|

(Source: Lazard)

Related data points:

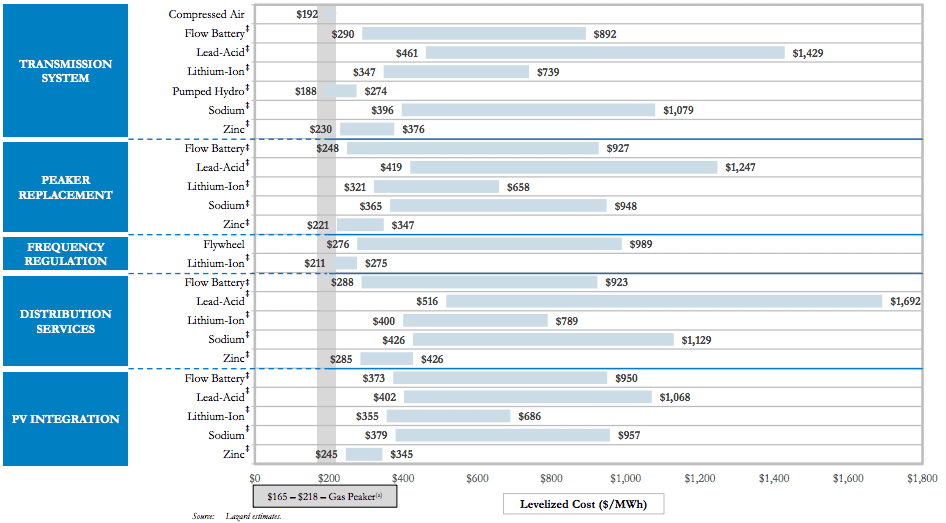

Energy storage must blaze new trails in bundled service business models in order to succeed In many ways, the economics of storage bears little resemblance to the economics of solar. Solar has undergone a remarkable jump up the technology learning curve, resulting in cost reductions that few predicted a decade ago. Solar electricity generation has characteristics that make it difficult to make a pure comparison with conventional generation. However, solar costs can be framed in terms very familiar to the energy industry: levelized cost of electricity (LCOE), power purchase agreement (PPA) rates, installation costs per watt, etc. Looking through this lens, we could see when and where solar approached grid parity, or the point at which there is no discernable cost difference between solar and incumbent technologies. The solar story was easy to tell - the technology could be relatively easily integrated into the current grid system, and the business models underpinning solar were eventually easy enough to grasp for consumers and the financial industry. This all drove the virtuous cycles of deployment, learning, and improvement that has placed solar squarely as the electricity source of choice for the future. The storage story, in contrast, is much more nuanced. Of course, at a high level, we can paint a similar picture as that of solar. We draw upon studies like Lazard’s, which provides some nifty levelized cost of storage (LCOS) comparisons for storage technologies across different applications (there is contention that levelized cost methodologies undervalue storage). Essentially all storage technologies in any application are outcompeted by natural gas peaker plants on a purely $/MWh basis. Two notable exceptions are with pumped hydro in the transmission system and lithium ion batteries for frequency regulation. Despite the fervor around battery technologies, it should be pointed out that the tried and true pumped storage technology is still, by far, the dominant storage technology in operation, comprising over 90% of installed capacity worldwide. But without some dramatic reductions in levelized costs for battery technologies, we are unlikely to see widespread adoption of storage technologies. Or will we? This is where the nuance in the storage story comes in. On the one hand, the cost of battery storage is projected to follow a similar downward trajectory as solar. Projections abound claiming anywhere from 25% to 70% cost reductions over the next 5-15 years. What is not to like? To put it simply - unmonetized value. On the other hand, there are a multiplicity of services that storage provides to customers, utilities, and grid operators (13 according to the Rocky Mountain Institute) for which there are no proven compensation schemes. For storage to break into the market in a meaningful way, it will need to move into bundled service business models. Getting beyond using energy storage for just demand charge reduction, backup power, or increasing solar self-consumption (which often only utilizes the storage system for a fraction of its lifetime capacity) to a stacked service model that also provides, for instance, frequency regulation, resource adequacy, or energy arbitrage services to the grid would open an incredible array of opportunities in which storage does not currently make economic sense. This is, however, no simple task. It will require time, experimentation, failures, and ultimately some successes to arrive on a spectrum of business models that can help unlock the vast potential of energy storage. The economics of storage works in certain niches, but the market needs stronger signals It is not altogether unfair to see some of the hype around storage as hyperbole. The technological optimists among us see a technology on the brink of unlocking a world of potential in the energy sector, and for more than just variable generation renewables. The skeptics might see the storage story through a somewhat different lens. Energy storage is not monolithic, comprised of a narrow range of market tested technologies that work at commercial scales. Rather, there is a staggering array of technologies, many in the R&D and demonstration phases, all competing to gain some traction in commercial markets. Picking the winners and losers out of this maelstrom is a tall task. And yet, VC investment in energy storage startups has fluctuated dramatically since its peak of $876M across 59 investments in 2011, according to CB Insights. There is clearly some concern about technology risk and market timing, given the sprawling field of energy storage technologies in development. However, the energy storage policy landscape leaves much to be desired. Grid policies have been slow to react to the growing promise of storage. Legacy net metering policies, while beneficial for generation technologies such as solar, are not well-suited for storage technologies that require the accounting for two-way energy flow. Ahead of many policy changes at the grid level, we can only hope to see more mandates such as California’s (1,325 MW of storage by 2020), which can clarify the way in which regulatory and grid policy must adapt. Without this high-level market signal, rate structures and other market restrictions may place a low ceiling on near-term energy storage deployment, especially grid-connected storage. In the meantime, behind-the-meter storage may be the best place to look for scaling up deployment, as customer-sited storage allows the users to capture the benefits of self-consumption, backup power, demand charge reduction, and time-of-use bill management, among others. Interestingly, behind-the-meter storage applications are rarely the least cost option, but offer a compelling return-on-investment proposition for enterprising customers. Yet, even these investments are leaving a lot of money on the table under current regulatory models and grid restrictions that prohibit behind-the-meter storage from providing grid services. Let’s hope that antiquated policy and market structures stymie the rapid progress needed in the energy storage market. Further reading:

Comments are closed.

|

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|