|

U.S. Energy Law and Policy Lead, IronOak Energy Capital Associate Dean for Academic Affairs, Hugh B. Brown Presidential Endowed Chair in Law, and Presidential Scholar, University of Utah What do you do within the renewable energy sector and why is it essential?

My work focuses on law and policy analysis for renewables and other clean and emerging energy technology sources. It is an extraordinarily exciting time to be working in this area. Law and policy for renewable energy are moving fast; they need to. The sector is rapidly evolving, and the old rules of the game are quickly being changed. Can you describe 2 of your most impactful past projects or engagements? Last year, Sanya Carley and I conducted an assessment of the factors that led to changes in the net metering laws in Nevada, compared against other jurisdictions that have considered moving away from net metering but decided not to. This work has been very useful, I think, to those concerned about what is going to come next in rooftop solar, and where possible solutions might be found. I have also provided analysis to the Korean government about green growth as well as about how feed-in tariffs and renewable portfolio standards function. That experience was very rewarding. What are you most excited about for the renewable energy industry in 2017-2018? Opportunity. I think that’s what this year holds first and foremost. There is opportunity emerging at every turn as prices for different technologies continue to fall, as the public becomes increasingly interested in participating in the energy sector, and with the promise of new infrastructure across the nation. States like Nevada are looking to build electric vehicle corridors. Rooftop solar has transitioned from a minority position to a major player. And there are so many more opportunities that are only now emerging or are about to. In these and other opportunities that we cannot yet see, there is significant potential for the renewable energy industry to contribute—to change the way we make energy, to improve the security of our nation, to help forge new paths forward. For those of us who work in the industry, that makes these very exciting times. Our task is to capitalize on these opportunities—to be leaders and innovators. What are you most concerned about for the renewable energy industry in 2017-2018? Uncertainty. We already were living in quite uncertain times, and that uncertainty has only heightened as the new administration has assumed office. Conventional wisdom is that national efforts to curb carbon emissions are likely to be allayed—or evaporate—but exactly how and when that will happen remains to be seen. At the same time, energy is often a more bipartisan issue in Washington, D.C. than other topics, so there is good chance there will be federal legislative movement on energy this year. Meanwhile, the states have been very active in their own right, and I only expect that to continue. While uncertainty is always difficult to deal with, it also opens doors for new and innovative solutions. So, while the uncertain times of today of course concerns me, I remain eager to help find those solutions going forward. What is one trend in the renewable energy sector that few are paying attention to? Breadth and diversity. I think many people view the renewable energy industry as one particular thing, when in fact that is not true. Both the scope and the differences within the industry are wide, and important. Renewable energy is not just wind or solar or distributed generation. It’s that but a lot else as well, including large centralized projects, storage, and a million other imminently creative solutions that are not receiving adequate attention, are just emerging, or are not yet discovered. Why does renewable energy law and policy matter? I can’t emphasize enough how important it is that every part of the renewable energy industry works together. What this industry is really building is a massive, new, emergent ecosystem. So law and policy cannot get lost in that mix, just as finance, engineering, sales, and every other part of the industry can’t be forgotten. It all goes together; it all relies on each other. Law and policy set the ground rules for the game—and they can and do change, and can be influenced by those who must play within their constraints. What has surprised you most about your career in the renewable energy sector? In my prior career, I represented (usually large) investor-owned utilities. That knowledge is extremely useful, because the clean energy industry is growing in a world that the historical vertically integrated utilities created. There is also much room for synergies between that part of the energy industry and the renewable energy industry itself. Synergies matter. And they are available. What are 1-2 pieces of advice you would give someone thinking about entering the renewable energy industry today? Buckle up. It’s a fun ride, but there is no question you’ll go fast. In many ways, what we are working on today is really a project in building the future. Transportation Innovation Lead, IronOak Energy Capital Founder, CBC Consulting (Global Transportation/Technology Consulting Firm) Board Director, Association for Commuter Transportation What do you do within the renewable energy sector and why is it essential?

I am the Founder for CBC Consulting, a global transportation technology consulting firm. We work with cities and transportation and technology organizations around the world. Our focus is to advance new transportation and municipal infrastructure options that are energy efficient and designed to deliver better mobility and living experiences. Examples include the high speed air/surface transportation options, drone travel, autonomous transport movement, municipal electric vehicle programs, electric buses/trolleys and more. Can you describe 2 of your most impactful past projects or engagements? I had the opportunity to be on the Vulcan/USDOT Advisory Council for the Smart City Challenge project in 2016 that promoted smart city planning in 80+ cities across the US. This project emphasized a reduction in greenhouse gas emissions in municipal energy grids, the advancement of electric vehicle programs, the launch of alternate transportation options (bike share/EV buses/trucking) and new energy options for cities (wind, solar and hydro power). This project spurred a whole new wave of smart city planning/investment in the US that continues today. Our firm also developed the first self-driving vehicle simulator comprised of a 3D printed electric vehicle and fully-immersive autonomous vehicle driving experience. We deployed our self-driving vehicle simulator in Seattle last year and have plans to bring this simulator to other facilities/markets in 2017. Our objective is to help educate the public on what it will be like to travel in self-driving vehicles and to gain some insight into the future of vehicle manufacturing - highlighting alternative manufacturing materials that promote energy efficiency and environmental sustainability via recycled vehicle platforms. What are you most excited about for the renewable energy industry in 2017-2018?

What are you most concerned about for the renewable energy industry in 2017-2018? The Paris Climate Meetings in late 2015 represented a groundbreaking moment for the future of renewable energy adoption. The gathering of 183+ countries and the subsequent agreement to reduce greenhouse gas emissions in order to achieve a 2-degree Celsius reduction in global warming was a huge first step toward reducing fossil fuel consumption around the globe. The outcome of these meetings was a global recognition that change is required in our energy production and consumption. Fast forward to February 2017. We are now seeing the Trump Administration signing executive orders to reverse advancements in alternative energy measures in favor of traditional coal, oil and natural gas exploration. Executive orders to approve the development of the Keystone Pipeline, the Dakota Access Pipeline and renewed shale fracking represent a stark reversal in earlier federal policy intended to promote renewable energy adoption. None of these Executive Orders align with the goals of the Paris Climate meetings and represent a roll-back in US GHG reduction goals. In addition, the Trump Administration has proposed the removal/reduction of EPA standards and guidelines that impact air quality restrictions for coal facilities and pave the way for a renewal in coal exploration. Lastly, the new Department of the Interior is being urged by the Trump Administration to reduce restrictions on offshore oil exploration and oil fracking operations by now allowing possible access to federally protected land for more energy exploration. None of the above activities help encourage renewable energy, better air quality, responsible management of federally protected land and a general focus on improving the environment. What is one trend in the renewable energy sector that few are paying attention to? Advancements in Graphene over the last 2-3 years are introducing new possibilities for renewable energy via hydrogen energy, kinetic energy and other fuel cell options. Graphene has the potential to be a real game changer in energy, industrial manufacturing, medical research, consumer electronics, transportation and more. Why are you motivated to do you what you do? The global warming trends of the last 10-15 years clearly cannot continue without causing irreversible harm to our environment, our long-term quality of life and our ability to sustain a planet that can support a rapidly growing population. The adoption of renewable energy measures is not a fad or trend but truly a recipe for a sustainable environment that balances growth with responsible resource management for generations to come. What has surprised you most about your career in the renewable energy sector? I never thought I’d see the day when solar energy could power an entire airport in India. Nor could I envision that a car could be 3D printed, equipped with an electric motor and driven down the street. The advancements in new technology and energy are changing how we move around the planet in ways I never thought were possible. What are 1-2 pieces of advice you would give someone thinking about entering the renewable energy industry today? The renewable energy market is a gold mine of opportunity. This market represents perhaps some of our biggest potential breakthroughs in energy development, transportation, medical research, clean water options and urban development. What do you do within the renewable energy sector and why is it essential?

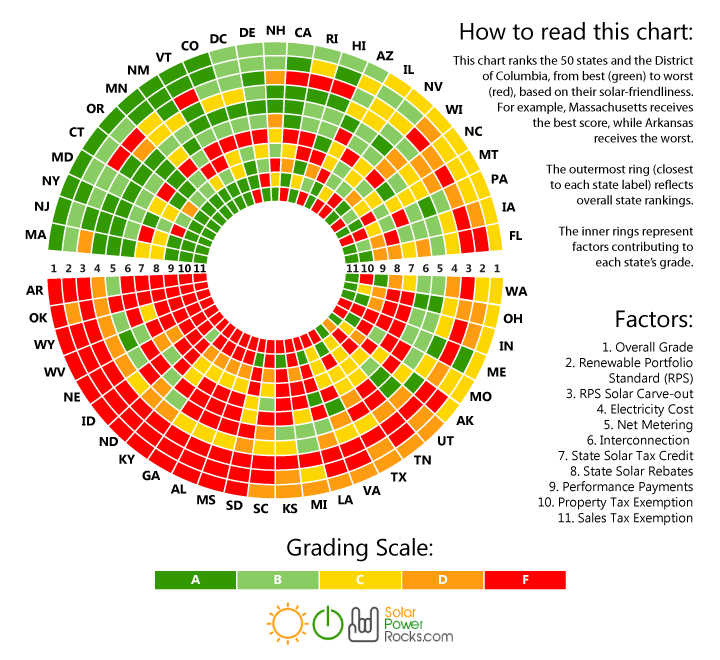

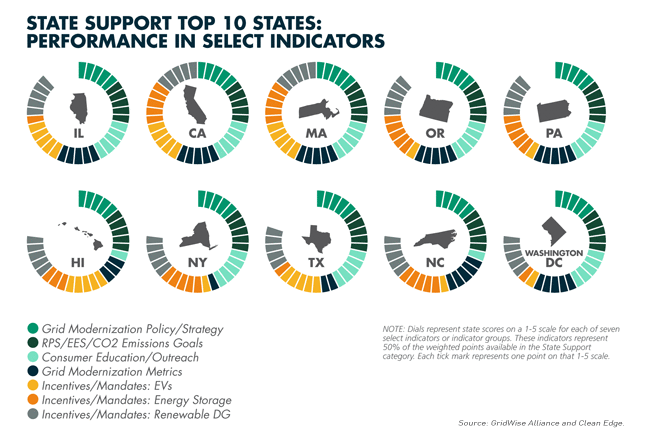

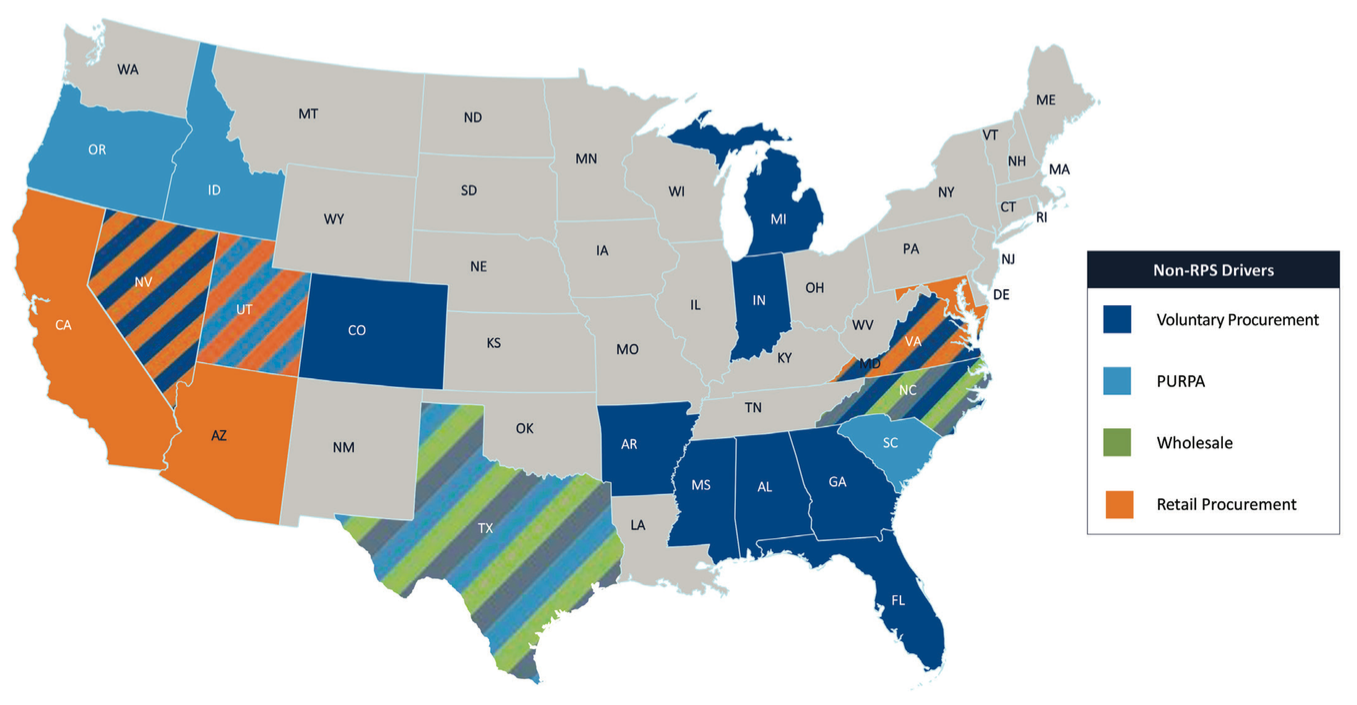

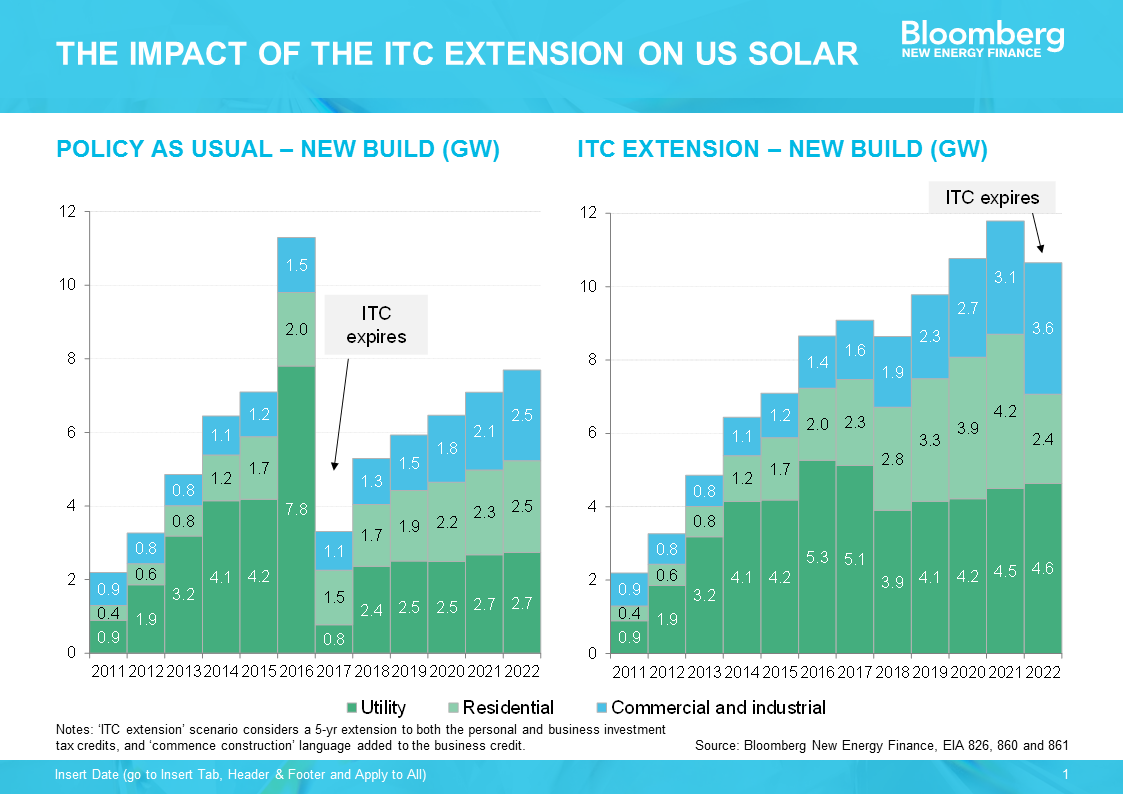

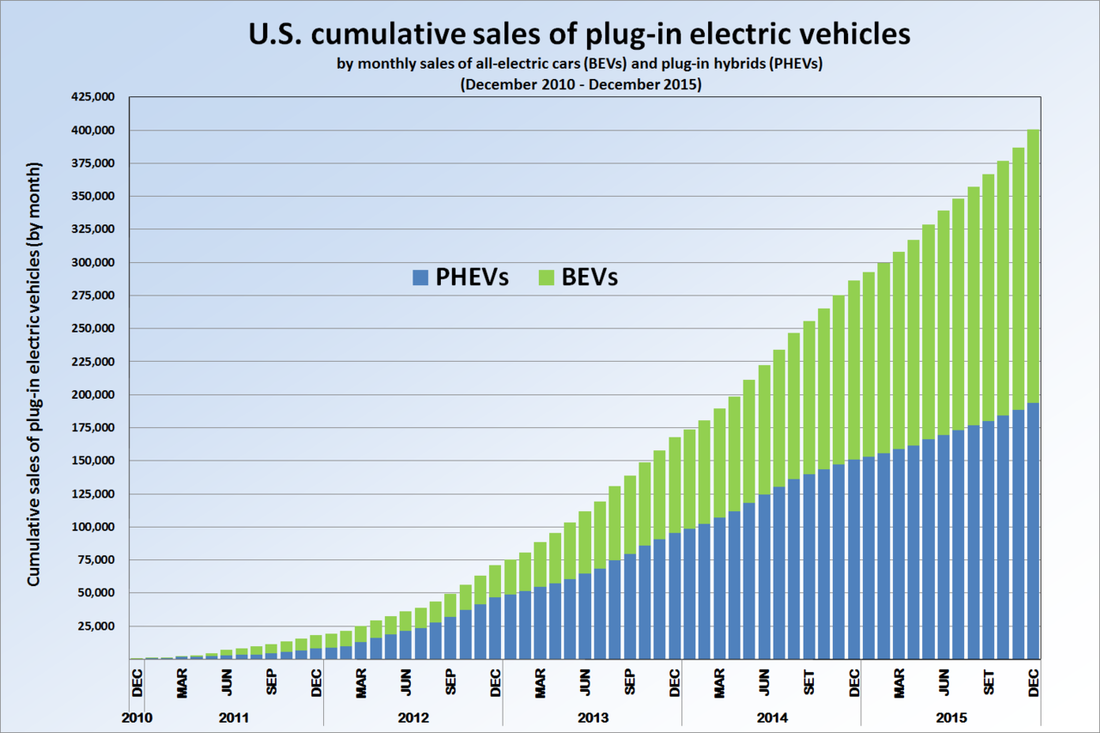

I help renewable energy (i.e. solar, storage, efficiency, etc.) business owners sell their companies by running a process to find the right buyer at the optimal purchase price. A healthy M&A market is an essential tool for companies looking to achieve scale and for equity-holders to realize returns on their investments. Can you describe 2 of your most impactful past projects or engagements? Leveraging Duke Energy’s acquisition of a wind energy services business to expand the company’s service offerings to other wind energy asset owners. Co-leading the 2014 Duke Energy NC Solar RFP and successfully acquiring 128 MW of solar projects and signing 150MW in new purchase agreements. What are you most excited about for the renewable energy industry in 2017-2018? I am excited to support the rapid maturity of wind and solar businesses in the market. As companies continue to consolidate with one another, the efficiencies gained will further drive down the costs of renewable energy installations making them more and more competitive with traditional fossil fuels. I am also confident that over the next two years the renewable energy industry will continue to shock and awe with dramatic increases in installed capacity of matured technologies and with its pace of innovation. What are you most concerned about for the renewable energy industry in 2017-2018? Policy or rather “bad” policy is always a concern for stewards of the clean energy industry. Uncertainty in any market can slow growth and stifle innovation. I am concerned about the resistance in the renewable energy industry for there to be winners and losers in terms of the types of technology and methods of deployment that win the day. If the industry tries to advocate for everyone to be a winner it will result in sub-optimal policies. Encouragingly, the renewable energy industry has time and time again proven its resilience to political uncertainty and I think is well on its way to being even less dependent on the whims of elected officials. What is one trend in the renewable energy sector that few are paying attention to? I think the trend of EVs becoming closer and closer to mainstream is sometimes lost in the noise created by Tesla, as if the whole EV industry depends on Tesla succeeding. At one point, I would have agreed, but now I see daily announcements for new EVs by all the major manufacturers and the cars actually look good. It feels like EVs are finally becoming mainstream enough that most consumers won’t see them as weird spaceships but rather consider them a viable, affordable, and attractive alternative to a gas-powered vehicle. Why hire an investment banker to sell your business? For the same reasons you would hire a lawyer to write an operating agreement or an accountant to do your books, you want experts to help you with non-core competencies. All we do as an investment banking firm is sell companies so we are good at it and know the pitfalls, the same way a good solar developer knows the permitting traps to avoid. What has surprised you most about your career in the renewable energy sector? I have been surprised by how much finance played a role in the success of the industry. The renewable energy economy has been built on innovations in financial structures sometimes for better or for worse (remember yieldcos). What are 1-2 pieces of advice you would give someone thinking about entering the renewable energy industry today? As a theater major, I never thought I would end up being an investment banker with a career in renewable energy. I am a testament to the fact that there are many paths to the same place. My advice to someone would be to try something scary, don’t get stuck in your comfort zone. 1. Have no delusions about policy risk -- it exists, but it is not unique to the solar market It is not an uncommon stance for private equity investors to claim that they will not enter markets with “policy risk.” Being someone trained in economics, this statement comes across as somewhat strange, bordering on naive. Markets are policy constructs. There remains some secular ideal of a free market without government or policy intervention. While this may exist out in the far reaches of less formal economies, it is wholly inapplicable to electricity markers. The policy landscape defines the contours of where and what kind of solar development can take place and where capital can be deployed with the reasonable expectation that it can meet investor hurdle rates. Ignore policy at your own peril. The most enterprising investors are constantly searching for ways to anticipate markets movements largely through the lens of policy. That said, if there is anything that will put a damper on sustained investment activity, it is policy uncertainty. And that pertains to everything from state-level mandates to utility-level interconnection practices to local land use planning. While it is relatively easy to have a clear view of the state-level policy, it requires much more on-the-ground knowledge of utilities, permitting agencies, and landowners to really discern where the most productive spaces to invest are. 2. The states rights debate emerges in the electricity market It is easy to assume that the biggest energy-related issue at stake at the federal level is the Clean Power Plan. Of course, whether the CPP makes it through the Trump administration’s grinder is a matter of no small importance, but let’s just say the odds are not in its favor. It’s a shame, as the CPP was never really given a chance to shine (pun intended). There is a larger structural issue at stake concerning federal vs. state jurisdiction. States used to control most of the electricity market regulation, but has started to cede authority to FERC as the electric grid has become more regionalized, interstate electricity markets have formed, and and transmission development issues have cropped up. Yet again, the age-old story of federal vs. state rights comes to bear its head. States have lead the charge with RPS mandates, various compensation schemes for distributed resources such as RECs, implementation of PURPA, and a host of competitive policy issues. And, as any clever investor or developer knows, this has created a remarkably vibrant but fragmented investment landscape for solar in the U.S. FERC is left to argue over who is responsible for creating a coherent picture of this vast mosaic of policy approaches. Left to their own devices, states will forge ahead with their own plans and policies. But that will not necessarily suffice when trying to address regional and national resource adequacy, generation mix, and transmission concerns. Keep an eye out for more rulings on how the energy transition will be governed and regulated at the federal and state level. Especially for states that are behind the curve, so to speak, it will be really impactful on how utilities are regulated and where new emerging markets for solar development and investment emerge. (Source: SolarPowerRocks.com) 3. Grid modernization is essential (and cool sounding), but it’s still going to be a bumpy road The New York REV program gets a lot of love, but don’t forget about California, Massachusetts, and Maryland, among others. Each is whipping up a unique secret sauce to address a docket of issues surrounding utility structures and incentives and the integration of distributed energy resources (DERs). At a high level, efforts such as these will ease the path to higher penetrations of renewables, a long-standing (and perhaps specious) contention of renewable opponents and skeptics. More importantly, these policy initiatives aim to create a more cooperative and predictable environment for developers to build projects and investors to deploy capital in the solar sector. Developers are always interested in more (low cost and patient) capital and high quality pipeline. But, increasing their Christmas wish lists include more certainty and predictability in navigating the increasingly gnarly regulatory landscape. If there is any simple heuristic for forecasting new solar markets, it is where grid modernization processes are underway. If it only were so simple. Where modernization makes developers and investors a little uneasy is how new DER compensation schemes are going to change the value of their development assets and operational projects. From a technical standpoint, it makes all the sense in the world to treat DER according to the value it contributes to the grid. By no means is this easy or straightforward, but there is some logic to doing it. But it is an entirely different matter to get investors comfortable with underwriting projects with significantly different revenue streams. Underwriting solar projects is something that the industry has become quite adept at, and there will be some reluctance in adapting to entirely new structures. If this comes to pass, and we are no longer in a solar world dominated by simple PPAs, then the most enterprising investors will need to lead the charge on how to finance these projects. (Source: Clean Edge) 4. PURPA has been a cornerstone in the solar market, but watch out for potential attacks. The Federal Public Utility Regulatory Act, otherwise known by the attractive sounding acronym PURPA, far preceded the solar industry as we know it today. Dating back to 1978, this policy lay relatively dormant for many years before becoming a key driver of growth in small utility-scale markets in many states. North Carolina can attribute its high ranking in terms of operating solar capacity - #3 as of 2015 - in great part due to PURPA projects, also known as qualified facilities (QFs). For years, this had been perhaps the best example of a market with low policy risk because the law mandates that utilities purchase electricity from small-scale generators at (or close to) their avoided costs. Developers could count on relatively predictable PPA rates and terms for their projects, which smoothed the way for scaling development and investment quickly. Many very successful developers got their start in these markets, and many investors could deploy large amounts of capital into portfolios of essentially identical projects, thereby reducing transaction and financing costs. But recently, many utilities in many states -- here’s to you North Carolina, Montana, Utah, and Oregon, among others -- have made efforts to slow activity in the PURPA market. Before you get your hackles up, let’s pause for second to consider how woefully unprepared many utilities were for the onslaught of QF development activity once solar costs dropped low enough to have projects pencil for investors. It is not altogether unreasonable that the PURPA market be reconsidered, as it might not be serving the purpose for which it was originally intended. That said, the disruptive tactics being used by utilities to cool the PURPA market have created a contentious environment. The risk and uncertainty surrounding the future of this market has undermined years of effort and investment on the part of developers and investors. (Source: GreenTech Media) 5. Is solar ready to wean its from the ITC? The time might be sooner than you think. Lest you thought that I was going to skip over perhaps the most important incentive in the solar industry, here are my two cents on the ITC. First of all, weren’t we just here? I recall at the end of 2015 all the consternation over whether the ITC would be extended beyond 2016. We poured over what-if scenarios like the one from BNEF below. We were all in store for a blitz to the ITC finish line at the end of 2016, and, lo and behold, Congress passed an extension just before holidays. That led to some interesting dynamics in 2016, as some solar development that was slated for 2016 ended up being pushed into the future. But, all in all, the solar industry thrived in 2016, and business-as-usual was the expectation through the early 2020s. Given the proliferation of fossil fuel industry proponents and climate skeptics entering the new administration touting the “all of the above” energy strategy as their cornerstone approach, it does call to question whether the ITC is as safe as we thought it was just a short time ago. On the one hand, the solar industry has, with notable success, achieved bipartisan support from the bluest to the reddest states. Solar job creation is an unadulteratedly positive story that few can dispute. On the other hand, there are many Republicans that would love to cut government subsidies of all kinds, regardless of the public good that they might provide. Moreover, there is some momentum behind the idea of a large tax reform, which might lead to a reconsideration of the ITC, among many other tax-related subsidies. Is the solar industry strong enough to survive without the ITC? Clearly, yes. But not everyone, and not all markets. There are many investors who would not lament the elimination of tax equity from the capital stack. But make no mistake, it would be a rude awakening to abruptly end the ITC. I would not put my money on that happening. The cost is modest and there is a sunset clause already in the policy to limit long-term government liabilities. But I cannot, in good faith, make any strong predictions, so be prepared for anything. (Source: BNEF)

By: Dr. Chris Wedding, Managing Partner 1. Investor interest in energy storage is high — perhaps irrationally high Enthusiasm around the energy storage sector is more feverish than ever. This is simultaneously encouraging and concerning. Important questions remain. Here are a few:

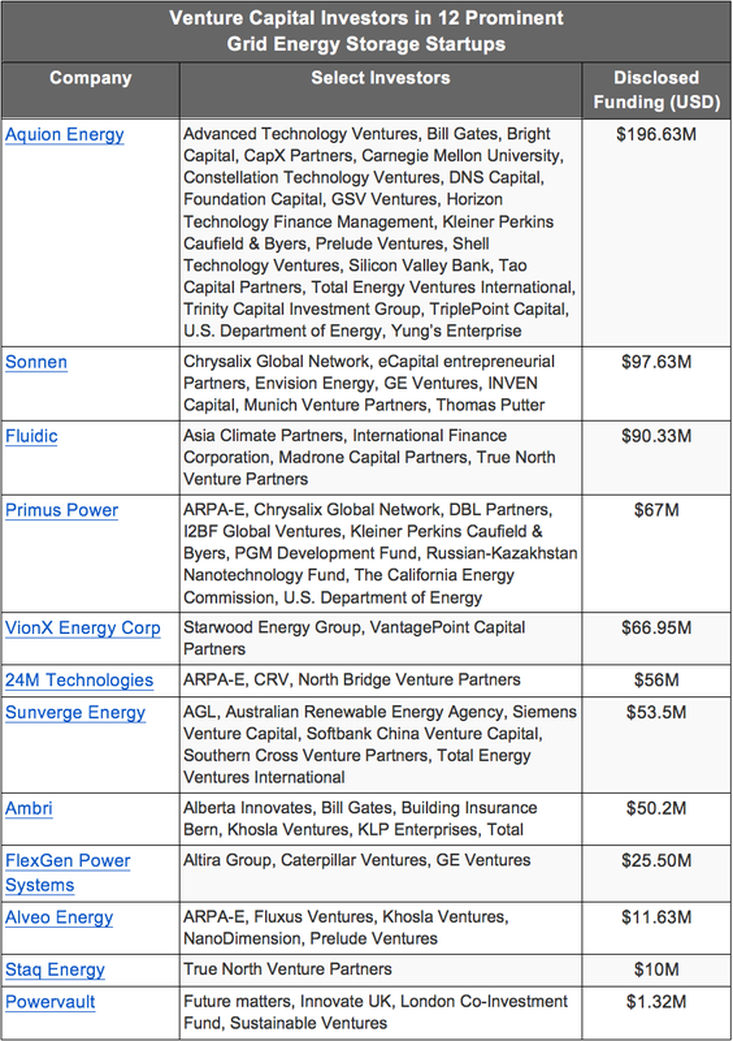

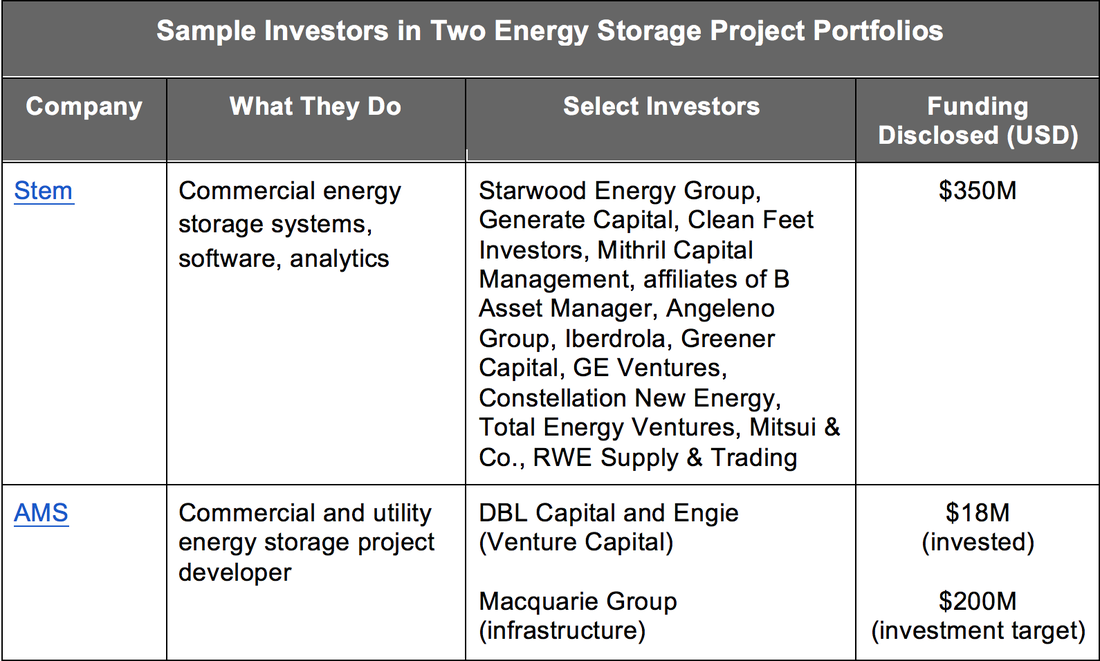

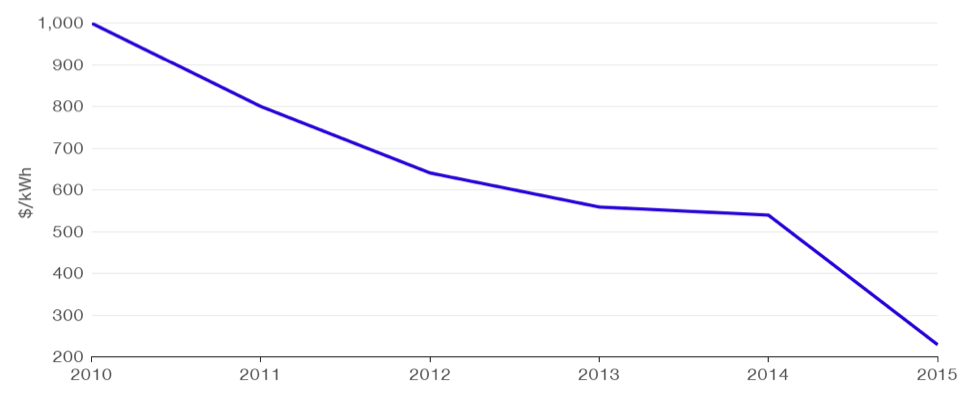

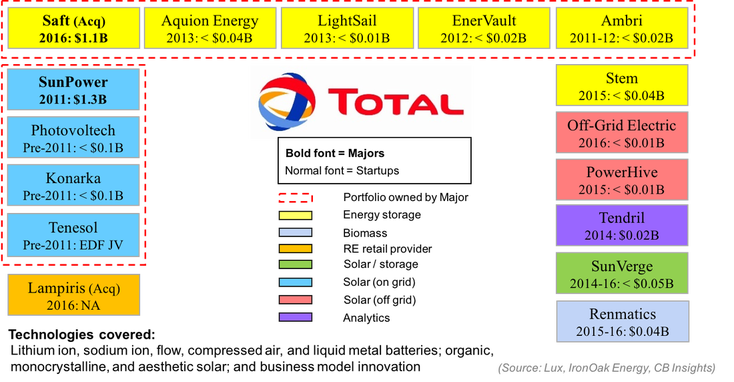

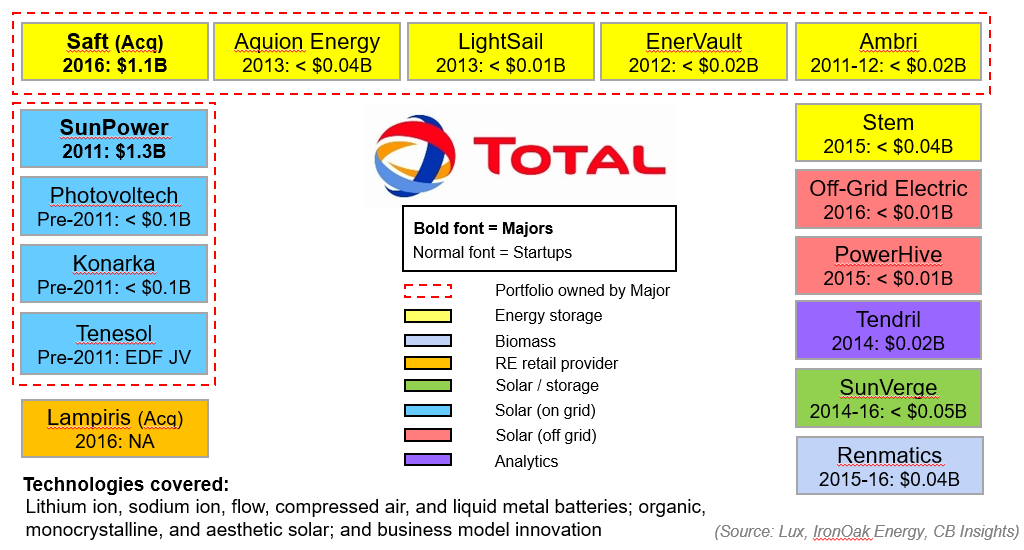

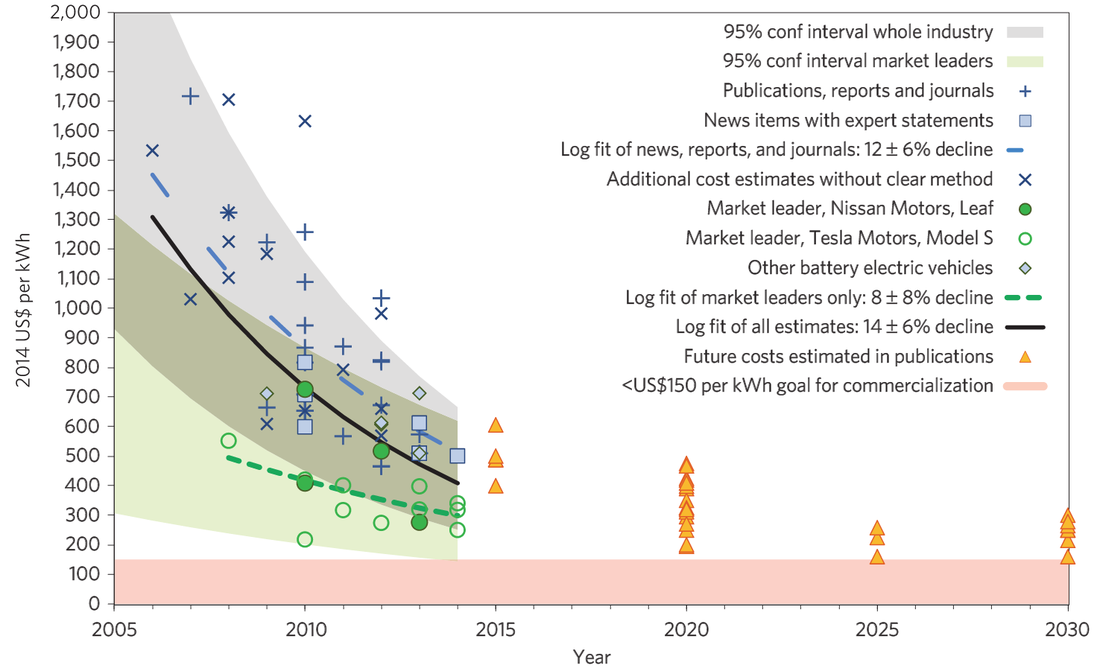

Despite such rationale thinking, many investors want in on the action. Consider the statistics below from the website AngelList, a trusted resource for angel and venture capital investors. 2. Most battery investors are angel and venture capital investors — for now Technology — both software and hardware — are today’s investment focus. As such, angel and venture capital investors drive this discussion. The table below from the witty and savvy data scientists at CB Insights offers a great summary of who’s investing in energy storage technology. (Source: CB Insights) 3. Project financing for batteries is coming — albeit slowly Given the industry’s youth, examples of infrastructure investment in this sector are hard to find. However, energy storage projects, not technology, will receive the vast majority of capital in the years to come. Let’s look at two examples of investors deploying capital for battery project finance. The table below is compiled using data from the good folks at GreenTech Media and Crunchbase. (Sources: GreenTech Media, CrunchBase) As the costs of batteries continue to fall roughly 10% per year, and as technology performance and warranties improve, more debt and infrastructure investors will get into the game. Bloomberg’s graph below illustrates how fast prices have fallen for batteries used in vehicles. Cost Decline for Electric Vehicle Battery Packs: 2010-2015 4. Oil and gas majors want a piece of the energy storage opportunity As an article at OilPrice.com put it, “Who cares why the [global] temperature is rising?” Said differently, regardless of where an individual, investor, or company stands on the issue of climate change (**), the opportunity to profit from the shifting global energy mix is very attractive, if not historic. Consider McKinsey research which projects that the global energy storage market could be worth $90B to $635B by 2025, depending in part on adoption of electric vehicles. Or take a look at the figure below illustrating how Total, one of the world’s seven supermajor oil and gas conglomerates, is investing in energy storage, amongst its broader renewable energy investments (e.g., 66% ownership in solar powerhouse SunPower). Total’s Investments in Energy Storage and Other Renewable Energy Other oil and gas giants are also making bets on energy storage, such as:

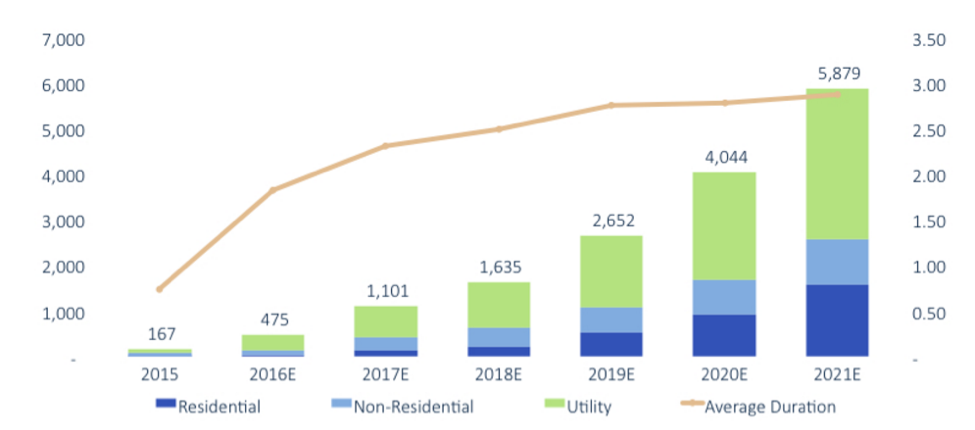

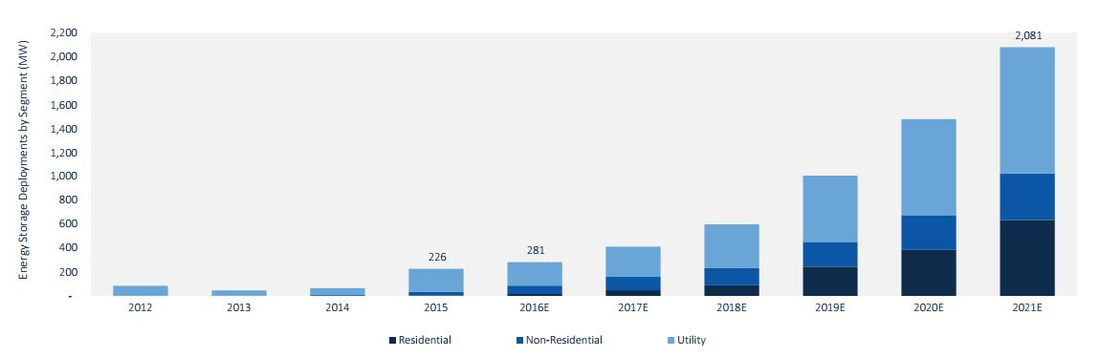

** We are not climate change scientists, but we defer to those who are: According to the US federal government (NASA), over 97% of actively publishing climate scientists agree that climate change over the past century is extremely likely due to human activity. Moreover, at least 18 of the world’s leading scientific organizations (e.g., US National Academy of Sciences) have issued public statements endorsing this position. 5. Lithium batteries are not the (only) opportunity When I speak to investors about the energy storage market, many are worried about technology risk. While the Energy Storage Association tells me there are over 70 battery chemistries being tested or deployed, research shows that there is just one dominant family of battery chemistries. Lithium-ion batteries made up 96% of all batteries installed in the US in 2015. More importantly, as the market demands batteries with longer duration, installations may shift away from lithium-ion, which are typically discharged in increments of seconds and minutes or perhaps two hours, to longer duration batteries, such as flow batteries. GreenTech Media’s projections below illustrate how investors may want to think about growth segments and technology as the market shifts from largely utility-scale installations to almost half of storage deployments taking place behind the meter. US Energy Storage Installations (MWh, left) & Battery Duration (hours, right): 2015-2021E (Source: GreenTech Media)

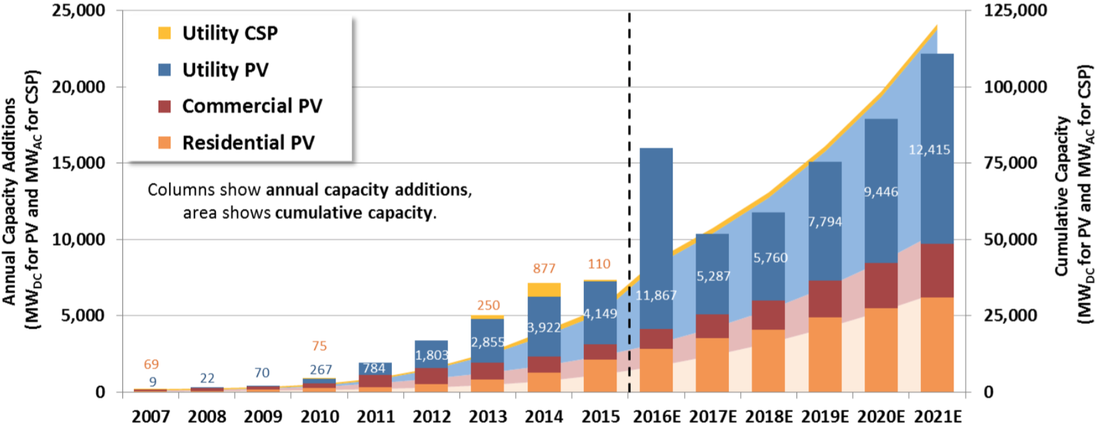

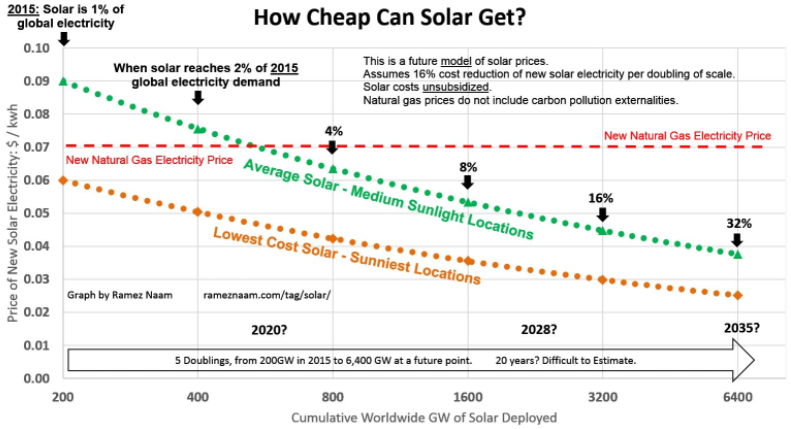

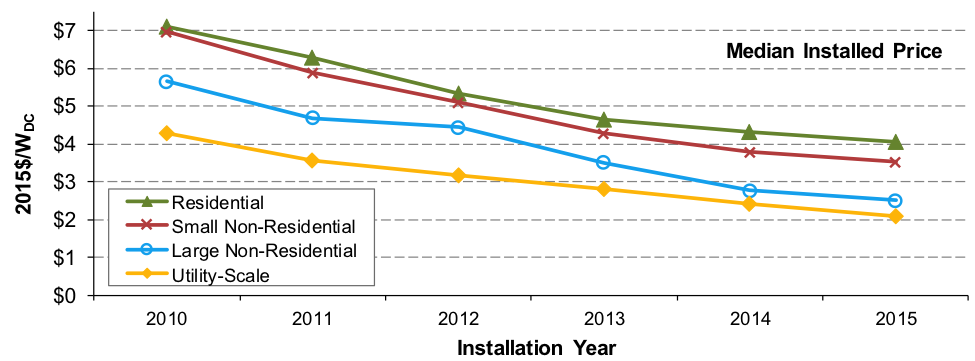

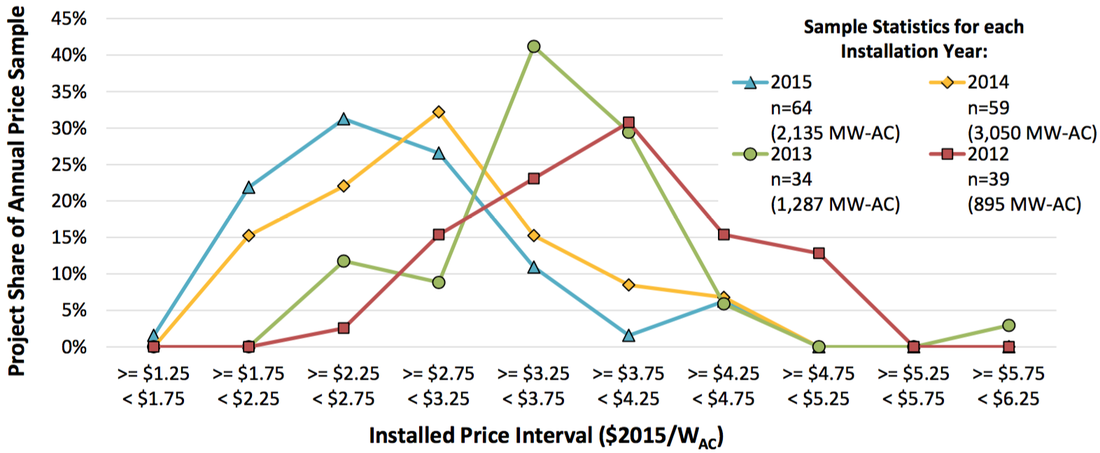

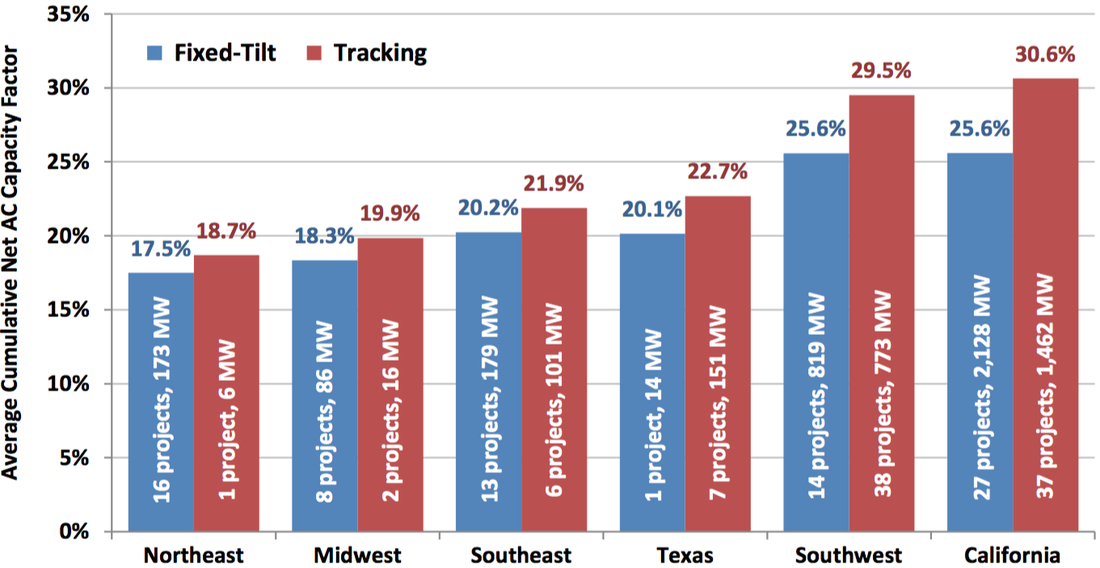

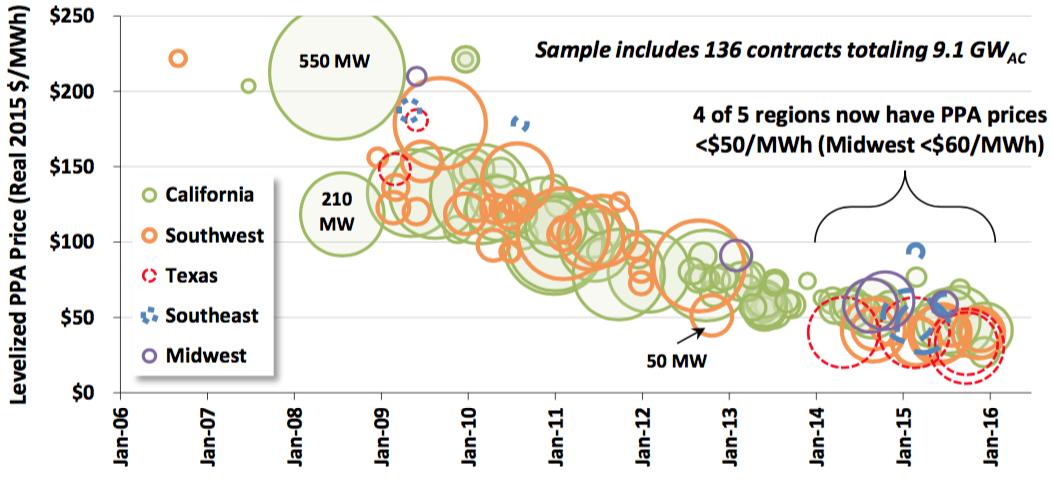

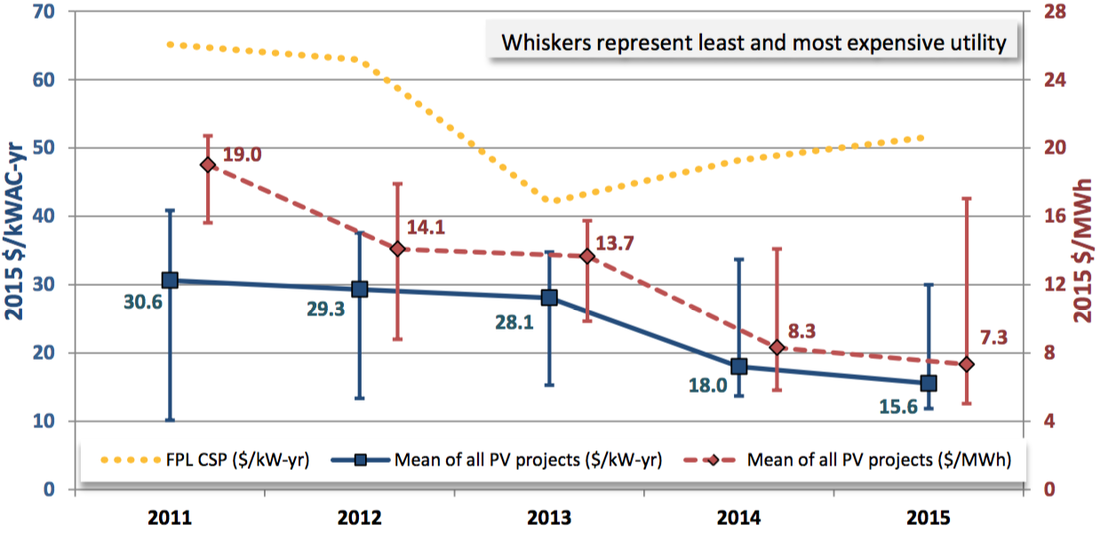

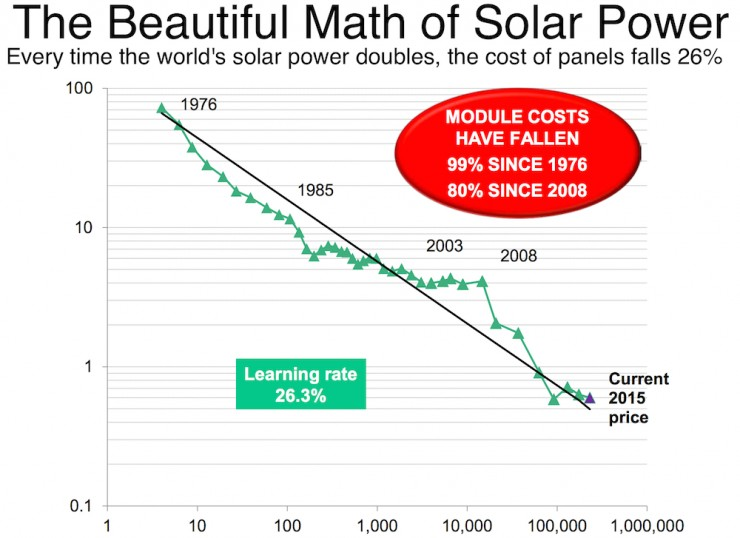

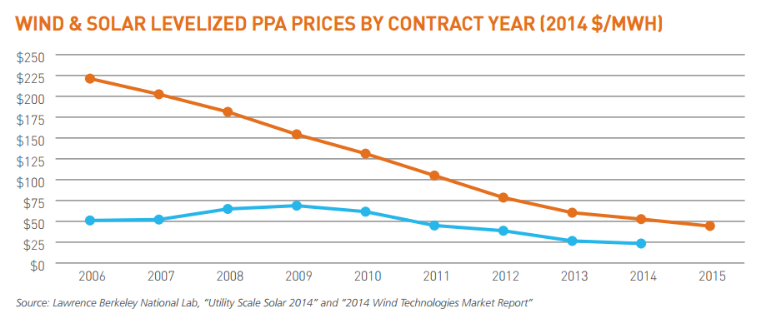

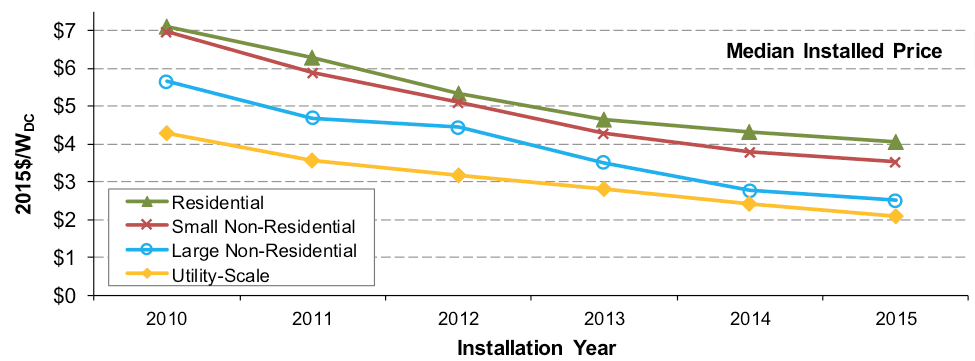

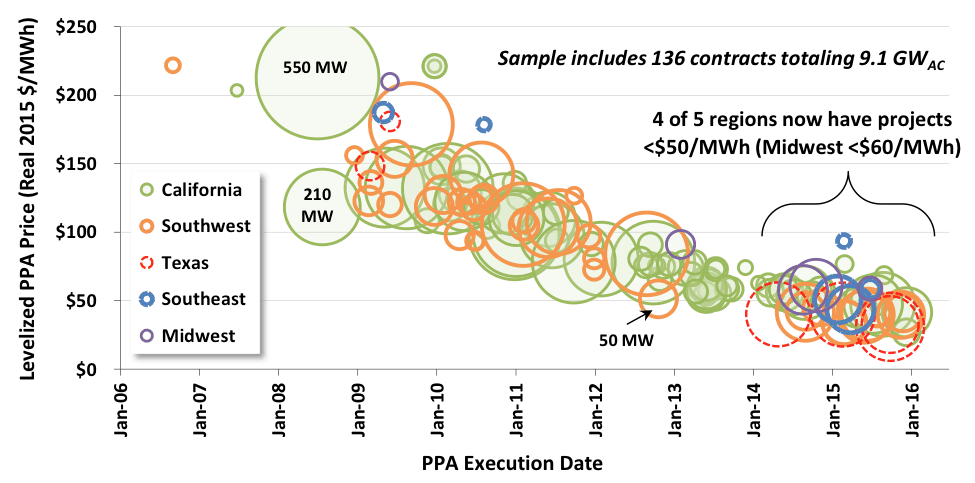

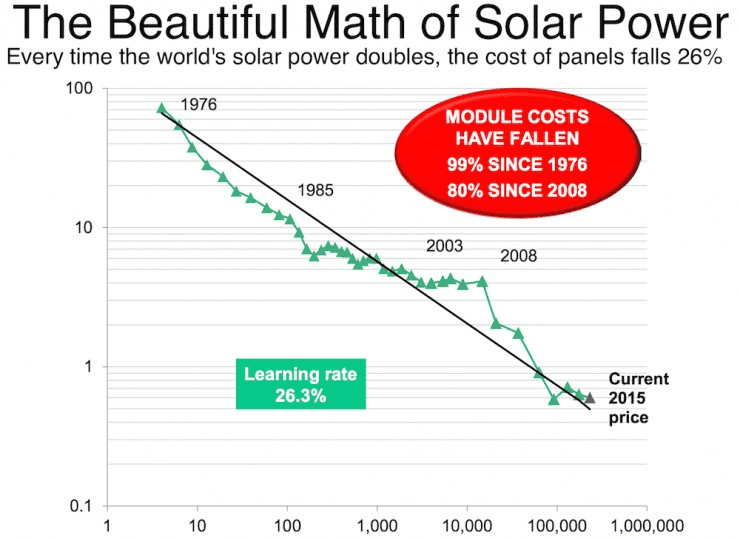

Conclusion If industry soothsayers are correct, and the energy storage market today is where the solar market was in 2005, then we could see substantial investment opportunities in this sector. But do not jump in with both feet. Warranties, balance sheets, developer assumptions on revenue and cost, track record, and policy enablers all require an extra set of eyes. (And, yes, we would be happy to help on that front.) 1. Growth in solar is pushing costs down the virtuous path of technological learning If you consume any media or analysis on the solar market, you have undoubtedly seen many graphs like the one below. That sweet exponential curve has driven much shift in investor attitudes about and activity in solar. It is likely a relief that you are no longer a pariah when you bring up solar at investor conferences. Solar has been one of the fastest growing sources of electricity (along with wind and natural gas) since 2010. (Source: GTM / SEIA Solar Market Insight Reports, LBNL Database) But the real beauty in the growth of the solar market has to do with technological learning, or the predictable cost decreases that result from increasing “experience” with the technology. Most technologies exhibit the pattern displayed below. Growth in the development (or usage) of a technology unlocks a hidden treasure trove of reductions in cost, which further fuels the positive feedback loop generating more development growth. And so the march goes on. The graph below shows the reduction in the price of solar electricity, which is one measure of cost. We are going to dive into some others. The brain tickler is what the rate of cost reductions will be moving into the future. Even though solar has experienced an unexpectedly rapid reduction in costs, many predict this trend will not abate for some time. (Source: Ramez Naam) 2. Just because solar build costs are cheapest in utility-scale does not mean that is where the best risk-adjusted returns are The undiscerning investor may jump to conclusions - utility-scale solar must be the best bang for the buck because it is the cheapest. But you would be only partially right (and sometimes mostly wrong). While utility-scale solar is now consistently being installed for less than $2.00/W, this is the market where we are seeing the lowest per kWh revenues, as utilities are getting a bit less generous with their PPA terms (more on that later). But the projects are big and relatively standardized, so the investment profile is still attractive to many investors. Commercial (here referred to as non-residential) solar is a tantalizing market in that it can present an attractive investment profile, but often with some funky (e.g., heterogeneous) risk characteristics. You can find some appealing portfolios of projects above the 500 kW threshold, but there are a whole suite of idiosyncratic risks associated with the offtaker, EPC, etc. Only the brave (and smart) are wading into vast expanse of untapped opportunity in commercial solar, and with some considerable success. Watch out for the leading actors in the space. (Source: Scientific American) 3. Averages are useless - smart investors think in terms of distributions It is all too easy to think of solar as a monolithic industry, but that would be missing the story beneath the headlines. Distributions are the key to understanding market trends, and identifying areas ripe with opportunity. The graph below tells a story of market convergence. Most projects are achieving similar build cost performance over time. If you are presented with a project with all-in build costs above $3.00/W, then you either have a particularly challenging project, or a particularly challenged builder. Pick your poison. This convergence also means there is more a general sense of how to benchmark a project, and hold EPCs accountable to the standards being set by their peers. (Source: LBNL) Disclaimer: the sunniest places are not necessarily the best markets for solar. That largely is a policy driven issue, which will be a topic of another post. But sun (or insolation if you want to sound clever) can be very useful. The real takeaway from understanding geographic distributions is that capacity factors (e.g., the underlying technology performance of generating electricity) places some bookends around what sort of revenues and costs a project can support to hit your hurdle rates. The Northeast needs a bunch of incentives to have projects pencil for investors. Less so the case in sunny California or the Southwest. Developers are often inclined to slightly (or aggressively) inflate the performance of their projects. This is an easy area to push back if you have the right data at your fingertips. Remember solar negotiations 101: Don’t take the developer’s project valuation at face value. (Source: LBNL) 4. Return compression and the southern PPA migration It is often headline news when a new record low PPA rate is achieved. This is great for offtakers and utilities, but can be a source of deep consternation for investors seeking market rate returns. What is the enterprising investor to do? Utility-scale PPAs are now consistently below the $50-$60/MWh threshold, which is remarkable considering that just a decade ago, PPAs were 5x those rates. But this means that an investor that wants to compete in this market needs deep pockets and a low cost of capital. If when you look in the mirror, that is not you, then it is time for a gut check. Translation - you need to take some perceived (?) market risk. If you want to wade into a different area of the PPA pool, that means tapping to the aforementioned commercial (often referred to as C&I) market, or exploring more nascent markets such as community solar. You may be able to attract better PPAs, but they will be offset by higher per Watt build costs, O&M costs, and a different risk profile. This means a different underwriting and due diligence process that can cascade into high transaction costs for the unprepared. Choose your battles. (Source: LBNL) 5. Don’t forget that solar projects are long-term operating assets. Investors should be riding the downward trend in OpEx to boost returns, especially on the back-end. One unmitigated piece of good news for investors is that O&M costs are also trending downward, now below $15/kW-yr. These often underappreciated components of any project cost profile are a key to unlocking longer-term value. Many investors often neglect to put the time and effort needed to manage OpEx costs to optimize returns, especially on the back-end of an asset’s lifespan. If you pay more attention in structuring asset management, O&M, insurance, and other OpEx contracts, the ROI will be, let’s just say, highly justified. O&M Costs (Source: LBNL)

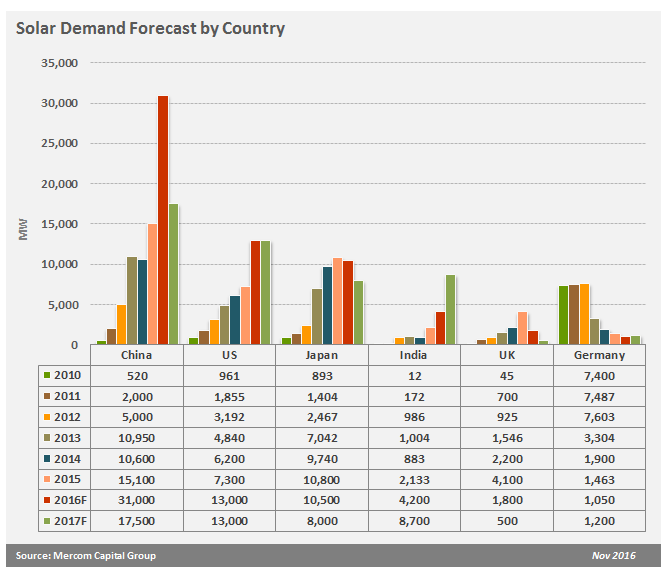

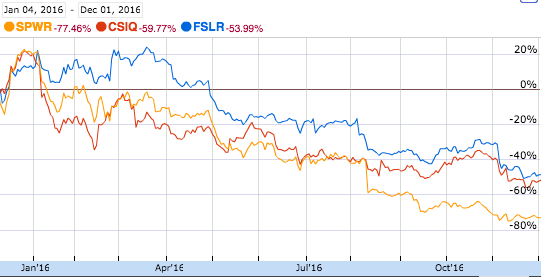

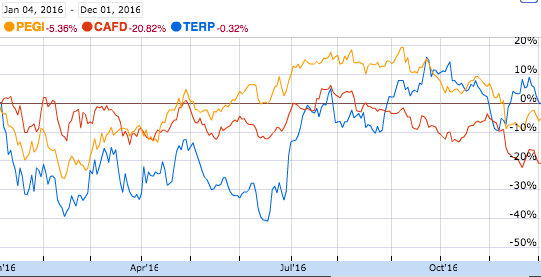

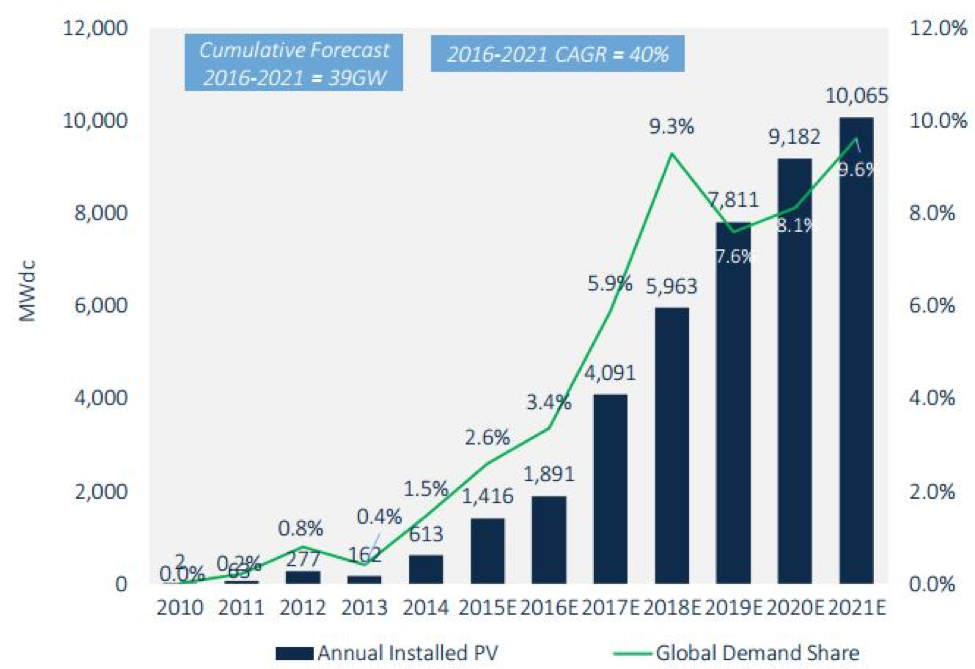

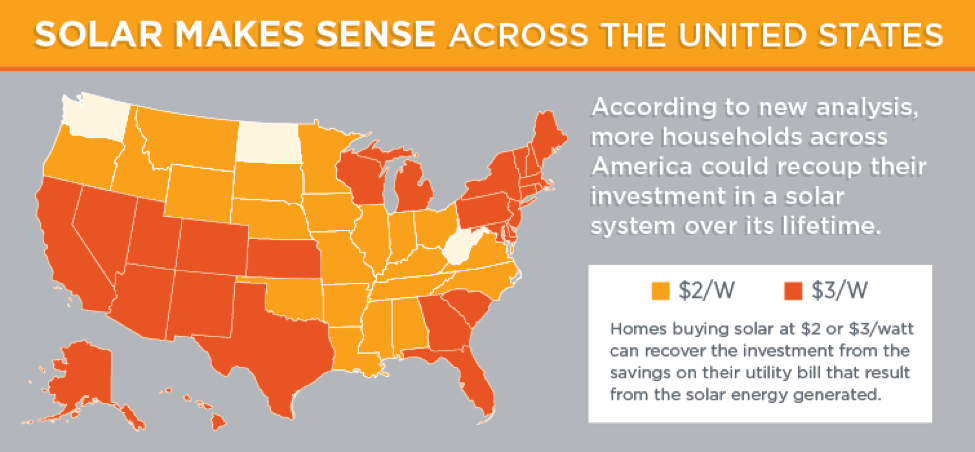

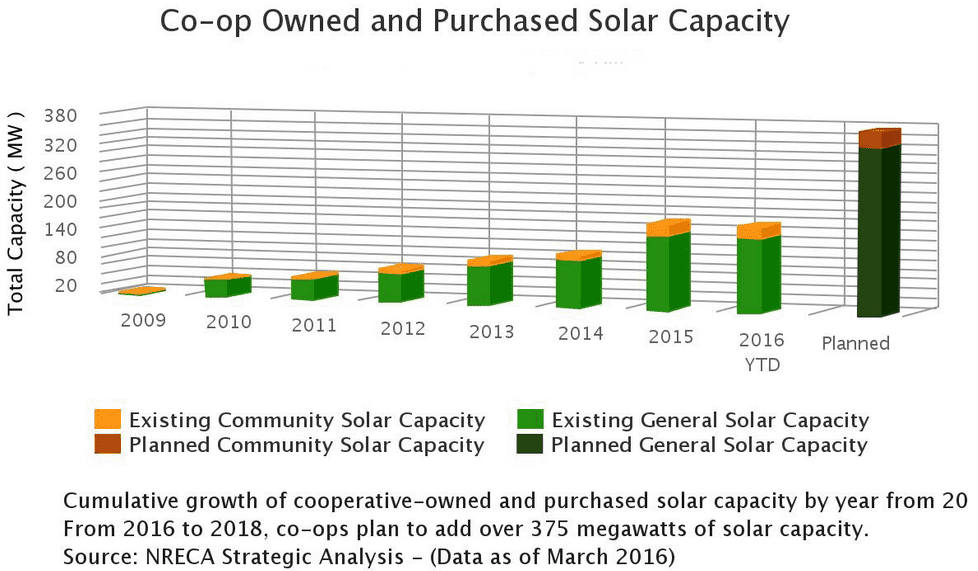

1. Growth in global solar development has not stalled, despite the 8% decline projected for 2017 Global solar development is projected to grow a remarkable 48% compared to 2015, reaching 76 GW installed by the end of 2016, according to Mercon Capital Group. We in the U.S. cannot claim all of the credit. It appears as though record-level solar development in China is largely responsible for this growth. But when you look at 2017, investors start to become very wary. Exponential growth from 2.6 GW to 76 GW in 10 years (40% CAGR), followed by a projected 8% decline in 2017! What gives? Well, again the story is about China, which is expecting a steep decline as a result of anticipated tariff cuts and reduced national targets following the solar module oversupply that fueled the 2016 growth. In the U.S, we are expected to stay steady after a 70% spike in solar development in 2016. But let’s not sleep on Japan (still a vibrant market) and India (emerging as a real contender). (Source: Solar Industry Magazine) 2. Don’t get too concerned about fluctuating solar stock prices -- remember the long game Public markets are fickle. And remember stocks are valued (theoretically) in terms of future projected cash flows. Which means it is all about expectations. Right now, many investors feel there is a bear market lurking around the corner, and the SunEdison debacle has done little to assuage the public’s concern about the solar industry. The big name market barometers are sending signals to be very worried about the long-term prospects of the solar industry. SunPower (SPWR), First Solar (FLSR), and Canadian Solar (CSIQ) are all taking a nosedive. Yieldcos -- Pattern Energy (PEGI), 8point3 Energy Partners (CAFD), and the much beleaguered Terraform Power (TERP) -- are also all trending down after a comeback from last summer’s downturn. Two things are dragging down stock prices - persistent low module costs putting a downward pressure on revenues and over-leverage eroding cash flows. Only the companies with the financial agility to continue to generate positive cash flows will weather the price wars, but the solar industry as a whole with weather this period successfully. (Source: Google Finance) 3. 83 companies committed to 100% renewable, but just wait for the prosumer revolution According to RE100, some of the largest corporations in the world are aiming to get to 100% renewables. Some of the usual suspects are from the tech world -- Apple, Facebook, Google. But you might be surprised to find old school corporate behemoths such as WalMart, Nike, Johnson & Johnson, Proctor & Gamble, and the Tata group have joined the ranks, as well. Now, all of that will not be solar, but a lot of it will. Solar affords the corporate investor a lot more flexibility in the project size and location, lower basis risk, and better synchronicity with peak demand. Corporate power purchasing grew to 3.23 GW in 2015 (Source: RMI), and is only expected to grow more, especially as virtual net metering and community solar policies allow for more off-site solar solutions. Watch out for some of these companies to cross into the ranks of “prosumers,” companies that both produce and consume energy. Apple recently filed for licenses in California, Oregon, and Nevada to sell its excess electricity directly to consumers (Source: HBR). This really could be a gamechanger. 4. Solar investors flock south to Latin America, even as returns head in the same direction It is not headline news that Latin America is becoming an attractive area for investment in solar. The region is expected to grow at an annual rate of 40% through 2021 after all, with Mexico, Chile, and Argentina leading the charge. Amid the many interesting facets of solar development and investment in Latin America -- transmission constraints, locational variability in price, currency and credit risk, new renewable energy mandates and policies, etc. -- the real braintickler is how are all of the auctions going to play out over time. Auctions have consistently returned remarkably low prices - $45/MWh in Mexico, $29/MWh in Chile, and $59/MWh in Argentina. With falling solar module prices, there is some room for developers to deliver projects that can meet investor hurdle rates at those prices. But the competition is tough, and some investors have grown wary of playing the auction game. All the while, do not forget about Central America and the Caribbean. El Salvador and Honduras, among others, are paving the way for solar expansion with a range of promising utility-scale projects. (Sources: GTM) 5. Community solar is the real anti-establishment energy choice Even though SunRun wants you to think that “roof-top solar is the anti-establishment energy choice” (Source: GTM), it is not a choice available to nearly half of all U.S. households. Enter community solar, the renewable energy choice for the masses, including the often forgotten low- to medium-income households. The benefits to offtakers are obvious -- access to clean, reliable electricity from solar farms built at a much lower cost than their roof-top solar siblings ($2.00-$2.50/W vs. $3.00-$3.50/W). And based on a simple savings-to-investment ratio, 35-48 states are attractive locations for community solar. No wonder NREL projects that community solar will make up half the distributed generation market by 2020 (Source: NREL). Once investors can get comfortable underwriting the somewhat unique risks of community solar projects, there will likely be a fairly attractive risk-return profile and a largely untapped market if and where policy falls in line. (Source: DOE Office of Energy Efficiency & Renewable Energy)

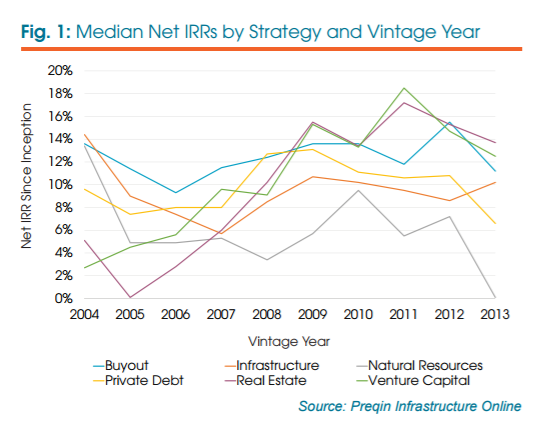

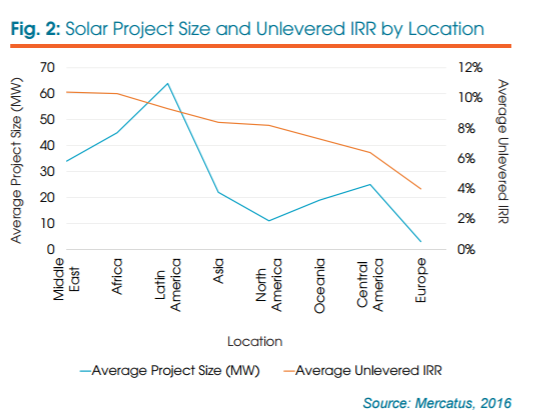

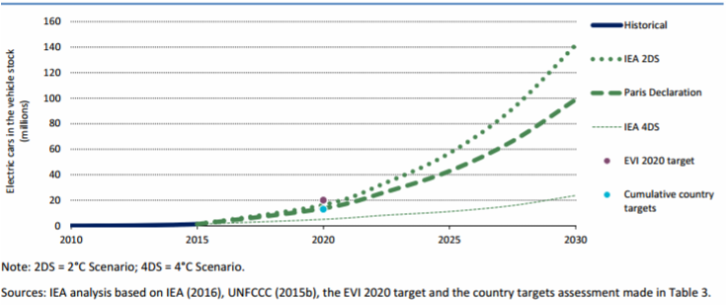

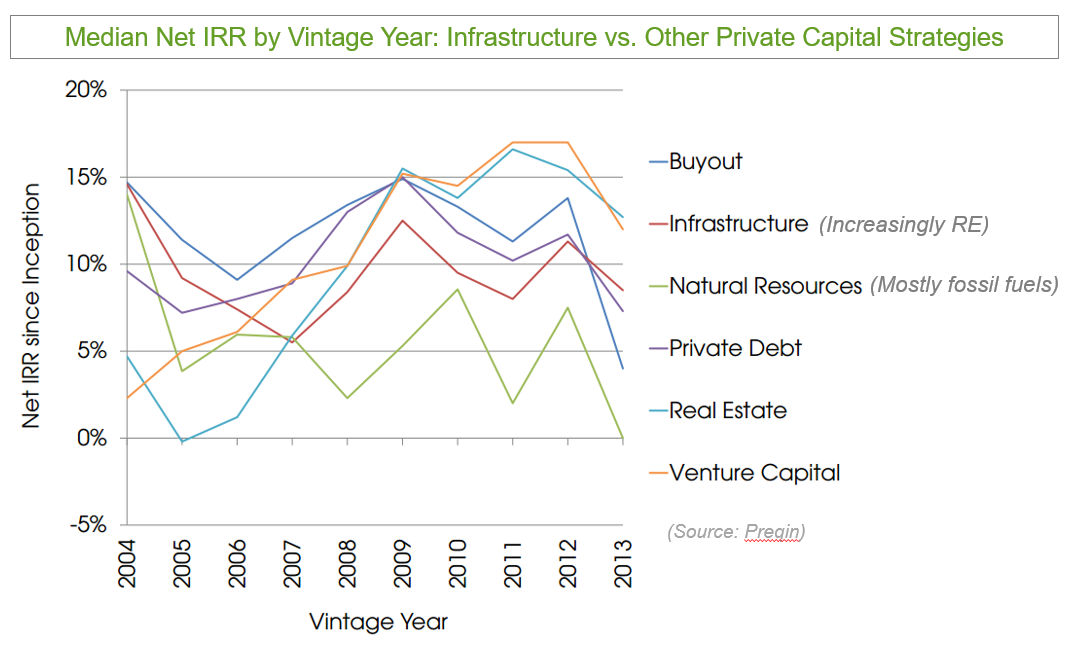

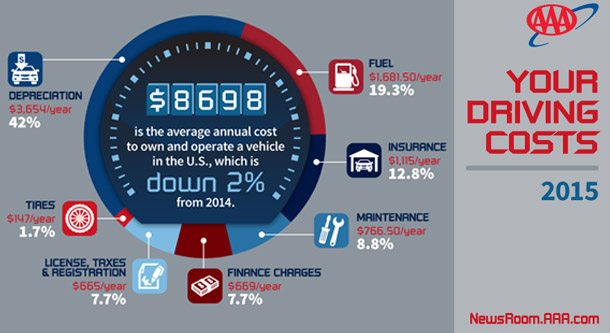

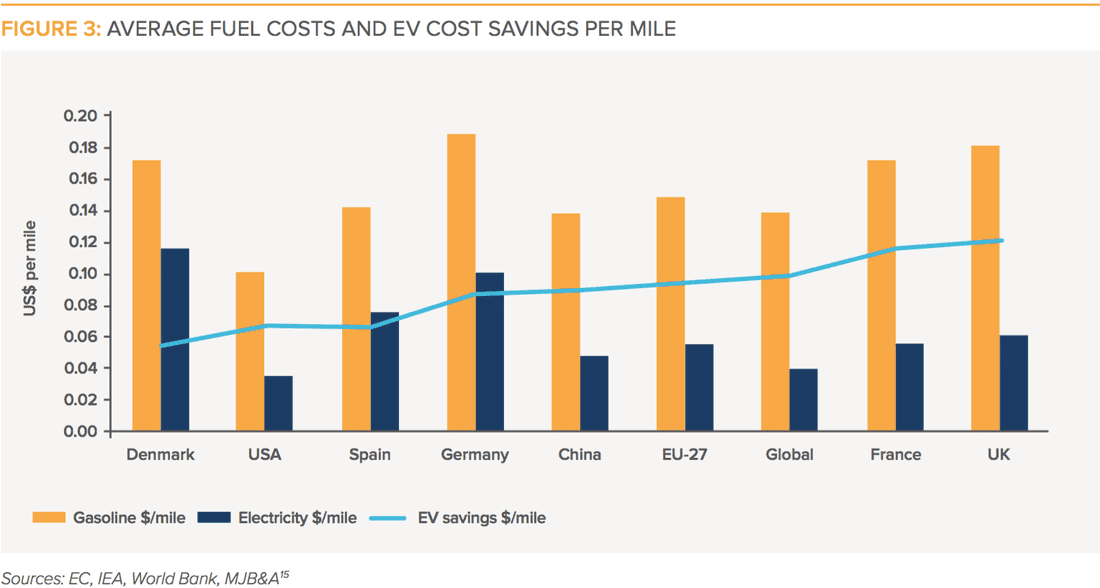

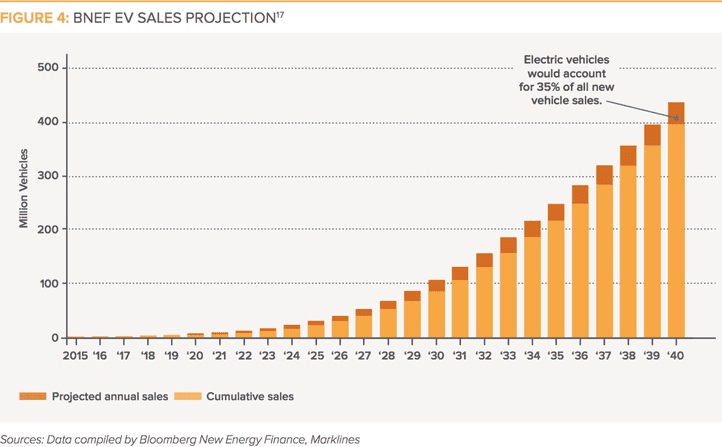

Postscript. Elephant in the room -- No one knows what the Trump era holds for solar Policy support at the federal level, most notably the ITC, has been essential in accelerating the growth and maturation of the solar industry. The ITC appears safe for the moment, but may end up on the chopping block in a larger tax reform bill. Nobody knows. What we do know is that the solar industry is here to stay, federal incentives or not. The value propositions for solar -- clean and affordable source of electricity, economic development and job creation, and attractive investment opportunities -- are not going to change. There may be bumps in the road if the federal government attempts to resuscitate the coal industry at the expense of support for renewables, but the industry will navigate them and move on. Coal's downward spiral is unlikely to be something that Trump can avert despite his grandiose promises (Source: Yale Environment 360). I’ll leave you with one heartening statistic - there are more clean energy jobs in the state of Ohio than there are coal industry jobs in the entire U.S. (Source: Renewable Energy World). If President-elect Trump holds to his promise to focus on job creation, the answer should be clear for all to see. 11/18/2016 The Mainstreaming of Renewable Energy Infrastructure Investing - Risks, Returns and Emerging SectorsRead Now If you work in renewable energy or infrastructure finance, then you might like this... Yesterday, I published an article in the Real Assets Newsletter for Preqin, a global leader in market intelligence for the alternative assets investment industry, serving 40,000 investment professionals in 90 countries. See the link below. It's on page 8. "The Mainstreaming of Renewable Energy Infrastructure Investing - Risks, Returns and Emerging Sectors" Here are two highlights... Figure 1 shows the attractive risk-return of infrastructure vs. other asset classes. Note that renewable energy made up 54% of all infrastructure deals globally in Q3 2016. Figure 2 illustrates that solar projects in the developing world tend to be larger (i.e., allow for greater volumes of capital allocation) and generate higher IRRs (albeit with more political and other country risks). What does it all mean for investors? It's time to look forward, not backward. Most perceptions about renewable energy are outdated because the sector is changing so quickly. Those wait run the risk of being late to the (raging) party. It is easy to relegate a discussion about electric vehicles to Tesla toys for the affluent. But that would not be the whole truth. As an illustration, I recently served on the Advisory Board for Vulcan in its Smart City Challenge partnership with the U.S. Department of Transportation, which jointly awarded US$50M to a single U.S. city to support transportation innovation, including electrification. In all, 78 cities competed. The enthusiastic response, impressive potential for scale, and wide-ranging innovation were a pleasant surprise. Although there are only about two million electric vehicles on the road globally today, that estimate is expected to grow to roughly 100x if the Paris Climate Accord has its targeted impact (International Energy Agency, 2016). Electric Vehicle Projections, 2010-2030 (Source: International Energy Agency, 2016) Although these vehicles are often deemed to be “too expensive,” many electric vehicles actually offer a lower total cost of ownership than conventional vehicles when assess over their entire lifecycle.

Moreover, by 2022, the average first cost of electric vehicles is projected to be the same as the average first cost for conventional cars. With cost concerns removed, plus the other benefits of less noise, no gasoline smell, fewer moving parts, and the “cool factor,” this market is expected to grow quickly from this point forward (BNEF, 2016). In fact, the growth of electric vehicles is expected to be so meaningful that Fitch Ratings recently stated that the sector’s rise presents potential for “investor death spiral” negatively impacting the oil sector (Financial Times, 2016). And at the Oil & Money Conference last month, Statoil’s CEO noted that electric vehicles could catalyze oil’s peak sales within five years, with a steady decline thereafter (Climate Home, 2016). Considerations for infrastructure investors:

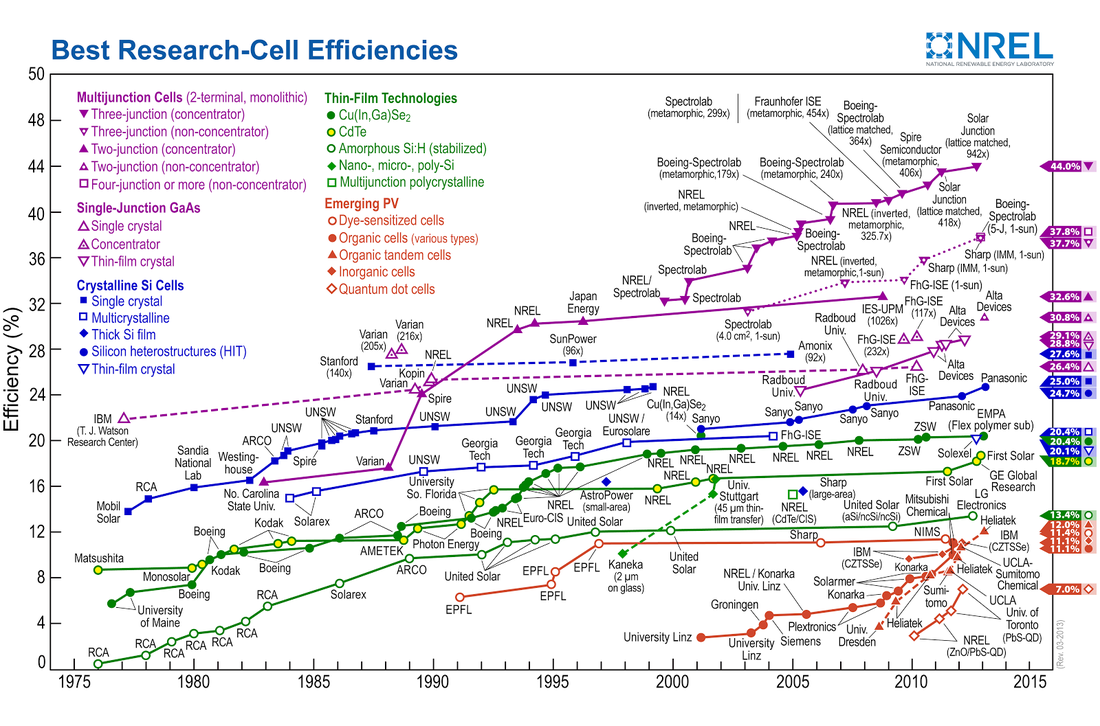

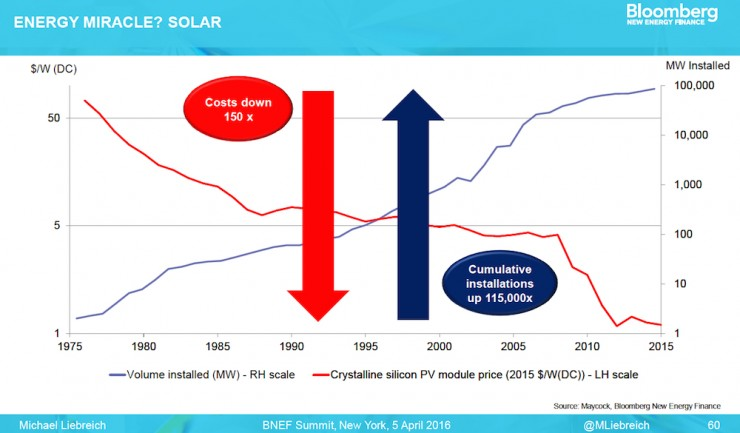

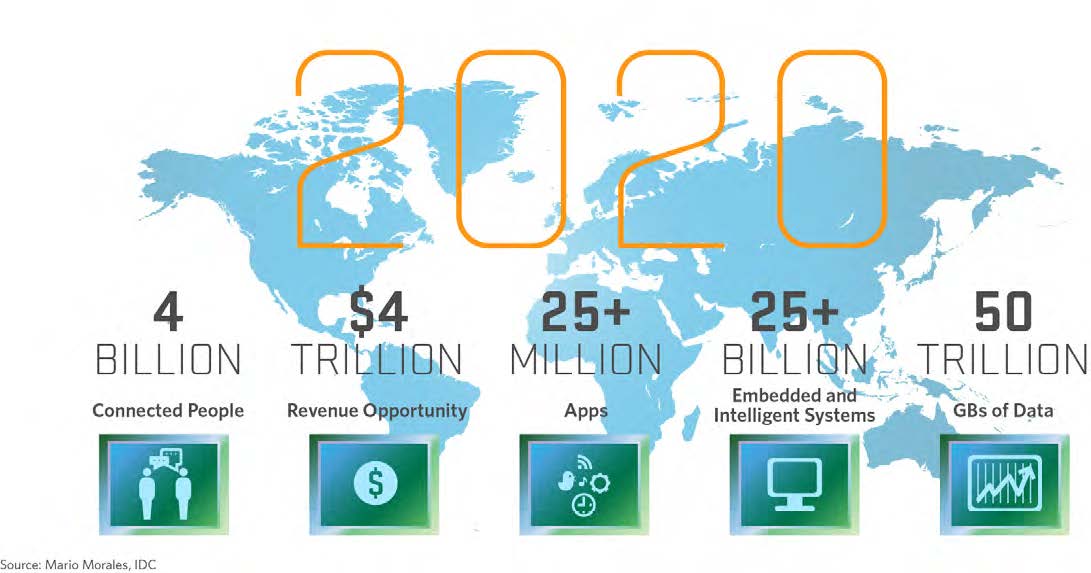

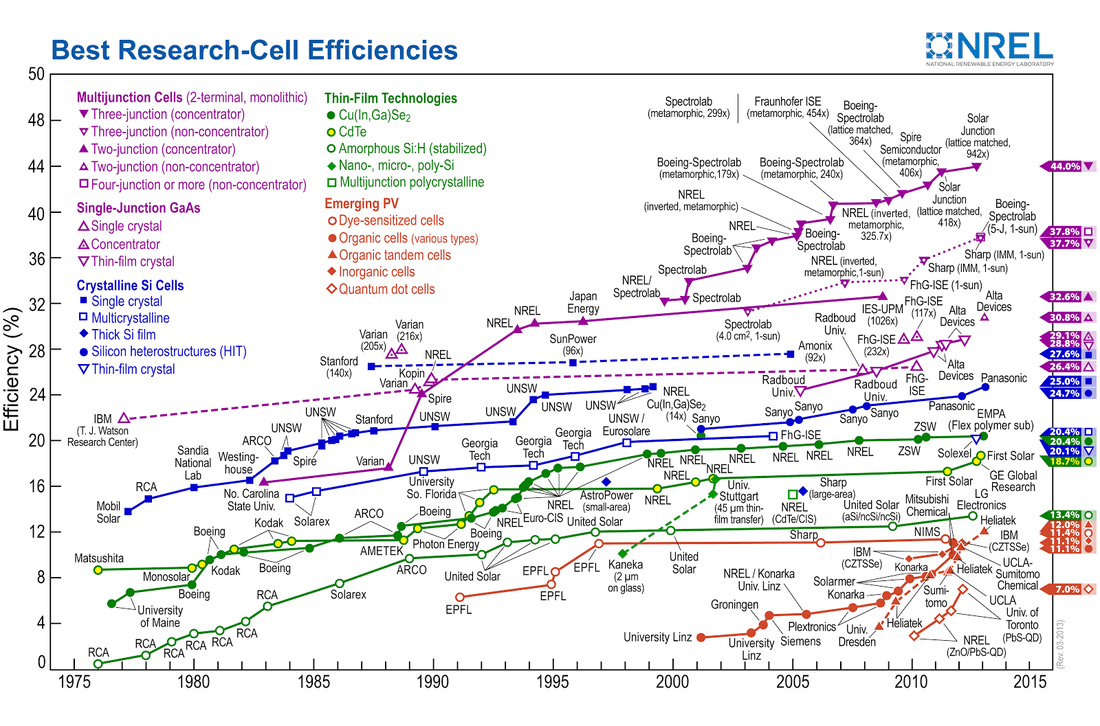

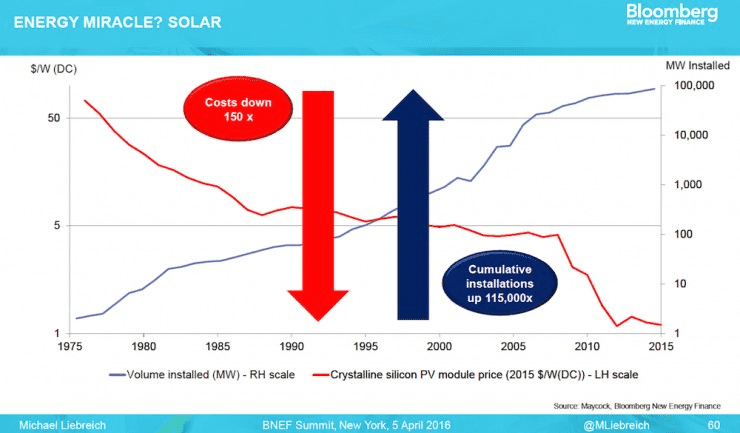

You’ve seen many headlines touting “record new solar panel efficiency.” We get excited seeing those, too. But they don’t matter. Alright, that was shock value. Let me explain. First, take a gander at the mind-numbing chart from the US National Renewable Energy Lab (NREL) below. This is one of my favorite figures in the whole world. Now, please memorize it -- there will be a quiz later. (Or so I tell my corporate and military executive students. They laugh at my false threats.) What does this figure say to you? Three potential takeaways: 1. There are way more types of solar panels than you thought, right? 2. Solar panel efficiencies have improved considerably between 1975 and 2015. Duh. 3. The guys doing the stuff in red font should get new jobs given their low efficiency. (Not really. Those are super cheap organic polymer-based solar cells. Their future will come one day.) OK. Now forget that graph. Look at these two more important charts from Bloomberg. Do you see any relationship between these the red and blue lines? (I hope you do.) Cost falls. Solar installations go up. And now for the next chart. Yes, you are reading that right. A 99% drop in solar panel prices since 1976. I know, I know. I hear the devil’s advocate: But doesn’t greater volume of solar installations drive down costs? Yep, but the opposite is more true. Cost drives volume. China got in the manufacturing game just as the recession of 2008 hit and EU solar demand fell off. Solar panel prices fell faster and haven’t really stopped, resulting in an 80% drop prices in the last 8 years. For more data and graphs about solar's falling costs and coming world domination (insert dramatic music), see energy rockstar Joe Romm's piece "You’ll Never Believe How Cheap New Solar Power Is." In case you fear that my ponytail is getting in the way of my PhD and love of private equity (insert humor), and that I'm being too kind to solar, consider this projection from Bloomberg: By 2040, global investment in solar will total $3.4 trillion, while fossil fuels and new nuclear will only receive $2.1 trillion and $1.1 trillion, respectively. One word: Yikes. So what? The next time you hear a sales pitch about panel efficiency, praise them for their ingenuity. They are real wizards. But just keep asking: What is the resulting $/kwh and Internal Rate of Return of the solar project? Efficiency is the finger point at the moon. Please go after the moon. You may have heard of phrases such as “The Internet of Things” (IoT) or the “Smart Grid.” Both terms are defined differently by many people. According to IBM, the IoT refers to the “digitization of the physical world.” According to the U.S. Department of Energy, the smart grid can be defined as “a [new] class of technology to bring utility electricity delivery systems into the 21st century, using computer-based remote control and automation.” The investment opportunities in improving the intelligence of our electricity generation, transmission, and generation system can be summed up by a joke reserved only for energy geeks (like me). It goes like this: “If Thomas Edison were alive today, and you showed him a smart phone, he would be blown away by the innovation. In contrast, if you showed him how we produce and distribute electricity, he would say, ‘Oh yeah, I recognize that.’” As an example of the scale we are talking about, estimates suggest that the U.S. alone needs to invest US$2.1T by 2035 to upgrade its electrical grid and integrate the massive surge in renewable energy and the need for greater resilience. (International Energy Agency, 2016) As an example of what is coming, consider analyst predictions that the number of internet-connected devices globally will grow from approximately 13 billion in 2015 to almost 39 billion in 2020. (Juniper Research, 2015) Or consider the scale of the opportunity in the infographic below. Source: Mario Marales, IDC Considerations for infrastructure investors:

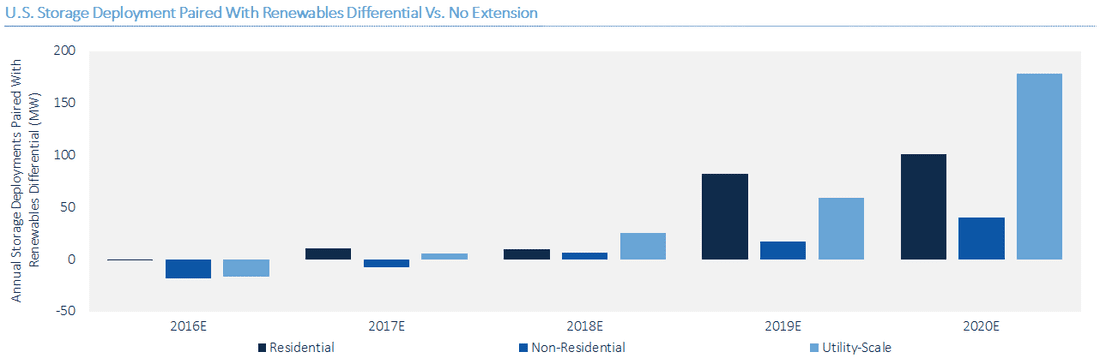

9/26/2016 U.S. Energy Storage Market to Grow 8x by 2020: What If It Had Its Own Special Tax Credit?Read Now Source: GreenTech Media Can the energy storage industry withstand the scrutiny of having their own ITC? It cannot be understated how transformative an energy storage ITC would be for the industry. At IronOak Energy, we have written previously on the impact of such an ITC, and even presented a positive take on its potential rollout. Here, I want to pose the question of whether the industry is really ready for such a game-changing policy. The graph above shows projections for the growth of energy storage development under the current policy regime. Not too shabby. But is the energy storage industry prepared to put that delicious tax equity to good use on stand-alone energy storage projects (in practice, solar + storage applications currently qualify for the solar ITC)? Of course, the answer is always: it depends. Depends on what? Some would argue that the critical issue holding back a tidal wave of energy storage projects is the technology. One could easily view the vast array of energy storage technologies vying for prominence with some trepidation. Some are commercially viable, while many are not. It takes some brainpower to suss out the contenders from the pretenders. Even the smarties at MIT have a tough time doing it. Do we want the government to incentivize the deployment of technologies that may not be ready to contend for the main stage? Conversely, is that precisely the role we want the government to take? The double-edged sword of government subsidy This is a classic double-edged sword phenomenon. On one edge, there are green grassy fields of opportunity in rolling out new storage technologies in commercial applications. Accelerating storage deployment will drive down costs and help evolve viable business models. Beautiful. Lurking on that other edge is the distinct possibility that many storage technologies in earlier stages of development will simply fail. And failure is bad press, even if it is the Darwinian process of technological progress. It puts the government in the untenable position of having subsidized a “reckless” experiment with taxpayer dollars. “Picking winners and losers” they will say, even though an ITC is designed to avoid precisely this potential conflict. And, let’s just say that there is a history of nasty repercussions for such interference with the so-called free market for energy (ahem - myth). Solyndra - need I say more. Some will say that Solyndra was blown out of proportion (it was) AND it was 5 years ago (a lifetime ago in the clean energy industry). To top it off, Solyndra was backed with loan guarantees, not really what the ITC is about. Details, details... But now, the vengeful energy gods have gifted us SunEdison. It was an altogether explicable collapse, but one that, nonetheless, provides ammunition against government support for the clean energy industry. Who knows what would have happened with the extension of the solar ITC if SunEdison has filed for bankruptcy in 2015 rather than 2016. So, be careful for when you wish upon your industry the scrutiny of being a target of government support. Technological risk is a red herring -- it is really all about how to finance storage Sure, risk exists with many energy storage technologies. Even the most established battery technologies lack the operational history to assuage the concerns of investors looking at decadal time horizons. If you are absolutely intolerant of risk, go invest in government treasuries (just kidding - terrible idea). Just running down the ladder to the cheapest storage technology fails to capture the complexity of the underlying value proposition. Cost is king, but there are many other factors competing for a role on the king’s court. Energy storage technologies cannot be reduced to a simple efficiency or production metric, as with solar or wind (even that is an oversimplification, but at least a reasonable one). There are more than a dozen potential services that could be generated by a given storage technology, many of which have few established market mechanisms to generate reliable revenue. So, here’s the central takeaway. The biggest challenge in the energy storage market is not how to choose the right technology. It is how to design the right market structures to support financial innovation. Making energy storage bankable is close to being a precondition for the successful utilization of an ITC. Recall that the success of the solar PPA model hinged on stable, contracted cash flows. Making solar bankable unlocked a vast market potential that we are still in the early stages of witnessing. There is no equivalent financial structure with energy storage, yet there remains a distinct need to create consistently financeable project cash flows. But wait, SolarCity and Tesla (perhaps soon to be joined in holy matrimony) pioneered a solar + storage PPA earlier this year. The energy storage industry needs a financial product the equivalent of a PPA, and perhaps we are not too far off. Thus far, it has taken a savvy, not mention risk tolerant, investor to back energy storage projects. There is only so much runway with this sort of approach. Easing the path for new investment in storage will hinge on making this inherently complex technology and market application simpler. There are already frontrunning markets generating experiences that will guide future market design and development - thanks, California. In tandem with this type of market development, energy storage needs a greater degree of standardization of financial strategies and structures to help make projects pencil. And not just for the smartest guys in the room, but for a broad swath of interested investors. The question remains as to whether an energy storage ITC will aid or inhibit such progress. Related Reading:

Related data points:

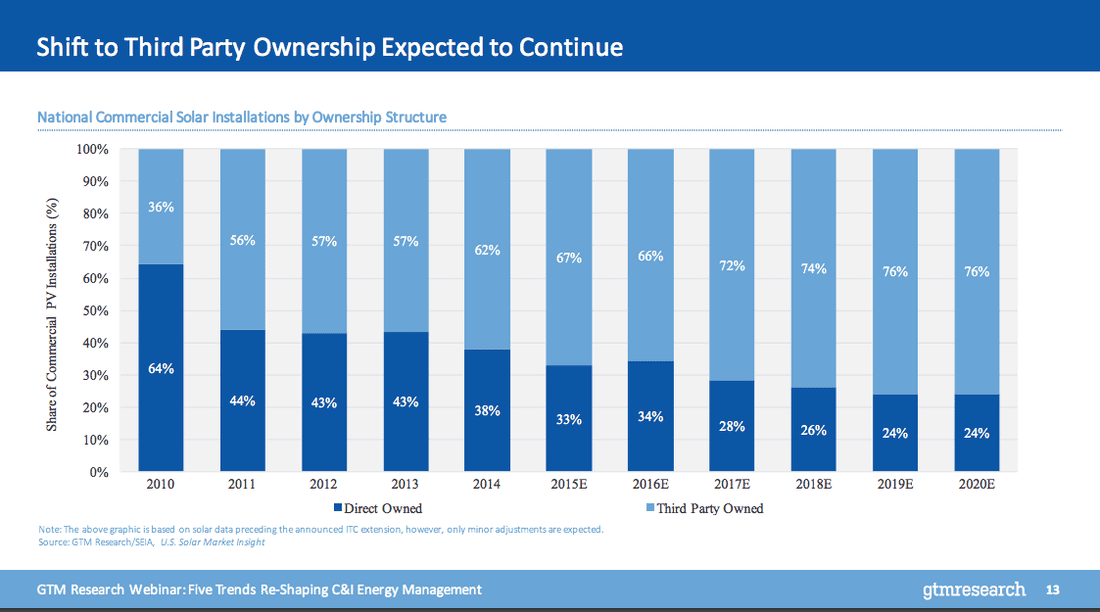

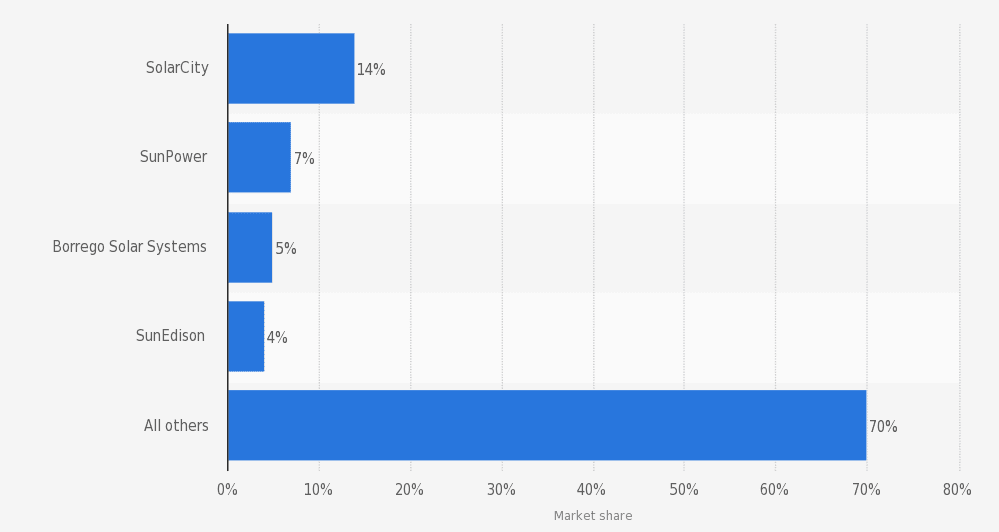

Amid the buzz of Solar Power International 2016 last week, there was a persistent cry of the financing gap in C&I solar. Yes, big money is flooding in searching for good projects to finance. The low-hanging fruit has always been utility-scale solar. Scale, credit-rated offtaker, stable cash flows - check. But margins are being squeezed as the race to bottom out PPA prices builds momentum. Enter C&I solar - a tantalizing large potential market of smaller-scale projects, trending towards 3rd party ownership (translation = welcome investors!), with low hanging fruit ripe for the picking. Commercial and industrial offtakers seem more willing than ever to sign up for solar, and at PPA rates often substantially higher than what can be gotten from our utility friends. But, is C&I solar the greenfield opportunity that many hope it to be? (Source: GreenTech Media) C&I solar is not blessed with the same attributes as a utility-scale project - smaller scale, offakers with no credit ratings, and, most importantly, extreme heterogeneity. Diversity is every infrastructure financier’s nightmare, as it stymies standardization, which is the key ingredient to scaling investment from more risk-averse, low cost of capital investors. And the C&I solar market has bedeviled many attempts to solve the standardization challenge. By way of example, I am going to pick on beEdison and their flagship risk analytics product, truSolar. TruSolar, a project cofounded by Distributed Sun, Dupont, RMI, and Underwriters Laboratories, was an attempt to create a uniform method for assessing project risk in C&I solar. The truSolar Risk Screen Criteria and Methodology (RSCM) identified over 800 unique risk elements and thousands of scoring dependencies. Impressive? Or overkill? Hard to say. On top of this great risk analytics tool, they created a marketplace platform, used a ton of project data to train their risk algorithms, created nifty flow charts like the one below, and hoped that buyers and sellers would seek holy matrimony at their table. By all accounts, truSolar is the real deal, and who doesn’t like marketplaces, but are buyers and sellers coming? They built it, so did they come? beEdison claims to have 200 members and 1,000+ projects totally over 4 GW and $10B of dealflow. But, I have to admit - I am skeptical. Around 2 GW of solar was developed in Q2 2016, and less than 20% of that was in C&I market (SEIA). So, it appears as though the 4 GW number is just maybe a bit of an overstatement. (Source: beEdison)

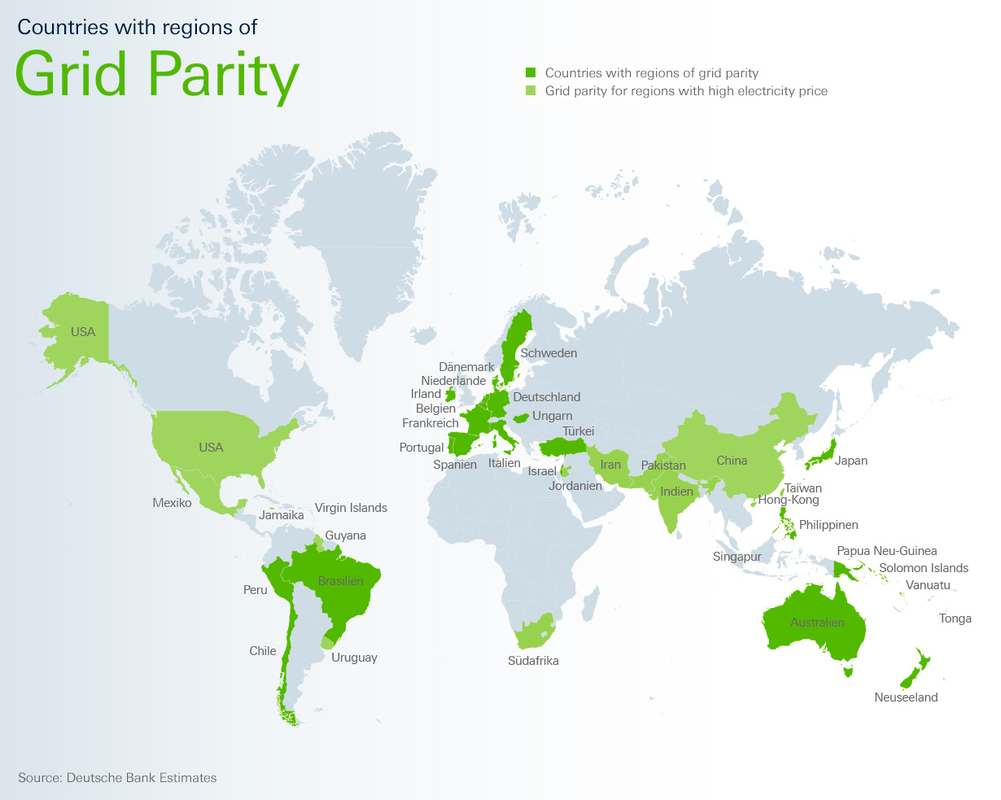

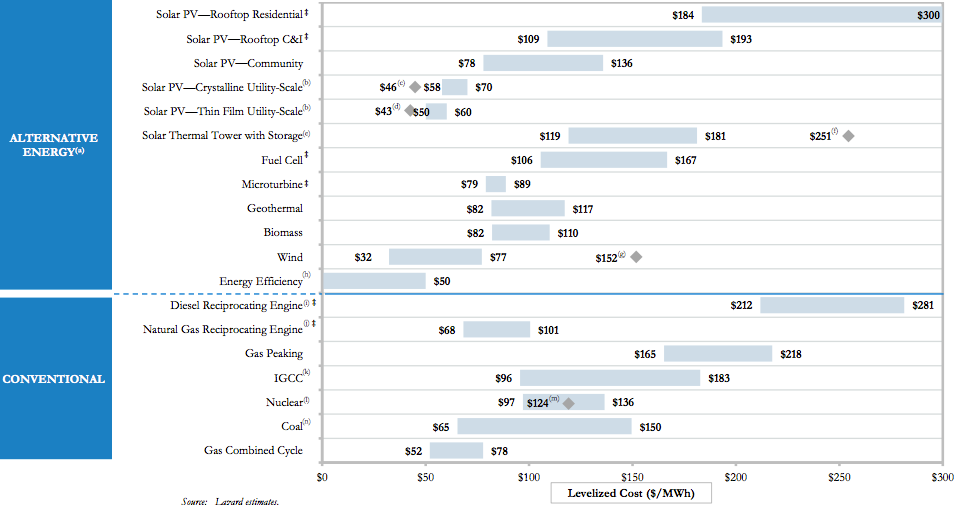

To be sure, I am fan of beEdison’s approach. It is ambitious, and it solves a real challenge in the solar C&I market using - everyone’s favorite buzzword - BIG DATA! So, why is it not sweeping through the marketplace with wild abandon? Perhaps, they made the risk analytics process too opaque and complex. Perhaps, sellers do not trust the idea of using a platform to meet sellers, or vice versa. Or, perhaps the real issue is that solar C&I projects are not penciling like investors would hope. The real challenge in the solar C&I market is not just standardization and credit analysis. It is that these projects do not turn out to be nearly as rich as investors had hoped. It is a classic case of failing to achieve economies of scale. Development and construction cost efficiencies in the utility solar market allow projects to pencil even with really low PPA rates. It is really difficult to translate those cost efficiencies into the C&I solar market due to the aforementioned issue of extreme heterogeneity. Said another way, solar C&I projects just cost more. And only in niche markets can those high project costs be supported by the prevailing PPA rates that a C&I customer will accept. Many geographies are blessed with low retail electricity rates, especially for large electricity users. These offtakers are not likely to accept a PPA which locks them into a higher electricity cost today, even if the long-term impact will likely be in their favor. When high development and construction costs run up against this ceiling of acceptable PPA rates, you start to see margins squeezed. But the difference is that these margins are on small projects with funky risk profiles. So for the time being, solar C&I remains a “diamond in the rough” market. Investors are seeking the gems out there, while many (I mean, many) projects out there just fail to meet their hurdle rates, risky or not. But be on the watch - there are many other companies exploring ways to serve this sector efficiently, and at scale. The real gamechanger may not be nifty platforms, but rather the tried and true method of securitization. Solar securitizations are happening, pioneered by SolarCity and SunRun, but can the question remains as to whether they can open the floodgates of institutional capital given the fragmented and idiosyncratic nature of solar C&I projects. Nobody likes paying more than they should. And my dad is a CPA, so this is definitely true for me, too. But this barrier is not unique to renewable electricity. The same expectation is true for most non-luxury goods and services. Yet I still hear the objections everywhere -- from sophisticated investors to family friends -- that solar and wind are too expensive. Is that still true? Yes, but increasingly no. OK, to be clear, most of the data says no, but as you know, perception is reality. This lingering misperception is also being observed by other energy leaders, including the Director of Sustainability and Cleantech at Schneider Electric in recent a Greentech Media article about Scheider’s New Energy Opportunities (NEO) Network. Consider the graph below from Clean Edge, which is based on data from the US Lawrence Berkeley National Laboratory. The levelized costs for solar electricity (LCOE) has fallen from 22.5 c/kwh to less than 5 c/kwh. That’s a roughly 78% drop in price over the last 10 years. But unless an investor or corporate executive has regularly re-evaluated the business case for alternative energy, they might have missed these market changes. It’s important to note that this refers to utility-scale solar, not rooftop solar. The latter has a higher LCOE (c/kwh), but it also competes with higher retail electricity rates. Additionally, Deutsche Bank estimates that unsubsidized rooftop solar is 30% cheaper than retail power prices in many countries. See their map below showing countries with substantial areas of grid parity. Finally, here’s another data-driven perspective from investment advisory firm, Lazard. The resolution is not great, so let me help you out. Here are some of the lowest LCOE values from highest to lowest:

Here’s a link to the full Lazard report, version 9.0.

If you like data and charts, you’re going to really enjoy this. Grab a big coffee and settle in for some quant goodness. And next time someone says that solar is too expensive, you can admit they are partially right. But then give them a little dose of 2016 data. The Chief Technology Officer of Tesla, J.B. Straubel, stated recently that it doesn’t make sense for electric vehicles to send electricity back to the grid. In the same remarks, he also noted the following:

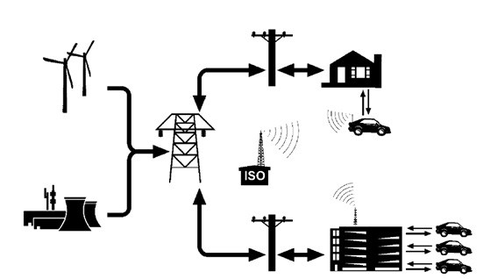

What the CTO is criticizing — vehicle-to-grid or V2G -- is essentially distributed energy storage on wheels. The function It takes advantage of unused EV battery storage capacity to allow for power sales back to the grid, either by draining some power when the vehicles are not in use or reducing the vehicle charging rates. At a basic level, V2G has three requirements:

Vehicle-to-Grid Schematic Source: Jim Motavalli, The Azimuth Project The EV technology and services company AC Propulsion, a V2G proponent, outlines the potential benefits of V2G as related to grid services: peak power sales, spinning reserves, base load power, peak power (either as a form of direct load control or to reduce demand charges), and reactive power.

In turn, the EV owners get paid for the energy services provided. But aren’t all of these benefits just the same as those for storage, but in EV form? The figure above seems very similar to one that would be drawn for fixed batteries. The challenges of V2GSeveral hurdles would have to be crossed in the current market and policy environment for V2G to be commercially viable. Among the not-so-attractive characteristics of V2G:

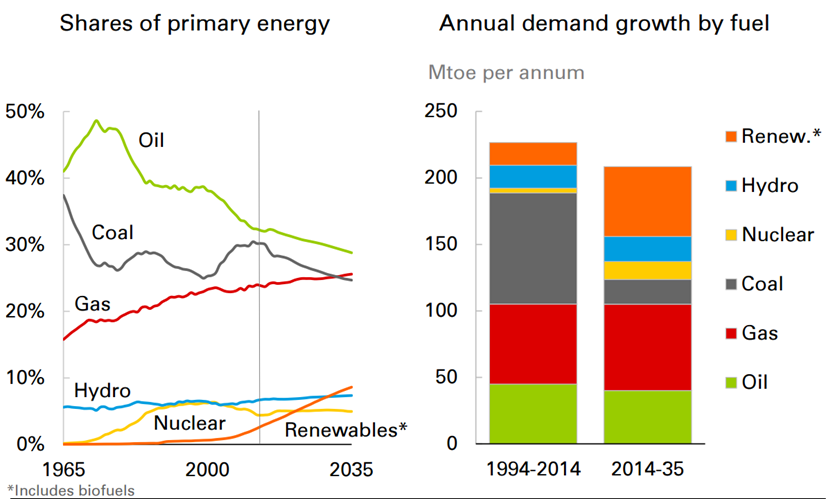

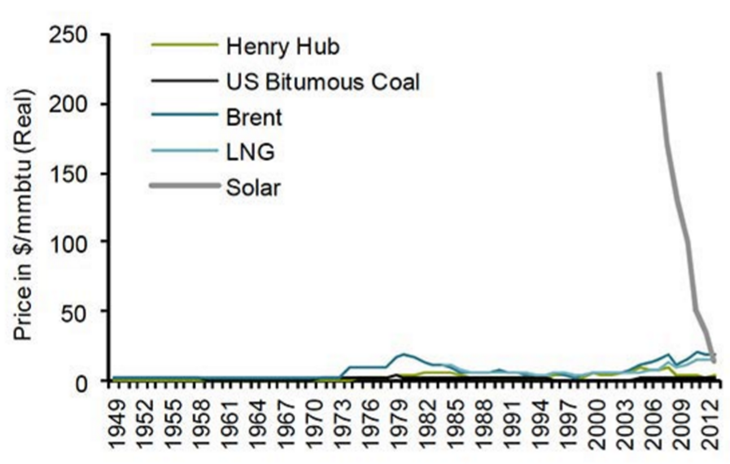

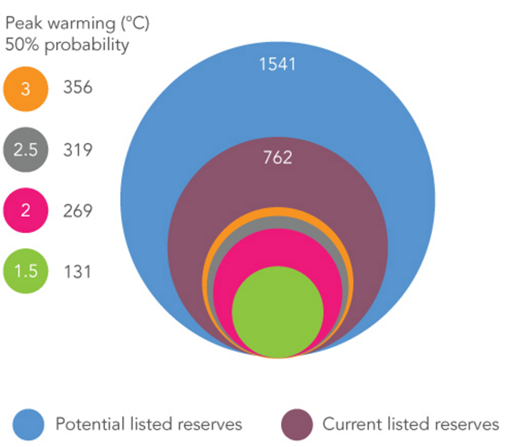

V2G Lite -- Commercial Fleet Applications The first of those challenges above could potentially be met with a market-derived refund incentive, though it is unclear how many EV owners would be willing to own a car with a shorter lifespan in exchange. Alternatively, EV battery manufacturers could design future batteries for more frequent power cycling, but that would require a major and disruptive shift from the current design parameters that do not take V2G into account. The second challenge would seem to be one of public policy, and conceivably overcome if stakeholders from the EV space were united in pushing for V2G (which they’re not). The third challenge might be addressed with commercial EV fleets. In this “V2G Lite” scenario, a fleet owner -- who with the help of data analytics has a good sense of the driving patterns of the fleet -- would be able to sign a power supply contract with a utility that guarantees a certain amount of EV battery capacity at different times during the day. Fleet contracts could be bundled, so risk is spread and utilities only have to deal with a few intermediaries when relying on this stored power source. Even if a fleet was designed to spend most of the day on the road and most of the night charging, there could still be some battery capacity free at certain times, available to be used by (and sold to) the grid. Along these lines, Nissan is notably optimistic about V2G’s horizons, and has been so since last spring when it announced cooperation on V2G efforts with Endesa, a subsidiary of the Italian energy multinational Enel. Now the automaker is working with Enel and the Californian V2G services provider Nuvve to install a commercial V2G hub in Copenhagen, Denmark. The 100 kW project is admittedly small, with 10 Enel 10 kW V2G charging units paired with 10 Nissan EV vans and a Nuvve platform to coordinate when idle vehicles can send energy back to the national grid on demand. V2G Strong -- V2G for Everyone? Or, what might be good for the public isn’t necessarily good for Tesla A group of EV researchers at the University of Delaware is at the leading edge of EV research and those advocating for full V2G penetration. In one study the numbers and justification for a full V2G push are impressive: if we put 20 million light duty V2G EVs on the road (just 10% of the current total U.S. fleet), and conservatively assume a peak power rating of 50 Kw for the cars, we could have a combined power capacity equivalent to the entire U.S. Electric grid. Paired with renewables, the V2G EV fleet would bring game-changing results for CO2 emissions and other transportation sector pollution. The EV future is being built now, with new cars, new charging stations, and new rules and practices. As this new EV built environment grows and develops, integrating V2G capabilities may just add an additional layer of complexity to the overall project, without a certain return. But if we were to make a major push for V2G capabilities to be integrated at the ground level, the benefits for society and the planet could be large. 8/30/2016 Major Oil and Gas Companies’ Growing Interest in Renewable Energy Investments: Passing Fad or Major Trend?Read Now You may remember BP’s attempt to rebrand as “Beyond Petroleum” years ago. Perhaps sincere, or maybe a public relations game, it did not last long. One thing for sure: It bred some real clean energy innovators, some of whom we at IronOak Energy work with today in their new ventures. The question is this: Are today’s headlines about fossil fuel majors investing in renewable energy any different? As I prepared to deliver a webcast to 75 global energy investors on this topic, many of our investment colleagues were doubtful. But I do think that things have changed. I’ll try to illustrate why I think this is the case (and hopefully I won’t look back in five years with my tail between my legs). Consider the leading conventional energy company in this new paradigm: Total, the French energy giant. Below is a figure which illustrates most of Total’s alternative energy investments, whether direct or indirect. Source: Lux, CB Insights, IronOak Energy But their clean energy play doesn’t stop there. Consider these additional facts from 2015: They committed to investing $500M in renewable energy per year going forward. They invested $225M to convert an unprofitable oil refinery into a biofuel plant. Why are oil and gas giants moving to more clean energy? 1. Granola-eating, Birkenstock-wearing They have become a bunch of long-haired hippies. Nope, not true. I'm just seeing if you’re paying attention. 2. FOMO? If you’re not a Millennial, let me clarify. This is not a curse word. Instead, it stands for Fear of Missing Out. The global energy mix is projected to change, and they don’t want to miss out on high-growth opportunities. See the graphs below. Source: BP 3. Costs Solar and wind costs are much more competitive today. Consider the two large solar farm contracts at 2.9 c/kWh in Chile and the Middle East. See graph below. Source: BNEF Source: Bernstein Research, CIA, EIA, World Bank 4. Global policy The Paris Accord showed 197 countries agreeing to significant greenhouse gas reduction goals. If their forecasts by the International Energy Agency are correct, $16.5T of low-carbon finance is needed to achieve the goals laid out in Paris. 5. Stranded assets Experts at the London School of Economics, Citi, and Carbon Tracker suggest that 60-80% of assets held by publicly listed conventional energy companies may be “unburnable” if the world is to stay below the 2 degrees Celsius target. Citi’s estimate is that $100T of oil, gas, and coal reserves may fall into this category. Yikes. (See graph below. Compare the smaller pink circle to the larger purple or blue circles. Units are GtCO2.) Source: Carbon Tracker, Grantham Research Institute, LSE 6. Growing interest in infrastructure The World Economic Forum estimates a $1T/year gap between global infrastructure needs and what limited government budgets can afford. This spells a big need for private capital to fill this gap. This combined with the current low-yield environment has led to growing investor interest in the global infrastructure market with an aggregate $3.7T/year need. Investors are seeing the attractive risk-reward fundamentals of infrastructure investment, in which renewable energy represented 55% of all deals in 2015. See the graph below highlighting the relative attractiveness of infrastructure investments. And by the way, I’m just getting started. We haven’t even talked about clean energy investments by other oil majors.

With between $5B and $30B in cash on hand, how will they diversify going forward? Surely not all to renewable energy, but probably a greater allocation than in years past. Does every solar project have to be big? Many solar investors’ intuition rests easy when they see the graph below. It fits into the elegant framework of “economies of scale.” The bigger the project, the lower unit cost of installation. The smaller the project, more cost-inefficient. Going big is part and parcel with cost efficiency, or so the saying goes. (Source: Lawrence Berkeley National Laboratory) But be careful, this is precisely the rationale used to advocate that utility-scale solar is the only form of solar in which we, as a society, should be investing. Heck, Warren Buffett believes so, and that guy never makes a bad bet (at least publicly). Why produce electricity from projects that can be built at $4/MW on top of a house, when you can generate those same electrons from a larger project that can be built for half the cost? It is a compelling argument, I must admit. But it suffers from the same “big infrastructure” fallacy that is currently hamstringing our legacy centralized energy system. Build BIG projects for cheap on a per MW basis. Big is cheap and efficient. But, as any good economist knows, external costs can cause headaches (and asthma, skin cancer… you get my drift). Utility-scale projects have gotten a free ride See, BIG projects are cheap, in part, because they burden society with costs not borne by the projects themselves. What costs you might say -- only the never-ending litany of transmission and distribution expenditures. Billions of dollars of deferred T&D expenditures hang like a dark cloud over electric sector. And who is paying for those? Not the project owner, that is for sure. Yes, there are interconnection costs, but let’s be real, they hardly cover it. That is not to say that there is not, in fact, a significant need for big projects. But only to a certain extent. Why only build projects that necessitate that we continue to invest so heavily and T&D infrastructure? Small can be beautiful (and efficient), too. Yes, we should invest in more high voltage DC transmission. But, why not minimize the need for such costly investments by building smaller C&I and residential projects? They may be more costly on paper, but at the scale of the whole grid, they may actually be introduce some much needed cost-cutting. Thus, it is the prospect of avoided T&D costs that gives any credence to the claim that smaller-scale projects can be both both prudent and cost-efficient. Avoided costs is a common concept in utility-scale generation, but, for some reason, this logic is not applied to smaller-scale projects. It is not because they don’t make sense, it is because utilities are uncomfortable with power producers that they do not control. Investors start to take notice of smaller-scale solar Now, from the perspective of an investor looking to be a long-term project owner, things get interesting. The graph below show the slow march down the path of PPA price decline. (Source: Lawrence Berkeley National Laboratory)

On the one hand, great - solar power is getting cheaper, and fast! On the other, there is a palpable sense that there is large-scale suppression of investors returns taking place. Fair enough. Once a market matures, actual or perceived technological risk reduces, and returns should decrease. But that does not stop investors from feeling the squeeze. And that squeeze is happening particularly in the utility-scale market. In part because utilities have a lot of negotiating power in many markets, PPA prices are plummeting, some creeping below the $0.04/kWh threshold. There is still value to be had, but the pressure to find good deals has encouraged (ahem… forced) investors to look back into the C&I market for the returns they seek. This is great from the standpoint of increasing access to capital for a market segment which historically has been more difficult to finance. Less standardized and smaller projects, diverse off-takers, many without credit ratings, and less financially robust developers have all hampered the expansion of C&I solar. But, now the suppression of utility-scale solar returns has led investors to start poking around the sleeping giant of C&I solar. Many C&I off-takers have the ability and willingness to pay much higher PPA rates than utilities. Translation = sweet returns. And, there are a LOT of them. If you are lucky enough to find them in places like Nevada where many large-scale C&I customers have been summarily pissed off by the antagonistic treatment by the utilities commission, then you could make some big waves. And, as C&I developers have become more sophisticated, projects are trending towards more consistency, bankability, and less risk. So, keep a lookout as the C&I solar market starts to find that sweet spot in the classic risk vs. return story. Small can be beautiful in the solar market. Projections are a fool’s game, but they are also unavoidable if you happen to care about infrastructure finance and policy. Why? Because investors are keen on timing the market, and economists and policy experts want to know when and how to intervene in the market. Understanding the dynamics of technology costs versus willingness to pay is central to both. Even with marked growth in the energy storage sector, the assumption is that the real boom awaits further cost reductions. Everyone is projecting those reductions. Here we dig into "why" and "where" those reductions may come from. Source: Ramez Naam We are all familiar with the proliferation of cost projections out there, much like the one shown above. Lots of reputable establishments produce these projections, with many clever approaches to thinking about technological progress (e.g., stuff getting cheaper and better).