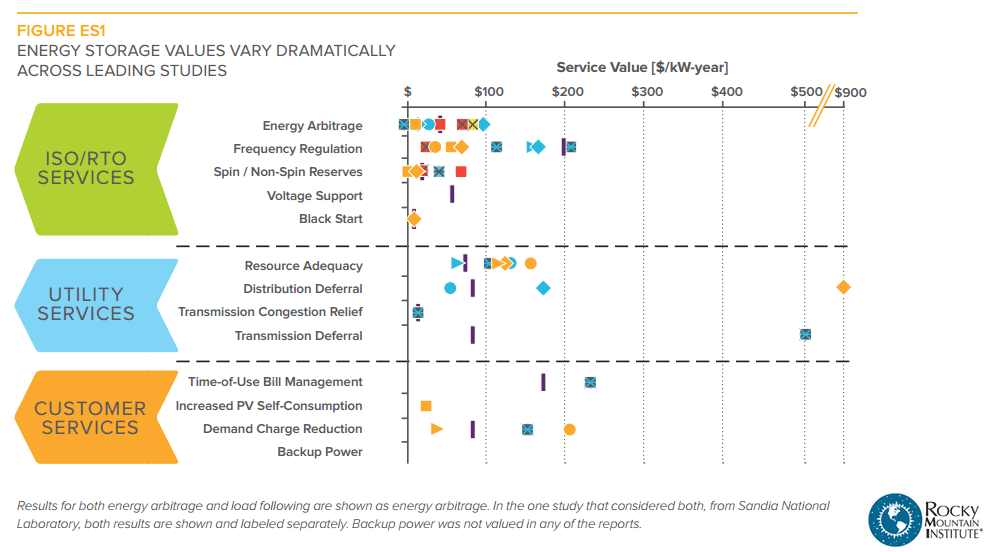

For a sense of the scale of this opportunity, as well as how fast the cost of storage is falling, consider the graphs below, based on Navigant and Deutsche Bank projections. Revenue risk: More than amount and number of sources, it’s about certainty No surprise, investors and banks like some predictability—less for the former and more for the latter—in the revenues and costs of the projects they own. The same logic applies to energy storage investments. However, with at least 70 different battery chemistries being tested or manufactured at some scale, many believe that technology risk is the main barrier for battery roll out. Yet lithium ion batteries accounted for 96% of (chemical) storage added to the U.S. grid last year. As such, it’s the ability to forecast revenue, not remove technology uncertainty, that is the key to growing this nascent market. Scanning the figure from RMI below, it is clear that batteries provide many services at the transmission, distribution, and DG scales. One would assume that each of these would also create revenue for energy storage project owners. But you know what they say about assuming, right? The Urban Dictionary tells me that certain body parts are involved in the saying. While the amount of potential revenue from multiple sources is appealing, it is not often possible in project structures. But it can happen. As an example, we have originated and are helping to underwrite a $100M-plus energy storage portfolio for a large international investor right now, and this projects makes financial sense because it is “stacking” several sources of revenue, and creating contractual certainty for some of these sources.

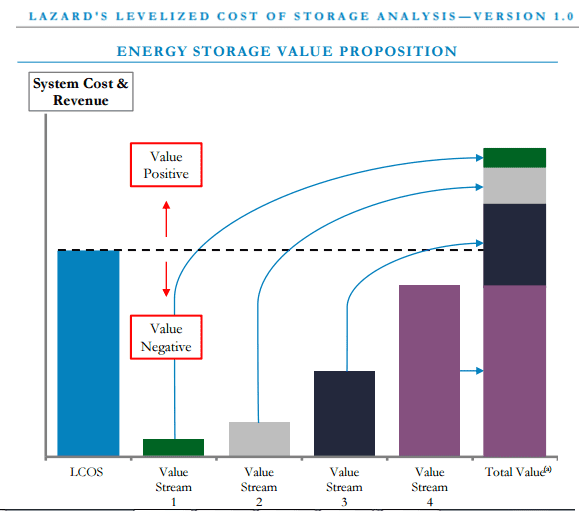

To further illustrate this potential stacking of revenue, consider the November 2015 levelized cost of storage analysis by Lazard (below). They rightfully stress that their study does not look at revenue stacking, but this is exactly what is required to make more battery projects financially feasible. However, as I learned from talking to a public utility commissioner recently, utility regulations to allow more of these battery services to be monetized are not making it onto the radar of utility commissions because the market is still so small. Alas, we have a chicken and an egg... Comments are closed.

|

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|