|

(Source: GreenTech Media)

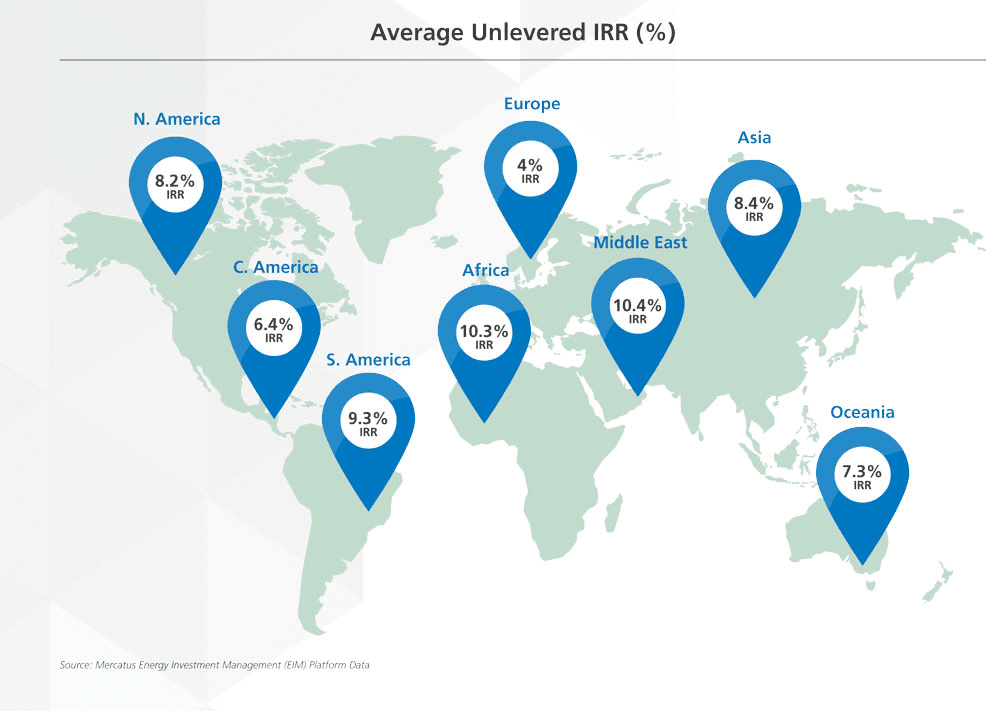

Everyone likes lists. Lists are candy for our mind. Give me a Top 10…, and my mind naturally embraces the elegant hierarchy, 1 better than 2, and way better than 10. A simple rubric for a messy world. So, it was with some curiosity that I digested Ernst & Young’s Renewable Energy Country Attractiveness Index. See renewable energy is complex, and lists are simple, so this makes a good pairing. Like red wine (complex, hence - see, swirl, smell, sip, savor) and chocolate (simply delicious). What do we find? Clearly, United States #1! As if… The BICS - Brazil, India, China, South Africa (sorry Russia) - are all in the Top 11 and are the big upward movers. Just fascinating considering the sheer scale and dynamism of those economies. Latin America is on the rise with Chile, Argentina, and Mexico all in the Top 20 (and Summer Olympics in Rio!). And Europe is increasingly looking like a basket case. Germany, France, United Kingdom, Netherlands, and Belgium all dropped spots. Regrettably, some petulant factions within the EU are backpedaling on much of the industry-paving progress of the previous decades. What a mess. Sophisticated European investors will likely migrate into international renewable markets. After all, a 4% unlevered IRR is not going to winning any beauty contests. The ascendant BICS and Latin American countries are the investor darlings of the moment. But the renewables investment landscape is not as simple as that. For this, we another list! The Venture Capital & Private Equity Country Attractiveness Indexmeasures the...well, it basically says it in the title. Rest assured, United States #1! As if… But some mind-tickling asymmetries arise between these two lists. Ahhh -- when lists tell contradictory stories, it makes us to have think! Some countries have an attractive investment environment for renewable energy but an overall weak (or altogether suspect) environment for VC/PE investors. Take, for instance, Argentina. 18th for renewable energy investing, but a lowly 64th for VC/PE investing. Lest we forget - the economic scene in Argentina can get a little wobbly at times. A similar pattern holds for South Africa, Brazil, Morocco, Egypt, and others. All great places for renewables, but a little shaky for investment in general. So, I leave you with the holy grail concept of risk-adjusted returns. How might you adjust returns to account for risk? Well, that is more of an art than a science. No simple list can tell that story. Comments are closed.

|

Details

sign up for ironoak's NewsletterSent about twice per month, these 3-minute digests include bullets on:

Renewable energy | Cleantech & mobility | Finance & entrepreneurship | Attempts at humor (what?) author

Photo by Patrick Fore on Unsplash

|