|

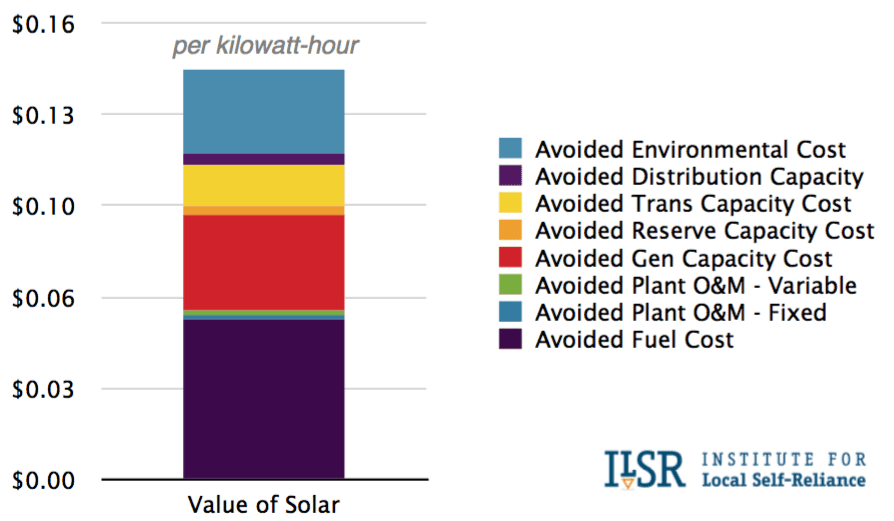

3/30/2016 What future Value of Solar policies could mean for the solar industry: 3 key things to knowRead Now There has been a wave of contentious net metering policy battles waged across the U.S. in 2016. Some net metering policies have remained largely intact, as in California, though much to the chagrin of the utilities. Other net metering policies, such as those in Nevada, have been fundamentally restructured, to put it kindly - though many would say they were just plain gutted. As with the ITC, a significant part of the solar industry formed around the net metering policy structure, and like many industries is reluctant to let go of such a foundational policy. But the aforementioned battles beg the question - is net metering the appropriate policy for solar looking to the future? Many believe that it has been a necessary stopgap policy measure, but not one that needs to live in perpetuity. One alternative that has been floated is the idea of a Value of Solar (VOS) policy that seeks to compensate solar based on a more nuanced understanding of the value that it provides to the grid. That is an easy enough idea to get behind, in theory, but just what could VOS mean for the industry? (Source: Institute for Local Self-Reliance)

Utilities and solar investors both come out on top with a VOS policy

Avoided costs hold the key to understanding how the “Value of Solar” is framed

Playing up the environmental costs angle could be the greatest strength of VOS

The City of Austin, TX and the State of Minnesota have led the charge on the initial VOS studies, and have proposed different cost structures and calculation methodologies. It would have been easy to anticipate that VOS would have taken off, especially as a substitute for the much-maligned net metering policies, but so far it has not. But if the recent solar policy battles are any indication, the days of the old net metering policies may be numbered. VOS may open the door for a more nuanced treatment of solar in our energy policy. Comments are closed.

|

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|