|

Until recently, it has seemed that “cleantech VC” was a four-letter word.

Or perhaps a term reserved for hushed whisphers of digust and distrust thanks to the financial woes in the sector about ten years ago. But, it appears that the tide may be turning. Here are three headlines that might give cleantech entrepreneurs some hope. #1: Renewal Funds just raised $145M to invest in cleantech (what?) Here are some highlights (link):

#2: ArcTern Ventures just raised $165M to invest in cleantech (oh my!) Here are some highlights (link):

#3: Clean Energy Ventures just raised $110M to invest in cleantech (gasp!) Here are some highlights (link):

But wait… Before all of us entrepreneurs get too excited about sending an email to these groups and receiving $10M in growth capital the next day, let’s remember this... Venture capital firms reject at least 95%+ of all the deals they review

Far less than 1% of startups raise capital from VC firms. The estimates vary:

In contrast, the last study above showed that “57% of startups are funded by personal loans and credit, while 38% eceive funding from family and friends.” These VC firms like low company valuations.

Fundraising takes a ton of time, and will distract you from running your business.

11/5/2019 Outcompeting lithium-ion in the 2020’s — Which new energy storage technologies might win?Read Now

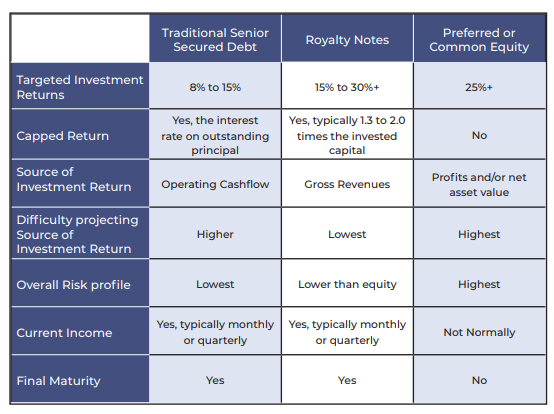

--- Author: Dr. Chris Wedding If you’re an investor that likes the predictability of debt (check), but loves the upside potential of equity investments (yep), then Revenue Royalty Notes might be worth exploring. Why might investors like Royalty Notes?

Importantly, future performance cannot be predicted by historical performance, so you’ve gotta feel good about the consistency and duration of a company’s past revenue, plus the sanity they used (or threw out the window) when making forward projections. A Comparison: Royalty Notes vs. Debt or Equity (CaroFin) And since it takes two tango… Why might entrepreneurs like the Royalty Note structure for their growth capital?

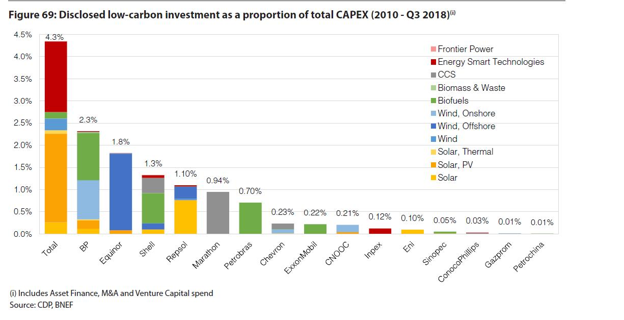

One more tiny detail: If there’s no revenue in the business yet, then there’s likely no Royalty Note either. Gotta stick to expensive equity for the time being… Conclusion We may not be able to have our cake and eat it, too. (Although people have been thinking about this since at least the year 1538.) Nor can we defy the Heisenberg Uncertainty Principle and know both the velocity and position of subatomic particles at the same time. [Dang it, my life’s dreams ruined…] (Geek out more here.) But don’t dismay… It is, in fact, possible to invest in companies with instruments having both debt and equity characteristics via the Royalty Note. [Insert a long sigh, and cue inspirational music...] To learn more about Revenue Royalty Notes, check out this article by CaroFin, a private marketplace for alternative investments: --- Photo credit: Pratiksha Mohanty via Unsplash By: Dr. Chris Wedding If you think the “energy transition” is just for Democrats or greenies, then consider this quote from a Goldman Sachs natural resource executive: “I’ve probably spent more time talking with oil company executives about the energy shift and renewables in the last 2 years than the previous 23 put together.” Last year, $6.4B was invested in hydrocarbons versus $5.8B in renewable energy, according to PitchBook. That’s a pretty tight race. And a CDP report notes that 2018 expenditure on clean energy sector by the world’s 24 largest oil and gas companies was roughly 1.3% of total budgets vs. 0.7% last year. On one hand, that’s almost 200% growth year-over-year. Or (slight reframe) its chump change as a fraction of overall investments, with 98.7% of capital still going to conventional energy lines of business. Plus, over 70% of those investments came from EU-based oil and gas majors. Maybe that’s because the science of climate change is magically different across the ocean. (Yep, sarcasm) As further evidence that times are changing, here’s a look at three organizations…

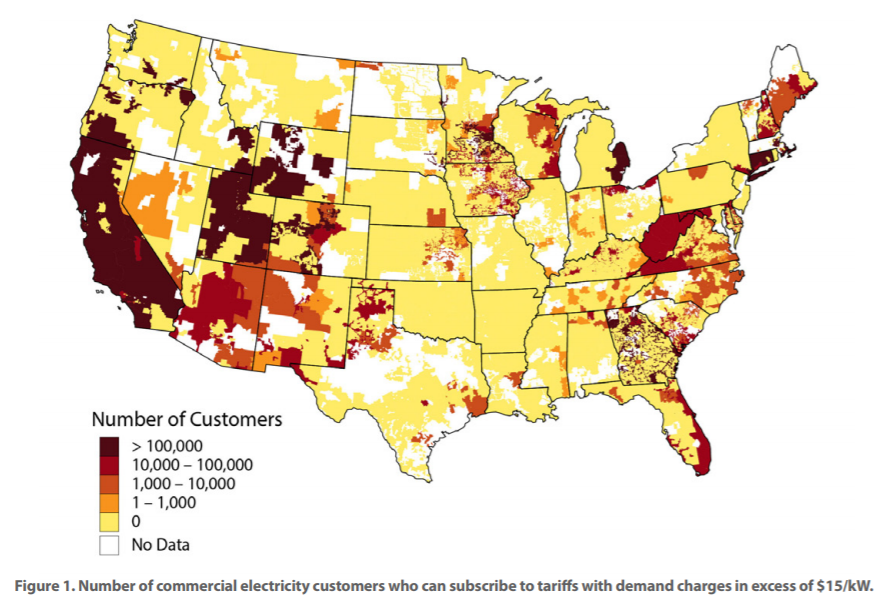

Why are oil and gas major making these investments now? #1. They are already experts in the energy sector. This is partly a situation of a [very powerful] hammer seeking a nail. Decades of experience in conventional energy can translate into efficient capital deployment, project development, and new technology commercialization in the new energy sector, too. Building and operating offshore oil rigs is complicated. The same is true for offshore wind projects, and this is a market expected to reach $60B by 2024. “Have skills, should apply.” Running gas stations is not rocket science, but profitability is also not a given. So, it makes sense for Chevron to add EV charging to its gas stations, as long as they get the rate tariffs right so they do not drown in pricey demand charges. #2. Clean energy investments can be a hedge against softer demand for oil and gas. When Fitch Ratings talks about the growth in electric vehicles potentially creating an “investor death spiral,” it’s worth listening to their reasons. #3. Renewable energy markets are not little runts to ignore anymore. Bloomberg projects that over 70% of all new power capacity investment between now and 2050 is expected to be in solar and wind projects. Their research further shows that clean energy sector investment has exceeded $300B globally for the last five years. Finally, analysis suggests that the advanced energy economy (clean power, alternative transportation, energy-efficient buildings) now exceeds $1.4T, or twice the size of the global airline industry. #4. Corporate sustainability reporting is becoming mainstream. “We are watching you.” At least 85% of Fortune 500 companies now engage in sustainability reporting. Drivers of this trend include stakeholder demands, global trends towards greater transparency, peer pressure, and a realization that sustainability topics can be material to financial risk and return. Samples of third-party sustainability reporting include the following:

What kinds of new energy investments are oil and gas majors making in the last two years? I will only focus on the top four oil and gas majors in terms of their investments in and commitments to lower carbon energy. This includes Total, BP, Equinor, and Shell. (See graph below). I am mostly listing investments by their VC arms, with some other infrastructure investments sprinkled in here and there. Finally, I am not listing companies that are “kind of” related to clean energy, such as ride sharing or financial settlement technologies for the energy sector. Total Energy Ventures

BP Ventures (plus some larger corporate deals)

Equinor Technology Ventures

Shell Ventures (and some bigger Shell New Energies deals)

How will investing in renewable energy be different than their historic energy investments? If recent history is a good predictor (not always true), then low carbon investments are likely to be different than conventional energy investments in the following ways:

How does the increasing involvement of oil and gas majors create winners or losers in the clean energy sector? The (potential) winners include:

The (potential) losers include:

Should you be bearish or bullish? Bearish perspective: Why these trends can be easily ignored

Bullish perspective: Why investors and entrepreneurs should pay more attention

In conclusion, here are some potential action items I will describe these as the 3 “C’’s, with questions for you to ask yourself, answer, and do something about over the next 30 days. (Or just hide under them rug for a while. What could possibly go wrong?) #1 - Canary What do these trends mean in terms of “canaries in the coal mine” for your overall investments in the conventional power, oil, and gas sectors? (Pun intended.) If a Shell executive refers to their “buying spree” in the low carbon sector like this -- “It’s all about survival” — then how or why would your investment allocation to the conventional energy sector be different, and therefore, not face some new risks? If McKinsey and Mining.com report that electric vehicles will likely reach cost parity with conventional vehicles in the early 2020’s, and if Fitch Ratings talks about how this shift in transportation choices could cause an “investor death spiral,” how might you view current or future investments in the oil sector? #2 - Clock Even if you agree that historic changes are coming to energy markets, the key question is this: When? When do you (or sources you trust) think that these shifts in energy investments will actually affect your portfolio? By way of analogy, at some point we may live on Mars, but now is likely not the right time to invest in Martian real estate. (Unless you’re a billionaire who thinks that all hope is lost for long-term survival on this planet.) #3 - Collaboration There may be winners and losers, but it is not a zero sum game. This discussion needs a reframe. Let’s consider a newly created 21st century word: “Coopetition” — collaboration between competitors for mutually beneficial results. For environmentally minded entrepreneurs, how can oil and gas majors be strategic partners, investors, and customers, instead of the enemy, a monolithic group to badmouth for all the world’s problems, the 800-pound gorilla that must be defeated. For VC or private equity investors, how can oil and gas major’s investment decisions serve as an anchors to derisk your capital allocation alongside them? How can you build relationships with them for a future exit opportunities? Finally, thank you... A big shout out to Pitchbook, IPE Real Assets, Greenbiz, Preqin, Bloomberg New Energy Finance, Advanced Energy Economy, Greentech Media, Reuters, CDP, RW Baird, Energy Storage News, Columbia University’s Earth Institute, Oilprice.com, Bloomberg, Mining.com, McKinsey & Company, ThinkProgress, Wind Power Engineering, and Governance & Accountability Institute for their research and reporting on this topic. By: Dr. Chris Wedding I recently spoke on a panel about impact investing at the UNC Cleantech Summit, where 1,000 good souls joined to talk about opportunities and challenges in smart and connected communities, energy storage, grid modernization, sustainable farming, coastal resiliency, and energy innovation for economic development. Fellow panelists included these smart folks:

To begin our panel, we talked about the definition of impact investing. If you can’t describe something, it’s hard to assess where it’s been, where it’s going, who’s involved, what the challenges are, what opportunities are most exciting, and… [drum roll, please] ...whether impact investing delivers financial returns that are less than, equal to, or greater than other comparable investments in the market. Starting from the broadest definitions and moving to the narrowest, here we go… ------------------ #1: Impact investing = “Total portfolio approach” This framing moves away from the magnetism of venture capital and instead points to the obvious: Every investment has some impact. Accordingly, all bonds, stock, checking accounts, and savings accounts need at least a cursory review for positive and negative impacts, as well as other alternative investment classes such as hedge funds, real estate, infrastructure, and private equity. In ImpactAlpha, William McCalpin, managing partner of Athena Capital Advisors, with $5.5B under management, put it this way: “Carving out $10M to do a few impact deals is no longer enough for many investors. Institutions want to drive this through their whole portfolio.” To that end, the impact investment non-profit TONIIC has created its 100% Network, a “global network of high net worth, family office and foundation asset owners who have committed to deploying 100% of their investments in at least one portfolio in pursuit of deeper positive net impact. These investments are made across all asset classes, in alignment with each investor’s social and environmental priorities.” This initiative provides tools, lessons learned, and a community to share best practices. Total market size:

------------------ #2: Impact investing = “SRI (Socially Responsible Investing)” Many of us associate SRI with negative screens — that is, public equity investments that screen against (and don’t invest in) “sin industries,” such as firearms, tobacco, gambling, and alcohol. (Though the latter, in moderation, is hopefully not a big sin, lest I need to repenteth.) This approach to investing goes way back, like hundreds of years, like ancient history, like Biblical times, man. (Insert surfer voice.) Investopedia will take you back in time to illustrate that SRI is not some newfangled innovation from know-nothing “hippie capitalists” (a term coined by my MBA friends years ago). Centuries-old SRI includes Jewish law, from about 3,000 years ago in the Pentateuch (first five books of the Bible); Shariah law, from about 1,400 years ago in the Quran; and Methodists’ and Quakers’ beliefs and practices, from about 200 and 100 years ago, respectively, in the U.S. Despite, or perhaps because of, this rich history, SRI has become an umbrella for many related themes of investor interest, including ““community investing,” “ethical investing,” “green investing,” “impact investing,” “mission-related investing,” “responsible investing,” “socially responsible investing,” “sustainable investing,” and “values-based investing,” per US SIF: The Forum for Sustainable and Responsible Investment. Total market size:

------------------ #3 : Impact investing = “ESG (Environment, Social, Governance), aka Responsible Investing” SRI was version 1.0 of investing for financial and social or environmental motivations, while ESG is supposed to be version 2.0. However, these two terms are still used somewhat interchangeably in many circles. For me, ESG is about an active approach and a positive screening process to not just do less bad (e.g., sin industries) in a passive style as in SRI. This includes seeking out companies that excel in the management of social, environmental, or governance issues. The goal is to reduce risk (beta) and increase profit vs. benchmarks (alpha). The United Nations Principles for Responsible Investment (PRI) may be the most popular group for defining ESG. (So, if you want to be one of the cool kids, you better, like, join now. I mean, totally.) UN PRI counts 1,900+ signatories from the finance sector, representing over $89T in AUM. Before you get excited thinking that about 50% of the world’s assets are invested according to ESG principles, hold those horses. These signatories apply ESG practices selectively, not across their entire portfolio. However, according to the principles to which they publicly commit (see below), the plan is for an evolution to a more all-encompassing approach to Responsible Investing. UN PRI -- Signatories’ Commitment “As institutional investors, we have a duty to act in the best long-term interests of our beneficiaries. In this fiduciary role, we believe that environmental, social, and corporate governance (ESG) issues can affect the performance of investment portfolios (to varying degrees across companies, sectors, regions, asset classes and through time). We also recognise that applying these Principles may better align investors with broader objectives of society. Therefore, where consistent with our fiduciary responsibilities, we commit to the following:

The Principles for Responsible Investment were developed by an international group of institutional investors reflecting the increasing relevance of environmental, social and corporate governance issues to investment practices. The process was convened by the United Nations Secretary-General. In signing the Principles, we as investors publicly commit to adopt and implement them, where consistent with our fiduciary responsibilities. We also commit to evaluate the effectiveness and improve the content of the Principles over time. We believe this will improve our ability to meet commitments to beneficiaries as well as better align our investment activities with the broader interests of society. We encourage other investors to adopt the Principles.” To learn more about the segments within ESG and SRI, you can view some great graphics and summary PDFs by by US SIF. Total market size:

------------------ #4: Impact investing = “Measurable social or environmental impact alongside financial returns” For this definition, I’ll reference a leading impact investing sector non-profit association, the Global Impact Investor Network, GIIN. [And if you’re remembering my prior reference to another impact investing industry association, TONIIC, and asking yourself whether investors in this sector actually do love “sin” industries like alcohol (gin + tonic), the answer is...I don’t know. But the more interesting question is this: Does the impact community have a stronger sense of humor relative to other financial sectors?] In their annual survey of impact investors (n = 229), they report a 13% increase year-over-year in impact investments globally, with total assets under management at about $228B. Here is a summary of the most popular sectors as determined by the percentage of impact investors investing in each:

GIIN stresses that impact investments should have intentionality (i.e., positive outcomes cannot be accidental) and should require impact measurement (e.g., show me your KPIs). Now, I love metrics as much as the next guy or gal steeped in finance and science. However, as I experienced when I was co-leading sustainability at a $2B private equity fund, measuring social or environmental impacts is tricky. To that end, Andrew Beebe, Managing Director of Obvious Ventures — a VC firm “on a mission to help fuel startups that combine profit and purpose,” aka, #worldpositive companies — had this to say about metrics. [Note: This may be the longest quotation I’ve every used in an article, but bear with me. It’s worth it.] “We don't require hard metrics in sustainability or impact from our portfolio company for specific reasons. First, it's super hard. When you ask a vegan cheese company, "Please tell us your positive impact each month," how do you figure that out? Is it how many cows didn't have to get milked? Is it how much methane from each cow that didn't get produced? But then, of course, you'd have to offset that with the emissions from your delivery trucks. It's just too hard. That's the practical reason, but there's also a strategic reason: Companies will pivot. And when they change, you have to rejigger all of those impact measures. What we do is simply ask the question, is this company likely — regardless of pivot and because of the value of its leadership — going to continue to have a positive impact on the future of humanity? On the human potential? After that point, our decisions are economically driven.” (Source: Greenbiz) As for whether impact investors are seeing real impacts from their allocations, 97% of the GIIN respondents report that they are meeting or exceeding their impact goals. As further validation of this type of measurable impact investing, TPG, one of the world’s largest private equity firms with over $100B in AUM, launched its Rise Fund in 2016 with $2B in AUM. That’s serious amount of capital from a very serious investor, who has no interest in below-market returns. Combining their deep investment experience with partners champions like U2’s Bono, impact investment experts like Elevar Equity, and nonprofit strategy advisor Bridgewater Group, fundraising has been fairly easy. In fact, they are now raising a second fund targeting $3.5B. The Rise Fund website provides more detail on the opportunity, the societal need, and their rigorous approach to impact measurement: “It will take more than $2.5 trillion per year to meet the United Nation’s Sustainable Development Goals...We have defined 30 key outcome areas, aligned with the United Nations Sustainable Development Goals, in which impact is both achievable and measurable through evidenced-based, quantifiable assessment. For each potential investment, we calculate an Impact Multiple of Money (IMM)™, part of our proprietary assessment methodology that allows us to estimate a company’s potential for positive impact.” Total market size:

------------------ #5: Impact investing = “Filling a gap” Finally, some industry professionals restrict the impact sector to investment opportunities that are thought to be unfinanceable — that is, ones that mainstream investors will not, or supposedly, cannot touch due to fiduciary duty, the responsibility to put financial returns above all else. The problem with this definition is that the boundaries of what investors consider attractive, or not, is always changing. Consider off-grid funding for small solar energy solutions. The size of the need (only recently deemed a “market opportunity”) is immense: According to the International Energy Agency, roughly 1 billion people globally lack access to electricity. I’ve been on the ground in Ethiopia and India doing work d.light and Greenlight Planet, two global leaders in this field, and I’ve seen how life-changing these microsolar products can be. Five years ago, most investors would have viewed this field as being all about charity, led by foundations and government aid organizations. However, today we see investments commitments such as these:

The other problem is that this definition severely restricts the size of the market. So, as a proponent of the sector, I don’t like it. But if I put my cheerleading pom poms down for a second, constraining the market size also means that mainstream investors might miss out on emerging sectors, demographic, and geographies that represent new ways to place capital and generate attractive financial, environmental, and social returns in parallel. Luckily, this is the least common definition of impact investing. Total market size:

------------------ Financial Returns: Below or Above Market? Ah, the most critical question and the most misunderstood: “Does impact investing require concessionary returns, a financial sacrifice in order to do the right thing?” One of the most authoritative studies on the topic was conducted by Deutsche Asset Management and the University of Hamburg in 2016. They reviewed 2,200 reports to assess the linkage between ESG excellence and the financial performance of companies. The results?

For another perspective, we can look at the responses from impact investors in the 2018 GIIN report. Here were their conclusions:

Going one step further than the mainstream might be ready for, as he does so well, Al Gore is championing a new initiative called the Fiduciary Duty in the 21st Century Progamme. Led by the UN Environment Program Finance Initiative (UNEP FI), UN PRI, and Generation Investment Foundation, it flips this discussion on its head. Instead of seeing impact returns as being at odds with an investor’s fiduciary duty, it notes that “there are positive [fiduciary] duties to integrate environmental, social and governance factors in investment processes.” That is, to ignore ESG consideration may be akin to slacking on one’s duty to achieve the best risk-adjusted returns for investors. To put some of this into practice, they have created roadmaps for institutional investors that “address fiduciary training, corporate reporting, asset owner interaction with service providers, legal guidance, the development of investment strategies, ESG disclosure and governance structures.” For more on this topic, you can check out more research aggregated here by US SIF. ------------------ Why is this market not growing faster? Because people too often act like ostriches burying their heads buried in the sand to avoid new impending realities? Nope. (And, by the way, ostriches don’t really do this. You can trust my source: National Geographic Kids. “Ostriches don't bury their heads in the sand—they wouldn't be able to breathe! But they do dig holes in the dirt to use as nests for their eggs. Several times a day, a bird puts her head in the hole and turns the eggs.” OK, Fun Fact Time is now over.) Below are a few barriers based on the reports referenced above and my own experiences in the sector:

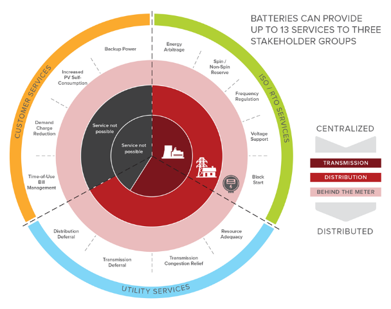

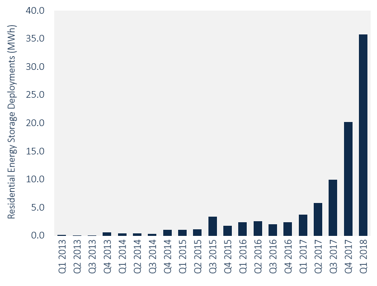

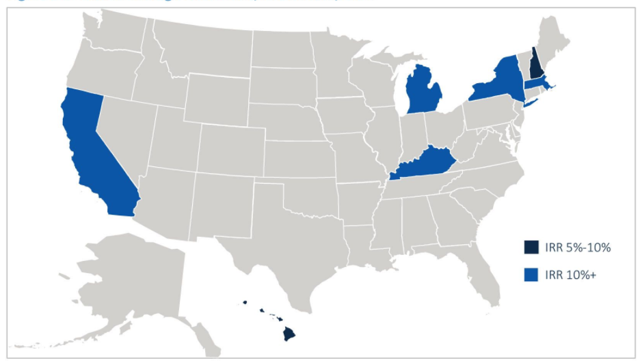

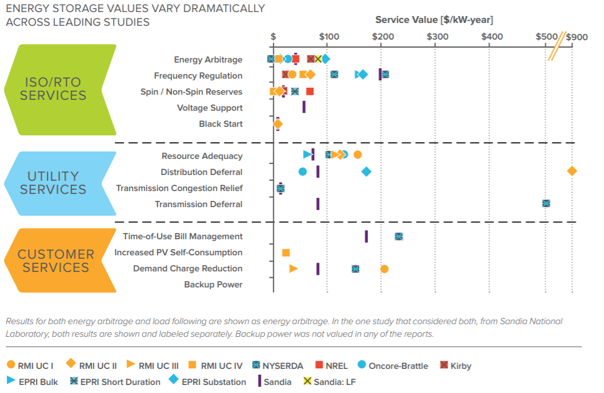

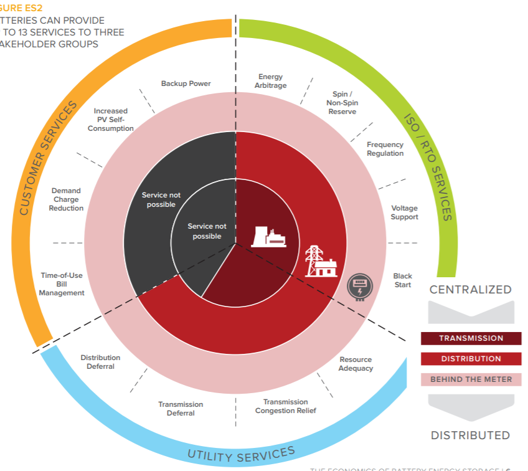

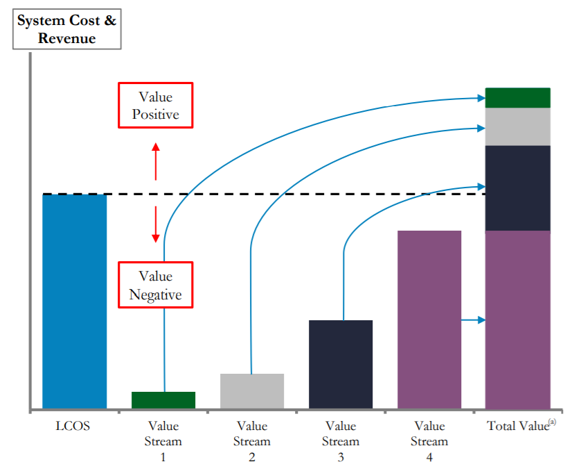

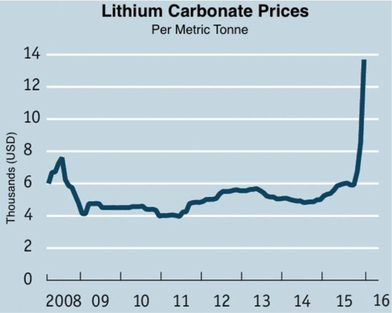

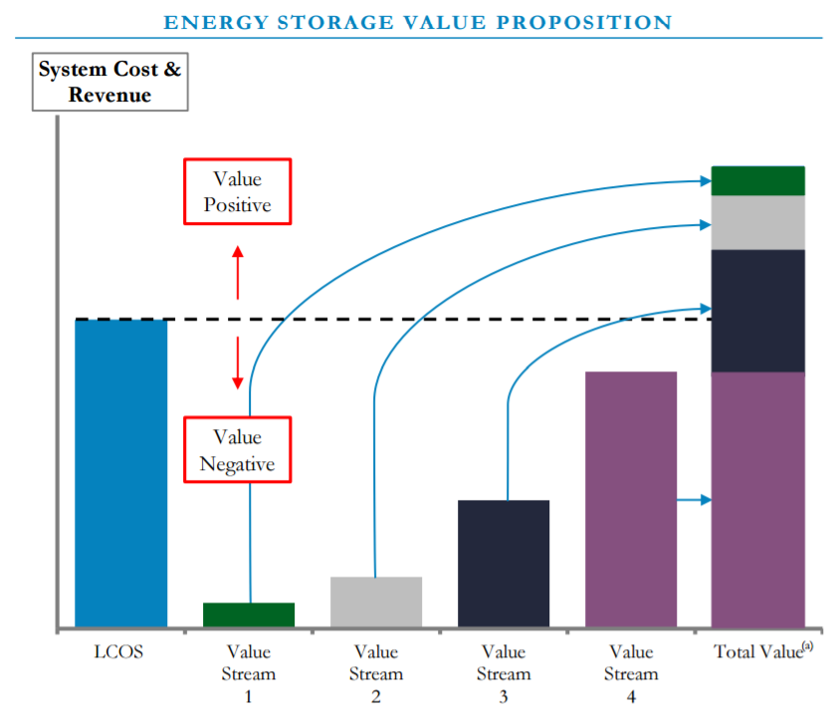

------------------ So what? Impact investing is not going away. Instead, it will become mainstream. I think it’s going to be like other niche fields that I’ve entered five years ahead of the masses — green real estate, solar power, energy storage — before the billions of dollars began flowing into sectors thought to be purely about mission, solely the purview of “hippie capitalists.” If you don’t agree, then consider one more trend: An estimated $30T of wealth is expected to be transferred from Baby Boomers to Millennials over the coming decades. And research shows that this younger generation cares more about using their capital to make an impact, not just a profit. Luckily, both are increasingly possible. By: Chris Wedding, PhD “You miss 100% of the shots you don’t take.” Depending on whether you are from the South or the North, you’ll think that quote was attributed to Michael Jordan or Wayne Gretzky. With two degrees and a professorship at UNC Chapel Hill, I’m definitely going with MJ. Regardless, this pithy wisdom applies to our topic at hand — Innovators that harnessed blood, sweat, tears, and billions of dollars to shoot for the moon with bold battery solutions that did not work out. The silver lining (or maybe it’s lithium) is that those were the early days. And it’s better to gamble with pennies than with gold. Going forward through 2040, Bloomberg projects $620B to be invested in the battery sector. That’s a frighteningly large amount of capital. So we better learn lessons from those early failures and invest these dollars intelligently. First, a review of why batteries are wonderful... Below are three figures which tell a compelling story. #1 The 13 benefits that batteries can create for building owners (behind the meter), utilities (front of the meter), and grid operators (e.g., Independent System Operators). — Source: RMI #2 The surprising growth of residential energy storage installation in the U.S. — Source: GTM Research / ESA U.S Energy Storage Monitor #3 Areas of the U.S. where commercial and industrial energy storage can produce an attractive return on investment today, not in some distant future where Elon Musk is the next billionaire president. — Source: NREL And now, a list of battery companies “with arrows in their backs” The following companies were cutting edge, but the cuts went too deep. God bless them for being innovators that were too early. A123 Systems

Alevo

Aquion Energy

Better Place

Fisker

In aggregate, these companies raised more than $5B from smart, accomplished, and connected investors, such as the following:

Sources: Pitchbook, Crunchbase, Greentech Media, PV Magazine, VentureBeat, and the New Yorker Finally, 10 lessons for “keeping your shoes clean in a cow field” #1 Focus. Focus. Focus. — Some battery manufacturers tried to serve multiple markets and geographies, across both stationary (power grid) and EV (electric vehicle) sectors. You have to pick. Say no. You’ve heard it before: “If you try to please everyone, you’ll end up pleasing no one.” #2 Vet storage technologies the way that investors vet energy project investments — This matters because ultimately tech needs to scale into deployments. Below are six questions to ask of a battery technology and company:

#3 Apply the pre-mortem — Watch for “froth.” If all investors are in love with the company, ask why it could fail. Once you identify the flaws, ask whether there are risk mitigation strategies, and if you believe them. Ignorance is not bliss. #4 Manage burn-rate like a hawk — Raising a big round, or being on a rocket ship based on confident financial projections are not excuses to spend too much. Pretend your dad was a CPA like mine. Make sure a board is in place and that they firmly hold the executive team accountable, without applying a death grip. #5 Compete against the giants with your eyes wide open — If the battery technology company wants to oust lithium-ion batteries from their global dominance, then get ready for a long, uphill battle. Granted, at the top of that hill, you might see a pot of gold waiting. But you may have aged a decade in the process. Or maybe instead you should just climb a different hill: Find a niche use case where lithium-ion is not the answer. Find its weakest performance parameter, innovate to excel on that same attribute, and then find the one customer segment in a specific geography that loses sleep over that problem you could solve with a non-lithium-ion solution. #6 Don’t depend on business-to-customer sale channels — As individuals, we are fickle, distracted buyers. Businesses are not. They seek what’s best for them and buy in large quantities. Find battery companies that make businesses happy. Then sell to them in order to reach your ultimate customer, whether it is the business or that business’ customers. For example, make the utility or auto manufacturer your friend, not your foe. #7 Partner with strategic investors — These guys (and gals) provide three benefits: (1) They might be more patient with their capital, allowing time to maximize company value before exiting an investment. (2) They can provide fantastic validation that the storage company has market potential and may indeed scratch their own itch. (3) They can be extraordinary customers that “make the business,” adding serious revenue through large contracts. #8 Raise capital before you need it — Plenty of companies run out of cash before they raise their next round. This was also true for some early stage storage startups. Don’t depend on cash flows for growth too early on in the business. Raise more than you think you need, share the pie, and earn the opportunity to watch it grow. #9 Prioritize capital-light business models — If the battery company wants to use lots of venture capital to build factories, run away. Far away. Instead, contract manufacturing, creative lines of credit, and supportive supply chain partners can reduce capital cost needs. In addition, it always helps to invest in the “brains” of the storage devices. Get some intellectual property, some software, and some automation. #10 Good looks alone won’t cut it — Cool design can’t overcome poor quality or inconvenience. That said, ugly form factors can also be recipe for inducing yawns if there is any consumer component to the sales cycle. Find the balance. But keep your eye on the target: High performance. In conclusion… I’ll conclude with a relevant metaphor that takes me back to my days in Kentucky... We’re off to the races. Don’t be too late to make that bet. Pick your jockey(s). Pick your horse(s). The prize money is much more than a bucket of oats. The energy storage market is kind of like the Loch Ness Monster — It’s rarely seen. It’s said to be huge. And many think it’s not real. If you’re like us, you have dozens of articles and reports on energy storage (and other topics) starred for reading later. But “later” never seems to arrive with the free time you needed to read about this high potential market. As such, we’re providing this “Cheat Sheet for Energy Storage Finance” based on our work as buy-side and sell-side investment bankers experienced in both energy storage venture capital and project finance. I’m also including some perspectives from my panel last week at the UNC Cleantech Summit entitled “Financing Energy Storage.” Thanks to Greentech Media, GTM Research, Utility Dive, Bloomberg New Energy Finance, Bloomberg, McKinsey & Company, i3 (Cleantech.com), Lazard, Energy Storage Association, PV Magazine, Rocky Mountain Institute, Renewable Energy World, and Energy Storage News for their great work that helped us compile this research. The Market Opportunity Big picture: The rise of energy storage is expected to mirror the giant leap that the solar sector took between 2000 and 2015 (link). For those of you who rode the solar roller coaster like we did, you might want to get that amusement park seatbelt and whiskey ready. You may need them. Global Market U.S. Market

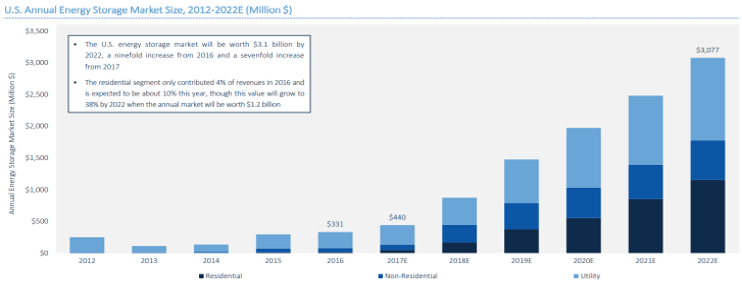

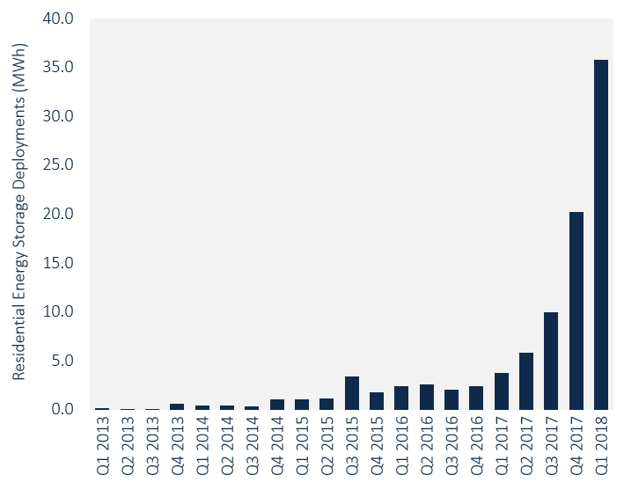

This September 2018 headline from Bloomberg sums it up well on the residential front: “Residential Energy Storage Surging, No Longer Just a ‘Cool Toy’” (link) Their impetus was two-fold:

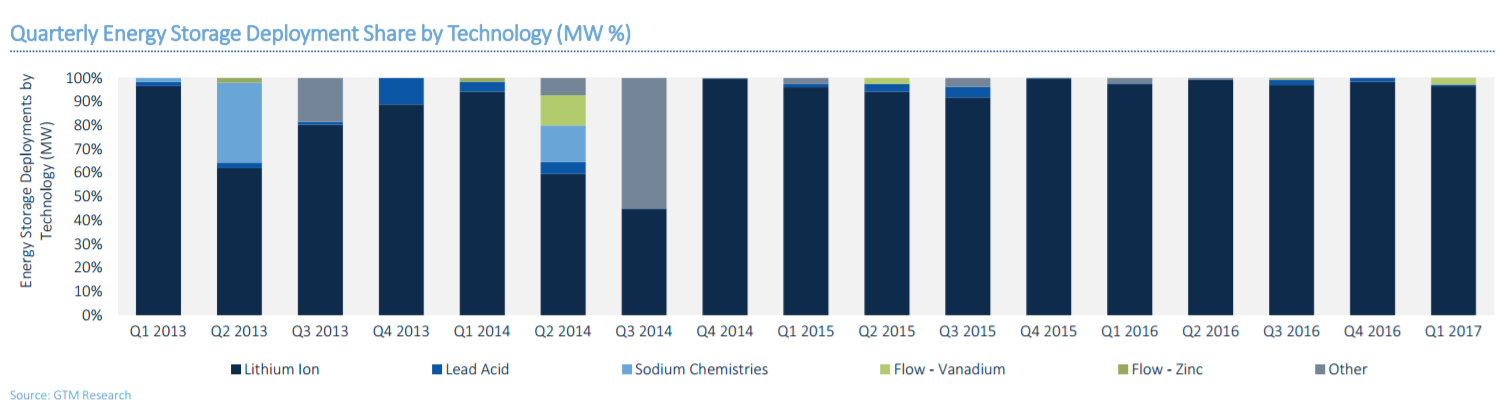

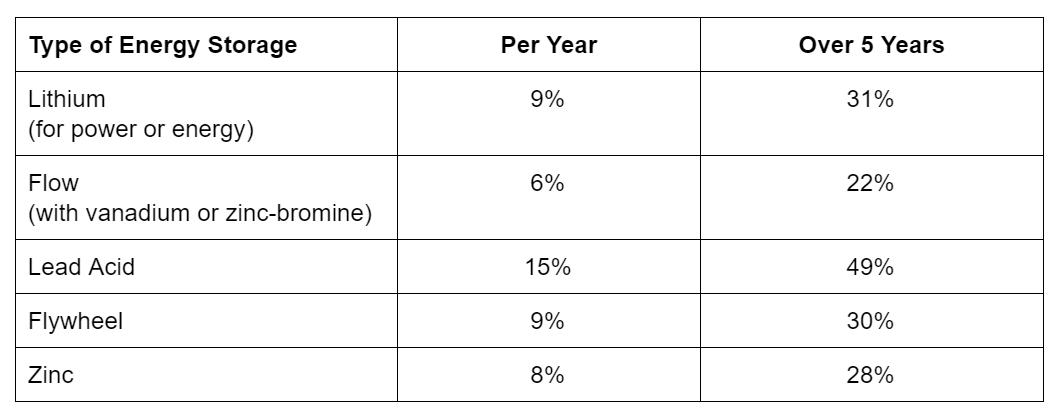

U.S. Annual Energy Storage Deployment Forecast: 2012-2022E (millions of dollars) Source: Greentech Media Technology

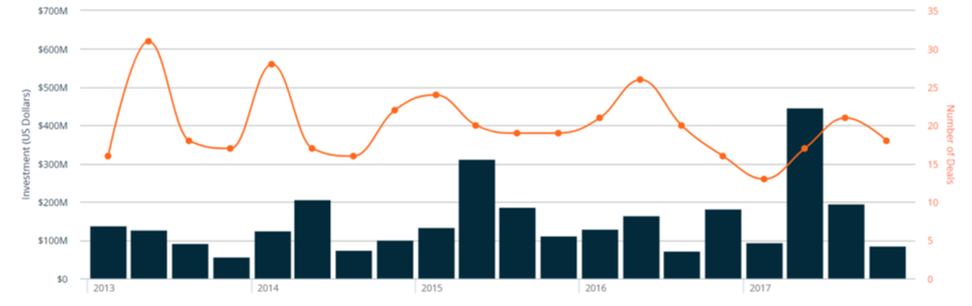

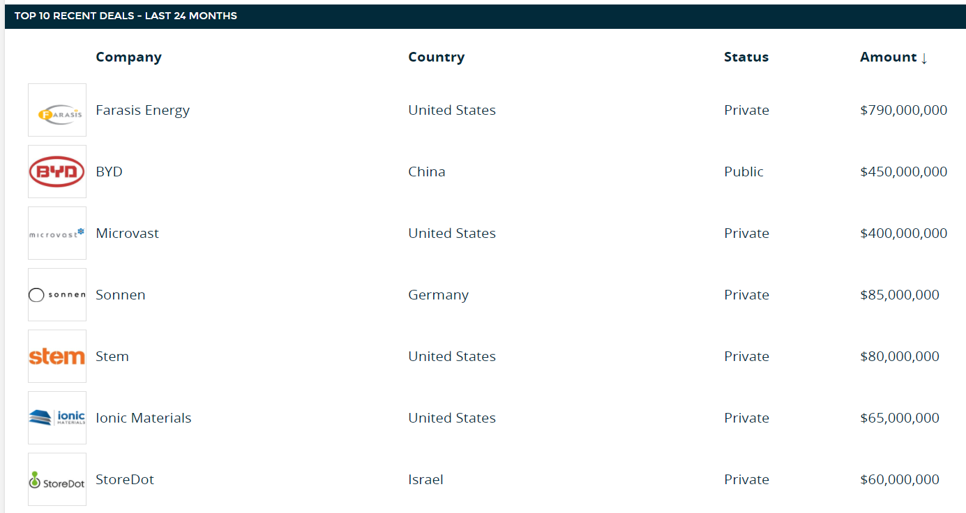

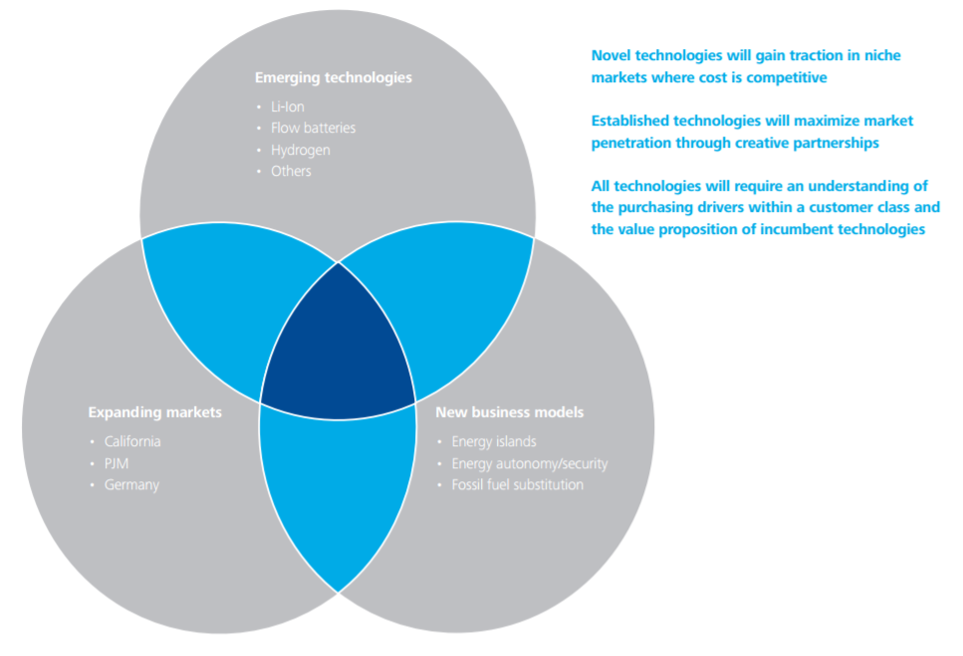

Angel & Venture Capital Finance We’re just in the first inning of this game. And for a guy who prefers basketball (born in Kentucky and living in North Carolina), that’s saying a lot. There’s little doubt that Stem has been the big winner, with almost $300M invested to date. With its focus on artificial intelligence, aggregation of distributed batteries, and managing demand charges for commercial customers, it makes sense. We’ve also seen a host of energy storage companies get gobbled up by bigger giants eager to get a headstart in the battery game. Enel bought Demand Energy. Wartsila snatched up Greensmith. And Aggreko consumed Younicos. See a longer list here. No one knows what other innovations will make it to market, but we can guess that they will make storage easy and beautiful, take advantage of multiple revenue streams, serve more than one customer, and be loved by utility giants for the grid problems they’ll help solve. Here some other statistics for your next dinner party:

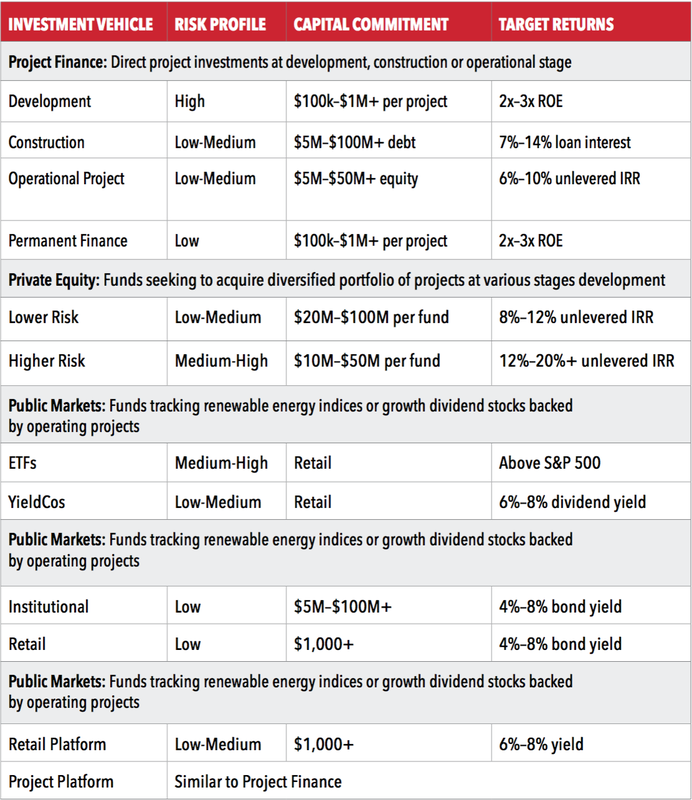

Project Finance The scale of investments in energy storage project finance will continue to dwarf venture capital investments in the sector. It’s also worth noting that non-recourse financing -- i.e., no corporate or personal guarantees necessary — is on the way. Three big project developers have won this unique benefit of the project finance model: Powin | RES | Green Charge. However, limitations to quicker market expansion for battery project finance revolve around these investor considerations:

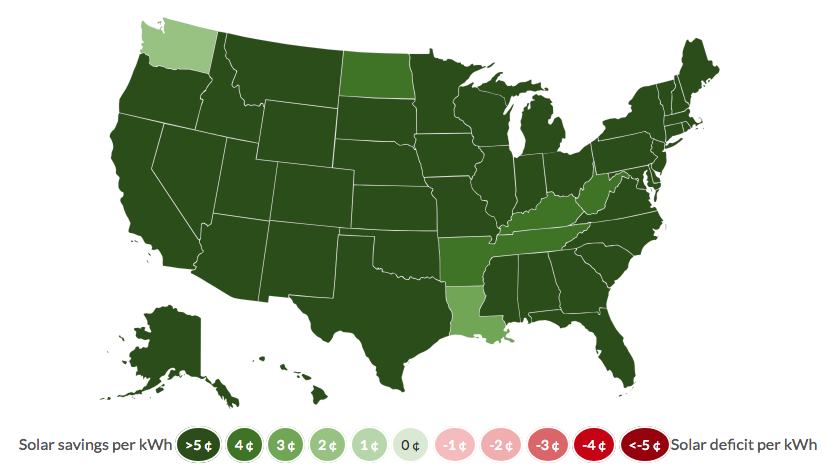

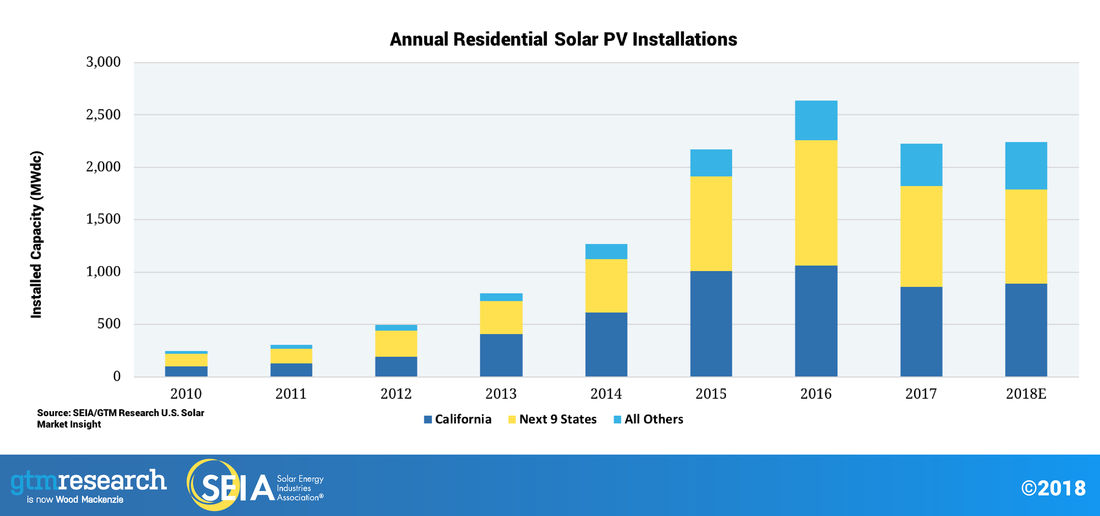

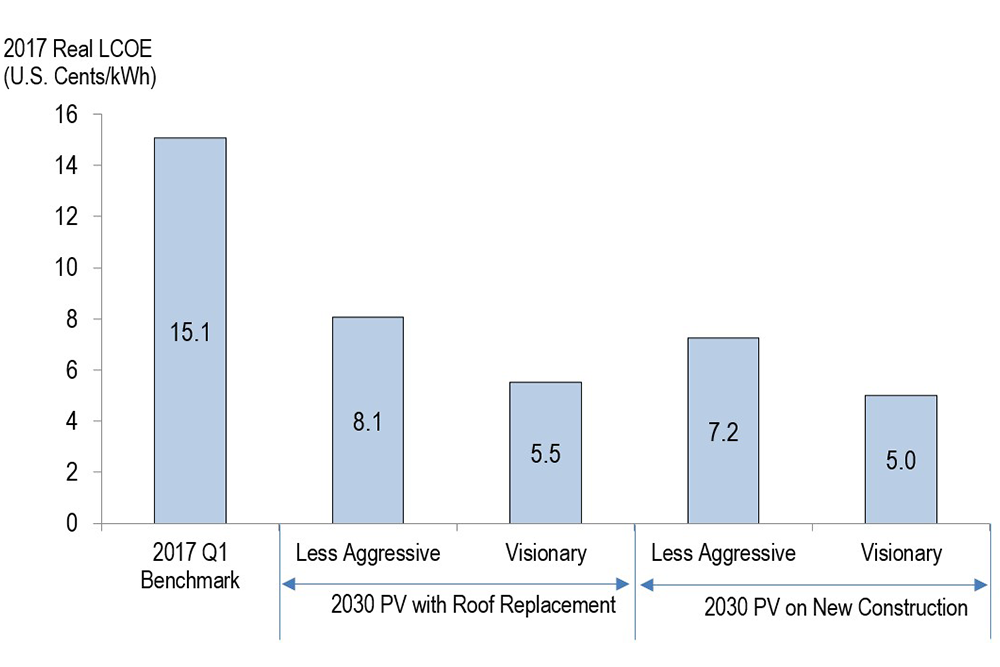

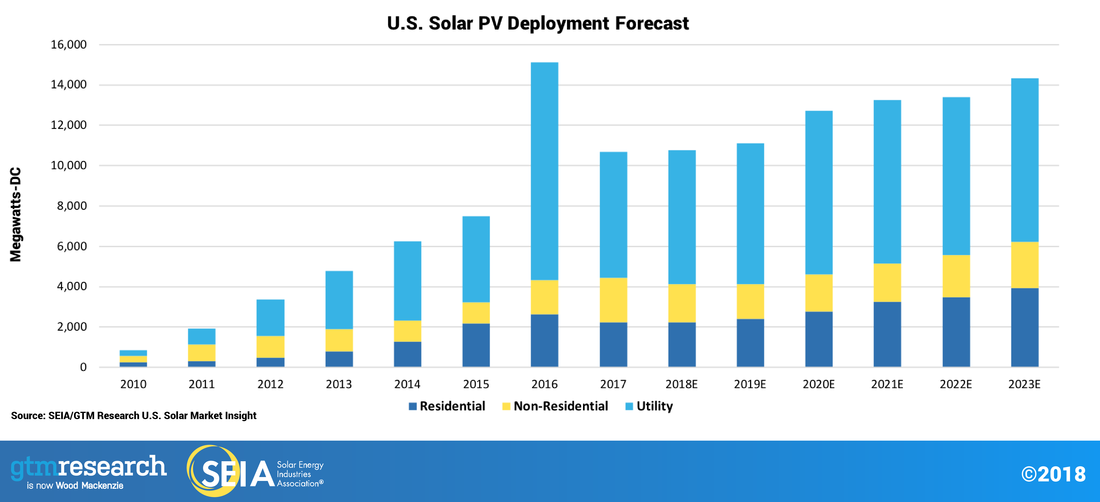

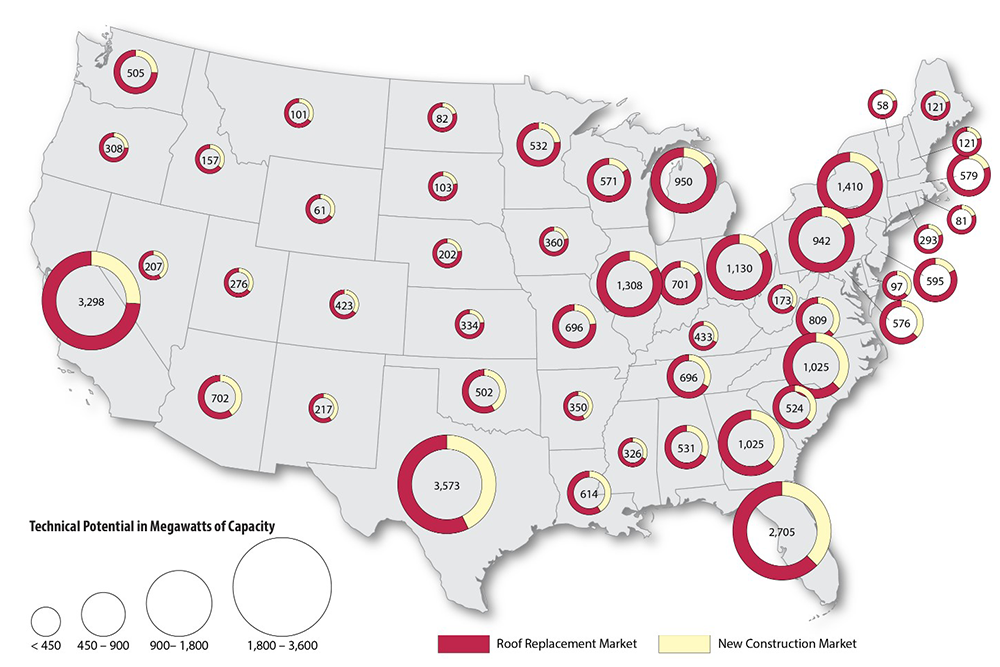

Here some other fun facts for your quiz later: Conclusion If you’re looking for a Blue Ocean Strategy play in clean energy, something with few competitors and new customers, then the time is nearing when you might be late to the party. But don’t run away crying and defeated just yet. With $100B of expected investment in the sector over the next 12 years, “the cup runneth over” with opportunities, whether your cup of tea be VC-stage innovation with hundreds of possible winners to choose from, or perhaps project finance targets for lower risk and much bigger capital deployment. -- Shout out to Thomas Kelley for the cool Volts photo. Recent solar industry headlines (see the latest from Forbes) would suggest that international trade negotiations (or perhaps more precisely, disputes or wars) are among the most important things to know about solar. Opinions vary on the efficacy of such international policy, but suffice it to say that this escalating trade kerfuffle is masking the growing strength of the solar industry. Let’s not get caught up in the headlines. Be smart and take a deeper dive. Part of the beauty of solar is that it comes in many shapes and forms, ranging from utility-scale solar farms to smaller-scale applications on homes and businesses. Here, I want to focus on bread-and-butter solar applications for homes, leaving the bigger, headline-grabbing projects aside. Residential solar is no longer just a “California and a bunch of others” story Far from being a luxury for the rich, residential solar has grown to being a legitimate complement to grid electricity (alternative if paired with energy storage) across the US. Generally speaking, the reason is simple -- cost. On average, residential solar is now cheaper in essentially every state in the US according to SUNMetrix, which produces a state-by-state solar cost comparison analysis. Even if the solar federal tax credit were completely eliminated, only two states would no longer offer cost savings to solar adopters. Figure 1: US Solar Cost Comparison with Grid Electricity Source: SUNMetrix, 2018 Figure 2: Annual Residential Solar Installations Source: GTM Research & SEIA, 2018 Precipitous reduction in solar costs, and still going Let’s put some numbers to this story. According to the National Renewable Energy Laboratory (NREL), residential solar costs have decreased from a levelized cost of energy (LCOE) of $0.52/kWh in 2010 to $0.151/kWh in 2017, with projections to reach $0.09/kWh or below by 2030 depending on technological innovations. That is over a 70% reduction in solar electricity costs the last 7+ years, with another 40% reduction projected over the next decade or so at a minimum. Translation: The already significant financial benefit of solar will only grow over time. #WhySolar Figure 3: Comparison of Modeled Solar Cost Pathways Source: NREL, 2018 The clever skeptic may retort -- this is apples-to-oranges when you compare the average cost of electricity on your utility bill with the initial installation cost of solar. Good point, oh revered skeptic. Initial capital costs to install solar have always been a limiting factor for potential consumers. Fortunately, this is also precisely the problem that was solved in order to unlock the potential of this market. Early on, the solution was for solar companies to offer long-term power purchase agreements (PPAs) to customers. The solar company would install the system at no cost, retain ownership of the system over the long-term, and sell the homeowner power from the solar panels at a specified rate over, say, 20 years. While PPAs still exist, they are giving way to solar loans, which allow the homeowner to retain ownership of the system and pay it down over time as with any other loan. Point being -- there are many options to offset those initial capital costs over a long period of time so that the solar adopter is, in effect, making an apples-to-apples monthly payment. These dramatic cost reductions paired with a wider array of consumer financing options have driven massive growth in market adoption, which is generally what we see in market growth, as shown in the GTM Research graph below. It is not the quintessential hockey stick graph due some policy uncertainty at various times in the past, but the growth trends are apparent, and not projected to abate even after the federal tax credit for solar is eliminated in 2022. Figure 4: US Solar Installation Forecast, 2010-2023E Source: GTM Research & SEIA, 2018 Still miles to go in market potential Even with this rapid market growth, there is still a large untapped, addressable market throughout the US. According to the NREL, there is a 30 GW annual technical market potential for residential solar nationwide across both new construction and roof replacements. “Technical” being the operative word here. There are many factors beyond just technical feasibility that drive market adoption, especially when it comes to a big expenditure for a person’s home. Notwithstanding, the point is clear. The addressable market dwarfs the current market penetration numbers, which were at just above 2 GW in 2017 according to GTM Research. Figure 5: Average estimated annual residential rooftop PV market capacity potential from 2017 – 2030 Source: NREL, 2018 Parsing the signal out out the noise among the morass of residential solar companies

At its core, the residential solar business is relatively simple -- sales, equipment, installation. As such, there are fewer barriers to entry compared to many industries, which has paved the way for hordes of supremely adequate solar installation companies. It is the quintessential “two guys (or gals) and a truck” phenomenon. It is not too hard to make reasonable money installing solar systems (at least for a little while), so a bunch of relatively unsophisticated companies are doing it. Yes, you have the publicly traded stars out there -- SunRun, Vivnt, prior to its Tesla acquisition SolarCity, etc. However, these national brands appear to be ceding their market position in many geographies to more locally grown and known companies that are buffeted by the holy grail of marketing, happy customers and word-of-mouth advertising. There is a smorgasbord of these smaller, local and regional companies. Some have really refined operations, well-oiled machines so to speak. Others have slick advertising, but spotty execution. In all cases, it is really difficult to cut through the noise to discern which are positioned to capitalize on the growing market opportunity in residential solar. Here are five hallmarks of a “cream of the crop” residential solar company:

Buyer beware, there is no magic formula to identifying the best performers among residential solar providers. It requires diligence, research, and some perceptive sleuthing to find those diamonds in the rough. The market conditions are ripe, however, for a number of successes to emerge out of this exciting sector. By: Dr. Chris Wedding, Managing Partner I recently spoke about investing in energy storage at the SuperReturn Energy investor conference in Boston. In this blog, I hope to pass along 4 of my top 100 takeaways. (OK, slight exaggeration, but productive indeed.) Unfortunately, I am unable to also magically transmit the decadent Legal Seafoods’ lobster tails and sushi rolls from the sponsored dinner (#WeLoveLawFirms) or the conference bling (#MyKidsLoveGiftsFromWorkTravel). 1. Natural gas is misunderstood. First, low commodity prices will not always mean low power prices. The costs of distribution of gas to the power plant, plus the transmission and distribution of the electricity it produces take place on an ancient grid. (That’s a technical term. But Edison would recognize today’s grid if he magically reappeared in his Florida laboratory.) Recent research suggests that the average age for power lines is 28 years, while the U.S. DOE quotes studies by the Brattle Group (for the Edison Electric Institute) estimating about $2T in investment needs for the grid from 2010 to 2030 just to maintain the service reliability. Second, natural gas is not a perfect “bridge” to a low carbon future. On one hand, its emissions factor (pounds of CO2 per BTU emitted when burned) is roughly 43% lower than burning coal (whose butt it is kicking). On the other hand, the operational emissions factor for natural gas is infinitely higher than solar or wind (#DivideByZero). Also, methane leaks during exploration and distribution likely counteract its lower greenhouse gas emissions (compared to coal, that is) when combusted at power plants. As you know, methane’s greenhouse gas impact is at least 30x more potent than CO2. Third, there are two giants in the natural gas ecosystem that see some writing on the wall, and I think they see lots of four-letter words there. GE has laid off 12,000 workers in its power generation business, and now Siemens is considering selling off its natural gas turbine business, whose Q2 revenue was down to $114M from $438M in Q2 2017. And with Bloomberg estimating 157 GW of renewables added vs. just 70 GW of conventional power in 2017, we can understand why they might be making those moves. Having said all of that, I don’t pretend to live in a world of rainbows and unicorns. Conventional energy will likely be part of the global mix for many decades to come. Even in a world where solar and wind power dominate, this analysis shows that natural gas will have a large, though diminishing role over time. 2. $1T of clean energy investment presents challenges for entrepreneurs and investors. Most climate change scientists, policymakers, and private sector leaders project a need for $1T of low-carbon investment needed per year in companies and projects in order to keep global temperature increases below 2o C. However, last year Bloomberg suggests that global clean energy investment stood at just $333B. By my math, that’s 67% lower than the amount of capital we will need. To get there, we need at least two things:

As for investor interest, it is growing. When I first began speaking at the SuperReturn investor conference series three years ago in Boston, London, and Berlin, I was often part of the 1%. (No, not that 1%. I am a pauper compared to my colleagues in attendance who manage billions in capital.) What I mean is that I was often the only guy talking about the future opportunities and threats presented by the mainstreaming of energy storage and electric vehicles, or the continuation of investment opportunities in solar, despite the challenges of (and false conflation with) the cleantech VC missteps of the late 2000’s. Today, many more investment professionals -- with decades on Wall Street instead of roots in the jungles of the Central American rainforest -- are making big investment commitments to renewables, exploring new deals in energy storage, or analyzing the threats that EVs pose to mid- and long-term oil prices. [You can read more here about the mainstreaming of renewable energy investing in my feature piece for Preqin, a global leading for market intelligence for private capital markets.] In contrast to this growing interest, investors worry about yield compression. With lots of capital chasing a disproportionately smaller number of good deals at scale, and with risks being hammered out of renewable energy infrastructure, IRRs have gone down. [Note: Although IRRs are a helpful underwriting metric, many investors prefer to look at the “multiple of invested capital,” or total cash out vs. total cash invested.] When I first began investing in solar power projects, we underwrote to private equity returns north of 20%. Today investors in operating projects might get 6-9%, while those investing in development plus operation and/or platform plays (investing in the development company, too) are targeting “mid-teens” returns. To clarify, these are leveraged returns. And when most oil and gas investors hear this, they laugh a little on the inside when comparing these numbers to their target returns from 20-30%. But this is apples-to-orange, due to risk. Renewable energy infrastructure returns are based on [15-25]-year contracted cash flows, while oil and gas investments often depend on far riskier exploration and development, plus volatile global commodity markets. As for deal flow, scale and quality are the two constraints. Regarding the scale of these markets, things are getting better. For example, annual U.S. solar project installations are up roughly 50% versus just two years ago, and by 2023 total installed U.S. solar capacity is expected to increase by more than 2x. But we still need more entrepreneurs to build more projects and companies worthy of investors’ capital. (A tantalizing call to action, for sure.) Regarding quality, over the years, we’ve vetted 100s of MWs of solar projects. But very few have passed review and made it to investment committees. Again, things are getting better. Developers and entrepreneurs are learning from past mistakes (e.g., using venture capital, the most expensive capital on earth, to built factories to make s*#t). For more about what it takes to increase a company’s chances of raising capital, we’ve written a few primers, structured in numbered lists, with attempts at humor included.

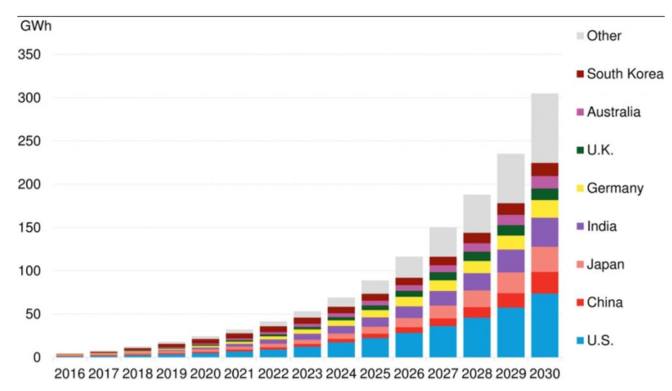

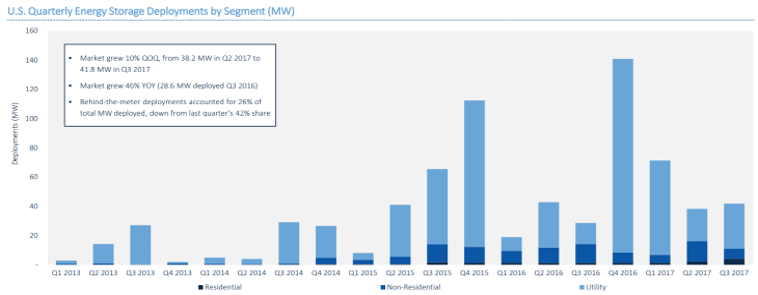

3. We overestimate the impact of new tech in the short-term, and underestimate its impacts in long-term. This quote from Bill Gates highlights a comment from an investor panelist: In the current energy transition, trillions of dollars will be created and destroyed. Another investor put is this way: If you have no strategy on the growing role of clean energy, then you’re leaving value on the table. For my panel on energy storage investments, the topic on most investors’ minds was this: “Is energy storage a real market today?” Opinions varied. But here is the right one: Heck ya, it’s real today. But it’s not real everywhere...yet. Hence the confusion. There are hundreds of millions of investment already committed to or invested in batteries each year at the utility, commercial and industrial, and residential level, including projects involving our clients. Consider these stats from Greentech Media:

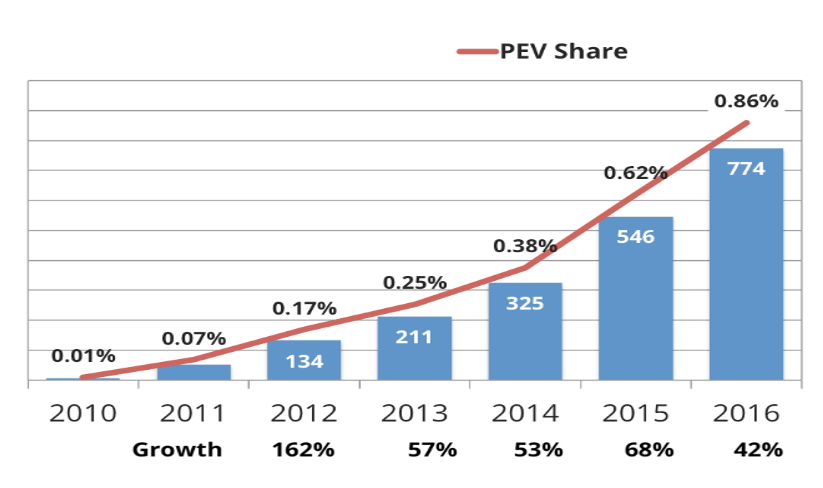

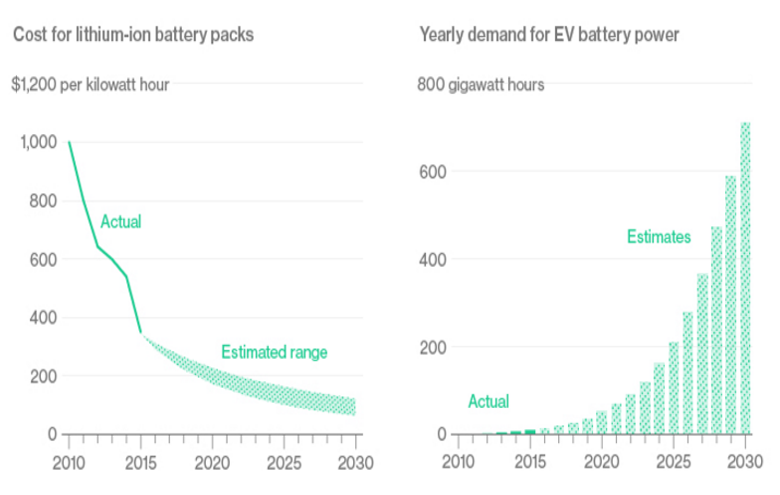

To be sure, the bulk of energy storage investments have yet to come. Bloomberg estimates $100B invested by 2030. For a great graph of billions of dollars projected to be invested, check out the black bar graph here. But even today, giants like NextEra estimate that no new gas peaker plants will be built post-2020 due to the falling price and increasing performance of large-scale battery storage. [For more about energy storage investing, you can read our research here -- Financing Energy Storage: A Cheat Sheet.] Despite early indications of massive growth for new clean energy solutions like storage or EVs, most people see them as a long-term thing. Not a material consideration for today’s portfolio. However, this graph from NYT / HBR shows that often new technologies are being adopted on increasingly quick timelines, following S-curves with step change growth, not incremental linear progress. Of course, when comparing EV adoption to smartphone adoption, investors at the conference pointed out that there is a massive difference in the CapEx among these items; hence much slower adoption is possible. But if any fraction of Tony Seba’s projections in his ReThinkX report on the future of transportation are correct (the question may be “when, not if”), then we could be talking about switching from a CapEx discussion to an OpEx discussion, thereby making the mass transition from ICE (internal combustion engine) vehicles to EVs much quicker. According to one investor panelist, this research estimates that most Americans spend about $10,000 per year on their cars, while ReThinkX projects that autonomous shared EVs could reduce personal travel costs by 90% while also delivering convenience, too. (Ah...to relax and work while going to the airport in a Lyft, instead of navigating traffic and crowded parking garages in my own vehicle.) Building on that theme, while at the event, I received an update from Bloomberg on their EV projections for 2040: 55% of new sales and 33% of global fleet. (#ThatAintNoNiche) [Quick aside: Some panelists laughed at the idea that EVs meant clean energy. True, it depends on the grid mix of high vs. low carbon energy sources. But this calculator from U.S. DOE shows that EV CO2 emissions are roughly 50% less than gasoline-powered cars based on average in the U.S. The calculator lets you see differences by state location, too.] Panelists also noted that major adoption of EVs in the U.S. could lead to 2x growth in utility power output, even describing this monumental revenue-generating opportunity as a “w*t dream” for utilities. (And, yes, the room was mostly full of men. I apologize. Just the messenger...) In a time when Moody’s just gave the utility sector a negative outlook for the first time in history, maybe Elon Musk is right: The electrification of transportation could be a much needed savior for the challenged power sector. Considering that the average capacity factor for U.S power plants is roughly 40%, the utility sector has lots of excess capacity in sunk costs to harness with 100+ EV models coming online by 2020. [Background: Most grids tend to overbuild capacity in order to manage peak loads, thereby underutilizing power plants and perhaps wasting CapEx for perhaps 90%+ of the hours in a year.] On a related note, solar plus storage has until recently been an enticing topic for discussions at conferences, or fun projects for my graduate students. But this, too, is changing quickly. Today almost all renewable energy RFPs from utilities in deregulated markets require the inclusion of energy storage capacity. And suprisingly, the bids are coming in at very low prices. As an example, Xcel Energy’s recent process resulted in 10+GW of bids for solar plus storage at 3.6 c/kWh and wind plus storage at 1.8 c/kWh, which are both new record low prices. Finally, investors often feel limited in their consideration of long-term trends and multi-decade infrastructure assets due to the [8-10]-year life of most private equity funds. In response, panelists came out in two camps:

4. Definitions of ESG and sustainable energy vary widely. Despite the concern that ESG (Environment, Social, Governance) or sustainable investing is for hippies who love to earn below market financial returns, many investment giants would disagree. Below are samples of their thinking:

Yet still there is confusion about what the terms mean. Some panelists said their investments in oil and gas have been doing ESG for many years. Now they just needed to add social sustainability goals. However, they were equating ESG with HSE -- Health Safety, and Environment. While there is overlap, and both are important, there is at least one key difference:

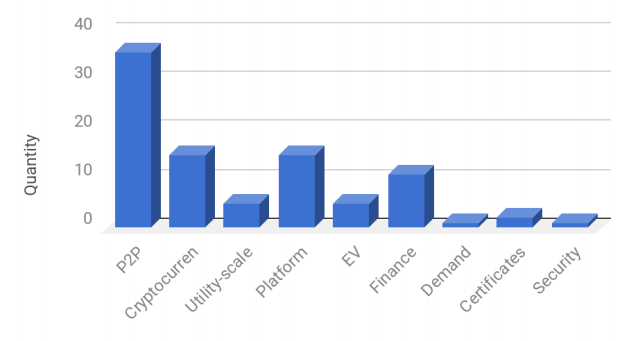

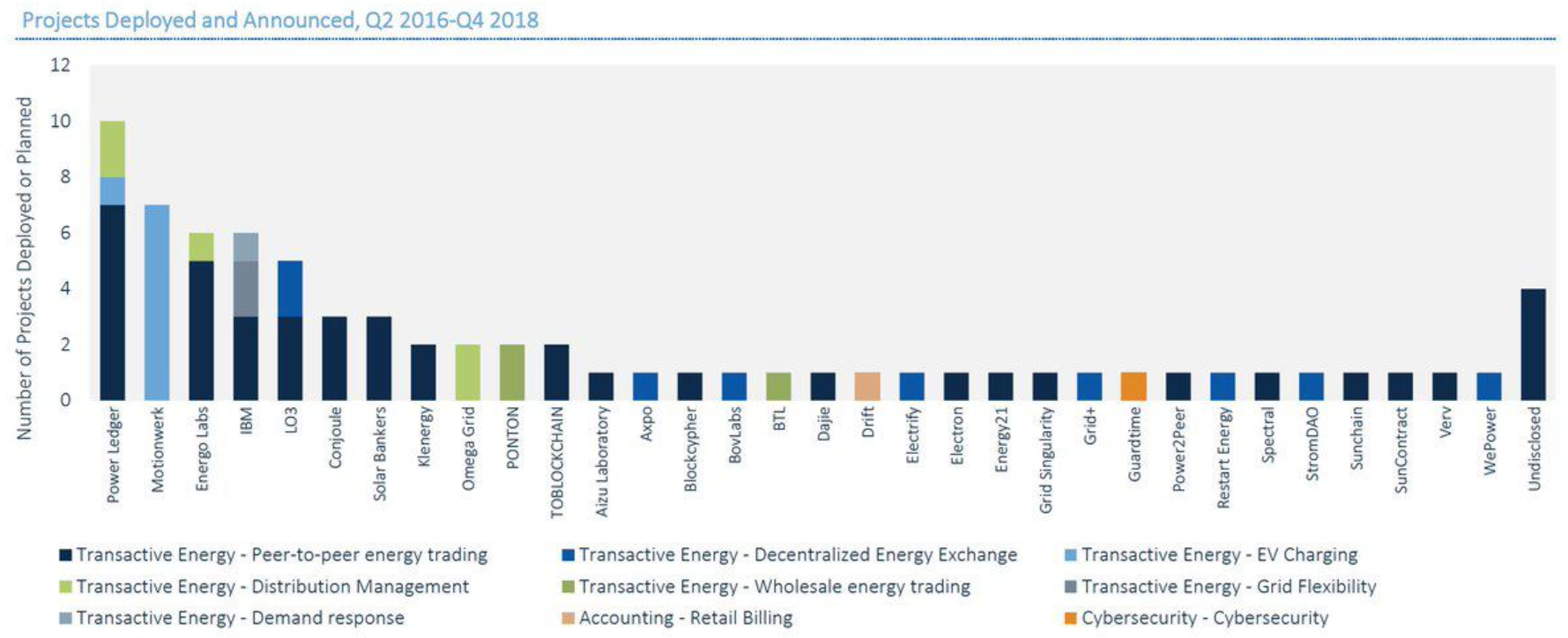

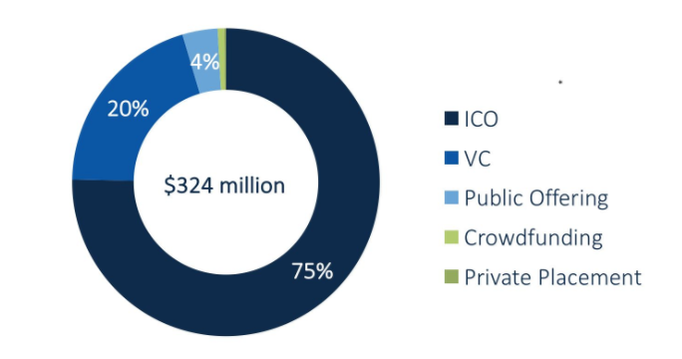

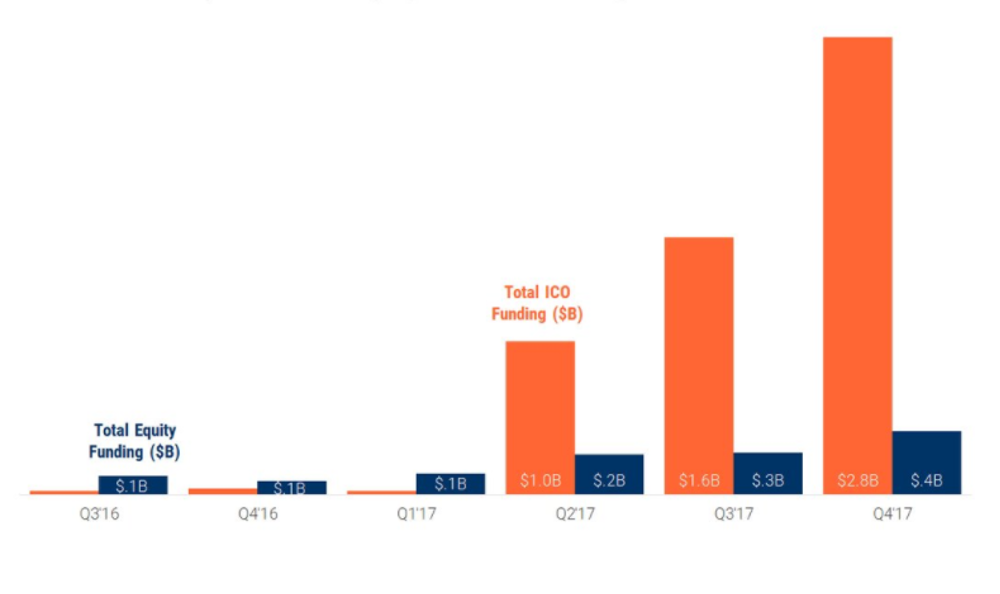

Furthermore, some conventional energy asset managers, intending to do better in ESG, described their greenhouse gas footprinting efforts, and believe that that their conventional energy holdings are low carbon. Some said the CO2 impacts of oil and gas investments were very low impact because exploring, drilling, and transporting via pipelines constituted a very small amount of the sector’s air pollution. This is true relative to the combustion of those resources. However, companies are increasingly being expected to consider and account for broader life cycle impacts of their investments, inside and outside of their direct corporate control. In this new world order, a new analogy may apply: Making guns, but not accepting some accountability for gun deaths, could be a dead argument. (Yep, pun and controversy intended.) --- For more short (and sweet?) commentary on clean energy finance, along with tips on productivity, life hacks, and trivia for your next dinner party, check out our (mostly) weekly newsletter -- 2 Bullet Tuesdays. It’s a quick 4-minute read, with bullets and short paragraphs, plus links for you to learn more if you somehow have more than 24 hours in a day. --- Photo by Jesse Collins on Unsplash By: Dr. Chris Wedding, Managing Partner In the last quarter, investors poured more than $324M into blockchain for energy companies. Can you believe that? Well, you shouldn’t. But which part is most unbelievable? While $324M seems shocking, it’s all about context. That amount has indeed been raised, but it’s taken 12 months to do so, according to GTM Research. What’s more shocking is that over 75% of this capital has been raised via Initial Coin Offerings, or ICOs. When thinking about this emerging market, it’s kind of like being back in high school: Some investors have FOMO (Fear of Missing Out). But others think they’re too cool to hang out with the kid who just became popular after years of dork-dom. But what should you, oh wise capital providers and ye capital-hungry blockchain entrepreneurs who worship the clean energy gods of purity, know about blockchain-focused energy opportunities? Here are our top 4, out of our longer list of 75. (I exaggerate slightly.) 1. There are 120+ blockchain energy companies. But most are relative newbs. Yep, that’s a term from my kiddos. I can’t wait to finish this blog so I can go tell them I used their word correctly. But do I use the word “newbs” to be mean? Heavens, no. I’m a good Catholic-Buddhist, after all. (Oh, they exist.) What I’m referring to is the age or maturity of most companies in this sector. Research from Solarplaza suggests that most ventures were formed in 2016 or 2017, and investors at the GTM Blockchain Forum note that most founders have little to no operational business expertise. That does not mean that these young ventures lack merit. But it does make the hill to success tougher to climb. (Think steep slopes covered in poison ivy and man-sized Venus flytraps.) As Greentech Media’s Chairman observed [paraphrase]: “We see many white papers for ICOs sponsored by blockchain in energy startups. Some are are interesting. But some are sketchy.” Another panelist at a recent blockchain energy conference noted: "We're currently working with Atari, but we need to be using Playstation 4 to make most [blockchain for energy use cases] work at scale.” An investor panelist put it another way [paraphrase]: “Blockchain is today where the Kardashians were in 2008. When their name is on something, it can print money. But then smart people ask ‘Why? What businesses do they really have? Maybe a clothing line, a home video business (get it?), and a few others?’ But then you realize there is a genius marketing mastermind behind it all. The hype is, in fact, part of the cause for success.” Lastly, all hail innovation. Seriously. This is how it works: First, divergence. Second, convergence. However, we’re very far from the latter. 2. There are a bazillion use cases. And the energy world is 6-trillion-dollars big. Just in case you thought that 120 companies in the same emerging sector was a lot, think again. The Energy Web Foundation, co-led by our friends at the Rocky Mountain Institute, see over 200 potential uses cases for blockchain in energy. Even if only half of those scenarios prove to be real, that is still many, many niche markets ripe for multiple companies to do well in many geographies. Moreover, the energy industry is not a tiny pearl hiding in a small oyster. It’s more like an ocean full of 100-foot long blue whales, as plentiful as squirrels on a college campus. But seriously...no wine glass in hand...The energy market is one of the biggest industries on the planet, and it’s full of intermediaries that control the flow of electricity and money. This creates a huge playground for diverse and interoperable blockchains, distributed and trusted ecosystems of counterparties, and automated and smart contracting abilities. 3. ICOs are crushing equity investors. But that can (should?) not continue. In the broader universe of early-stage blockchain companies, ICOs are killing venture capital. I mean, like the Incredible Hulk vs. me in a boxing ring, or some such awful mismatch. However, the U.S. Securities and Exchange Commission is taking a pretty hard look at ICOs — in the past, present, and future. And let’s just say that their eyebrows are raised, you know, where one is raised higher than the other. While many ICOs have tried to avoid SEC oversight, when it walks like a duck and quacks like a duck, then...It’s a security. (If you don’t know what I mean, take a look at their guidance here.) All is not lost for conventional equity investors. Venture capital and corporate strategic investors bring value that can be far greater than capital alone. (The latter is the extent of the contribution from ICOs.) The other benefits of working with institutional equity investors include rich networks that can lead to partners and customers, insights on corporate governance based on lessons learned from dozens of past ventures, and deep sector expertise to allow for threat and opportunity recognition beyond what the core team might focus on while their heads are down building a company. Capital Raised for Blockchain Companies: Q3 2016 to Q4 1017 Equity (blue) vs. ICOs (orange) Source: CBInsights, Tokendata 4. Blockchain is not just for nerds. It’s for the C-suite.

Some famous venture capitalists have said that they look for the next big investment opportunities by watching what scientists, engineers, and other smart folks are doing outside of work, perhaps late at night or on the weekends. Blockchain may have started out that way. But today, it’s a topic that rises up to, or comes down from, the highest level in organizations — the C-suite or the Board of Directors. Why is that? One guess is that they see blockchain as a disruptive innovation focused on challenging core competencies and going outside of the box to amplify corporate synergies, finding opportunities in AI, and gobbling up low-hanging fruit. Just kidding. I was trying to use as many meaningless buzzwords as possible in one sentence. But the reality is not too far off: The top level of management is charged with finding and responding to risks and opportunities that lurk further out, beyond the blocking and tackling of tactical business execution, metaphorically crouching behind a dumpster to surprise the marathon runner in mile 20. Wrap up, Part 1: What are some things that investors love about blockchain? Blockchain-based energy companies can be attractive because...

Wrap up, Part 2: What are some attributes that investors hate...ur...worry about blockchain-based energy ventures? Investments in blockchain-based energy companies can be challenged because...

Conclusion: Is there one? OK, so like many emerging sectors for investment, there is plenty of risk and reward. But as they say, “Sitting on the sidelines is no way to win a game.” (Can you tell that it’s almost March Madness. I grew up in Kentucky and am a professor at Duke and UNC, so go blue!) As IBM put it in a recent Tweet, “We do not know where #blockchain will go, but there is a need to jump on board!” Let’s be clear about one thing. It really could have been you.

You knew about cryptocurrency way earlier than your friends. You could explain blockchain to your grandmother in less than 60 seconds. But you did not pull the trigger. Some hint of disbelief that something so newfangled and profoundly nerdy could not take over our collective financial imagination. So, here you are today with a severe case of FOMO, watching cryptocurrency values skyrocket (and plummet and skyrocket again), and your 20/20 hindsight dreams of overnight millions squashed. We are all feeling it, though funny enough, the ones that are feeling it the most are probably the ones that did invest and are riding that roller coaster up, down, up, up, down, up. Why didn’t I buy more!?!? $1,000 dollars invested in Bitcoin in 2013 would be over $300,000 today (though this could easily spike or plunge 25% just while I am writing this piece). The agony! As of this writing, Bitcoin had lost more than 60% of its value since its peak at over $19,000 in late December. Heed the crash and avoid Bitcoin like the plague, or buy low as smart investors do during an overcorrection? Again, the agony! An unintended consequence of the fervor around Bitcoin, as well as some other popular cryptocurrencies like Ether and Ripple, is the new public debate about the potential of blockchain to disrupt (!) industries other than just the financial sector. Any industry that is founded on the flow of information and money qualifies, so that’s basically everything. But is blockchain a panacea, destined to democratize data and money, all the while disintermediating the entrenched intermediaries that dominate the global economy? Of course, there are camps firmly planted on both sides of that debate. I am not here to stake my flag on one side or the other. Rather, I aim to take a sober view of where blockchain may actually be the revolutionary technology that it is touted to be, and where it fails to live up the hype. Before we get started, there are any number of awesome explanations as to what blockchain is - see here (PwC) and here (IEEE) for two of my favorites. Here is my heroic attempt to distill blockchain to its bare bones essence:

That sounds kind of revolutionary, so what am I missing? At its core, blockchain is most suitable in contexts in which data transfer (communication) is challenging, trust and privacy is highly valued, and data security is paramount. Again, this sounds like virtually everything that takes place on the Internet. This comes to bear primarily in two places: (1) the increasing number of unwieldy, siloed data systems that are highly susceptible to cybersecurity issues (e.g., see here for the 17 biggest data breaches in the 21st century) and (2) markets that are hampered by unnecessary inefficiencies, limitations, and complexities due to costly intermediaries. Seen through this lens, the energy sector is an excellent test case to take a deeper look into potential applications and pitfalls of blockchain technology. Sounding the Emergency Horn for Energy Monopolies The electric grid is arguably the most impressive technological achievement in the modern world. At the very least, it is certainly one of the most impactful to our everyday lives. The extraordinary cost and complexity of the electric grid initially lent it to monopoly protection by governments seeking order and control over its development and management. The last several decades have seen the unraveling of the heavy regulation supporting electric utility monopolies in many areas of the world, which have given way to more competitive markets in which many different types of energy providers, generators, and other service providers vy for customers. This has opened the floodgates to a much more diverse set of actors engaging in energy transactions via the grid, yet antiquated regulation and entrenched utility interests still limit the ways in which producers and consumers can transact for power and energy-related services, especially micro-transactions. Blockchain applications in the energy sector are positioned squarely at the crossroads of deregulation and the empowerment the market participants (e.g., consumers, prosumers, generators, etc.). Consumers and producers can form a more direct relationship with each other using blockchain technology wherein smart contracts (very smart) are used to transact for power and other grid services. As direct procurement and contracting scales, the role of the electric utility may be relegated to managing the transmission and distribution infrastructure, which, in many markets, would be a significantly reduced role in the functioning of the market. (Gulp.) This simple example may naturally lead you to conclude that peer-to-peer (P2P) energy trading is the inevitable future for the energy sector. Imagine you have excess rooftop solar generation you would like to sell your neighbor across the street -- the blissful life of the prosumer. This fanciful scheme is actually being tested and enacted in a small number of demonstrations. However, for reasons that we will get into shortly, P2P energy trading is neither the most likely nor nearest-term viable application of blockchain technology. Where Blockchain Finds its Groove in the Energy Sector Let’s start with the good news. The ballyhooed explosion of cryptocurrencies, which has fueled the popularity of blockchain, is not the only game in the energy sector. There are a wide range of applications from energy trading (e.g., grid management, microgrids, wholesale and P2P trading) to asset management (e.g., data collection and processing) to renewable energy certificate tracking to mobile payments (e.g., electric vehicle charging), among many others. To say that there has been an explosion of emerging companies in this space in recent years would be an understatement. But how many companies have a legitimate product, and, importantly, a viable market application with willing [and ready] customers is an entirely different question. Most energy and blockchain companies still bask in rose-tinted fields of possibility, while precious few have deployed a commercial product beyond demonstration projects. Not to despair, we are still in the early stages. But neither does that mean that this process of innovation and experimentation will inevitably lead to a wholesale disruption (!) of the electricity sector. As with many prognostications (especially related to technological innovation), please take my ranking of energy + blockchain applications in order of their long-term viability and timing to market with the requisite grain of salt: