|

Which ducks do you see?The California Independent System Operator (CAISO) can be commended for providing an accessible daily data dump on renewable usage across its system. With these data one can construct various “duck curves” for the grid’s daily net load profile, the shapes of which result from the rising penetration of a variable energy resources (VER) such as wind or solar. VERs exhibit four characteristics:

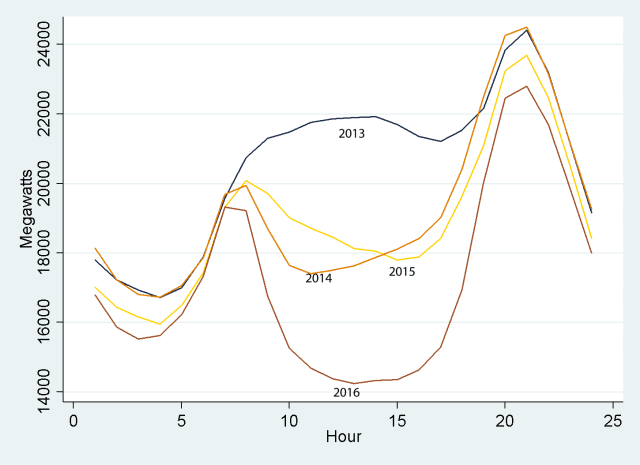

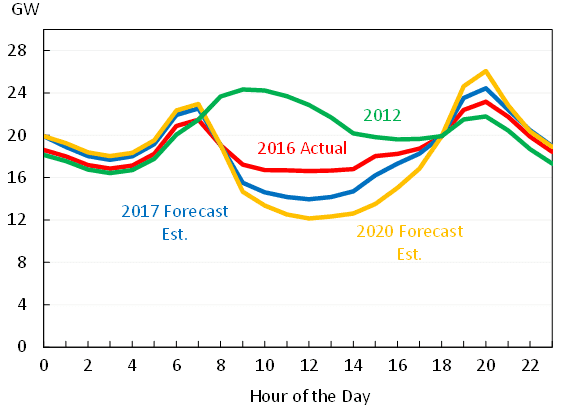

Duck curves are in essence the daily net load profiles after accounting for VER generation. They show the required remaining dispatchable energy required to ramp up or down to take up the solar and wind shortfall. As we see from the two examples below, duck curves can take on various forms, often depending on the scale range of the y-axis. 1st flock of ducks: Average net load profiles over seven days around March 31, over 2013-16. Source: Blog post by Meredith Fowlie, “The Duck Has Landed” (5/2/16), using CAISO data. 2nd flock of ducks: Net load profiles for March 31 for 2012 and 2016. Forecasts for 2017 and 2020 were made in 2013. Source: Council of Economic Advisors, The White House, “Incorporating Renewables into the Electric Grid: Expanding Opportunities for Smart Markets and Energy Storage,” Fig., 4 (June, 2016), using CAISO data.

Both sets of curves cover almost exactly the same sets of data, with the first emphasizing a more extreme story. The the stories are essentially the same -- net load after VERs bottoms during the day when solar is peaking, ramps up very quickly as solar generation drops off dramatically and evening usage rises, and then drops again as nighttime usage drops and wind picks up. The takeaways are two:

Ancillary services as regulation mileage A recent report from the Council of Economic Advisors at the White House goes deeper, looking at some ways of understanding the value of energy storage via the idea of regulation mileage. The concept measures the changes -- increases or decreases -- in power output that a grid operator requests from an electricity generation resource over a specific timeframe. It would stand to reason that regulation mileage, a proxy for the amount of ancillary services required, would be determined by several factors. The Council’s study looks at the total load, the amount of that load from VERs, the slopes of each of those load curves, and a series of effects that are specific to the hour of the day, day of the week, and week of the year that the electricity is generated. Among other results, and as expected, one of the clearest that appears is that the slopes of the load and VER generation have a lot to do with the services required. In other words, the faster the late-afternoon ramp up at the end of a sunny day, the more energy storage will be wanted. Valuing storage based on its ancillary benefits What are other approaches to valuing energy storage in these settings? The peer-reviewed journal Nature Energy recently carried the results of a new study on capturing the full benefits of energy storage in investments. Applying a techno-economic model, the authors of ”Limiting the public cost of stationary battery deployment by combining applications,” find that battery storage becomes more attractive as an investment as each storage facility offers more energy services. An article summary carries the message that energy storage apart from pumped hydro is, “still considered unattractive by investors on mainly two grounds: cost-competitiveness with other technologies and the absence of a commonly shared classification of electrical storage as a competitive or regulated activity -- that is, as an electricity generation asset or network component” (emphasis added). The drawn conclusions are that the best way to incorporate all of these benefits are to remove non-market barriers, a legacy of rules that were originally written for conventional generators. According to the summary, these “institutional and regulatory frameworks are key elements in the determination of the economic value of storage,” and “economic principles require new, enabling rules to be technology neutral, that is, not directed at the diffusion of storage or any other technology in particular.” The article calls for three such policy recommendations:

This policy neutrality from above is a point worth repeating. In revising public policies, the goal is not the promotion of energy storage out of any favoritism towards the technology. Rather, the point is to promote energy storage as an enabler for VERs such as solar and wind, which in turn leads to progress on an overall societal goal of reducing greenhouse gas emissions. Comments are closed.

|

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|